The Big Beautiful Bill Act (BBB) and the expiry of the premium tax credits and subsidies for the exchange market will eliminate ~15% of the insured market as early as 2026. This puts the financial viability of health plans at significant risk and will, for the first time in US history, lead to health insurers filing for bankruptcy. The only way out of this jam is for health plan CXOs to start addressing health (preventing disease, delaying onset, and extending healthy life expectancy) and diversifying the health plan value proposition.

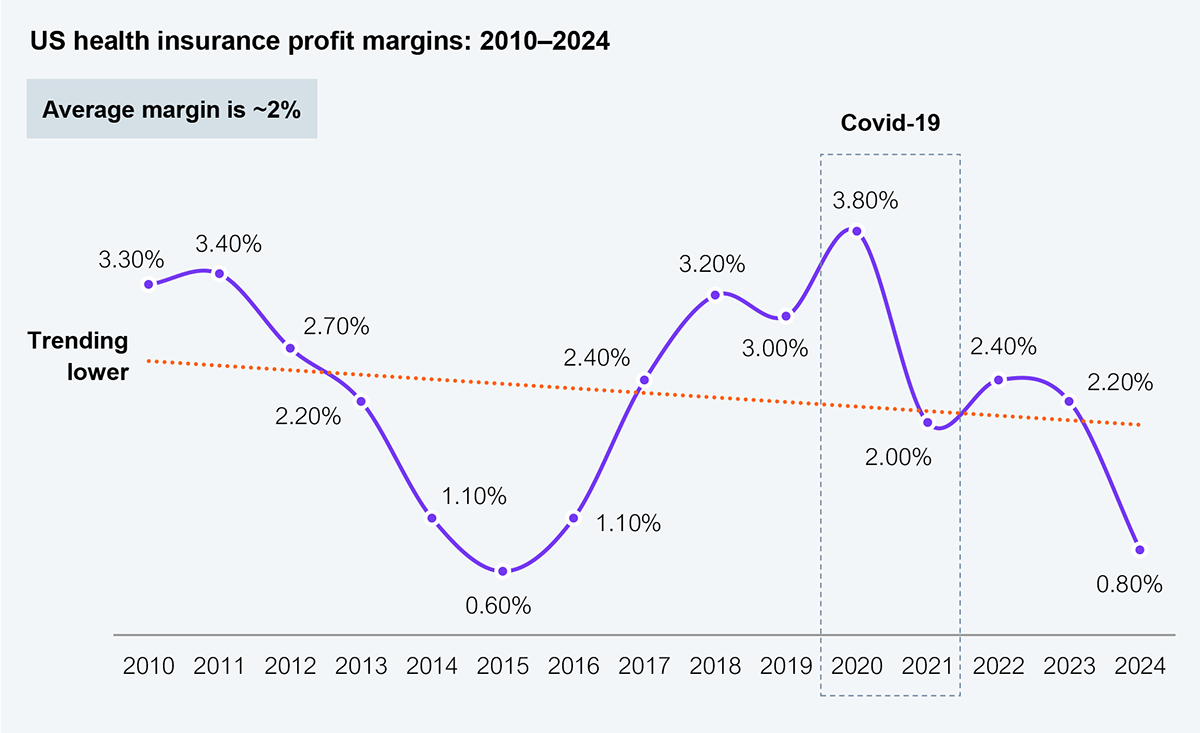

HFS Research estimates that ~80% of health plans generate ~90% of their revenues through services and ~10% through underwriting medical risk. Underwriting (risk) businesses tend to attract premium pricing with higher margins (higher revenues), while services businesses tend to be lower on both pricing and margins. Exhibit 1 clearly indicates that the health plan business is now predominantly services-based.

Source: NAIC (1000+ health plans reporting), HFS Research, 2025

Seventy-two percent of all US lives are underwritten by either the government (Medicare, Medicaid, CHIP) or self-insured employers, not health plans, a trend that is 15 years in the making. To make matters worse for health plans, their inability to manage medical costs continues to worsen year over year (see Exhibit 2), further diluting their value proposition as medical fiduciaries and impacting their margins. Consequently, some health plans (Cigna, Humana, Highmark) are diversifying by acquiring provider, technology, and services businesses to build vertically integrated businesses. However, there is limited evidence that vertical integration is improving the financial story; case in point: five of the six largest publicly traded healthcare enterprises operate at margins of ~2.5%.

