Mid-market enterprises (those with revenues ranging from at least $100 million to $5 billion) have long endured structural disadvantages, smaller budgets, leaner teams, and lower margins. But the AI era has shifted the landscape: cloud, automation, and AI have collapsed the entry barriers that once protected large incumbents, creating a rare window for them to leapfrog scale through digital modernization. That window, however, is closing fast. Though armed with agility, this segment will go extinct in two years if it doesn’t modernize. Those that hesitate risk getting absorbed, falling into low-growth cycles, or losing ground to AI-native competitors.

For a long time, mid-market firms have fought to keep pace with larger competitors despite their limited transformation budgets, lower margins, and reluctance to commit to monolithic technology stacks. Now, cloud, automation, and AI have democratized access to enterprise-grade capabilities. The same architectures powering Fortune 500 companies are now available as on-demand, pay-as-you-scale services. Additionally, with smaller bureaucracies and flatter hierarchies, these firms can pivot faster than their larger peers if they choose to. Considering the changing market dynamics, large IT and business service providers, once fixated on mega deals, are now building mid-market divisions, custom vertical plays, and outcome-based service bundles tailored to smaller enterprises. At the same time, mid-market firms must use their core competencies and technologies like AI as a value multiplier and leveler to avoid exposure to the growing complexity of global markets.

Adoption and transformation must happen face in the face of rising uncertainty and global pressures (see Exhibit 1). Enterprises of all sizes are adopting “China+1” strategies and friend-shoring initiatives—more of a survival mechanism than a strategy—along with making other strategic adjustments to their supply chains. These changes necessitate AI-enabled modernization to address emerging challenges head-on. The mid-market, which lacks the cash reserves and consulting muscle of large enterprises, is the most exposed. CEOs can’t wait for political clarity and must modernize now to control their own exposure.

Sample: 305 major enterprise decision makers, various external data sources

Source: HFS Research, 2025

Meanwhile, the AI-native acceleration curve is unforgiving. Automation and GenAI are reducing cost structures across industries. Those still anchored in manual processes are falling behind by the quarter.

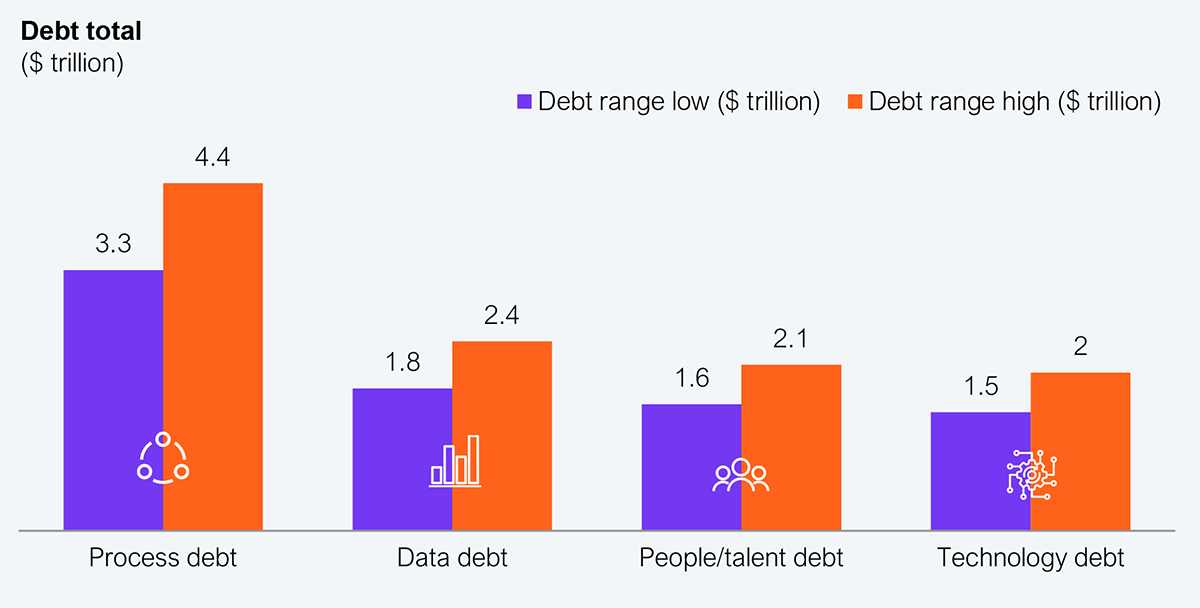

HFS data shows that global enterprise debt encompassing tech, process, data, and skills has crossed $10 trillion (see Exhibit 2). This is a tax on transformation, and the mid-market pays the highest rate. Every dollar tied up in technical, process, and skills debt means losing out to competitors running at the speed of AI. Without structural modernization, they’ll remain trapped in negative-to-low growth cycles, precisely when the market punishes inefficiency. Traditional ERP and consulting-heavy models can’t pay off this debt; only Services-as-Software™ can.

