CFOs, CIOs, CTOs, and finance leaders across enterprises are seeing a paradox in digital finance. While central banks pour billions into central bank digital currency (CBDC) pilots, private stablecoins are already delivering what CBDCs promise: instant settlement, global reach, and institutional-grade efficiency. Enterprises don’t need to wait for CBDCs; stablecoins are ready today.

CBDCs fail to register an impact globally

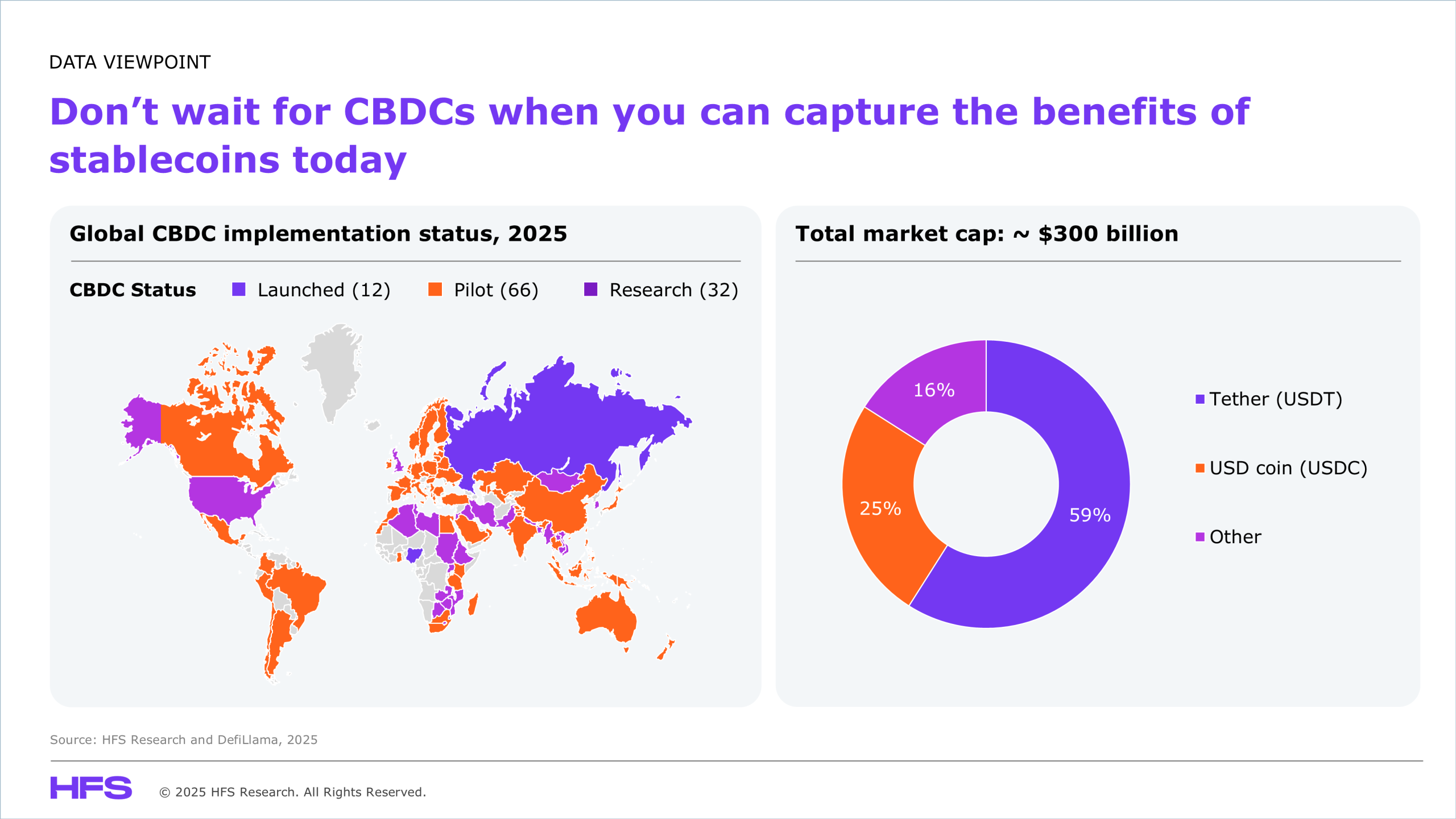

Despite extensive experimentation, wherein 110 countries representing a major portion of the global GDP have explored or are exploring CBDCs, deployment remains scarce. China’s digital yuan leads with ¥7.3 trillion across 180 million wallets, proving technical feasibility. This aligns with the country’s vision to establish a robust digital financial framework. Russia, on the other hand, delayed the launch of its digital ruble by over a year due to resistance from the banking sector. Also, the US banned a digital dollar, citing privacy concerns, while EU efforts remain exploratory. Collectively, this points to fragmented, geopolitically incompatible approaches.

Stablecoins rush in to fill the void CBDCs promise, but they’re not perfect

Stablecoins have quietly built a $300 billion market. Pegged to fiat currencies, they enable near-instant settlement and liquidity across borders. Frameworks like the EU’s MiCA and the US GENIUS Act provide the regulatory scaffolding that legitimizes stablecoin usage, giving enterprises legal clarity to operate across jurisdictions–something CBDCs are still years away from achieving. This regulatory certainty is why institutional players like Tether, Circle, and J.P. Morgan can confidently scale. But CFOs, CIOs, and CTOs must remember: stablecoins aren’t without risk. They face uncertainty in emerging markets, limited legal protections if an issuer fails, and transparency gaps in reserve management. Although stablecoins are not perfect, they’re still ahead of CBDCs in terms of enterprise adoption, primarily due to their agility and utility.

Why enterprises are choosing stablecoins

CBDCs do face several challenges, including institutional resistance from banks and retailers, privacy-driven political gridlock, incompatible global standards, and operational issues related to cross-border transactions. Stablecoins, on the other hand, offer enterprises immediate utility for transactions and liquidity management.

This isn’t a battle between state and private control; it’s a race for speed to value. While CBDCs remain policy-driven, caught in pilots and regulatory deliberation, CFOs and treasurers are already deploying stablecoins for instant cross-border settlements, despite CBDCs and stablecoins having their own set of challenges. Adoption is a natural outcome of that maturity. Forward-looking organizations are already leveraging stablecoins as a practical bridge to digital finance. While CBDCs shape policy debates, stablecoins shape enterprise balance sheets. Those integrating them today will likely outpace peers that are still waiting for regulatory clarity.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started