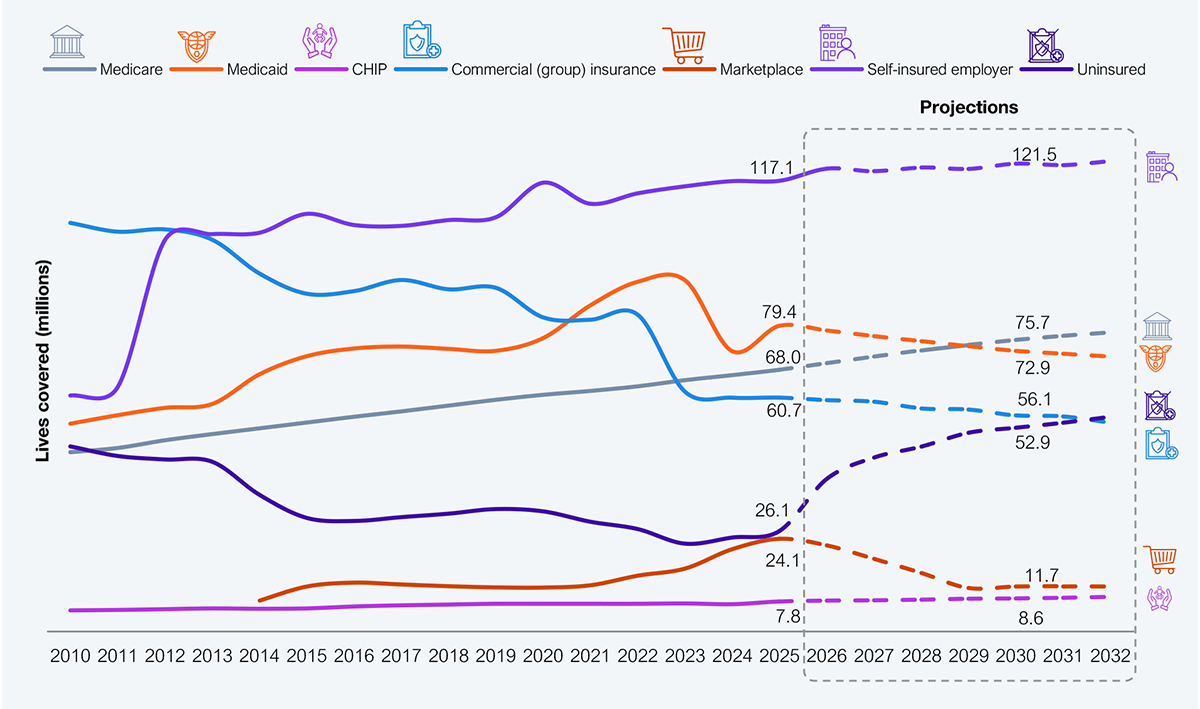

Despite employers being the largest healthcare market segment (see Exhibit 1), they don’t benefit from volume power, given that they go to market individually. Over the last two decades, large employers have increasingly underwritten their employees’ medical risk to save on premium costs but lost out on savings as they purchased services (provider network, administration, reporting) from health plans that continue to increase prices year over year (YoY) at rates two to three times higher than inflation.

In July 2025, the Big Beautiful Bill (OBBBA) became law, eliminating approximately 15% of government spending on healthcare, rendering up to 30 million more uninsured, including eliminating ACA premium tax credits.

This unprecedented shakeup of the healthcare market will create opportunities for employers with sourcing advantages they must leverage, experiment with new models, and realize the benefits of underwriting risk. It is an economic imperative to keep employees healthy and productive in the age of AI. Contrary to the idea that AI will eliminate the need for people…far from it, it will need more smart people, who are healthy (mentally, physically, and financially) and well.

