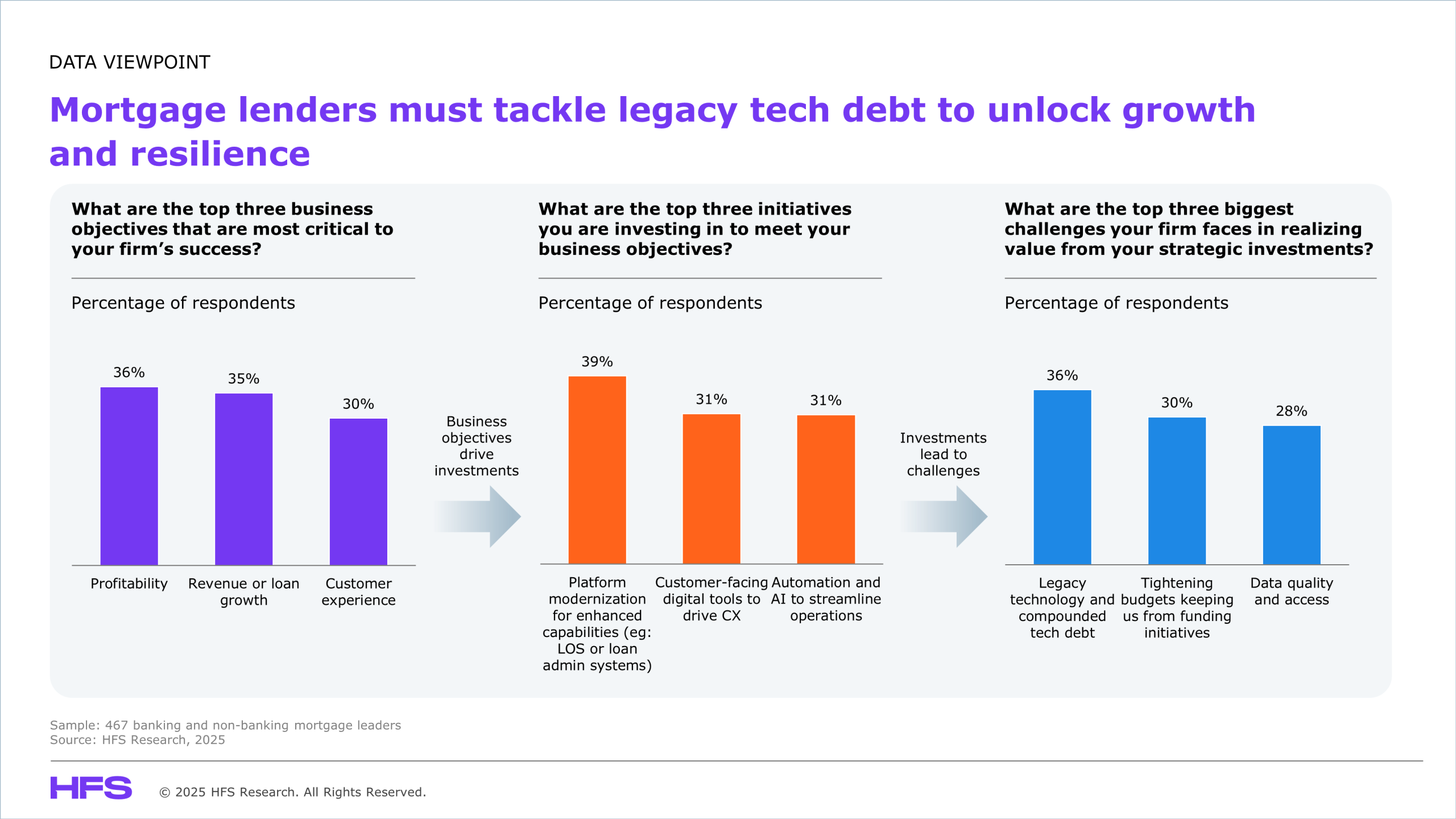

Our survey of 467 banking and non-banking mortgage lenders shows that the mortgage industry is grappling with margin compression, higher capital costs, and shifting customer expectations for faster, fully digital loan experiences. To address these challenges, leaders are investing in platform modernization, CX tools, and automation/AI for operations. However, legacy systems, fragmented data, and tightening budgets are major hurdles in the industry’s attempts to reinvent itself.

Banking and non-banking mortgage lenders are chasing profitability (36%), loan growth (35%), and CX (30%). Yet decades of legacy technology debt (36%) remain the biggest obstacle—driving up costs, blocking scale, and stalling innovation. Firms have long avoided this problem because core modernization feels too risky, expensive, and slow.

AI changes the game. The industry has already automated repetitive, manual tasks. The next step is augmenting automation with AI to deliver predictive and cognitive capabilities at the task level.

Mortgage lenders that weaponize AI for core renewal will unlock margin growth and agility. Those that don’t will keep spending just to stand still.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started