An undeniable truth from negotiation experience is that enterprise leaders prefer flat-rate pricing—the dominant model across all indirect expense categories, from marketing services to software. Buyers cling to flat-rate and fixed-pricing models, even when they’re higher. This fixation on flat-rate isn’t just about economics; it’s rooted in psychology. With FTE-powered deals being replaced by AI-powered deals, pricing is being constructed differently. Buyers must adapt to these new realities, while innovative providers must understand what truly happens in the buyers’ psyche.

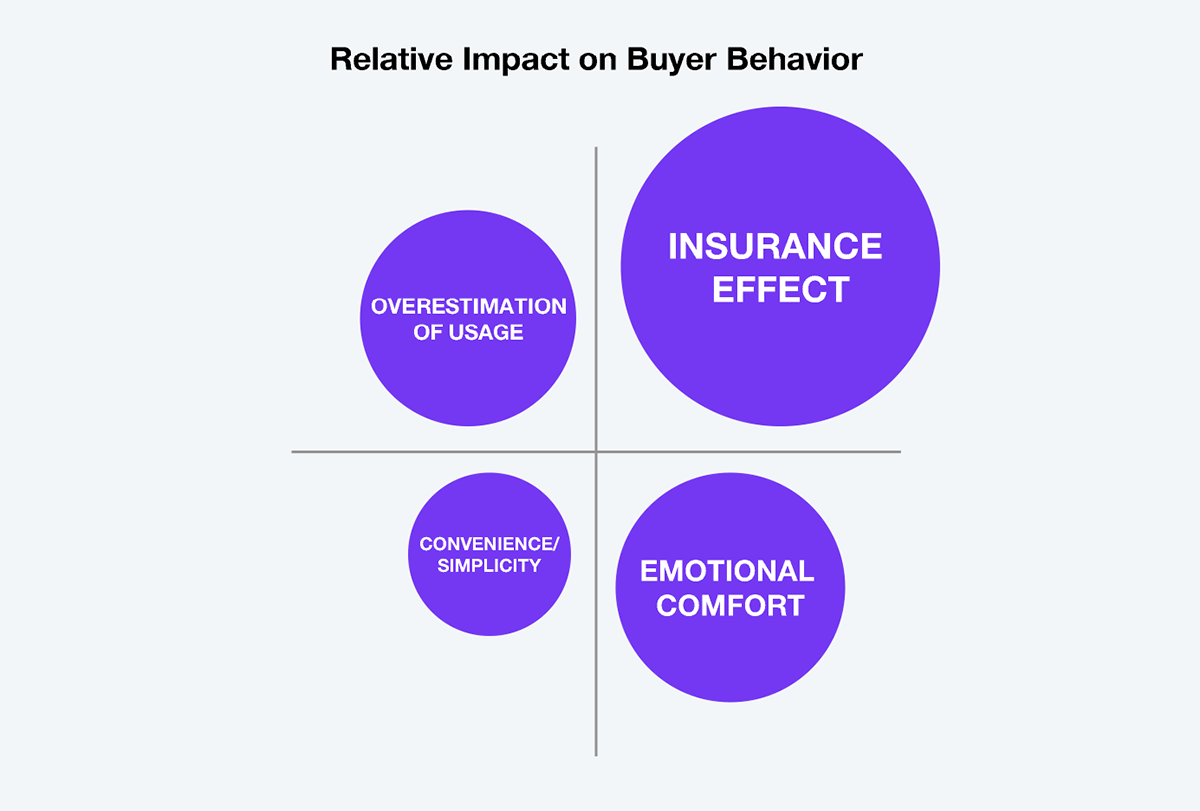

In 2006, Lambrecht and Skiera analyzed consumer preferences using wireless telephone data, exploring how consumers decide between flat-rate and pay-per-use plans. They compared what customers paid under their selected plan (flat or pay-per-use) to what they would have with the alternate plan based on actual usage. They discovered:

Consumer psychology transfers directly to the business world, where it may be even more pronounced. Despite the often lower rates of usage-based pricing, business buyers prefer the predictability of flat rates.

Unlike consumers who rarely manage their budgets and heavily rely on credit, business executives operate firmly within the realm of cost centers and project budgets. They simply can’t exceed their budgets without jumping through all sorts of budget approval hoops, driving them to value cost predictability greatly. Buyers insure against variability by agreeing to fixed fees that are slightly more costly than transaction fees.

In high-visibility AI deployments, budget overruns aren’t just financial—they’re political. Enterprise leaders know a busted AI pilot can derail transformation credibility for years. However, with the rise of AI-driven automation and intelligent solutions, transaction counts are the name of the game. This, plus uncertainty surrounding AI’s performance, strengthens buyers’ preference for fee certainty, which fixed pricing provides. For example, fixed-price application development offers predictable monthly expenses in a world of intense IT spend scrutiny. CIOs are willing to accept higher costs for peace of mind, highlighting the strong psychological appeal of flat rates, even in the context of AI-driven cost savings. As a result, large-scale deals will feature a fee schedule outlining monthly charges for each service category, differing from the early days of pricing that relied heavily on additional resource units (ARCs) and reduced resource units (RRCs).

Flat-rate pricing isn’t just a financial preference—it’s often a political shield. Leaders use it to lock in spend and deflect scrutiny, shielding themselves from CFOs, boards, and management consultants. Nobody wants to explain why variable costs spiral when AI fails to deliver. Fixed fees become a weapon of plausible deniability.

