The latest firm to receive the coveted HFS Challenger accolade is Quantiphi for its AI-first digital engineering approach and push to bring Services-as-Software™ (SaS) economics into mainstream delivery through what it calls Technology Services-as-Software (TSaaS). Quantiphi is not unique in talking about platforms, accelerators, and outcome-based pricing. What sets the company apart is how it tried to operationalize those ideas in both delivery via agentic platforms (Codeaira and Baioniq) and creative commercial constructs (fee-at-risk, transaction pricing, and subscription access).

Quantiphi aims to address the primary challenge in enterprise AI adoption: repeatedly deliver governed, production-grade outcomes at a predictable unit cost. TSaaS is its attempt to make that ability appealing to procurement and CIOs by defining units of work, automating as much of the work as possible, and pricing the output rather than the labor. Quantiphi is a strong reference point for what SaS looks like in practice and is proving that its model works

at scale.

Founded in 2013 and headquartered in Boston, Quantiphi is an AI-first digital engineering firm that employs around 3,500 professionals and serves more than 400 customers globally. It has roots in applied AI, data engineering, and cloud modernization and has expanded through vertical business units and acquisitions into a broader set of “AI-native” build-and-run services. The company supports customers across industries, including healthcare and life sciences, financial services, telecom, media, retail/CPG, manufacturing, education, digital-native enterprises, and the public sector. Quantiphi’s specialist focus enables it to experiment with risk-based and unit-based commercial models while maintaining a low cost-to-serve, supported by its offshore-heavy delivery model. Ecosystem alignment is a major part of its go-to-market, acting as a demand-shaping mechanism. Much of Quantiphi’s scale-up opportunity depends on riding hyperscaler-led modernization and AI adoption cycles without becoming over dependent on any single platform or channel.

Quantiphi’s model explicitly diverges from the traditional “more people = more revenue” economic principle. Rather than selling traditional project-based services, it packages modernization, data, and AI work into repeatable, platform-infused offerings that are priced and governed more like software. This model is designed for CIOs, CDOs, and COOs who need to move from pilots to industrialized modernization and AI programs without losing cost discipline or control.

