Industrial and consumer products are increasingly becoming software-defined, with traditional engineering, research, and development (ER&D) getting increasingly commoditized. To stand out, ER&D leaders must shift left toward silicon, i.e., moving upstream in the product lifecycle to lead not only in embedded software, but also the very electronics or semiconductor chips that go into products.

At HCLTech’s first exclusive ER&D Services (ERS) Analyst Day in Bangalore last December, Hari Sadarahalli, Corporate Vice President and Global Head, ERS explained the company’s strategy to shift to a silicon stack-based ER&D model with AI as the foundation. He also highlighted investments in areas such as outsourced semiconductor assembly and testing (OSAT) to stay ahead of industry trends.

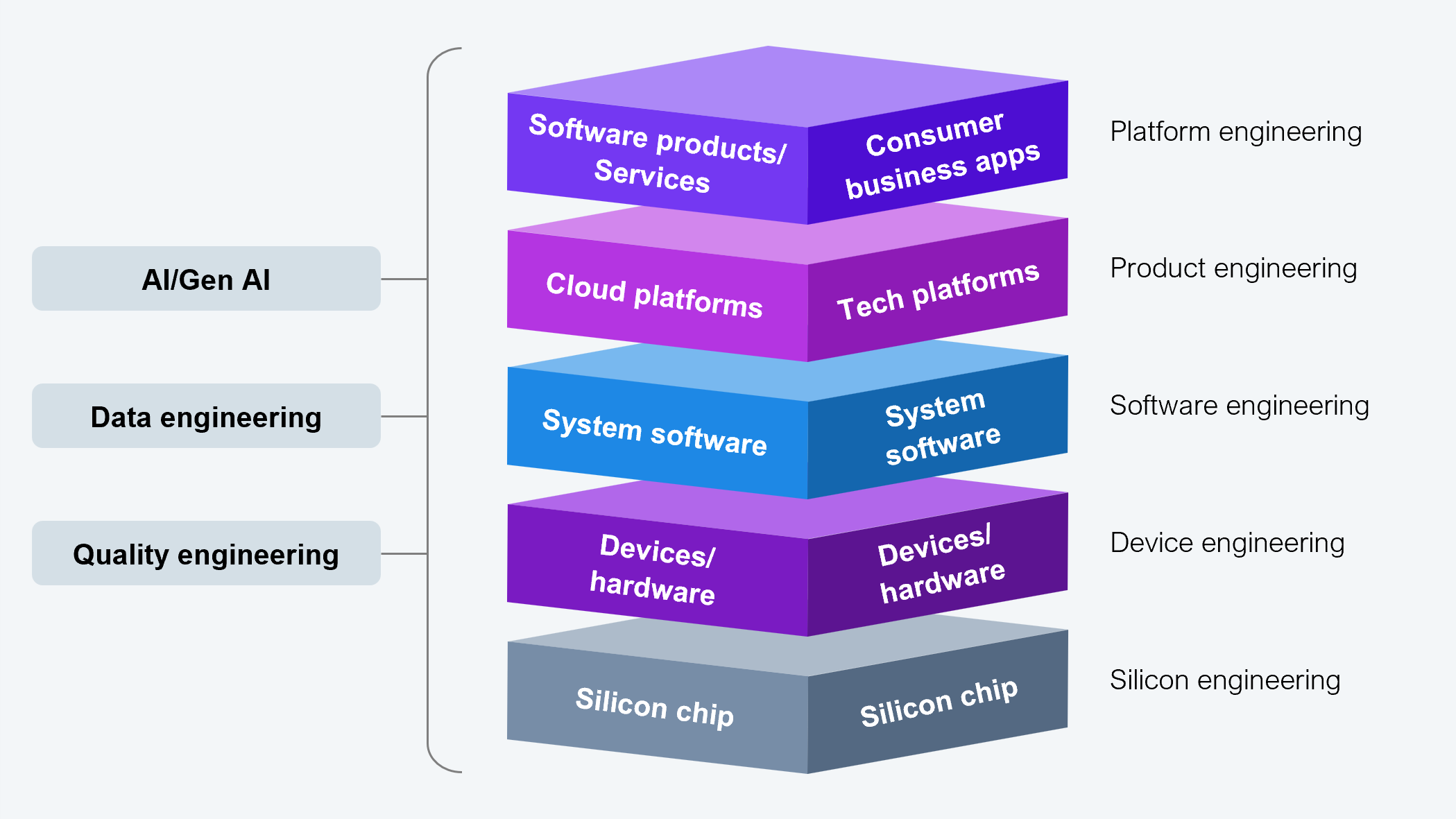

ERS has been HCLTech’s key driver for innovation, accounting for over 16% of overall revenue in 2024–2025. Its shift-left transformation strategy spans the chip-to-cloud engineering value chain, integrating capabilities across silicon and VLSI design, embedded and platform engineering, software and digital product engineering, cloud, AI, and manufacturing engineering (see Exhibit 1).

Source: HCLTech, HFS Research, 2026

This end-to-end engineering scope enables HCLTech to shape not just how products perform but how they are architected from the chip level upward. It is a fundamental realignment of engineering services toward higher-value, higher-impact domains. Three core levers power the transformation: 1) an outcome-led business model that shifts from time-and-materials to shared success, 2) AI-intrinsic service delivery, embedding automation, agentic, and GenAI across the lifecycle, and 3) Services-as-SoftwareTM, a concept HFS Research has championed.

“Silicon is no longer just a component, but a critical part of intelligent and connected products. Across industries, we’re seeing growing demand for custom ASICs, not only to improve performance and efficiency, but also to drive growth and differentiation. Custom SoCs help in IP protection as they are specific to a given product and leverage enterprise IP to deliver superior features and experiences. We take pride in working closely with forward-looking enterprises with our AI-powered chip-to-cloud proposition, delivering value at scale across the globe,” said Hari.

