Financial crime is getting smarter, and frankly, the manual processes of conventional KYC simply can’t keep up. It’s time to close compliance gaps with real-time, continuous monitoring and updating of customer data through perpetual KYC (pKYC). Capgemini brings the muscle to deliver this in an AI-led approach.

In 2024, HFS Research coined the term Services-as-Software, a bold new paradigm where it’s less about people delivering services and more about technology, notably AI, delivering outcomes. Nothing embodies this more than AI-led services for KYC, especially Agentic AI, as it significantly reduces reliance on manual efforts, drives down costs, and increases speed-to-market. The analysis we draw in this paper is a call to action for compliance officers and financial crime leaders to shed traditional KYC’s static, episodic, and outdated verification cycles.

KYC is unavoidable. It’s the gatekeeper for every financial services client onboarding. It’s costly, slow, and resource-hungry, yet mandated by industry practices that have often defaulted to fixed cycles. In the digital-first world, moving from a static checkpoint model to an always-on approach is no longer a ‘nice to have’ but a ‘must have’ to ensure competitiveness. As a senior financial crime compliance executive put it:

Fincrime programs spend way too much time reporting, not fighting crime. And it’s getting worse. The function has become very checklist-driven these days. Like we have 50K clients, but most files are three years out of date. So, updating the files becomes the priority instead of using data or smart analytics to ensure we’re focused on what matters, led by risk analytics.

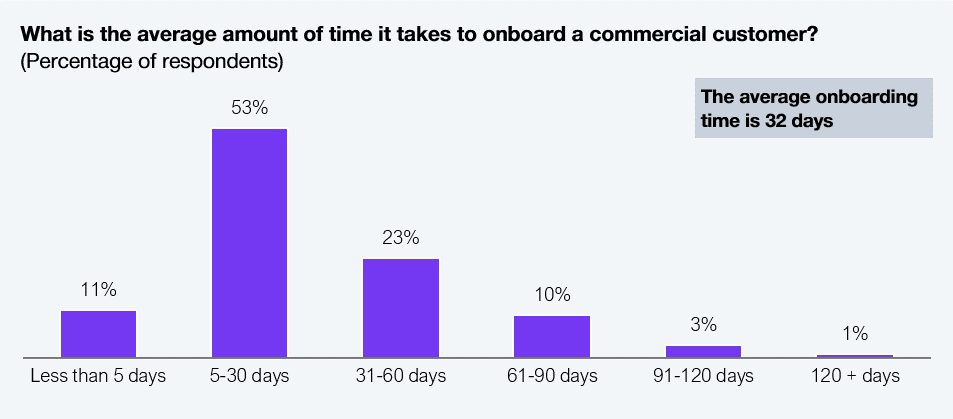

A data point that underscores the urgency of the shift to pKYC: When we surveyed 150 commercial bank leaders (see Exhibit 1), we found it takes them an average of 32 days to onboard a commercial client. In an economy where customers expect everything instantly, 32 days is painfully slow. Much of that delay is driven by the manual grind of traditional KYC processes.

Sample: 150 commercial banking leaders

Source: HFS Research, 2024

The consequences for commercial banks from extended onboarding times go beyond creating dissatisfied clients—it has financial implications. AI-powered pKYC doesn’t just shave days off the process; it reduces the endless document chase that drives costly remediation. With clear, up-to-date data, the risk adapts dynamically, and transaction anomalies are detected in real time.

We don’t intend to trivialize the complexity of the shift to pKYC. It’s a serious operational challenge that demands process and policy transformation, along with changes across the tech stack. It’s not an overnight switch; the journey typically takes two to three years.

This is where Capgemini simplifies the path with its sandbox environment, enabling organizations to first test and learn, and then build on that success with full implementation. It is a trust-building journey. The preconfigured sandbox runs on cloud and follows a microservices and modular architecture. It pivots from costly database licensing to API-driven connectivity. Sandbox uses web crawlers and agent-led crawlers that mimic human actions to source information from public domains and retrieve data under specific conditions. Further, the model avoids ‘boiling the ocean’ by focusing on a targeted set of up to 500 datasets. With API integration, AI agents, and strategic platform moats, the sandbox enables organizations to tap into multiple integrations and hooks, seamlessly connecting to the enterprise’s existing channels, platforms, and workflows.

Capgemini has implemented AI agents that mirror human roles across the KYC value chain, creating a role-based ecosystem that operates like a well-structured team. Processes are decomposed into discrete capabilities and subprocesses, and agents are trained for each. For example, outreach agents handle requests, respond to client feedback, compare documents against policy requirements, and retrieve relevant information. Other digital agents triage alerts to reduce false positives and negatives, with humans stepping in only for exceptions, judgment calls, and final sign-off.

Overall, Capgemini’s pKYC proposition reduces processing time to under 20 minutes. For banks with hundreds or thousands of customers, that’s a game changer, delivering sharper risk management, less grind, and a workforce free to focus on high-value work that moves the needle.

Capgemini’s sandbox offers a scalable, modular structure with access to critical platforms and connected workflows, an agent repository, and APIs into internal and external data sources. The firm has built the scaffolding to bring pKYC to life. Now, commit to the safe sandbox environment and leave traditional KYC behind. Firms that pilot pKYC in 2025 will not only cut costs, reduce risk, and enhance efficiency, but also be positioned to meet increasing regulatory expectations. So, compliance officers and financial crime leaders, don’t miss the opportunity to jumpstart your pKYC in a trusted environment!

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started