Sample: 305 major enterprise decision makers, various external data sources

Source: HFS Research, 2025

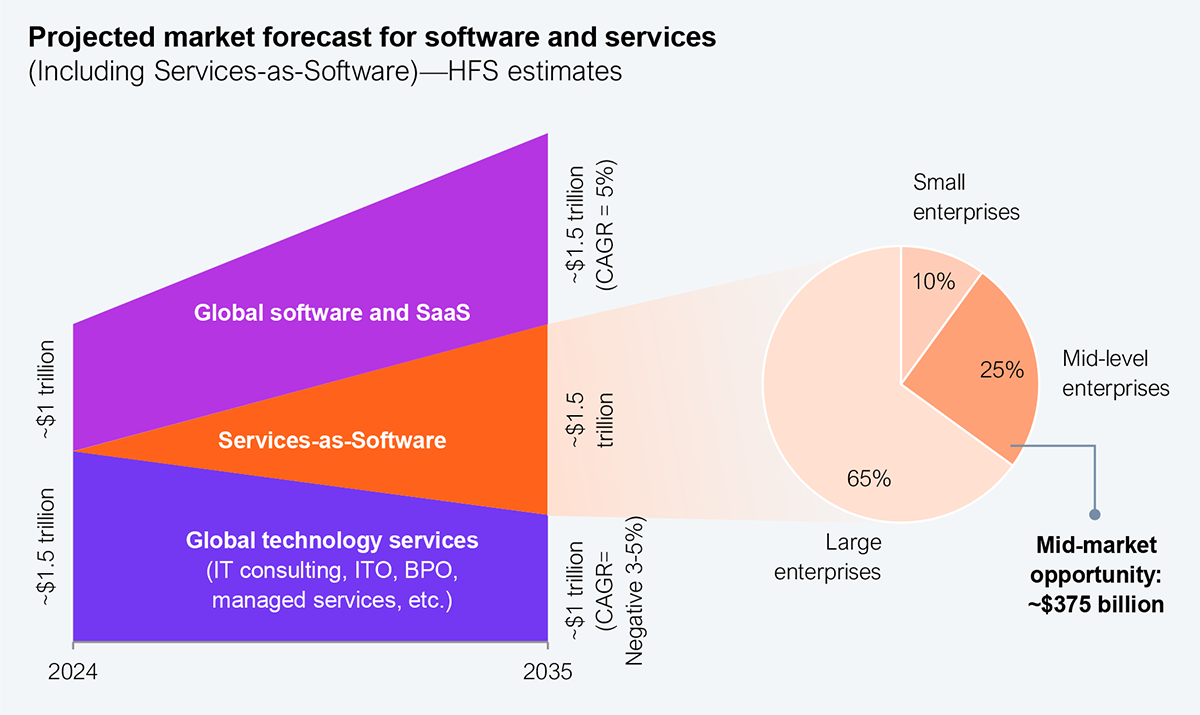

The only escape velocity left for mid-market firms is Services-as-Software (SaS). HFS believes that the convergence of services, software, and automation into code-driven delivery offers mid-market leaders a lifeline to transform themselves. By blending advisory, management, and compliance into modular, code-driven services, SaS enables their firms to access enterprise-grade capabilities without the high costs and rigidities associated with traditional IT and business services.

HFS projects that the SaS market will reach nearly $1.5 trillion by 2035, with mid-market firms accounting for roughly $375 billion (25%) of that value (see Exhibit 3).