Source: 10k filings, annual reports, HFS Research, 2025

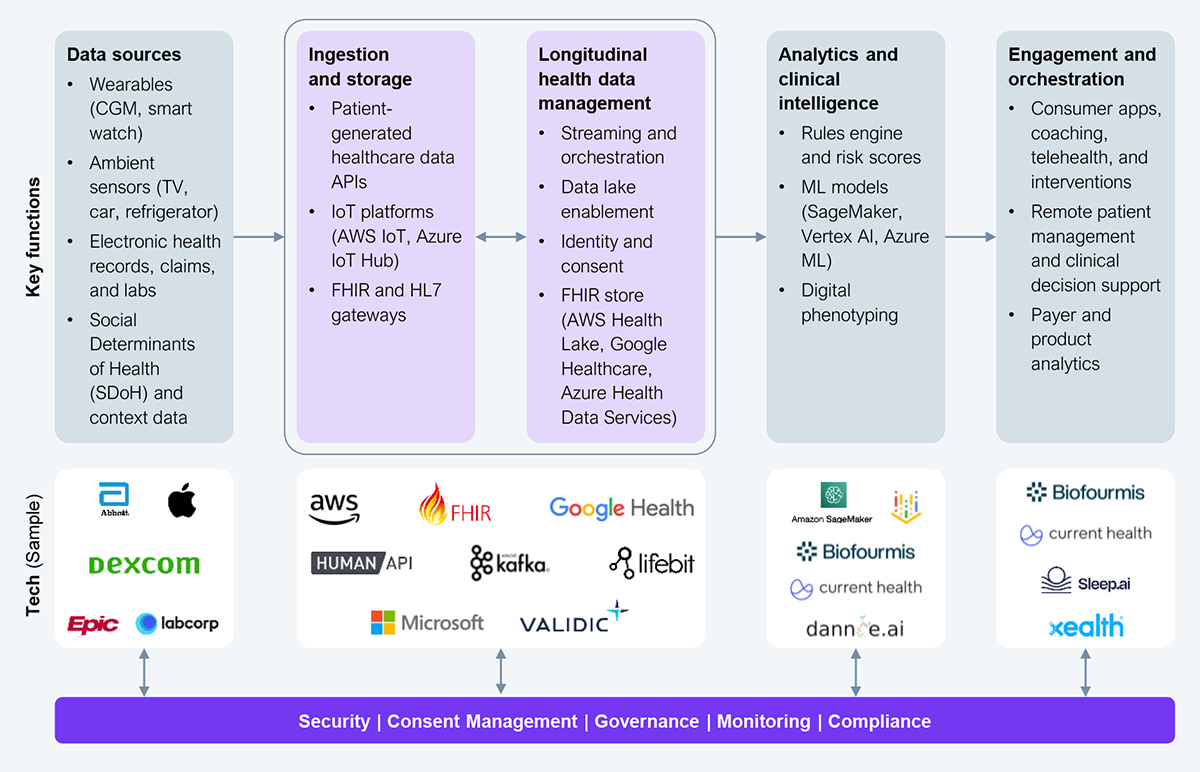

The current healthcare paradigm is reactive in addressing sickness and disease. The systems deployed by health plans (Core Admin Process Systems – CAPS) and health systems (Electronic Medical Records – EMR) are purpose-built for healthcare, not health. To address health and navigate the revenue challenges in a collapsing market, health plan CXOs must invest in a health-built system with a new architecture (see Exhibit 3), thereby preventing disease, delaying onset, and increasing healthy life expectancy.

Source: HFS Research, 2025

The health architecture will manifest through five key pillars.

The health architecture represents a minimally viable, technology-enabled manifestation for delivering health objectives. Without it, all that talk about health is disingenuous. Health plans must thus invest in developing the health architecture if they want to survive as a business.

A common refrain is that there is no money in health, hence its deprioritization. Yet, it is perhaps the most crucial driver for reducing expensive clinical interventions. Exhibit 4 identifies three models that can help monetize health. Model 3, in particular, is the most advantageous one, where smart investments delivered through a curated ecosystem using Services-as-SoftwareTM will yield rapid results. The other models, in comparison, are biased toward traditional technology enablement.

Source: HFS Research, 2025

The traditional healthcare market is undeniably in decline. To remain relevant, expand your value proposition to health by harnessing technologies and building a health architecture that urgently addresses the real priorities—preventing disease, delaying onset, and increasing healthy life expectancy.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started