Enterprises want transformation, but many believe their ever-tightening budgets can’t afford it. Building out the technical underpinnings of large-scale transformation has steep upfront costs and slow rates of return. Transformation ambitions are growing, but budgets aren’t. This mismatch has frozen progress. This is where self-funded transformation models have emerged as a pragmatic path toward funding modernization through existing savings. Given the economic headwinds of inflation, tariffs, and capital constraints, CFOs and CIOs are acting smarter, not slower, and self-funded transformation is a proven operating model. Waiting for funding delays growth and compounds cost pressures. Every quarter of hesitation costs market share. HFS Research, in partnership with UST, surveyed 110 enterprise leaders to understand how companies are breaking this paradox through self-funded transformation.

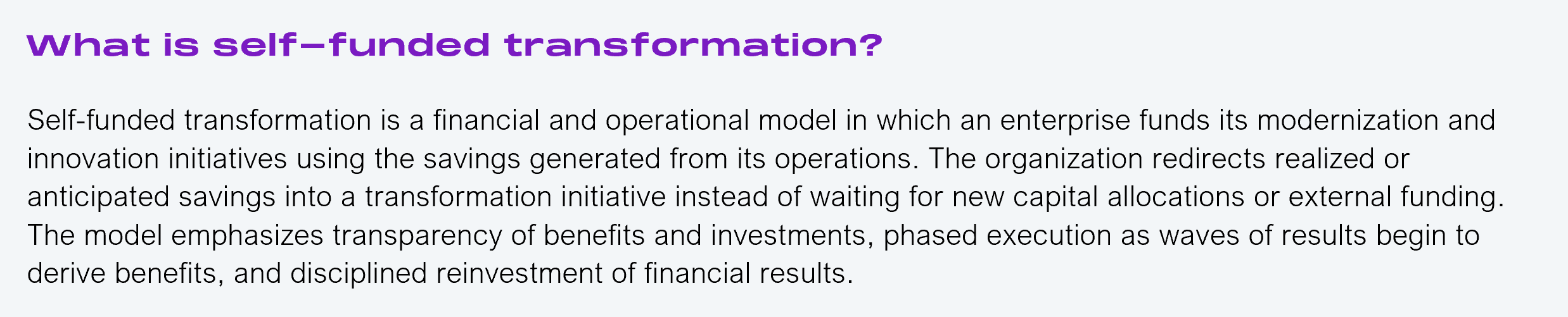

The cornerstones of self-funded transformation are the funding sources. In a break from the past, enterprises are not waiting for external capital to start transforming. Instead, they are turning to the hard cost reductions shown in Exhibit 1, such as automation (38%), vendor renegotiation (29%), and nearshore and offshore labor shifts (28%). These forms of change are easy to quantify and permanent across the deal term, providing tangible funds to reinvest in future transformation.

The result is a powerful new source of innovation funding, and most executives would agree that it is readily available. In a recent two-day HFS AI-First Deal Lab workshop, enterprise and service provider executives from a significant global life sciences relationship jointly identified over 20 quick wins worth millions of dollars. The service provider was willing to contractually self-fund the agentic transformation in their infrastructure and application management teams.