AI is central to this shift-left transformation. HCLTech is the first Indian IT firm to report over $100 million in standalone advanced AI revenue in Q2 FY25. Critically, it acknowledged that AI is not just an enabler but a disruptor of its own traditional engineering business. For instance, its GenAI-based AutoWise solution uses large language models and natural language processing to enhance the car purchase process, enabling customers to personalize the product configuration while driving insights for carmakers on customer preferences.

HCLTech also expects AI agents to replace low-end, repetitive engineering effort, especially in verification, validation, test automation, requirements decomposition, documentation, and model-based design. This level of productivity gain pushes ER&D service providers to move toward higher-order engineering, from silicon architecture to system-level design and integration. Without the shift toward such silicon models, providers will miss the silicon bus and become trapped in low-margin, downstream work.

HCLTech’s new semiconductor lab in Bangalore gives distinct advantages in the çhip-to-cloud journey: greater control over the costliest engineering stage (verification and validation), tighter integration between design and test cycles, accelerated “time-to-silicon” for customers, and a stronger foothold in the semiconductor manufacturing value chain.

This investment positions HCLTech not just as an ER&D services provider, but as a vertically integrated engineering and silicon partner. For manufacturers, this translates to end-to-end services with seamless transfer of work across the engineering lifecycle.

Software-defined products, AI-driven automation, and semiconductor complexity are reshaping where value is created in ER&D. HCLTech’s investments in silicon capability, AI-led engineering, and OSAT demonstrate a clear recognition of this shift.

The next decade will favor those who shift left toward silicon, system design, and chip-to-cloud engineering. ER&D service providers must control their upstream value creation, build differentiated IP and reusable platforms, integrate hardware, software, cloud, and AI into unified engineering stacks, and embrace AI as a catalyst to reinvent engineering. Those who don’t act now risk being marginalized by commoditization and AI-driven delivery models.

For enterprise CXOs, this means moving beyond treating ER&D as low-end outsourcing work and strategically engaging with providers that offer deep capabilities across the silicon tech stack.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started