Since the tumultuous departure of two CEOs, Atos is looking to stabilize the organization. Its divestitures are meant to spin out legacy business units, and the new core business will focus on data and cyber assets as higher margin opportunities. To safeguard those crown jewels from opportunistic bids, a European solution bringing together organizations with a similar mindset encouraged by politicians, including the suggested stake by Airbus, would provide the most stable outcome for operations leaders weighing sourcing decisions or undertaking scenario planning to mitigate risks.

Analyzing Atos is challenging. On the one hand, new CEO Nourdine Bihmane appears to be stabilizing the organization. The mood within is more positive than under his predecessor. On the other hand, its share price remains under pressure, not least since Atos lost its flagship BPO mega deal NEST, a UK pension provider, as the client walked away from the deal. Throughout 2022, the NEST deal has led to profit warnings.

This development provides more color on the Atos separation plans. The BPO business is slated to be part of the spin-off dubbed TFCo (for “technology foundation”); it is meant to retain the Atos brand. The deal logic is to hive off all the low-margin business units of core infrastructure, digital workplace, professional services, unified communications, and private cloud platforms.

The public announcement that Airbus is looking to take a minority stake in Evidian suggests the bigger decisions for Atos’ future appear nigh. Evidian is the business that Atos plans to spin out; it contains the crown jewels around data and cyber assets. Two main issues surface when analyzing Airbus’ move.

First is Atos’ corporate development. Atos struggled to react to the commoditization of its core infrastructure business. Accounting scandals and a CEO merry-go-round compounded those secular headwinds. (See further analysis here: Service providers must buy Atos’ crown jewels now and learn from dithering over Kyndryl, Horses for Sources | No Boundaries).

Second, Atos is deeply involved in French and European public sector initiatives, indicating the innovation potential that Atos continues to push and the political dimension of any deal. If successful, the deal would demonstrate that France won’t let one of its industrial stalwarts be sold off, even though Atos used to be an M&A machine. At the same time, Europe would safeguard initiatives like GAIA-X, an ecosystem to ensure European digital sovereignty and highly sensitive defense contracts. As the governments of France, Germany, and Spain are the biggest shareholders in Airbus, they would thwart opportunistic and hostile bids. This move is far beyond market dynamics and shareholder considerations. For France and Europe, this is far more serious.

With a market cap of $1.63 billion, Atos is more than vulnerable. This was already demonstrated back in September 2022 when it received an unsolicited offer by a smaller French rival and a PE fund.

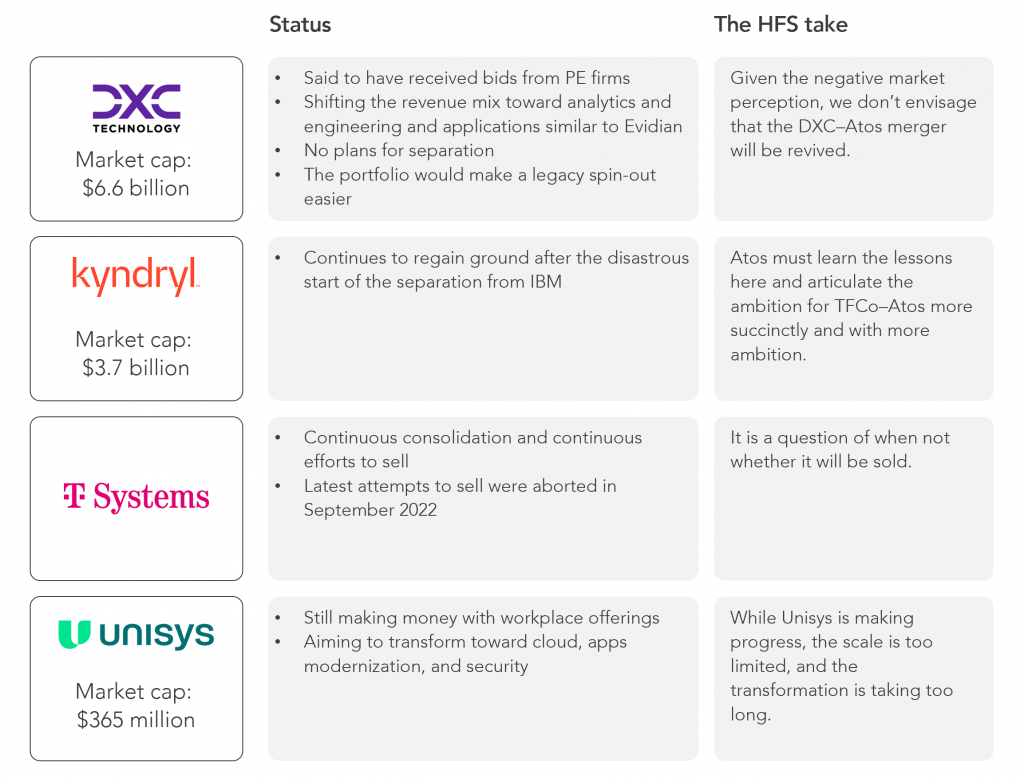

Atos is not alone in battling the structural headwinds. Erstwhile proud names with excellence in infrastructure capabilities face similar challenges, as shown in Exhibit 1.

Source: HFS Research, 2023

Doing the necessary scenario planning is no small feat. On the one hand, there doesn’t appear to be a willingness of any of those legacy providers to entertain bids from private equity. On the other hand, it seems unlikely that somebody has the guts to try and consolidate and scale such legacy assets. Furthermore, Indian heritage providers continue to remain coy about large-scale M&A. One can’t rule out an opportunistic move by providers such as CGI to get a broader European footprint even though the portfolio is not fully aligned.

While there is no obvious corporate development path for legacy providers, for Atos, the most likely scenario is a European solution, or at least a solution maintaining the political influence of France and Germany.

Thus, operations leaders should reflect the European solution in their scenario planning. Looking at it from an investor perspective, despite the depressing current share price, one shouldn’t forget that there is a significant upside possible if management can steady the ship. There are many lessons in IBM’s separation. Evidian could see strong tailwinds, and the legacy Atos business must learn from Kyndryl’s mistakes.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started