Sample: 110 Global 2000 executives

Source: HFS Research, 2025

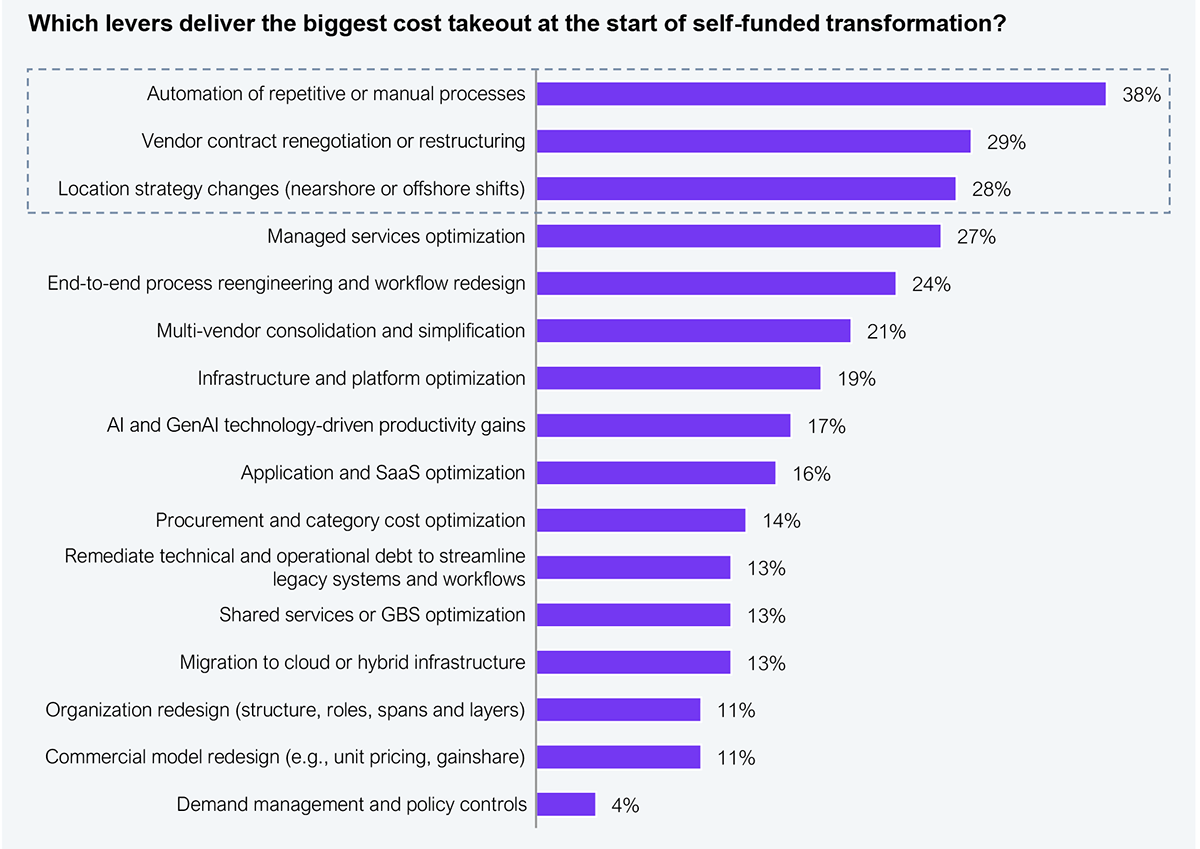

Once upon a time, CFOs would allocate new funding only after savings were fully secured. That high standard is clearly changing as it creates stalled moments in a company’s evolution. Self-funded transformation contracts allow executives to structure investments in advance of results, which both accelerates results and prevents lulls in delivery. As shown in Exhibit 2, 86% of enterprises are willing to initiate modernization before achieving full savings, and even 38% of enterprises are willing to begin modernization in parallel with savings creation, albeit on a limited scale.

The implication is that innovative executives are breaking the budget cycle by partnering with service providers that are willing to commit resources in advance of results. This only works when both enterprises and their service providers are fully aligned and have great trust in the delivery of results.

Sample: 110 Global 2000 executives

Source: HFS Research, 2025

Self-funded transformation is an increasingly popular deal structure. Our research, as shown in Exhibit 3, indicates that 42% of companies use it as a standard or common practice, and another 38% use it selectively for specific initiatives. This is evidence that self-funded transformation has transitioned from an experiment to a norm. Enterprises that master self-funded transformation will ultimately own the playbook for next-generation deal structures, while other companies will be stuck in cost-cutting mode.

There are several positive implications of self-funded transformation becoming a commonly leveraged new operating model. First, enterprises will be able to fund more innovation. Second, enterprise relationships with service providers will become more selective, deeper, and longer-term. Third, service providers will have greater client commitment to reinvest in platforms and capabilities that fit client needs better.

