Enterprise blockchain is often declared dead after years of hype. With budgets tightening and leaders demanding clear ROI, justifying and securing investments has become increasingly complex. The “HFS Horizons: Enterprise Blockchain Services, 2025” report tells another story: service providers are now delivering real value with the technology.

For the Horizons report, HFS assessed 14 global service providers that are helping enterprises move into production using enterprise blockchain. They are embedding blockchain into their core infrastructure as another piece of the stack rather than treating it as a standalone technology. Their engagements have moved beyond “where can I use this new technology?” to driving real efficiency gains and unlocking new revenue streams within the enterprise and their broader ecosystems.

As enterprise blockchain becomes increasingly embedded within enterprise infrastructure, service providers that can move beyond pilots and proofs-of-concept into real production engagements are worth their weight in gold. Our assessment showed the market is talking less about blockchain and more about the use cases it enables. We saw three key use cases driving demand for this technology:

As these use cases mature, service providers have been changing their market approach. Historically, expensive and time-consuming custom builds were the norm as enterprises sought a competitive edge. Today, most providers are pitching rapid, repeatable solutions built around key use cases to lower costs and accelerate time-to-value. But the onus is on enterprise leaders to determine which providers have actually made the pivot and which are just talking the talk.

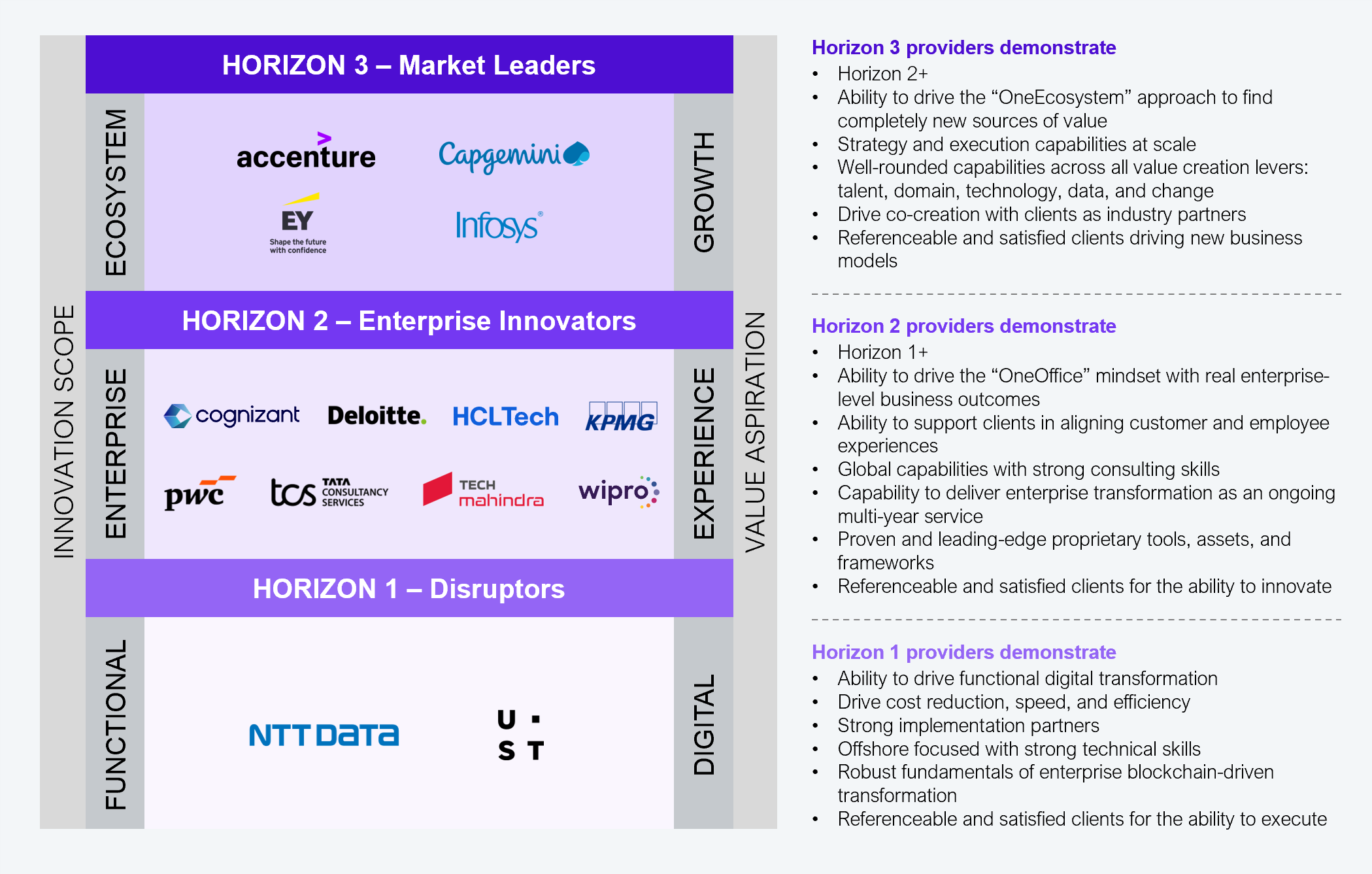

Horizons reports assess service providers across three key layers of value creation (see Exhibit 1). Our assessment dimension (see points below) covers factors such as how well each provider navigates regulatory expertise, builds repeatable platforms, and integrates other emerging technologies to deliver meaningful outcomes at scale with enterprise blockchain.

The “HFS Horizons: Enterprise Blockchain Services, 2025” report identified four Horizon 3 leaders: Accenture, Capgemini, EY, and Infosys. While these providers are delivering production-grade blockchain at scale, our assessment reveals a bloat in Horizon 2, indicating a strong group of promising partners. Still, we need to see more scaled production outcomes.

Note: All service providers within a Horizon are listed alphabetically.

Source: HFS Research, 2026

The overall rankings highlight how the enterprise blockchain market has matured in recent years, despite the hype dying. There are plenty of providers that offer credible blockchain assets, accelerators, and consulting-led capabilities, but fewer have translated them into repeatable and scalable assets that drive tangible outcomes. Enterprises, in turn, must demand proof of real-world value, not just more slide decks and theory-driven IP.

Enterprise blockchain has matured beyond the realm of experimental technology. It is production technology, and that changes how you choose partners and how you deploy it. Here’s what the CTO should do next:

But here is a critical trade-off: speed vs. governance. Fast experimentation can deliver quick wins, but production blockchain requires regulatory alignment, shared governance, and auditability, and that takes time.

The Horizons report shows which providers can actually execute. Enterprises can use the Horizons framework to shortlist based on ambition: Horizon 1 for pilots and Horizon 3 for scaled production. Challenge provider pitches using the evaluation criteria and ask for proof about live deployments, transaction volumes, regulatory clearance, etc. Align IT, business, procurement, and risk teams on what “blockchain-capable” means in practice, i.e., repeatable platforms, shared governance, and measurable trust outcomes.

Enterprise blockchain has shifted from hype-driven pilots to production infrastructure for trust and value exchange. Shortlist providers with live production deployments and ecosystem governance experience, not vision decks. Avoid those that can’t show client references and measurable outcomes. Accept the trade-off: building governance-ready blockchain takes longer, but it’s the only path to scale.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started