Source: CMS, CBO, KFF, US Bureau of Labor Statistics, HFS Research, 2025

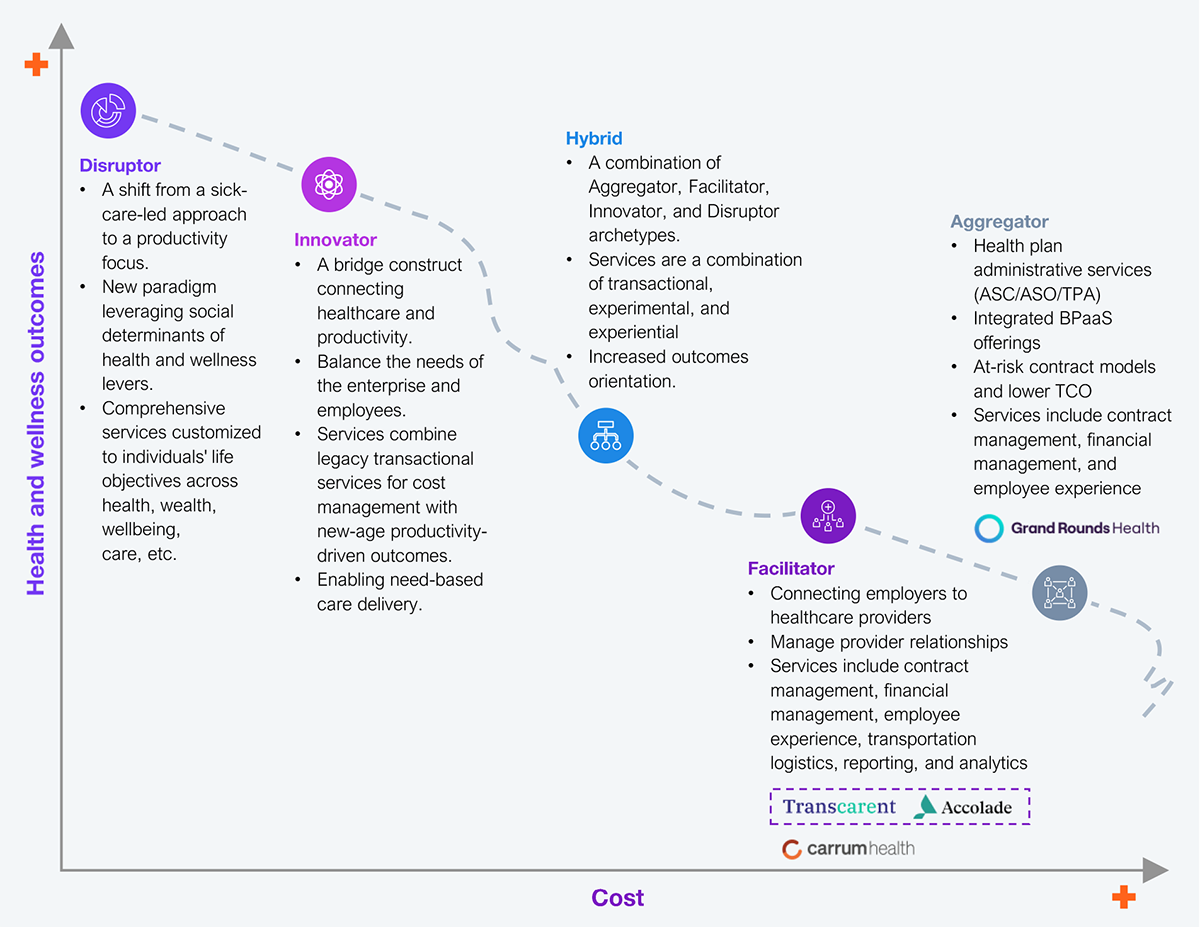

The financial needs of an enterprise must optimally intersect with its employees’ health and care needs. When they don’t, the mismatch will manifest in higher healthcare costs for employers and poor healthcare for employees. Employers can be categorized into five archetypes to facilitate a better match, each yielding different cost and health outcomes (see Exhibit 2). Each archetype will align with partners who bring in expertise such as cost management, technologies, and new payment models. For instance, the Aggregator archetype could work with third-party administrators (TPA) such as Point C, Lucent Health, or Allied Benefits System. Similarly, the Facilitator archetype could work with Transcarent or Carrum Health, while the Innovator archetype could work with Virta Health or Maven.