Sample: 110 survey participants

Source: HFS Research, 2025

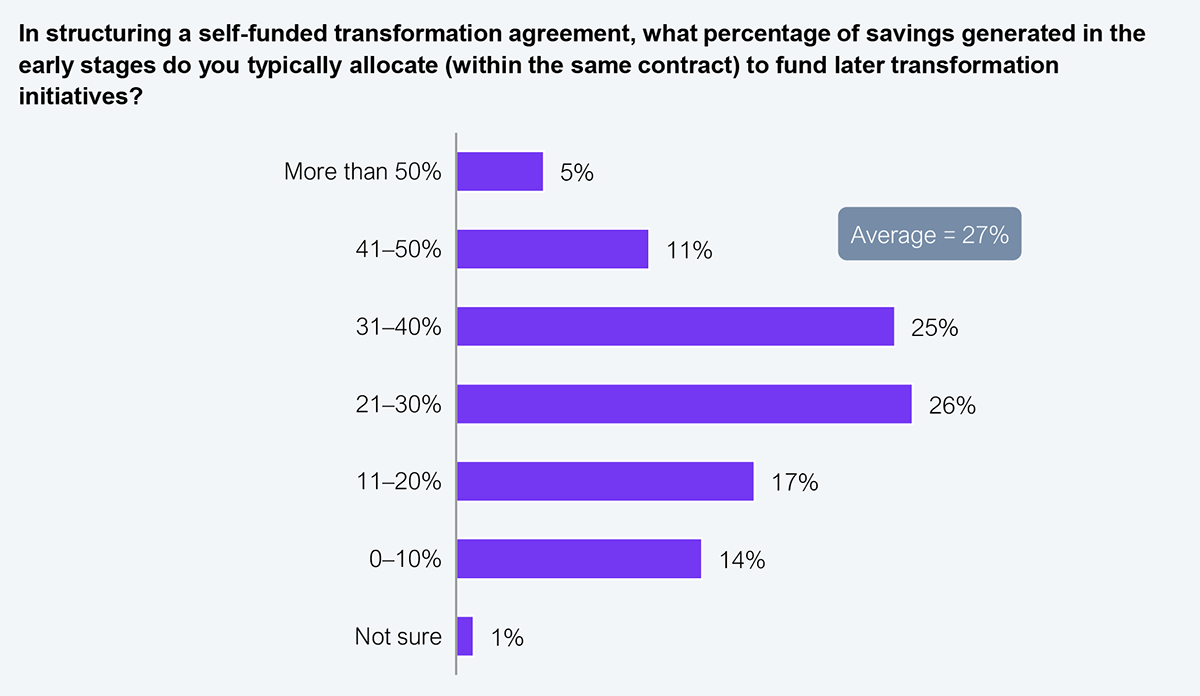

Our research, as shown in Exhibit 4, indicates that self-funded transformations typically reinvest 27% of benefits back into the transformation, leaving the remaining results for operating budget reductions. For nearly all firms, 27% represents a meaningful amount of reinvestment, indicating that enterprise executives are leveraging self-funded transformation models to achieve significant improvements in operating results.

The key to successful transformations, which take time to deliver, is to avoid the cost-cutting trap of reducing budgets to reflect the full benefit of the transformation. These efforts starve transformation’s funding sources. However, it’s clear that all companies expect financial results. So, savvy executives balance budget cuts with reinvestments. But what’s the right balance?