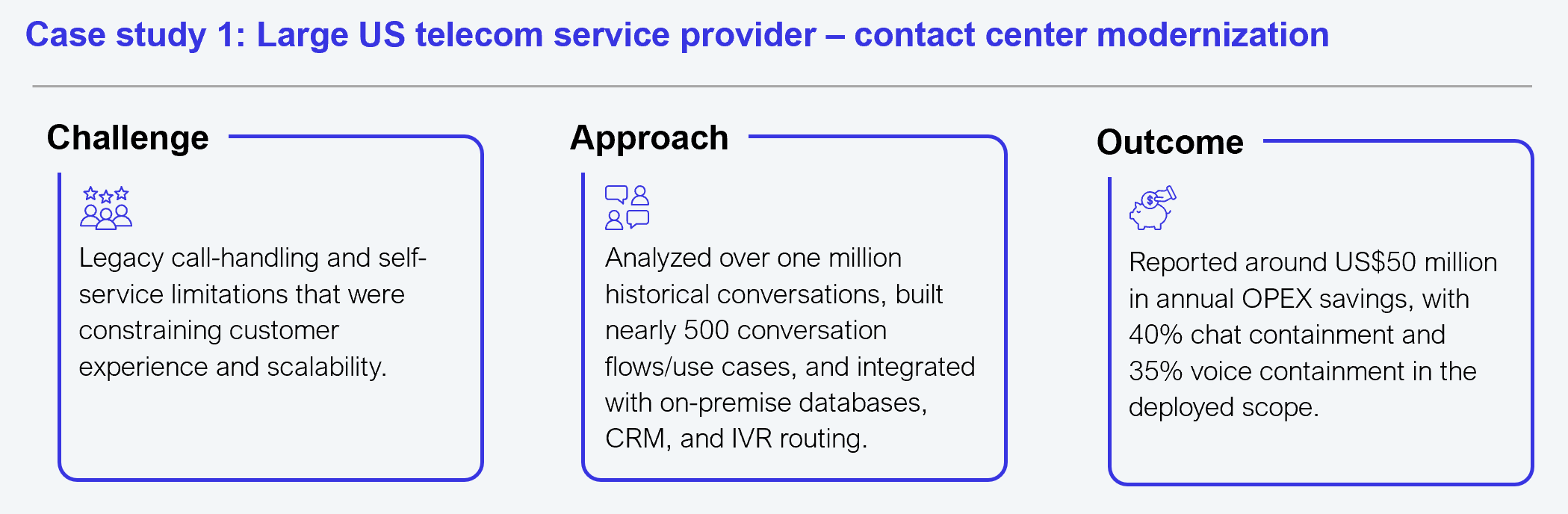

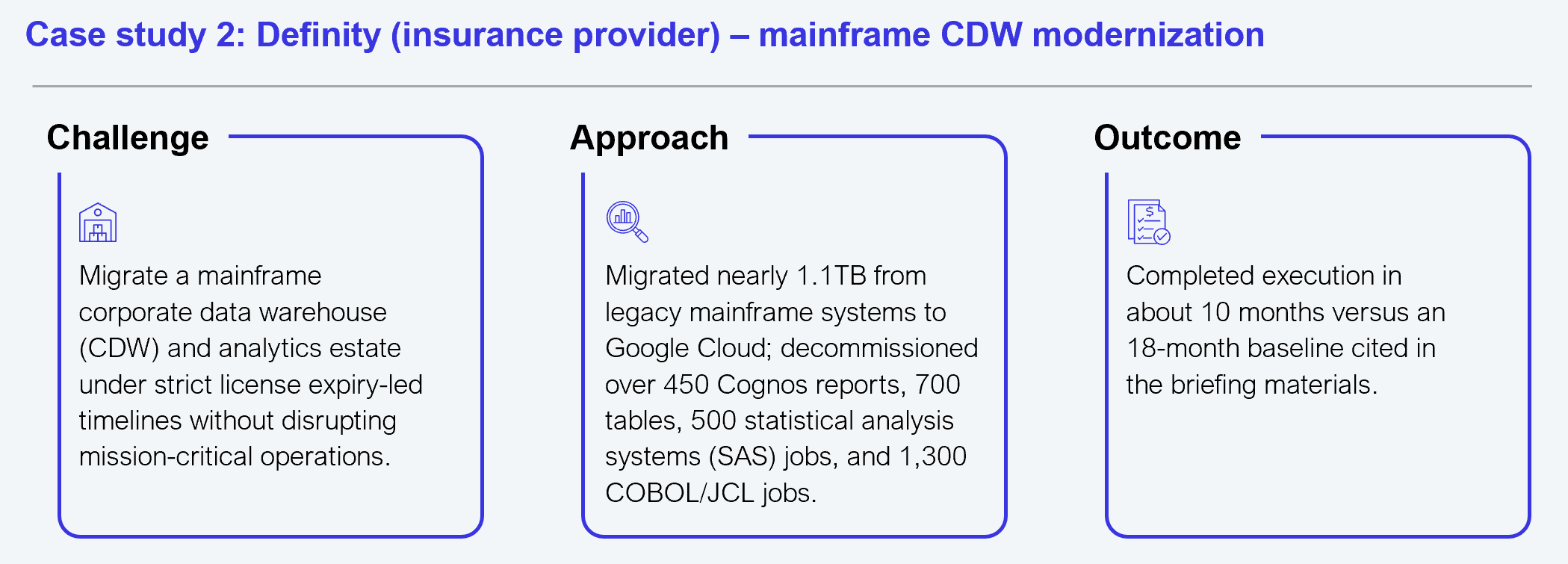

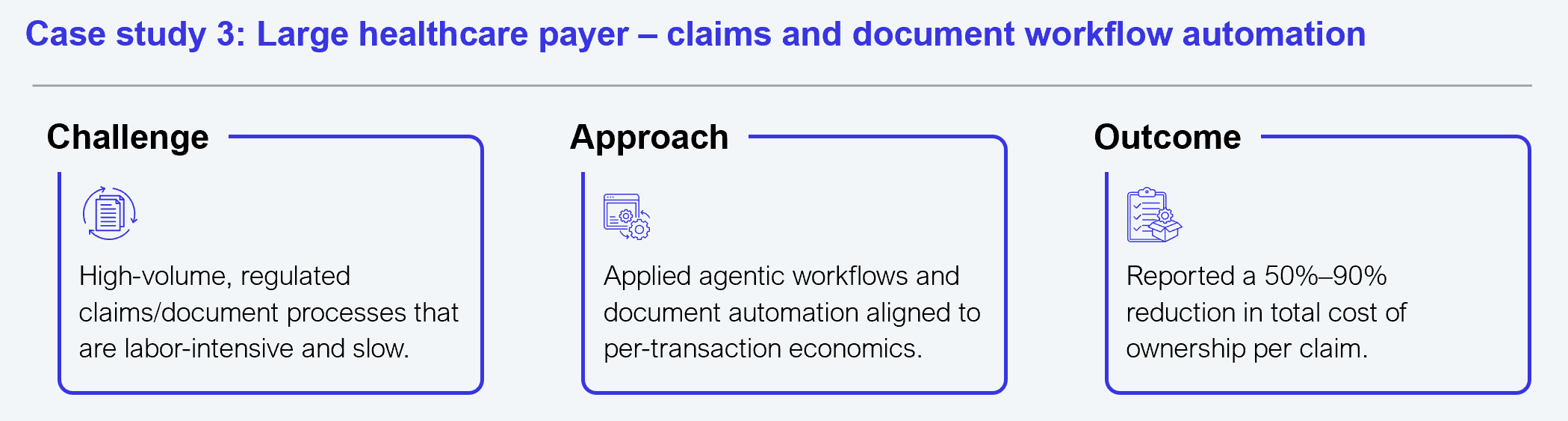

The company highlighted its use of creative commercial models such as fee-at-risk structures (bonus/penalty) in contact-center transformations tied to containment and experience guardrails, volume-based constructs for document-centric automation, and onboarding-plus-subscription models for enterprise agentic AI. Each of these models is designed to reward repeatability and measurable outcomes rather than effort. For core infrastructure and data modernization, Quantiphi adopts pricing and sizing mechanisms that translate migrations into countable units (e.g., per virtual machine, job, table), serving as a practical bridge between project services and consumption-like delivery. This is where many services firms struggle. The lack of a robust sizing discipline turns unit pricing into a marketing slogan rather than a contractually binding construct.

To deliver tangible outcomes, Quantiphi relies on platforms such as Codeaira and Baioniq to industrialize delivery. Codeaira is its engine for moving modernization beyond “manual heroics” into repeatable execution and accelerates discovery, transformation, and testing automation across large application and data estates. Baioniq is an enterprise agentic AI platform delivered through an onboarding-plus-subscription model, with forward-deployed engineering for custom agent development. These represent a materially different commercial posture from pilot-to-program services, creating a recurring base while keeping customization bounded and value measured in operational throughput.

