Life sciences enterprises, particularly pharmaceuticals, will see over a trillion-dollar revenue decline in the next 10 years, driven by US government price negotiations, the end of the blockbuster reign, and the net loss of patent protections. Commercial leaders must realize that their go-to-market (GTM) is becoming obsolete. This calls for changing their business paradigm and going directly to end consumers through new payment models and distribution pathways.

The Inflation Reduction Act of 2022 allows the US Centers for Medicare and Medicaid (CMS) to negotiate prices with pharmaceuticals, a historic first in the country. CMS-negotiated prices for 10 drugs will go into effect on January 1, 2026. This will be followed by 15 drugs annually in 2027 and 2028, and then 20 every year thereafter. Over the next 10 years, 180 drugs will be added to the list.

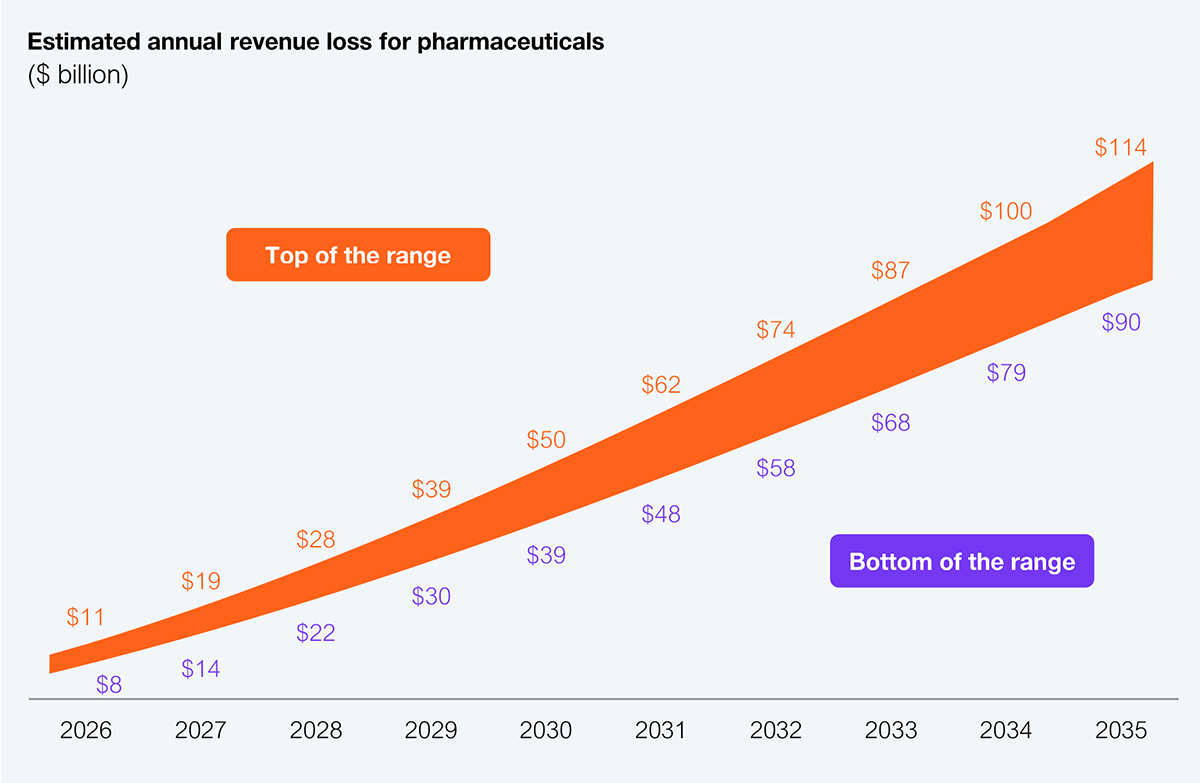

CMS estimates savings of $6–$7 billion in 2026. Due to other commercial impacts, this could translate into $8–$11 billion in lost revenues for affected pharmaceutical enterprises. Looking ahead, CMS expects to save $350–$400 billion over the next decade, potentially leading to revenue losses of $450–$600 billion (see Exhibit 1).

Source: CMS, KFF, Dept of HHS, HFS Research, 2025

About 20% of patents are projected to expire by 2035, opening the market to generics and eroding the premium pricing tied to patent protection. This could contribute an additional $200–$300 billion in revenue losses.

