Life sciences firms are staring down a $1.5 trillion revenue cliff through 2035 due to the Inflation Reduction Act (CMS negotiations for Medicare and Medicaid), the end of the blockbuster era, and the patent cliff. However, most CXOs and their suppliers are still clinging to outdated models. This complacency must end now. A reckoning is about to force all parties to reorient themselves toward a future that will embrace AI to improve health outcomes, explore new distribution models, and address health equity as a function of expanded market access.

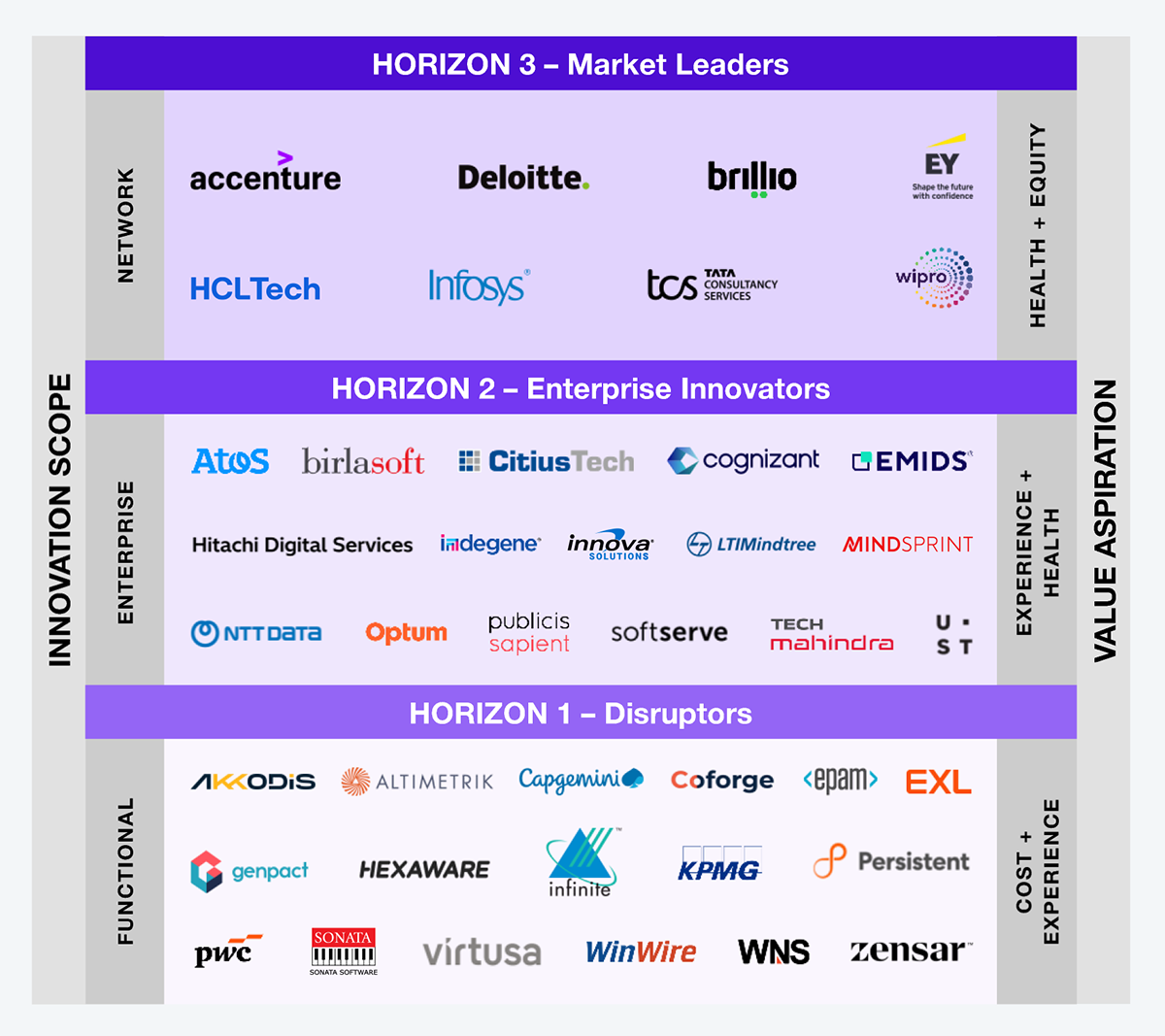

The HFS Horizons: Life Sciences Service Providers, 2025 study evaluated 41 service providers (see Exhibit 1) on their ability to address the quadruple aim of care (cost, experience, health outcomes, and health equity). Horizon 1 providers predominantly demonstrate evidence on bending the cost curve and enhancing the care experience. Horizon 2 providers delivered improved health outcomes in addition to impacting cost and experience. Horizon 3 providers impacted all attributes of the quadruple aim of care.

Note: All service providers within a Horizon are listed alphabetically

Source: HFS Research, 2025

The industry is at an inflection point. The top five CEO priorities, based on the last 12 quarterly earnings and public disclosures, show a clear agenda:

These priorities are not particularly new or radical, but rather a reflection of a more determined focus on addressing the heightened realities of the foreseeable future.

Technology is central to all these priorities. Yet enterprises still lack the support they need from most IT and business service providers, which remain focused on cost takeout, a key focus area of the last CEO agenda. Nearly three-quarters of service providers claim full value-chain coverage, yet fewer than a quarter deliver outcomes that materially shift enterprise priorities. Every quarter spent optimizing costs instead of outcomes is a quarter lost to competitors rewriting their models around growth and patient access.

Some enterprises depend on a small group of more sophisticated suppliers with strategic ecosystem plays, enabled by deep domain-led capabilities backed by scientists and industry experts. But even they can’t bank on them to address their priorities (policy, pricing, market access, supply chain strategy, etc.) due to their limited expertise.

Seventy-five percent of suppliers have an explicit “AI-first” branding or positioning (29 of the 41 service providers evaluated), but the outcomes delivered do not suggest the use of AI first, second, or ever. Enterprises must look beyond the AI narrative and demand outcomes that address their priorities. Otherwise, there is a high risk of lost revenues, market-share erosion, and innovation lag.

