The mortgage industry has always been cyclical, with loan demand fluctuating in response to interest rates and broader macroeconomic shifts. Mortgage lenders are setting themselves up for failure by clinging to outdated, manual processes when macroeconomic conditions are becoming more volatile and technology is advancing rapidly. The traditionally labor-intensive mortgage lifecycle from underwriting to servicing is ripe for digital transformation. Mortgage leaders must think beyond small incremental tech advancements, such as using IDP to automate documentation and, for instance, embedding AI across workflows to boost employee productivity and decision-making capacity. The end goal of this transformation should not be just about shortening loan cycles, improving efficiency, and cutting costs—but about building resilience against the cyclical nature of mortgage demand and breaking the constant cycle of hiring, firing, and rehiring skilled resources.

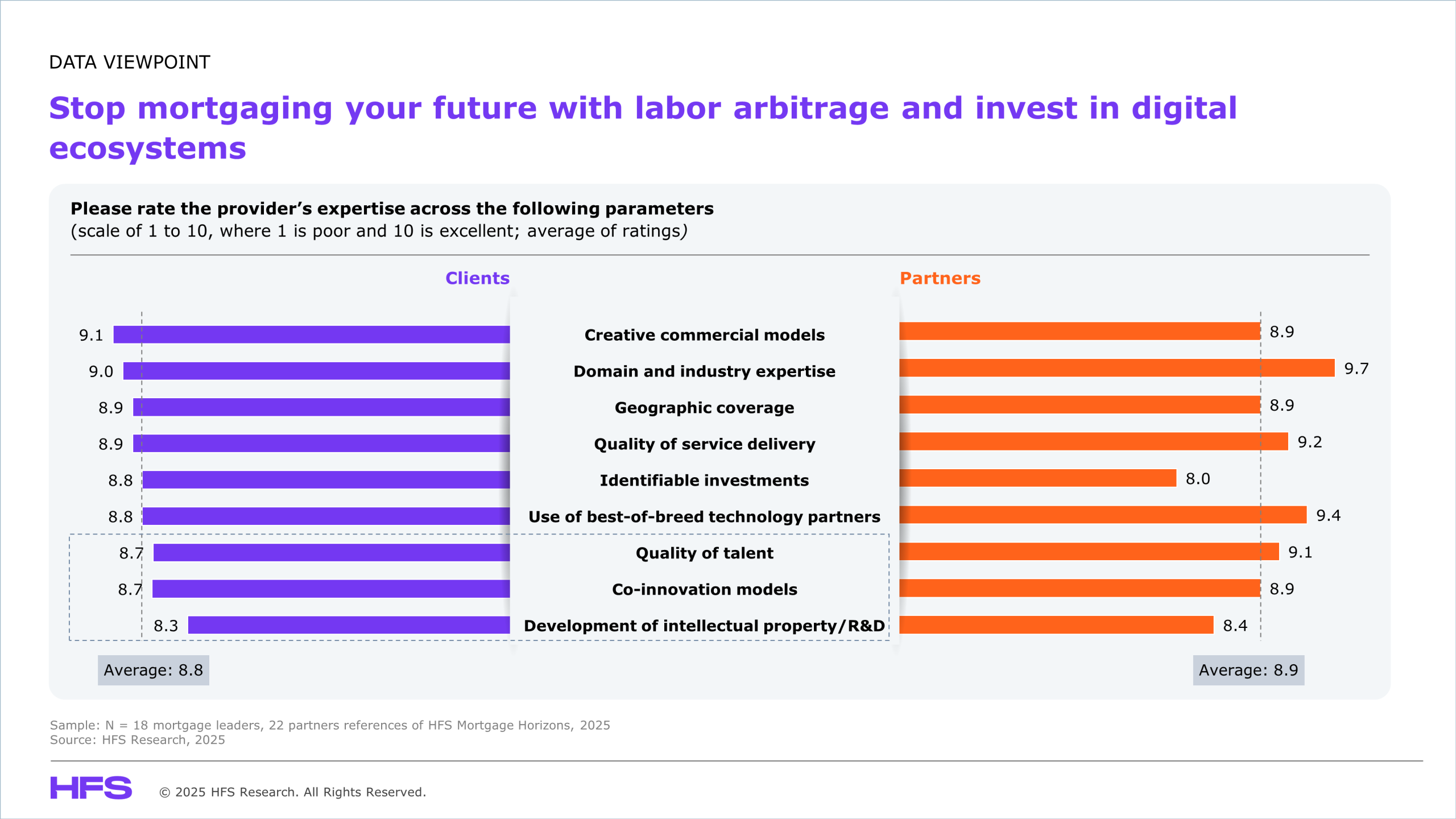

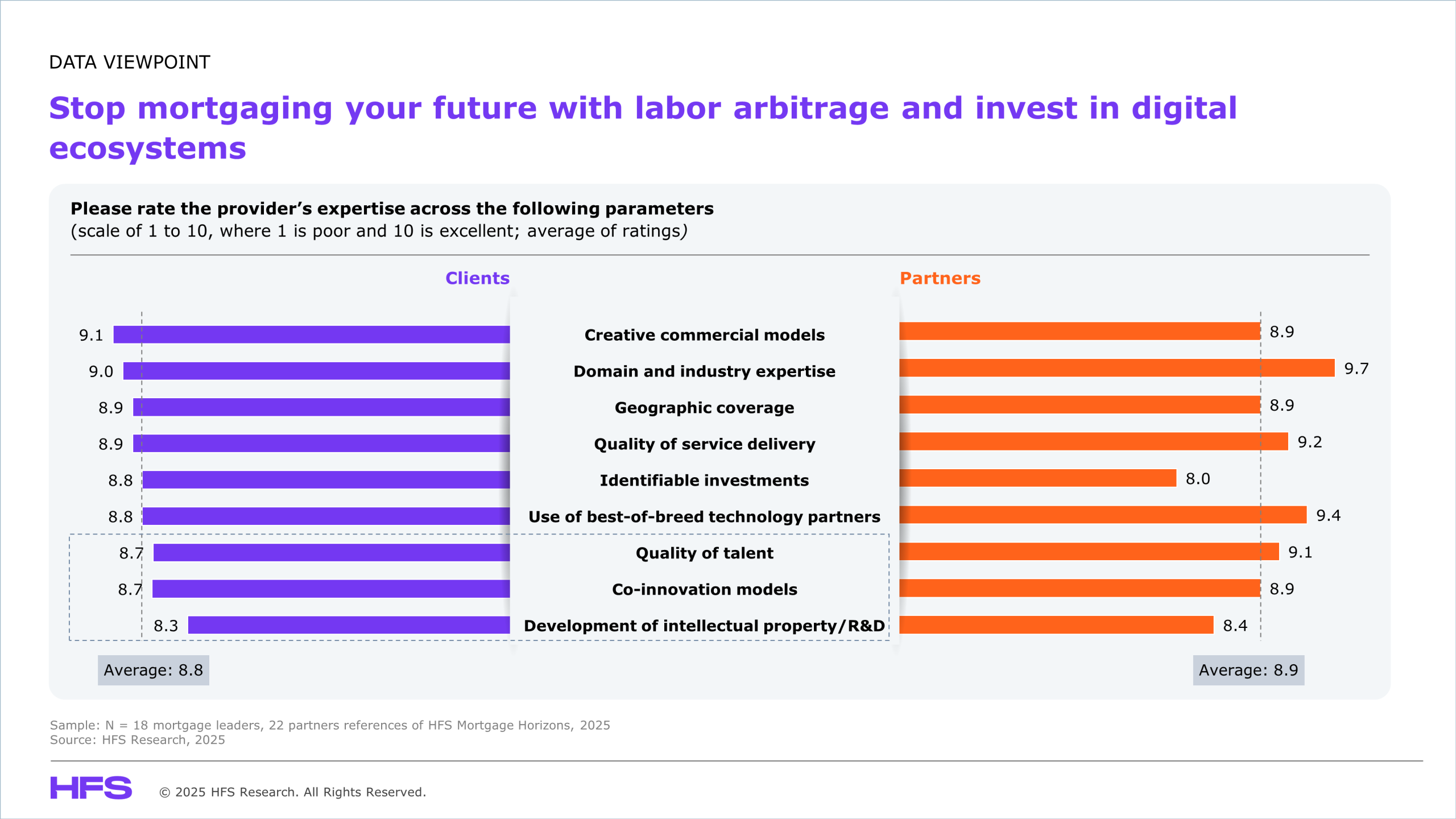

In our recent “HFS Horizons: The best service providers for Mortgage Re-invention, 2025” report, we interviewed 18 mortgage industry executives and 22 service provider partners. The report revealed that these mortgage companies are rewarding service providers for execution but starving them of innovation opportunities, which are critical to building resilience and improving overall operations (client average ratings: 8.8; partner average ratings: 8.9). Although service providers are showing progress, there are still critical gaps across R&D, development of IP, co-innovation models, and quality of talent that should be addressed. The key takeaways are as follows:

