Our conversations with enterprise leaders reveal they often look beyond the TWILTCH (TCS, Wipro, Infosys, LTIMindtree, Tech Mahindra, Cognizant, HCLTech) players for a high-growth partner blending operational agility with scalable delivery. This search is precisely the motivation for HFS to identify the “fastest-five” service providers—the five (of many we track) that report the highest year-over-year (YoY) revenue growth in a quarter.

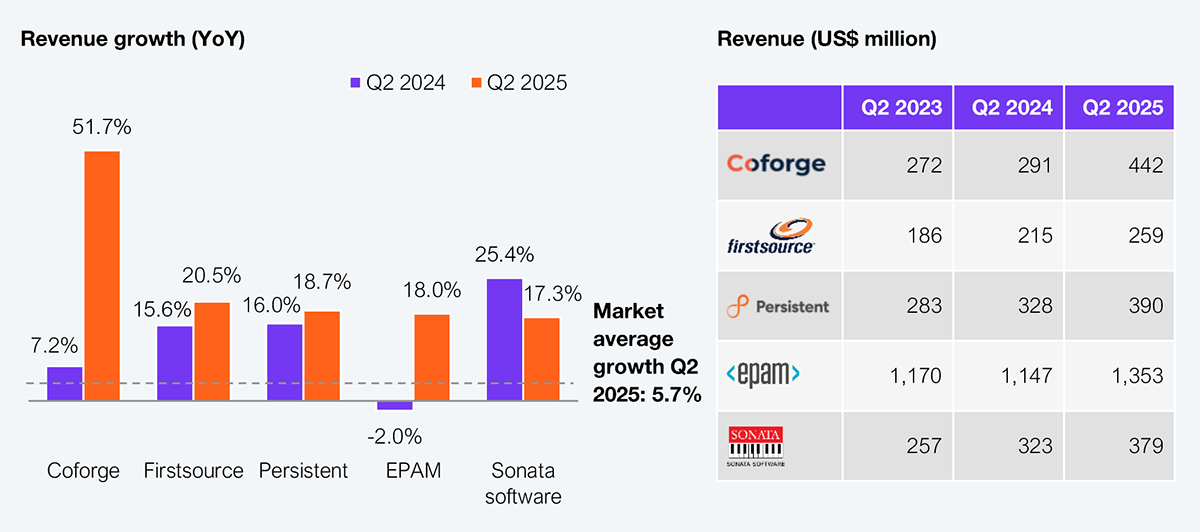

In Q2 2025, Coforge, Firstsource, Persistent, EPAM, and Sonata Software were the fastest-five service providers. They all surpassed the market average growth rate of 5.7% YoY (2) to report double-digit growth (see Exhibit 1). They make an interesting watch list for any enterprise assessing the ecosystem in search of its next partner.

Note: Revenue and growth data represent HFS estimates based on analysis of publicly available information. YoY growth compares a quarter with the corresponding quarter of the previous year.

Source: HFS Research and earnings reports of leading service providers, 2025

The fastest-five service providers demonstrate organic and inorganic AI investment as they equip themselves to help enterprises advance their AI strategies. They specialize in key verticals (such as BFSI, life sciences, and healthcare), likely appealing to organizations operating in unique and regulated industries. The result is a flurry of AI-centric deals, including Coforge’s recent $30 million AI-powered modernization deal.

This deal activity means the fastest-five have the capability and experience to help enterprises scale AI initiatives effectively, but enterprises still have questions about their operational resilience.

Smaller, more nimble firms often still battle the perception that they might struggle in an uncertain macroeconomic environment, frequently prompting enterprises to look to bigger providers. The fastest-five’s success proves that search isn’t always necessary. Their AI success comes when enterprise caution stretches sales cycles—particularly in BFSI—and tariff uncertainty impacts operations daily.

The fastest-five are proof to enterprise leaders that bigger is not always better.

Enterprise and AI leaders who value flexibility, industry-specific focus, and AI-embedded services and tools will benefit from considering these “fastest-five” service providers. Their recent earnings highlight that expanding capabilities, vertical depth, and proprietary AI platforms drive revenue traction, a key proof point for their ability to help enterprises realize their AI ambitions.

Notes:

(1) Growth data represents HFS estimates based on analysis of publicly available information. The year-over-year (YoY) growth compares a quarter with the corresponding quarter of the previous year.

(2) HFS considered Accenture, Birlasoft, Capgemini, Coforge, Cognizant, Conduent, DXC, EPAM, EXL, Firstsource, Genpact, Globant, HCLTech, Hexaware, IBM, Infosys, Kyndryl, LTIMindtree, Mphasis, Persistent, Sonata Software, TCS, Tech Mahindra, Wipro, WNS, and Zensar for this analysis.

(3) HFS defines mid-tier companies as those with revenue between US$500 million and US$2 billion.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started