Source: HFS Research, 2025

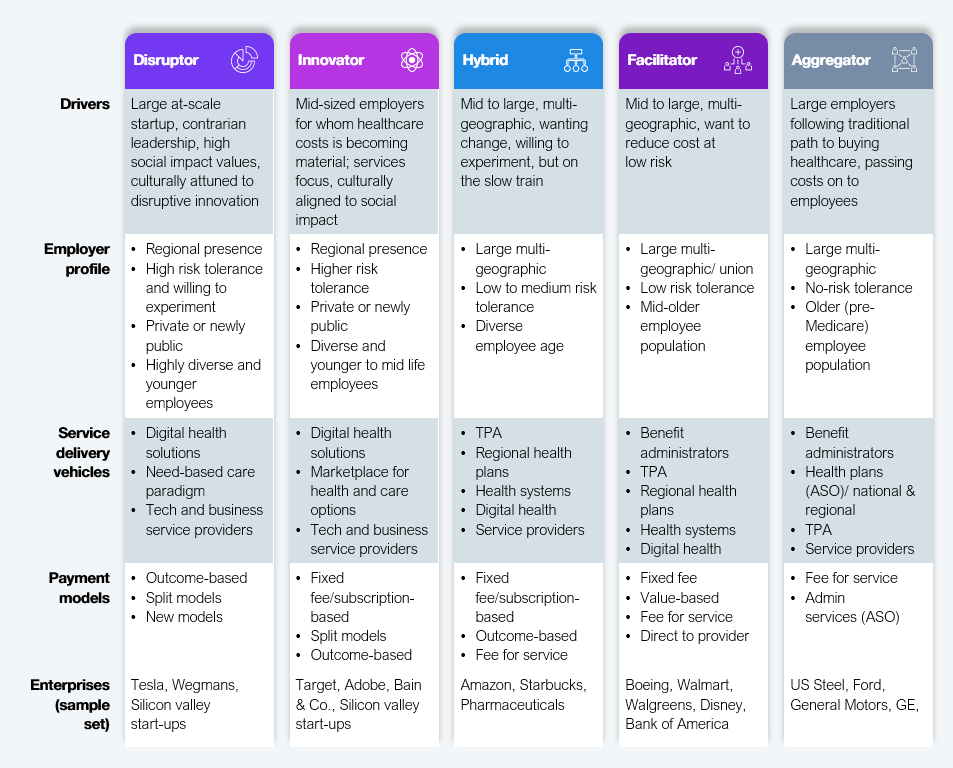

Employers must understand the right path for an optimal intersection of cost and health outcomes. Each of the five archetypes (see Exhibit 3) guides employers to what could be an optimal fit. This fit will help them determine the path forward to meet their financial objectives and employees’ individual health and care needs.

Source: HFS Research, 2025

Employers have begun to explore new approaches to address the dual needs of the enterprise and the employees; however, they are in pockets and not mainstream yet. The enactment of the BBB into law in July 2025 will upend the market, and employers must act to craft new models at attractive prices to drive scaling.

