The semiconductor crunch didn’t just delay product timelines; it exposed a structural risk that now threatens every AI and digital transformation roadmap. As G2000 firms scramble to diversify from East Asia, India presents a rare opportunity to co-create a resilient and scalable semiconductor ecosystem. Enterprise buyers’ actions over the next 24 months will determine whether India becomes a global leader in chip manufacturing or misses its moment entirely. If India misses this opportunity, enterprises will face rising computing costs, delays tied to East Asia–centric supply chains, and increased exposure to geopolitical disruptions.

Today, India’s chip industry is rich in design talent but poor in manufacturing infrastructure. To fix this imbalance, government policy and enterprise leadership are necessary, but they’re not sufficient. Enterprise buyers must step in. The future of computing won’t wait for policy speeches. It will be shaped by those who fund capacity, develop talent, and influence supply routes.

The global semiconductor landscape is undergoing unprecedented realignment, driven by US-China trade tensions and supply chain vulnerabilities. As AI reshapes global value chains, nations capable of designing and manufacturing integrated circuits will define the next technological era.

For India, this presents a once-in-a-generation opening. Indian semiconductor and IT services firms host approximately 20% of the world’s chip design talent. Yet the absence of large-scale fabrication threatens to keep India locked in the services lane while others control the silicon that powers AI, defense, and digital infrastructure. Time is running out to bring the vision of India becoming a major semiconductor hub to life, and enterprises must step in to complete the missing pieces of the semiconductor value chain.

The opportunity is massive, as shown in Exhibit 1. India’s semiconductor market, according to the Ministry of Electronics and Information, is projected to jump from $38 billion in 2023 to more than $100 billion by 2030, with a CAGR exceeding 14%. With global demand for chips heading toward $1 trillion by 2030, India could deliver 10% of that value, but only if it moves fast from design to manufacturing.

![]()

Source: HFS Research, Ministry of Electronics and Information Technology, 2025

Complementing India’s semiconductor capabilities further are its approximately 55 semiconductor global capability centers (GCCs), which employ roughly 60,000 engineers providing a range of services, including the entire chip manufacturing value chain from design to support. Those GCC capabilities directly support fabrication plants (fabs) and outsourced semiconductor assembly and test (OSATs) vendors. However, infrastructure, imports, and advanced-skills gaps persist. Manufacturers should partner early with GCCs to co-build labs, embed engineering teams, and sponsor training pipelines.

![]()