Sample: 110 Global 2000 executives

Source: HFS Research, 2025

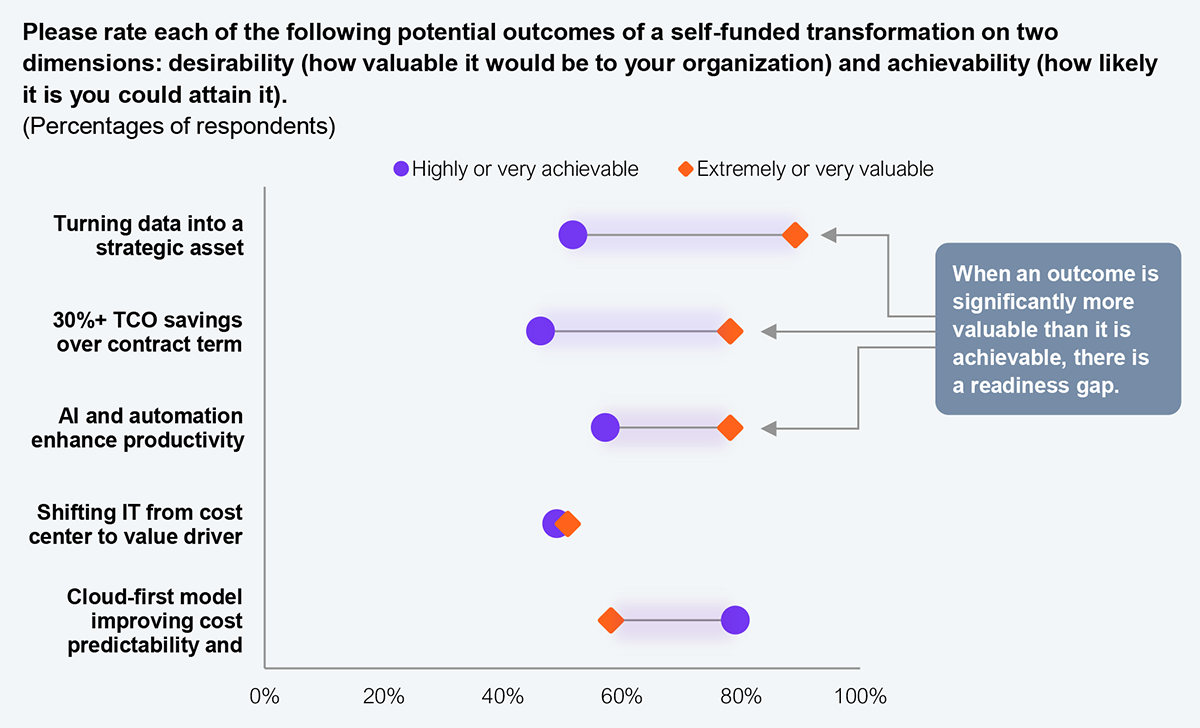

Given the state of market competitiveness, executives have high expectations. From delivering strong TCO savings, turning data into business gold, and leveraging automation to drive efficiency and agility, enterprise executives demand meaningful results. However, as shown in Exhibit 5, there is a significant gap between what enterprises want and what they think they can deliver. Only 52% of enterprises believe they can deliver on transformation goals. This is proof that waiting for traditional funding isn’t just terrifyingly slow, it’s self-defeating. For example, nearly 90% value turning data into a strategic asset, but only 52% believe they can deliver. This perfectly demonstrates the readiness gap companies have.

Self-funded transformation provides enterprises two powerful levers to close this gap. First, they provide a powerful reinvestment mechanism to fund high aspirations. Second, they provide contractual guarantees and expense run rates that remove risk. In place of risk, enterprises get guaranteed results because funding doesn’t get hijacked by finance or budget changes. Instead, reinvestments are driven straight into results that are contractually guaranteed. Remember: budget paralysis isn’t neutral because the results compound. Every quarter of delay adds technical debt, inflates costs, and hands a competitive advantage to faster peers.

Sample: 110 Global 2000 executives

Source: HFS Research, 2025

Based on our research, we believe that the best self-funded transformations will have four key characteristics: savings-fueled investments, iterative and self-reliant waves, a governance-driven ethos, and trust-based financing.

In an era where enterprises regularly demand improved profitability, self-funded transformation is a powerful operating model that allows innovation to pay its own way. Self-funded transformation is a financing strategy for growth, speed-to-market, and efficiency. Enterprises that practice reinvestment discipline modernize faster and scale smarter, while those that don’t will be dragged through the morass of corporate budgeting cycles and be forced to sacrifice their aspirations to appease CFOs. Transformation isn’t delayed. Rather, it’s self-funded. Start building your growth engine today.

Since 1999, UST has worked side by side with the world’s best companies to make a powerful impact through transformation. Powered by technology, inspired by people, and led by our purpose, we partner with our clients from design to operation. Our digital solutions, proprietary platforms, engineering, R&D, products, and innovation ecosystem turn core challenges into impactful, disruptive solutions. With deep industry knowledge and a future-ready mindset, we infuse expertise, innovation, and agility into our clients’ organizations—delivering measurable value and positive lasting change for them, their customers, and communities around the world. Together, with 30,000+ employees in 30+ countries, we build for boundless impact—touching billions of lives in the process. Visit us at www.UST.com.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started