Source: HFS Research, 2025

Pillar 1: Stop saving for the storm, it’s already here

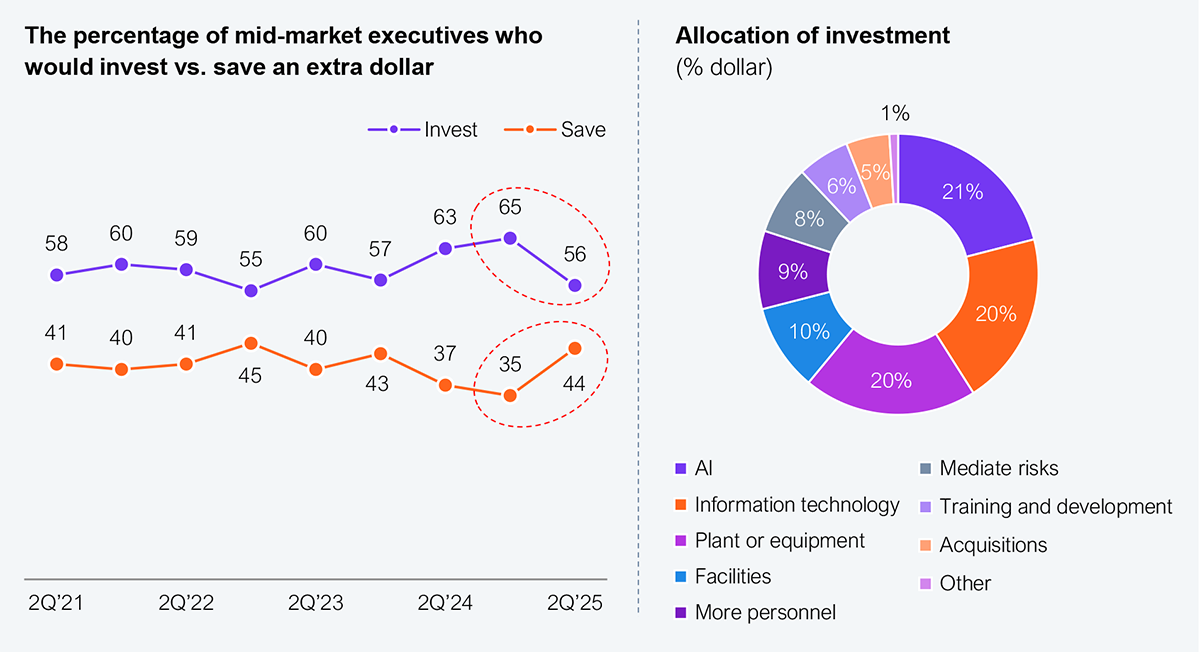

Mid-market enterprises are more likely to build a nest egg for rainy days rather than invest in transformation and modernization (see Exhibit 4). However, the storm is already here. AI and IT are the top investment areas (41%), reflecting their intent toward utilizing these technologies for innovation. Mid-market leaders must double down on these investments. By pairing agility with a bold investment mindset, they can outpace larger enterprises in adopting the SaS model.

Source: National Center for the Middle Market

Pillar 2: Exploit lean decision-making to outpace large enterprises that can’t turn that fast

Mid-market firms operate with lean teams of only 1–3 key decision makers versus the 10–15 stakeholders typical in enterprise deals. They involve both IT and business teams, compared to only IT in large enterprises. This allows for faster sales cycles and streamlines procurement while demanding service providers to demonstrate immediate results with zero tolerance for drawn-out discovery phases that larger enterprises usually opt for—a key advantage that the mid-market must continue to exploit.

Pillar 3: Rewire sourcing models around platforms and outcomes

Mid-market firms must continue to utilize intelligent sourcing models that incorporate not only traditional service providers and tech vendors, but also horizontal and vertical-specific start-ups with specialized IP assets tailored to meet client needs. They must ask for platform-driven models, demand high-quality skills, and push for predictable pricing, striking deals with service providers that may not be willing to meet their demands.

Pillar 4: Transform in sprints to eliminate waste and boost agility

Short sprints (3–6–12 months), by business unit or application, with measurable outcomes rather than large transformation waves spanning years is the preferred model for this segment as it reinforces continuous improvement. It also helps them avoid vendor lock-in and the overhead of large-scale buildouts, while adopting AI capabilities with significantly less effort and complexity than traditional transformation models. Moreover, mid-market firms can remain agile in response to dynamic market needs and demands, responding effectively to these pressures.

Each pillar reinforces the core thesis that the mid-market’s only competitive advantages are velocity and the SaS model.

The AI era favors the fast, not the big. Mid-market leaders have a narrow window of just 24–36 months to transform their operations, rewire their sourcing, and scale AI-driven innovation. With agility as their superpower and SaS as their accelerator, the time to act is now. Delay now, and risk slipping into irrelevance and low-growth cycles.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started