Source: HFS Research, 2025

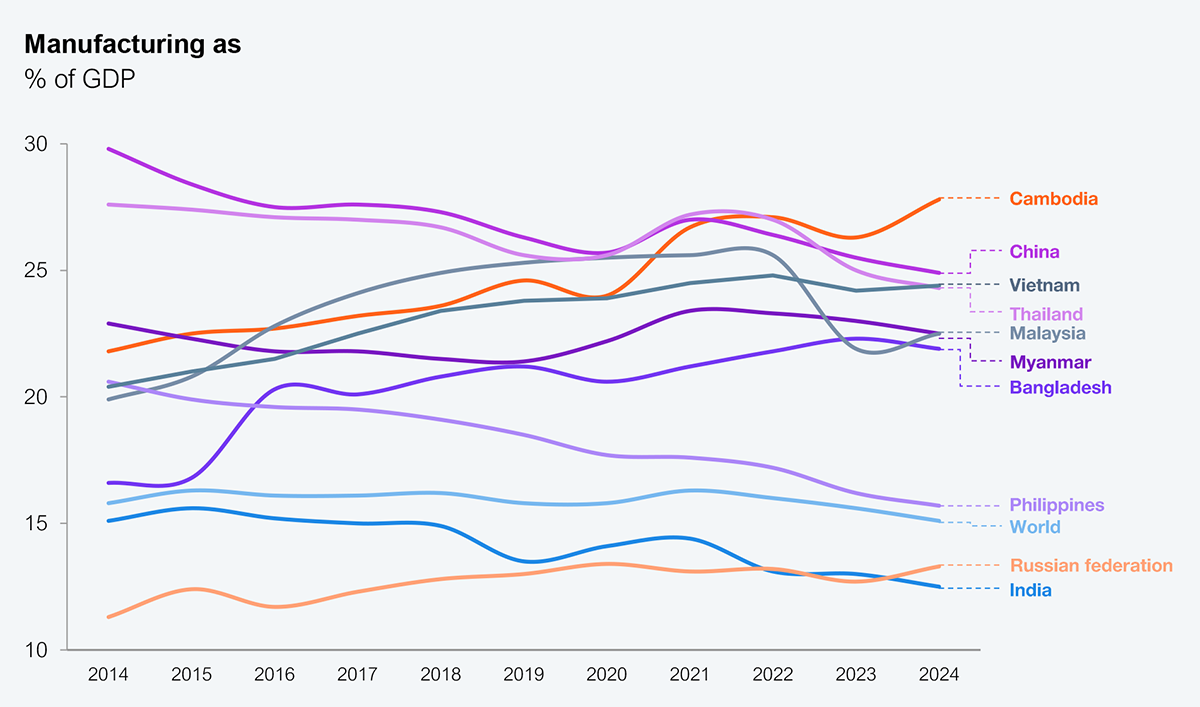

Unlike other Asian nations, such as South Korea, China, and Taiwan, India’s growth has primarily come from services rather than manufacturing. This gap makes India’s semiconductor ambitions both more challenging and more urgent. As AI automates knowledge work and compresses value chains, a services-centric economy becomes a vulnerability, not an advantage.

Source: World Bank

The result is a widening gap. India currently manufactures semiconductors between 28 and 90nm, meeting about 60% of the global demand for legacy nodes. But it is absent from the 3–5nm frontier that defines modern AI computing. AI is collapsing traditional value chains, making chip capacity the new measure of digital sovereignty. Even India’s robust GCC sector cannot close the gap, as talent and software alone cannot fabricate silicon. Without domestic fabs, India’s semiconductor aspirations remain profitable but strategically hollow.