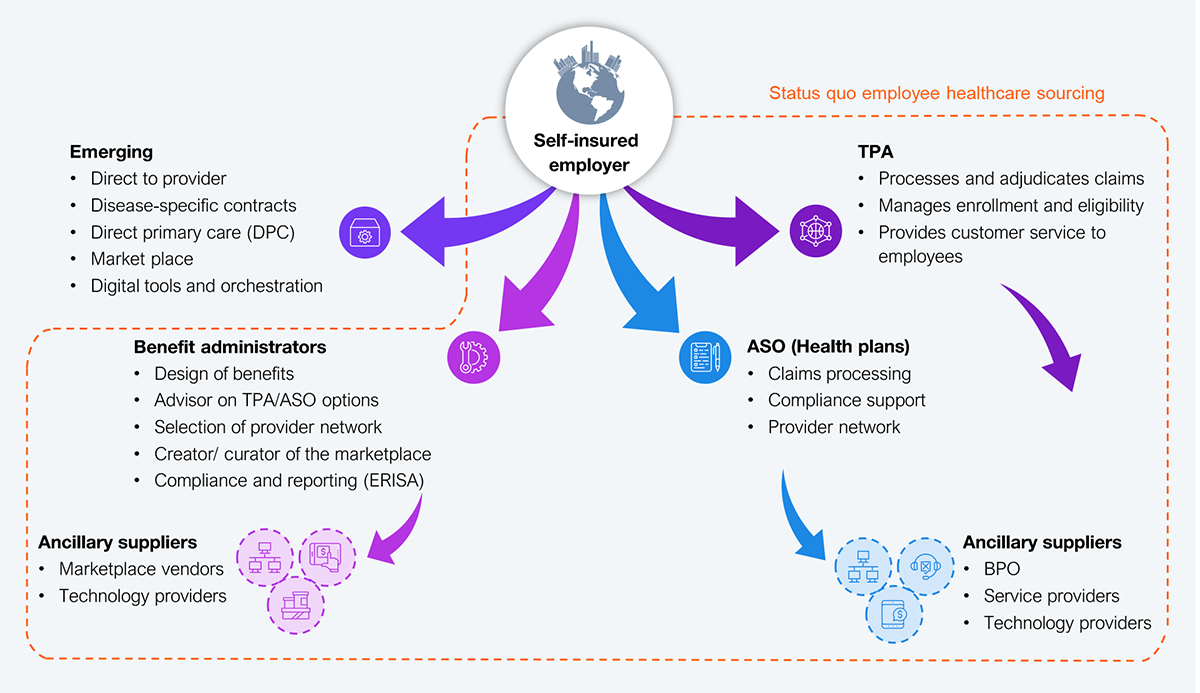

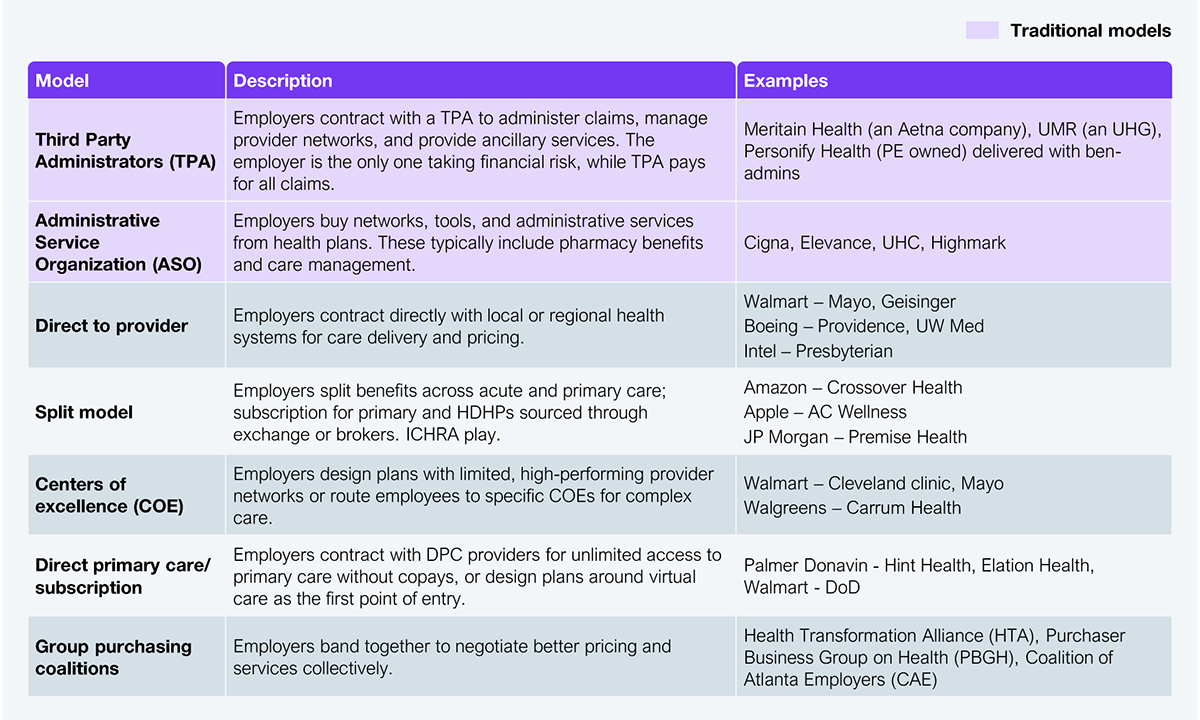

The cost of healthcare has been rising at twice the rate of nominal inflation for the better part of 15 years, while life expectancy declined to the bottom of the Organization for Economic Co-operation and Development (OECD) list, being on par with semi-developed countries like Turkey and Colombia. Employees are also falling ill at a higher rate, embracing the multi-epidemic landscape of the US with diabetes, obesity, substance abuse, and mental health disorders. In this context, the status quo on sourcing models for healthcare (see Exhibit 4) is detrimental to any progress that can be achieved to address cost and health outcomes.

Source: HFS Research, 2025

The status quo model involves employers underwriting the medical risk and working with benefit administrators to design plans and eligibility criteria. Then, they contract with TPAs or Administrative Services Organizations (ASOs) to manage claims and reporting. This model does not have meaningful quality metrics, and employer Chief Financial Officers (CFOs) just keep seeing a higher bill year after year for no incremental value.

For the first time, employers are in an advantageous position due to shifting demographics (younger cohorts who are health consumers, not healthcare), the upending of the market due to the BBB, and a supplier landscape that is primed to address employers directly and creatively. Exhibit 5 lists various new models that go beyond the traditional models and help employers and employees meet their respective objectives.

