Organizations are aspiring to progress their business operations toward becoming fully digital by deploying end-to-end data and decision-making capabilities. To do this they’ve adopted strategies to deploy automation at scale by integrating automation tools across systems, applications, and workflows. However, they are often frustrated that these efforts have failed to deliver the promised ROI.

Thus, native integration of RPA with Hyperscalers, and embedding automation as part of a broader ISV ecosystem, is an important step in progressing toward those goals. Yet, what clients need more than anything else is a clear understanding of the outcomes that collaboration with their automation providers should yield. It is on those outcomes that the success of the partnership between AWS and Blue Prism will be measured. But first, we must see if AWS really is serious about Intelligent Automation.

The upheavals of the pandemic have led to a reassessment of organizations’ operational and automation priorities. As recent HFS research has shown, their focus has shifted toward delivering immediate outcomes by designing workflows that take the RPA value out of the back office, where most RPA solutions have been buried, and align these solutions with the immediate commercial needs for the enterprise. The need to create immediate solutions with the hyperscaler platforms is now far greater than ERP suites, as that is where the hyperconnected business environment operates, as opposed to the traditional back office.

Against this background, the announcement of the strategic collboration between AWS and Blue Prism is seeking to address these requirements by natively integrating the capabilities of both partners rather than just integrating at an API level. From Blue Prism’s point of view, it is the deepening of a partnership that they had for some time. Now Blue Prism is advancing from a tactical relationship into a strategic collaboration. But what does that really mean for customers? Blue Prism aspires to deliver four components:

For Blue Prism the strategic implications are significant. On the one hand, it is aiming to access new buying centers on the IT side. On the other hand, it aligns Blue Prism with AWS while reducing its reliance on Microsoft. Blue Prism is continuing to work with Microsoft, but the strategic intent is clear. Having said that, UiPath is just as wary of Microsoft as Blue Prism is. We are seeing Microsoft gaining strong traction across the industry with its Power Automate Platform and other assets. With that, competition is significantly increasing. This is not just about RPA, but about the shift of RPA into ISV ecosystems and about the rise of Low Code/No Code offerings. Therefore, we view it as a bold move in a transforming market that provides Blue Prism with a much clearer positioning for its offerings.

In contrast to Microsoft and Google, AWS has been sitting on the fence on Intelligent Automation. Judging from the announcement, the goal is neither to buy nor build but partner on those capabilities. Yet, what we need as next steps is a clear articulation of the client requirements, use cases, and ultimately outcomes of those newly integrated capabilities. With the market noise both on the cloud as well as RPA front, this would help to get back to more realistic and therefore valuable discussions on automation.

When assessing the cloud strategy of Blue Prism and the potential of AWS, the breaking news of the acquisition by software and services firm SS&C is the elephant in the room. SS&C has been on a parallel intelligent automation platform development track targeting financial services and healthcare sectors. As these firms come together, they mutually need to develop the succinct narrative of value and benefit to clients. The focal point for those narratives should be outcomes around data-centric issues – not technology.

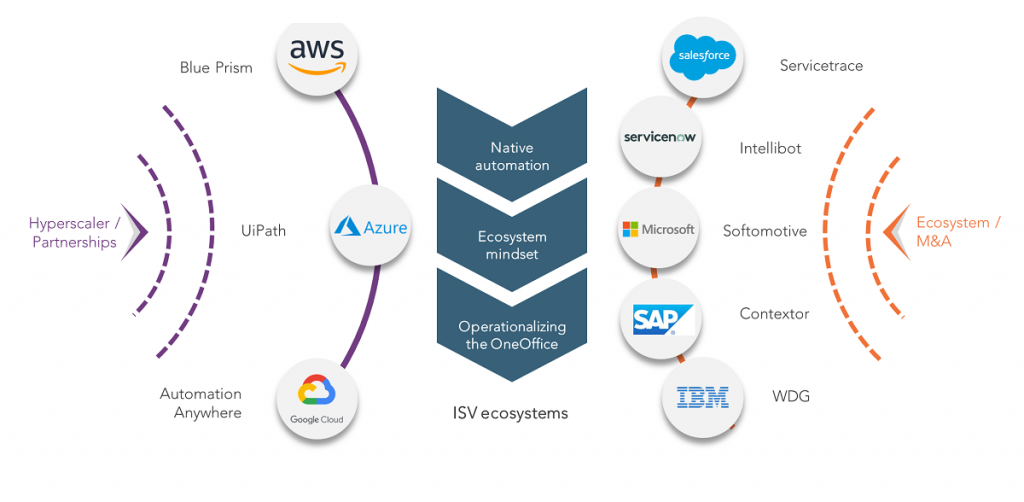

The announcement is yet another proof point that large parts of RPA-centric requirements are moving or more precisely have already moved into ISV ecosystems. Recent acquisitions such as Servicetrace by Salesforce or Intellibot by ServiceNow are further indicators for this shift. As Exhibit 1 highlights, the leading ISVs have already acquired RPA to expand the reach of their ecosystem. RPA is an embedded functionality that expands the functionality of the respective platforms. Conversely, RPA providers must focus on excessive partnering to offer broader functionalities that allow customers to finally scale their deployments.

Of the RPA incumbents, UiPath is natively integrating into AWS and Azure but equally into Salesforce and ServiceNow, giving them a strong position in both the Hyperscaler stacks and ISV ecosystems. Automation Anywhere is boasting of the intimacy of their relationship with Google. While all RPA providers have partnerships with the leading Hyperscalers, the level of closeness and the native integration of capabilities are starting to shape a clearer competitive landscape.

Source: HFS Research, 2021

Natively integrating RPA capabilities with offerings of the Hyperscalers could provide organizations with the foundation to finally scale the automation deployments. Their goal, but also the fundamental challenge, is to provision and consume data anywhere and at scale. Yet, enterprise technology leads need clear use cases and outcomes to understand how this will work. And to make sure they aren’t left disappointed for a second time.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started