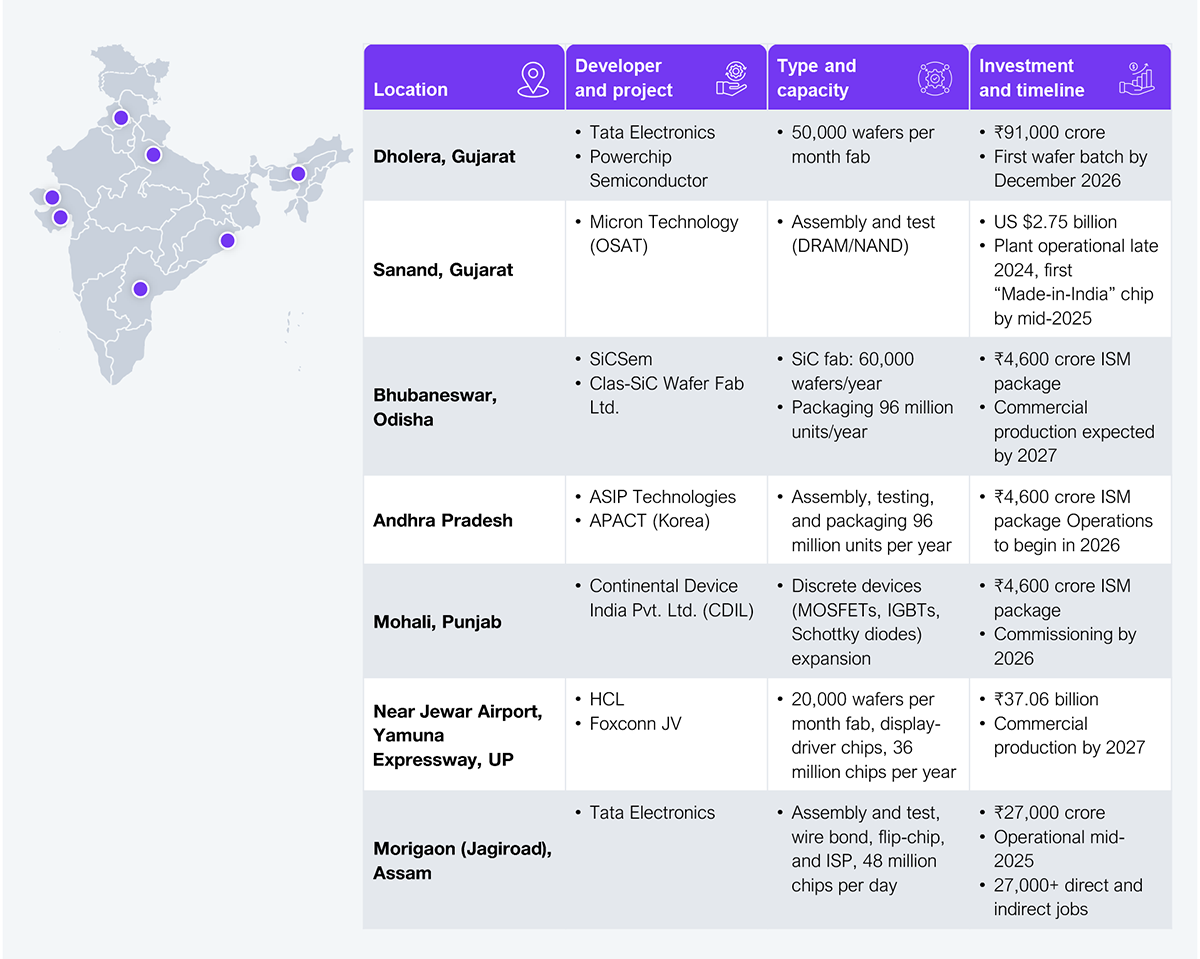

India is taking steps to close the gap. The government’s ₹76,000 crore (approximately US $9.1 billion) commitment through the India Semiconductor Mission (ISM) has already catalyzed approximately US $18.2 billion in investments. Prime Minister Modi’s presentation of the indigenous Vikram 32-bit processor at SEMICON India 2025 demonstrates the capability to handle specialized, security-critical applications in defense, aerospace, and high-assurance enterprise systems.

Source: HFS Research, 2025

The government’s multi-layered policy frameworks (as shown in Exhibit 5) are designed to connect central incentives with state-level competition. This multilayered approach bridges manufacturing capabilities across states with indigenous technological development while addressing implementation challenges through regulatory and talent development policies.

Source: HFS Research, 2025

However, even though the government policies are likely to address the challenges below, it will still take some time for the country to get on its feet in terms of semiconductor manufacturing, for these reasons:

If India doesn’t accelerate semiconductor manufacturing over the next two years, enterprises will face rising computing costs, delays tied to East Asia–centric supply chains, and increased exposure to geopolitical disruptions. The risks compound quickly: Every month without domestic capacity increases dependency on a fragile global manufacturing base. Given the scale of AI-driven demand, enterprise buyers must lead India’s silicon leap or risk losing control of their AI future.

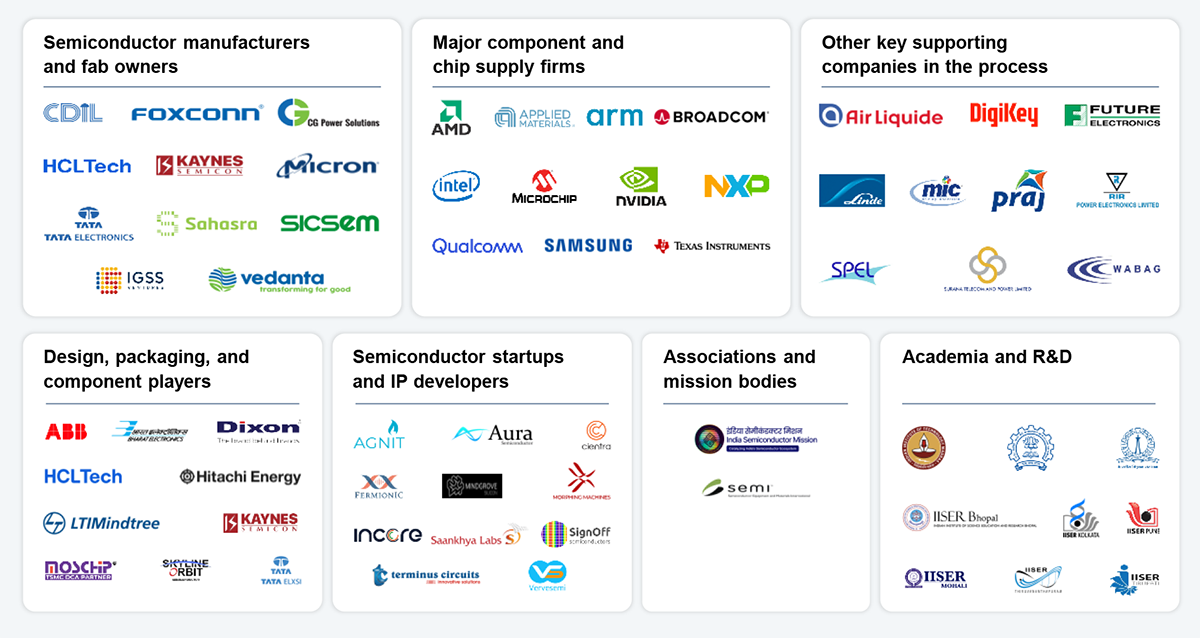

India’s technology and services firms are already investing across the value chain—from design and packaging to research, logistics, and materials. But to make India a credible alternative to East Asian fabs, these firms must shift from participants to ecosystem builders.

Source: HFS Research, 2025

To prevent paying a steep price, enterprise buyers must do the following:

India has the design talent, policy momentum, and early investments, but not yet the manufacturing depth to meet AI-scale compute demands. Over the next 24 months, enterprises will decide whether India becomes a viable alternative to East Asian fabs or whether they remain locked into a fragile global supply chain. Co-creating India’s chip ecosystem is no longer an industrial strategy; it’s a matter of digital self-preservation. It’s the only credible path to resilient, cost-stable, innovation-ready compute.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started