Quantiphi’s model offers a credible option for scaling modernization and AI adoption. Beyond tooling, what stands out is the company’s effort to institutionalize bespoke engineering into reusable assets that can be governed, priced, and improved over time. For enterprise buyers, the impacts are faster modernization and AI deployment, a more predictable cost-to-serve profile, and greater transparency and accountability for outcomes. Taken together, this gives large enterprises a way to scale modernization and GenAI initiatives beyond pilots while keeping risk, compliance, and value realization visible in commercial terms.

Quantiphi is a challenger worth taking seriously because its differentiation is structural, not messaging. It is attempting to make AI-first delivery pay for itself by leveraging automation to drive operational efficiency, supported by commercial constructs that can (when governed well) align incentives with outcomes. This approach closely aligns with HFS’ SaS approach as it packages agentic AI services into subscription models. What sets Quantiphi apart is the way it combines its own platforms with outcome-linked commercials such as fee-at-risk, transaction pricing, and subscription access, so that both sides are rewarded for sustained, measurable performance.

However, enterprise buyers should stay disciplined on three watch-outs. First, outcome models only work when baseline definitions, attribution rules, and customer experience constraints are explicit; otherwise, disputes become a bottleneck to value realization. Second, clients must scrutinize portability, data residency, and exit terms for Quantiphi’s platforms. Third, many productivity and margin claims remain provider-asserted; buyers should insist on reference-backed validation and security assurance, aligned to the scope of modernization and AI access being granted.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started