- Mortgage lenders value dynamic resourcing amid demand volatility but call for continuous talent upskilling. The mortgage industry is highly susceptible to macroeconomic conditions, leading to a cyclical rise and fall in demand for housing loans. Most mortgage leaders are satisfied with service providers’ ability to deliver trained domain experts on short notice. However, with the increased digitization and geographic expansion, some lenders highlighted the need for stronger training in digital operations, AI-led workflows, and localized subject matter expertise.

- Flexible pricing reflects provider agility. Lenders must capitalize on this and push for skin-in-the-game partnerships to drive co-innovation. Enterprises are satisfied with their service providers’ openness to leverage outcome and transaction-based commercial models. The transactional nature of this industry lends itself well to non-FTE-based contract terms such as ‘100% compliance achieved’ and ‘cost per claim file processed.’ At the same time, lenders must capitalize on this pricing flexibility to revisit their outsourcing contracts and push for more skin-in-the-game co-innovation. By co-developing tailored automation and embedding AI across workflows, organizations can drive efficiency, boost profitability, and reduce reliance on manual labor. Also, some seek simplified invoicing over lengthy, complicated details.

- Execution-first mindset and regulatory caution limit co-developed modernization. Mortgage clients and partners rate R&D, IP development, and co-innovation models lower than average or do not rate them at all because most service provider engagements are based on execution. Providers typically offer staff augmentation, process outsourcing, and operational efficiency, while core product innovation and proprietary platform development (such as loan origination systems) are in-house. Additionally, regulatory constraints limit experimentation, especially in processes such as underwriting and risk decisions. Lenders prioritize compliance, stability, and cost control over co-developing new technologies. As a result, providers are investing in internal productivity tools for mid and back-office transformation instead of building joint IP or industry-specific solutions with their mortgage clients.

- GenAI and digital innovation are redefining the mortgage operating model beyond compliance and document automation, but adoption is still slow. Service providers are moving away from pure-FTE lifts to bundled tech and ops models, cloud-based, AI-enhanced business process delivery, and GenAI-led processes. This reduces hiring/firing exposure, improves cost predictability, and accelerates transformation. Enterprises that partner with such providers will outpace those that continue throwing bodies at mortgage processes. Moreover, they must overcome resistance to automation by investing in technology beyond automated document processing to other areas of the mortgage lifecycle such as RegTech partnerships, co-innovation on digitizing title, appraisals, post-close processes, and front-end tools that assist but not replace core lender functions.

- Some providers are already investing ahead of the curve. Mortgage leaders should demand more of these domain-rich, AI-first solutions to break free from execution-only partnerships. For instance, Infosys is deploying its Topaz AI suite and Finacle Digital Lending suite for product management, GenAI-enabled underwriting, chatbot assistants, and automated document checks. Cognizant’s Neuro Mortgage Suite transforms loan servicing and underwriting with AI-driven personalization, tax research streamlining, and predictive analytics (for e.g., with Neuro BP for Cotality, an operations transformation platform). Firstsource’s relAI platform powers underwriting co-pilots, GenAI-led QC, and mortgage-specific language models that cut loan cycles and enhance accuracy. These solutions go beyond cost reduction; they are enabling smarter, more resilient, and agile mortgage operations that can thrive in the cyclical market.

The Bottom Line: Mortgage lenders are outsourcing for convenience and cost optimization, not resilience. This model must change.

The mortgage industry’s cyclicality is no excuse for reactive staffing and tech-light execution. To survive the next cycle, leaders must shift from transactional outsourcing to partnerships that build long-term resilience and digital capabilities driven by automation, AI-led decision support, and outcomes, not just headcount delivery.

End-to-end automation is limited in this highly regulated industry, which is built on high-value deals and the need to establish borrower trust. Enterprises that develop agile compliant digital ecosystems will be able to improve overall borrower and employee experience across the mortgage lifecycle while shifting toward easier-to-scale tech-driven models. Service providers can play a critical role in enabling that shift with their domain knowledge and technology expertise.