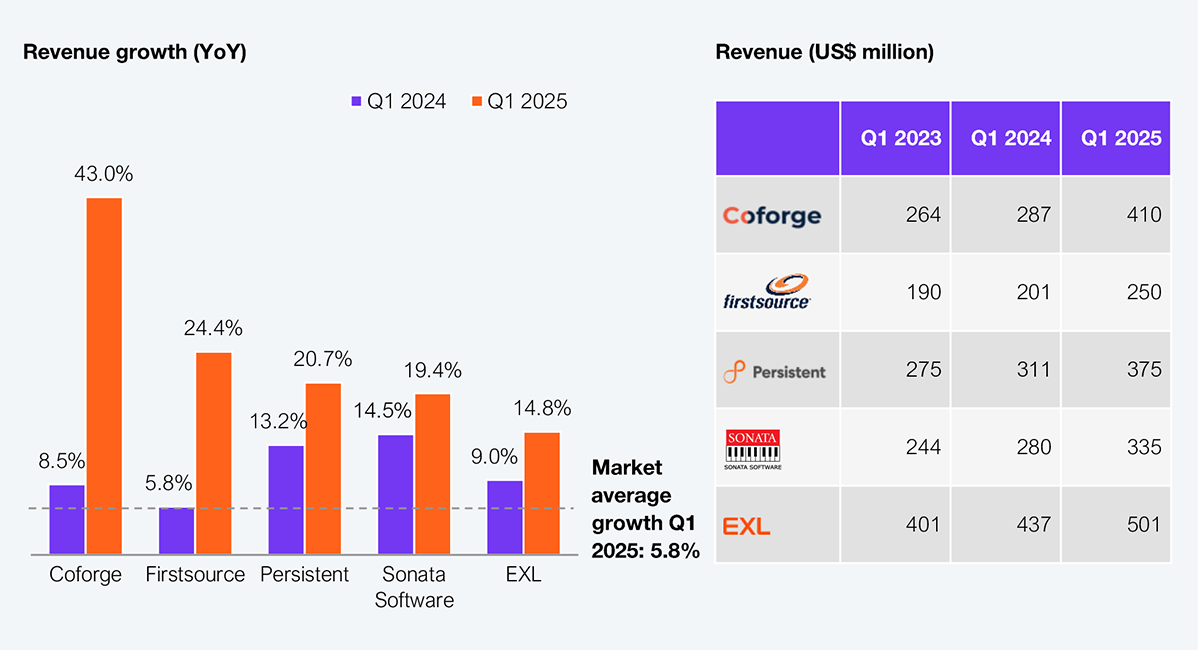

In Q1 2025, HFS Research identified the ‘fastest five’ service providers—Coforge, Firstsource, Persistent, Sonata Software, and EXL—achieving the highest year-over-year (YoY) revenue growth(1) of the providers we track. Each service provider surpassed the market average growth rate of 5.8% YoY (2) to report double-digit growth (see Exhibit 1). Interestingly, it’s the same roster of providers we covered in the previous 2 quarters, highlighting continued success for some, and the impact of inorganic growth for others.

These emerging leaders typically represent a differentiated value proposition for enterprises seeking alternatives to traditional TWILTCH (TCS, Wipro, Infosys, LTIMindtree, Tech Mahindra, Cognizant, and HCL) firms, combining operational agility with scalable delivery capabilities. Notably, strategic inorganic growth initiatives have also significantly accelerated their market and positioning and given them a deeper specialty in specific sectors.

Note: Revenue and growth data represent HFS estimates based on analysis of publicly available information. Year-on-year (YoY) growth compares one quarter with the corresponding quarter of the previous year.

Source: HFS Research and earnings reports of leading service providers, 2025

The fastest five service providers share common traits: AI-first, domain-deep, and US-centric. Their proprietary AI platforms drive deal traction, and earnings reports reveal success in BFSI and healthcare. Meanwhile, the US continues to drive growth, while Europe’s decision-making has slowed. However, tariffs and global uncertainty could change this—we’ve already seen tariffs and trade uncertainties affect retail, manufacturing, and tech—large deals continue, but with longer sales cycles. Mid-market players are typically much more vulnerable to such changes, so seeing how this report plays out in the coming quarters will be interesting.

In today’s uncertain environment, procurement, CIO, and transformation leaders must look past brand recognition and marketing narratives. A deep evaluation of execution strength, industry relevance, and cultural alignment is essential. Fast-growing mid-tier firms often bring sharper focus, greater agility, and a more collaborative approach. These traits are increasingly valued by enterprises navigating rapid change, and this is where the ‘fastest five’ stand out.

(1) Growth data represents HFS estimates based on analysis of publicly available information. The year-on-year (YoY) growth compares a quarter with the corresponding quarter of the previous year.

(2) HFS considered Accenture, Birlasoft, Capgemini, Coforge, Cognizant, Conduent, DXC, EPAM, EXL, Firstsource, Genpact, Globant, HCLTech, IBM, Infosys, Kyndryl, LTIMindtree, Mphasis, Persistent, Sonata Software, TCS, Tech Mahindra, Wipro, WNS, and Zensar for this analysis.

(3) HFS definition of mid-tier companies: revenue between USD 500 million and USD 2 billion.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started