Source: HFS Research, 2025

The direct-to-provider model is particularly attractive now more than ever before for two key reasons: 1) the consolidation in the health systems means the provider footprint is broader, rendering it better aligned to employers with a distributed workforce, and 2) price transparency rules have provided clarity on costs, which aligns with abbreviated negotiating cycles.

The center of excellence (COE) model balances predictable costs well, providing the CFO with peace of mind regarding mitigating surprise overruns while delivering high-quality care to employees.

Split models and direct primary care are ideal for cost-conscious younger employees who do not need catastrophic coverage but need health guidance.

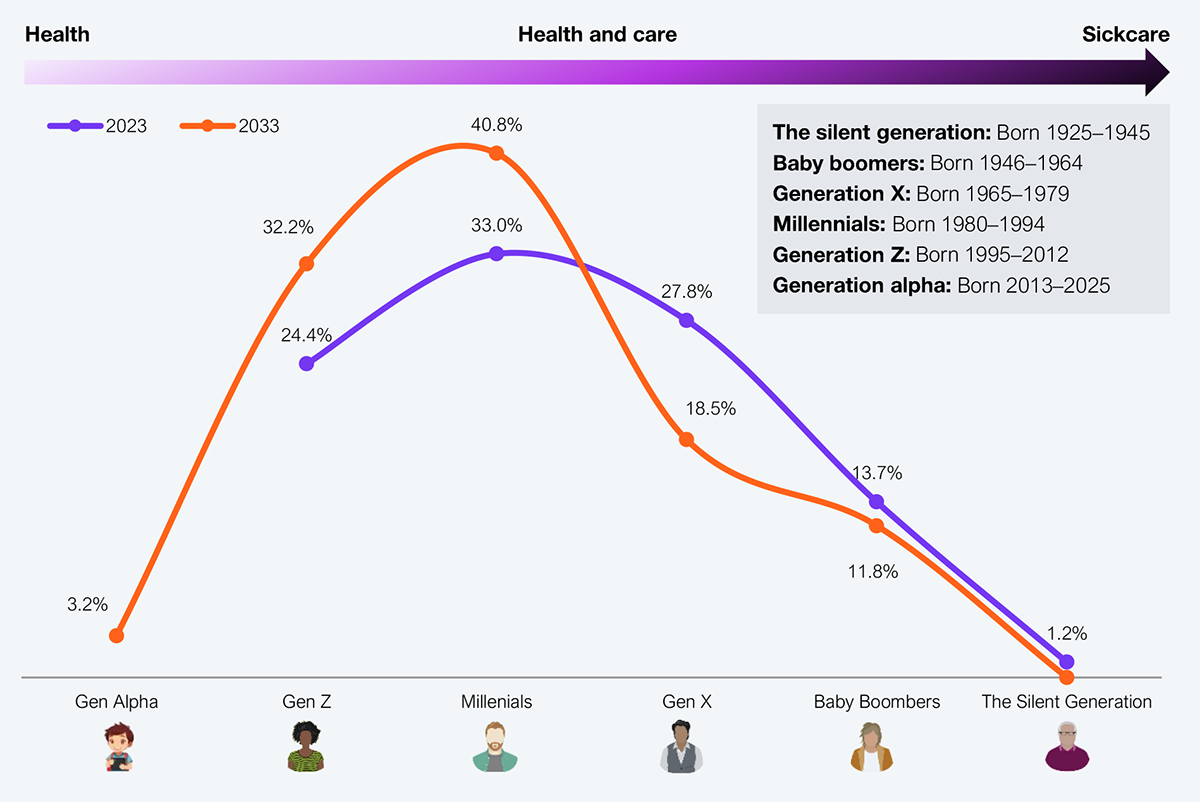

The average employee age is moving from older healthcare consumers to younger consumers (see Exhibit 6). This is a once-in-multiple-generations opportunity for employers to cut the cord with traditional models that stopped adding value years ago. With younger consumers, experimenting with and adopting digital channels, including Dr. AI, are key attributes of the new models that employers must seek to embrace.

Source: US Department of Labor, HFS Research, 2025

Employers have a choice: stick with the known devil, paying higher YoY prices for declining value, or embrace the unknown angel, unlocking the potential of new models that enable better health at a lower cost for a whole new generation of health consumer employees. The best option could not be more obvious.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started