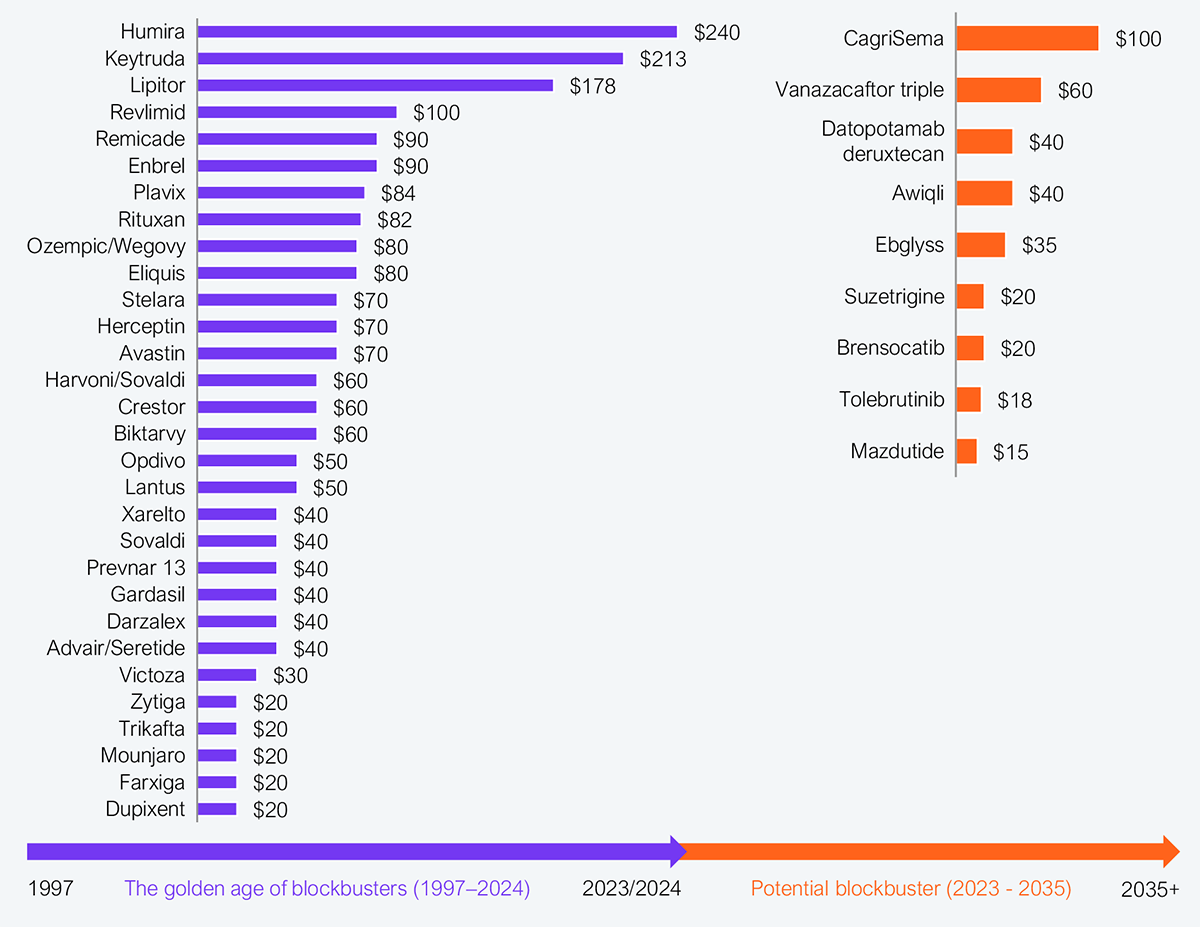

The golden age of blockbusters, from about 1997 to 2024, saw around 30 drugs generate a little over $2 trillion in revenues (see Exhibit 2). However, in the next 10 years, only 10 drugs have the potential to reach the blockbuster status ($1 billion in annual revenues) with a combined lifetime revenue of approximately $350 billion.

Source: Enterprise annual reports, HFS Research, 2025

The new economic reality is ironic: the global population is growing older and sicker than ever before, yet life sciences enterprises are set to lose more than a trillion dollars. While not an existential crisis, the threat is dangerously close for some of them. Global stakeholders will place continuous pressure and market capitalization will erode, impacting the ability to raise funds and invest in innovation. The vicious cycle that has commenced must be broken through radical paradigm shifts.