The expectation that AI will supercharge results across the quadruple aim of care is valid, but service providers are yet to be the channel for that. While the outcomes linked to cost, patient experience, treatment efficacy, and access to a greater number of patients are encouraging, there is insufficient evidence that AI has enabled or even enhanced them.

HFS Research remains bullish about the potential of AI. There is growing evidence of this in life sciences, yet enterprises must be selective in their partnerships to realize its full value.

The industry has traditionally oriented itself to disease conditions that support scale (diabetes, oncology, cardiovascular). While that strategy remains valid, it should be complemented to remain viable. Enterprises must now tackle more rare diseases and develop more effective therapies for existing conditions. They must expand the populations they serve, i.e., poorer nations and underserved communities. While the margins on expanding access remain unattractive, it will alleviate their revenue challenges to some extent.

Enterprises must not only embrace the technology, but also its potential to positively disrupt value chains, legacy processes, and reorganize for a different future. AI’s ability to accelerate high-quality drug discovery, analyze trial signals, and reinvent dynamic supply chains is now well established. Still, it must be utilized at scale, not merely as an innovation talking point. AI’s role in establishing dark factories and keeping patients engaged is a next-level, near-term opportunity that must be addressed.

Moreover, enterprises must allow service providers to push collaboration on addressing the next level of challenges. They should leverage their investments in AI and domain specialization. The opportunity to address outcomes across the quadruple aim of care has never been more critical, as they are all tied to enterprise top-line priorities.

Life sciences don’t have a demand problem, but rather a revenue challenge exacerbated by a legacy supplier ecosystem. Every dollar spent on AI optics over measurable outcomes deepens the $1.5 trillion revenue gap.

To address this, enterprise leaders must take three key actions: I) rebuild supplier portfolios now by cutting ties with partners that can’t prove outcome impact, 2) reallocate budgets toward those that co-own innovation and risk, and 3) measure success in growth delivered, not costs avoided. The next decade will belong to those that treat suppliers as engines of revenue, not as cost centers of convenience.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started