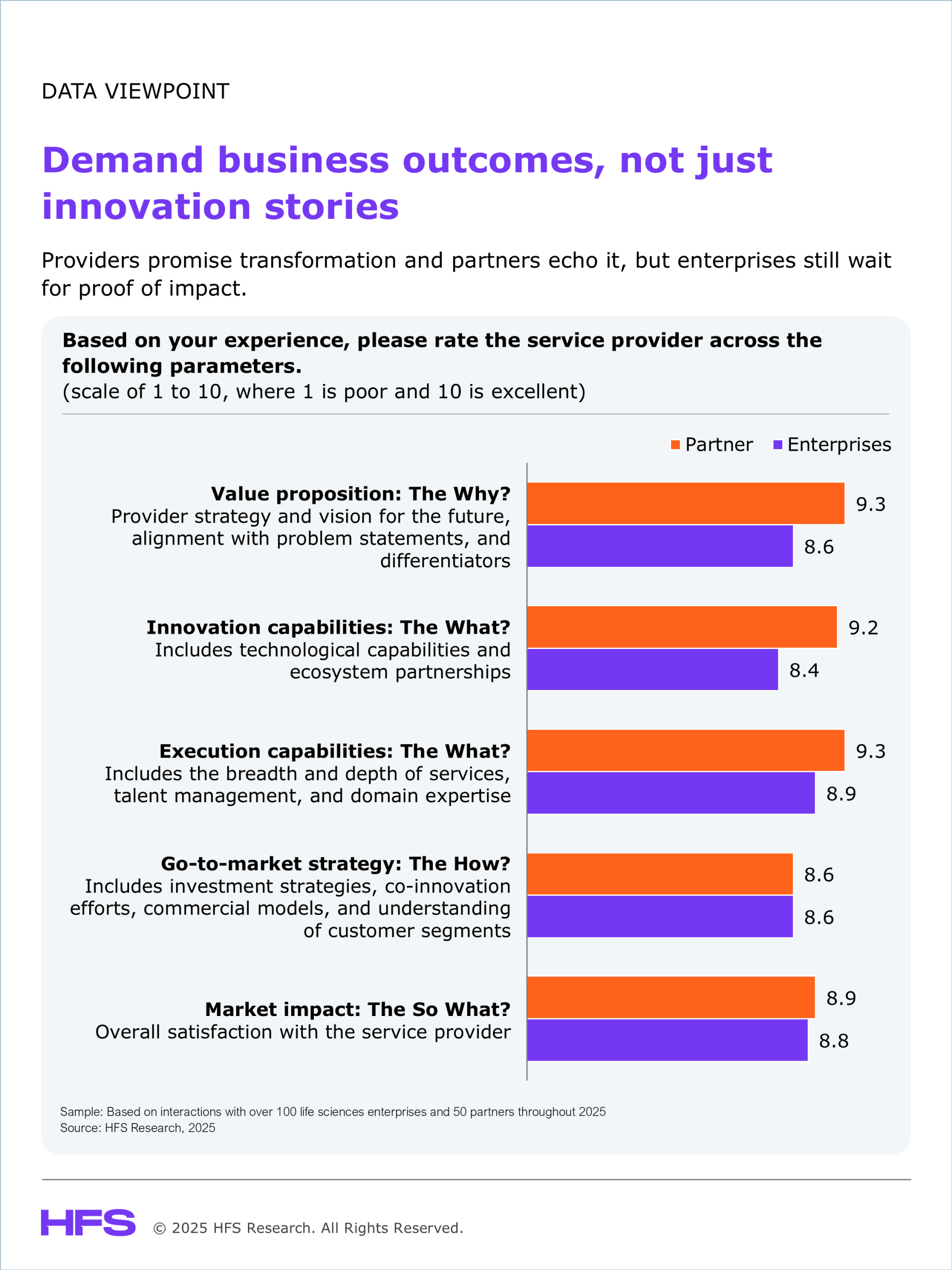

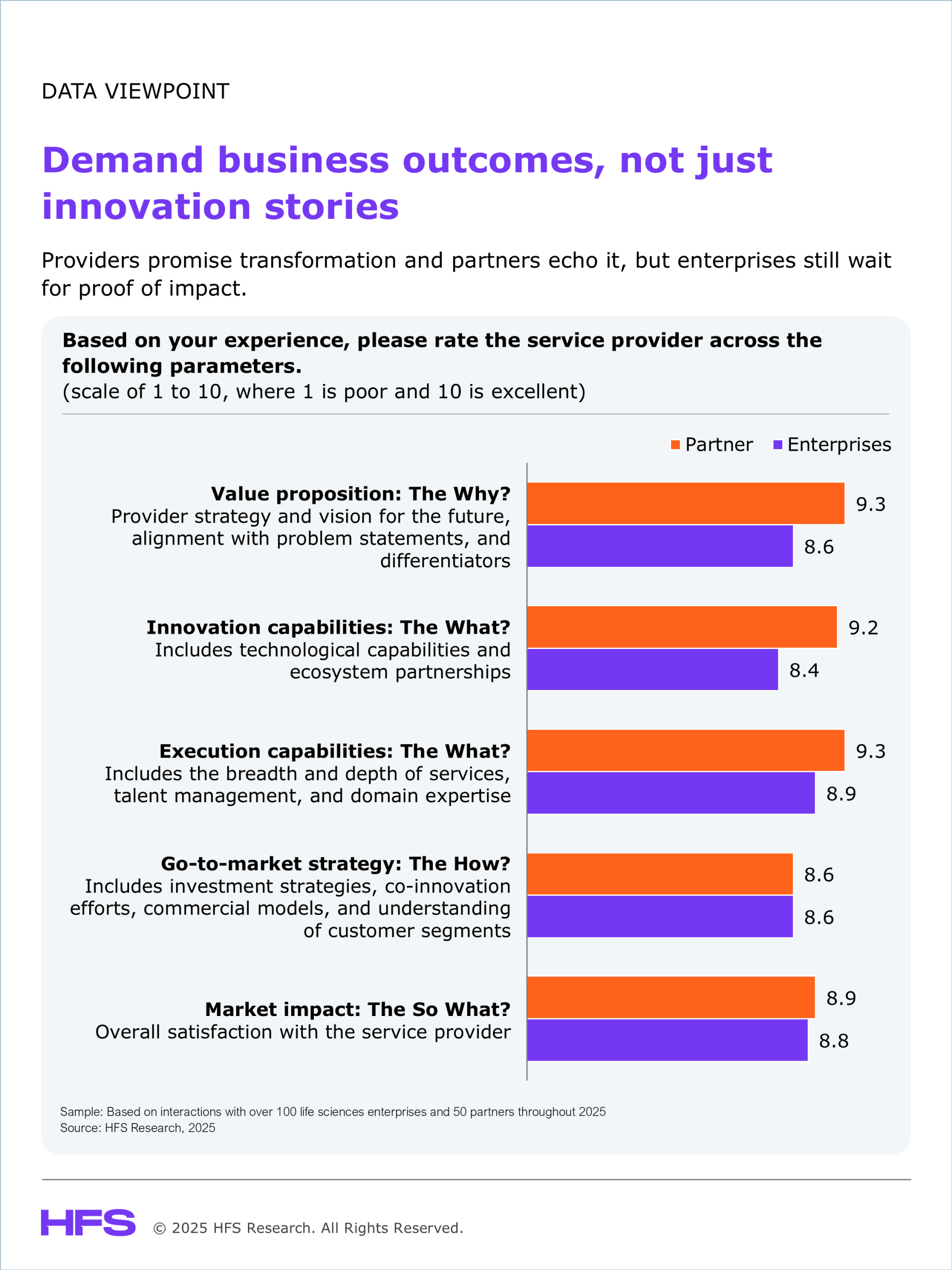

We received feedback from over 50 life sciences enterprises and 60 partners and incorporated the insights of more than 100 life sciences enterprises since early 2025. Compared to enterprises, partners consistently rated their service providers higher on execution, innovation, and value proposition. Both enterprises and partners agree on market impact (8.9), indicating real results, but partners rated the go-to-market strategy slightly lower (8.6 vs. 8.7), reflecting commercial friction.

Here are the key takeaways:

- Strategic vision resonates more with partners than enterprises: Partners (9.3) strongly align with providers’ vision for the future and their clarity of purpose compared to enterprises (8.6). Partners see a clear strategic direction and differentiated approach. Enterprises are slightly less convinced, suggesting that providers’ long-term messaging and strategic articulation are not yet translating into clear value in enterprise engagements.

- Strong market presence and consistency: The equal rating from both enterprises and partners (8.8 for both enterprises and 8.9 for partners) shows that providers are considered stable, dependable, and trusted. However, it also suggests that they are not yet standing out with a bold market identity or unique differentiation.

- Partners highlight innovation leadership: Partners view their providers as strong innovation players (9.2), recognizing their technological strengths and ability to co-create with the ecosystem. On the other hand, enterprises rated innovation lower (8.4), indicating that they may not be seeing the full impact of these innovations in actual business outcomes. Providers need to connect their R&D and partnership work more clearly to enterprise success stories.

- Execution remains a core strength: Both enterprises (8.9) and partners (9.3) agreed that execution is a strong area. Partners rated it exceptionally high, indicating trust in providers’ delivery processes, domain knowledge, and talent management. Enterprises also acknowledged this strength but expect more proactive problem-solving and speed in addressing their evolving business needs.

- Go-to-market strategy needs sharpening: While both ratings are healthy, enterprises (8.6) felt that providers’ go-to-market efforts could be more differentiated and outcome-driven. There’s scope to strengthen messaging, tailor offerings to specific life sciences sub-segments, and design more agile commercial models that resonate with enterprise priorities.

The Bottom Line: While life sciences providers have earned strong trust from enterprise and partners, they must prove impact, not just intent. Partners already believe in their story, while enterprises are waiting to see it pay off.