Finalist

Sustainability

With Atos acquiring EcoAct, both its own and NatWest’s ecosystem have grown. Atos brings scale and experience (including with technology and software) to the relationship. EcoAct and NatWest must leverage the Atos ecosystem moving forward. The transition planning and results outlined here need to move from case studies to bigger offerings that can help less-progressive organizations accelerate their sustainability efforts. Atos needs to scale the NatWest example into solutions (call them blueprints, templates, or whatever) that can help the BFS ecosystem plan, accelerate, and deliver under the global sustainability context. But it can’t only be a question of internal sustainability.

NatWest is an example for other organizations—banks and otherwise. Next, it must address the most significant impact financial services (FS) firms can make on sustainability—influencing their clients and ecosystems. Can NatWest and FS take this chance?

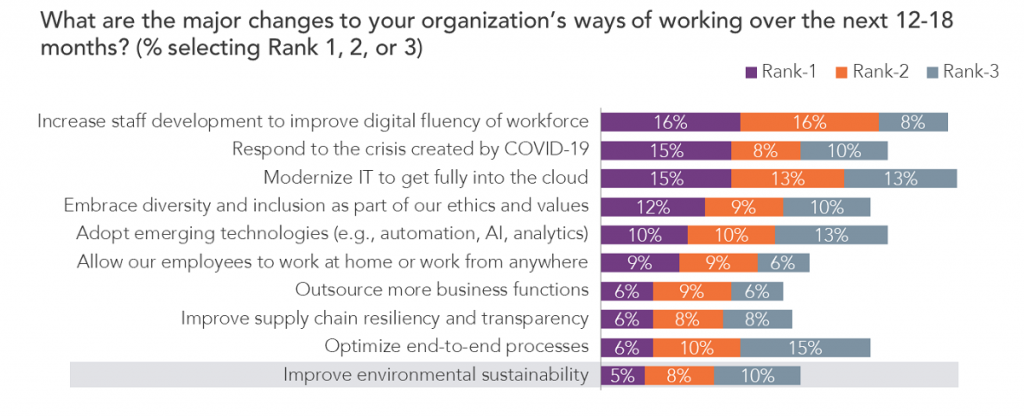

Finance and sustainability are tightly intertwined, and leading FS firms must help scale best practices. Widespread roadmapping of internal sustainability and public disclosure are desperately lacking for all organizations—fewer than 20% have a transition plan aligning to the global context of decarbonization and the 17 UN Goals (see our separate take). The worrying lack of priority Global 2000 FS firms give to environmental sustainability is apparent in Exhibit 1. But despite the need for FS firms to address their sustainability, as all firms must, the sector must fulfill its vital role in transforming its clients and ecosystems.

We spoke with NatWest about its efforts to-date, but also its opportunity to be a major FS ecosystem leader, that landed it a place as a Sustainability finalist in the HFS OneOffice™ Awards; a team representing its engagement with EcoAct, a climate consultancy acquired by Atos in 2020, was also part of the discussion. We highlighted this acquisition when it occurred; we can see it marked a massive acceleration in activity throughout the consulting, technology, and services industry on developing sustainability capability internally and for clients, leading to our Sustainability Services Ecosystem Mapping study.

We cannot understate the impact of FS’s investments in business, infrastructure, and services in the pursuit of decarbonizing and addressing all 17 UN Goals. The link between the FS retail arm and changing consumer behaviors connected with sustainability also gives FS firms significant influence, making Exhibit 1 even more worrying. There are signs of accelerated activity and progress, including recent examples of executive pay increasingly linked to environmental, social, and governance (ESG) metrics, Santander acquiring a climate consultancy (and many others expanding their services portfolios), and Coutts (reportedly the bank of Queen Elizabeth II… and Stormzy, a British rapper) integrating ESG throughout its products and services (which we detail here).

NatWest aimed to simultaneously reduce energy consumption and costs (a positive step toward organizations realizing the win-win that sustainability delivers), improve its data quality and reporting accuracy, and improve its engagement with internal and external stakeholders. NatWest needed a new strategy and toolset for a data-driven approach. Its incumbent systems and processes relied on spreadsheets and featured multiple data systems and suppliers, leading to slow reporting and data integrity problems.

In 2020, NatWest increased its ambition to make its operations “climate positive” by 2025. The pandemic challenged this commitment when 50,000 employees were suddenly working from home. The massive work-from-home shift risked falsely impacting emissions reductions, and NatWest needed to distinguish long-term reductions brought about by its actions from those that were a temporary result of the pandemic.

Sample: 67 financial services leaders Source: Source: HFS Pulse Survey, H2 2021

An EcoAct team embedded within NatWest integrated the bank’s reporting processes, and a software platform captured and analyzed data from more than 5,000 locations in 57 countries, facilitating expense management, reporting, and energy management. EcoAct and NatWest collaborated with a working group of other large organizations to develop a methodology for measuring and reporting homeworking emissions.

NatWest improved process efficiencies and achieved significant energy and costs savings. A data-driven approach ensured accurate reporting and emissions reductions continued during the pandemic. NatWest outlines the case for sustainability being a win-win across business and ESG outcomes:

Reliable data and accurate reporting for communicating NatWest’s ambition meant that as the principal banking partner for COP26, last year’s UN climate summit (see our presentation to the summit here), the bank could demonstrate sustainability was at the core of the bank’s purpose—and benefits.

NatWest’s homeworking emissions methodology allowed it to calculate and offset all homeworking and commuting emissions (37,596 metric tons of carbon dioxide equivalent). The new methodology gained recognition across NatWest’s ecosystem, and the whitepaper became one of EcoAct’s most downloaded documents of 2020.

Downloaded whitepapers and internal energy savings are great, but the scale that NatWest, EcoAct, and Atos could achieve in driving the FS space to align to the global sustainability context is the most-critical next step.

With Atos acquiring EcoAct, both its own and NatWest’s ecosystem have grown. Atos brings scale and experience (including with technology and software) to the relationship. EcoAct and NatWest must leverage the Atos ecosystem moving forward. The transition planning and results outlined here need to move from case studies to bigger offerings that can help less-progressive organizations accelerate their sustainability efforts. Atos needs to scale the NatWest example into solutions (call them blueprints, templates, or whatever) that can help the BFS ecosystem plan, accelerate, and deliver under the global sustainability context. But it can’t only be a question of internal sustainability.

If you don't have an account, Register here |

With the exception of our Horizons reports, most of our research is available for free on our website. Sign up for a free account and start realizing the power of insights now.

Our premium subscription gives enterprise clients access to our complete library of proprietary research, direct access to our industry analysts, and other benefits.

Contact us at [email protected] for more information on premium access.

If you are looking for help getting in touch with someone from HFS, please click the chat button to the bottom right of your screen to start a conversation with a member of our team.