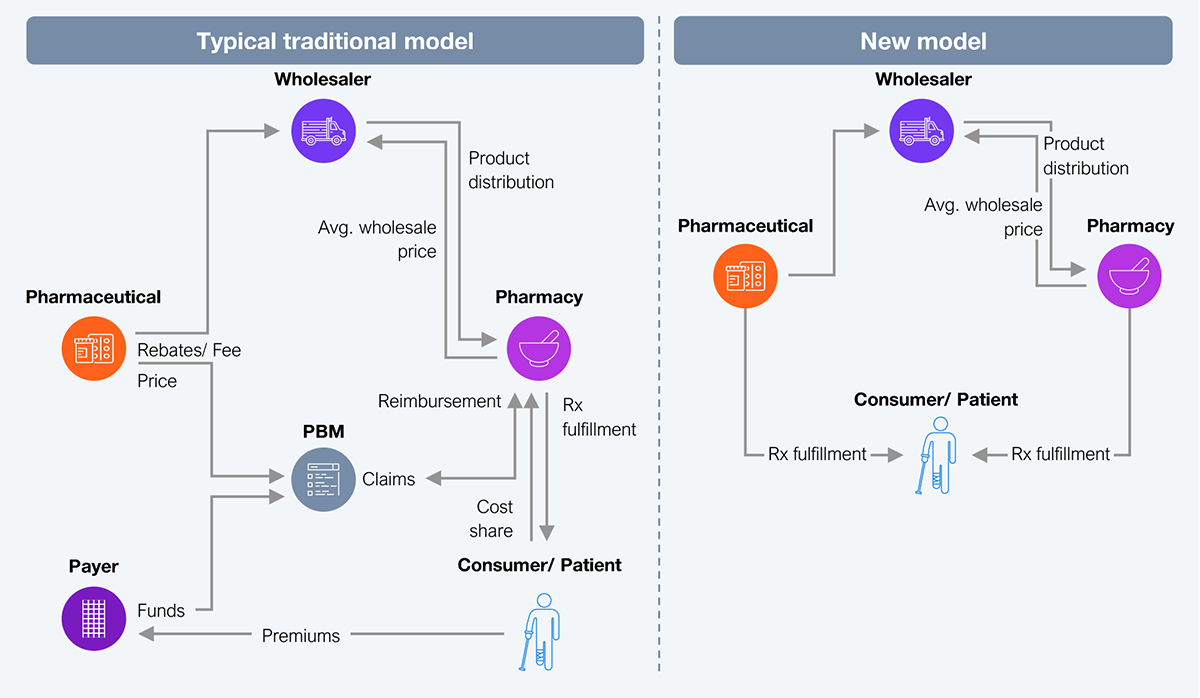

Around the world, the ecosystem connecting life sciences, distributors, pharmacies, insurers, and consumers is varied. On a spectrum of complex to simple, the US leads in complexity (see Exhibit 3 – typical traditional model) with various stakeholders involved in payments, distribution, and prescription management. In simpler systems, prescriptions are optional or not enforced, like in many Asian and African countries where controlled drugs can be bought over the counter.

Source: HFS Research, 2025

While simpler systems may not align with patient safety or responsible medication distribution, there is clearly a way to balance simplicity and safety (see Exhibit 3), bridging any gaps in consumer health and pharmaceutical financials. While pharmacies will remain a key distribution point, pharmaceuticals must open a new direct channel with consumers and patients.

This direct channel will allow pharmaceuticals to be more involved in patient care, particularly those with co-morbidities that require regular medication. It could overcome the trust deficit pharmaceuticals have with consumers by expanding access to cures (drugs, medical devices) and diagnostics, easing price challenges, and providing another point of clinical support. A critical enabler will be making medications affordable without the need for third-party underwriting (health insurance or a payer) and expanding access to underserved populations.

This direct-to-consumer (DTC) pathway, while not novel, is operationally practical and will help pharmaceuticals bridge their topline challenges by enabling volume growth, improving margins by eliminating revenue-sharing with various middlemen, and reducing dependency on government programs, thereby mitigating risk.

Pharmaceuticals must address a wider spectrum of diseases, not just the financially attractive diseases. They must rethink equity as a function of market access to serve markets they traditionally shunned.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started