The myth that usage-based pricing saves money is just that—a myth. With unpredictable AI usage patterns, unmonitored adoption, and limited internal governance, enterprises can quietly blow past their initial estimates. Flat fees aren’t expensive—they’re often the only thing preventing a financial time bomb.

Hourly and transaction-based billing models drive buyer anxiety through the roof—a phenomenon Prelec and Loewenstein labeled the ‘taximeter effect.’ This psychological discomfort intensifies with AI, as buyers resist transaction-heavy use cases and various technology charges for services, such as tokens and compute charges.

That doesn’t mean a provider can slap any absurdly high fixed fee on an engagement. In August 2021, Kienzler, Kowalkowski, and Kindström published a study of pricing plan choices made by procurement professionals. The research, involving hundreds of Swedish and German procurement specialists, revealed that these professionals preferred flat-fee pricing despite their desire to secure the lowest price. However, the study also indicated that interest in flat-fee pricing diminished as it exceeded the transactional fee price. If this is true for buy-savvy procurement professionals spending other departments’ money, business leaders would suffer even more from this effect.

Consider AI-driven legal contract review services: hourly charges for AI-based reviews seem ridiculous when the work is processed through an expertly trained GenAI contract analysis tool in just seconds. Transitioning to a flat-fee, unlimited AI-review model significantly changes buyer perceptions, enhancing satisfaction by eliminating the psychological strain of watching the meter tick up contract by contract. This effect is even more pronounced in distributed organizations, where business users can globally access the contract review service with limited governance. Their usage could lead to budget-busting invoices that no business executive wants to justify to their CFO. Provider revenue recognition teams prefer fixed-fee pricing due to accounting regulations and the calculations of sales commissions. Behind every sold deal, an accounting team adds to a growing list of deals that drive revenues for quarterly results. Sales achievements and commissions are also more easily computed for fixed-fee deals.

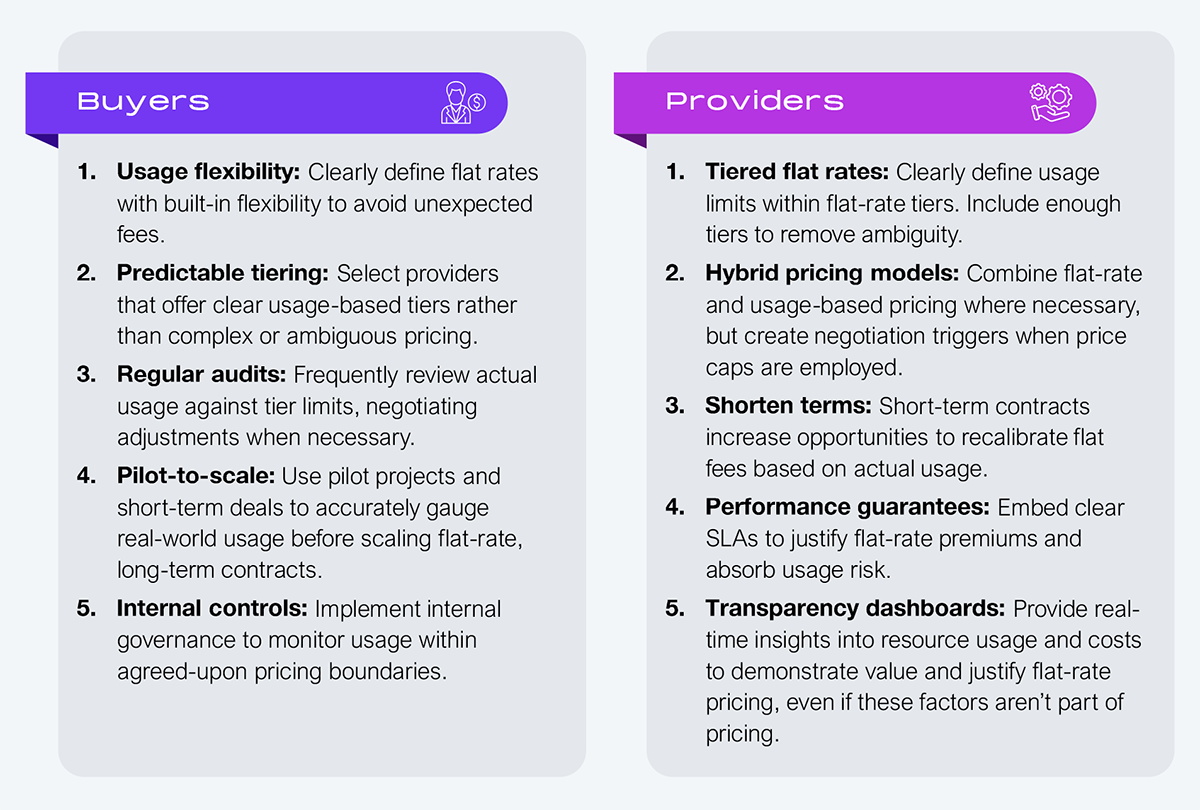

So, both sides prefer fixed-fee solutions to reduce the taximeter effect. However, the costs of using AI technology are real and significant (see sidebar). Buyers and sellers should explore tiered pricing and hybrid models that mitigate much of the risk.

Source: HFS Research, 2025

The study by Kienzler et al. revealed two additional findings. First, when faced with complex pricing models, procurement buyers prefer flat-fee arrangements. Such complex pricing structures create negotiation friction and can overwhelm them. Second, procurement buyers with an existing supplier relationship favor a flat-fee model because they overestimate their usage. Conversely, when there is no prior relationship with a supplier, procurement buyers are inclined to choose a flat-fee model on considerations around insurance, taximeters, and convenience. So, procurement buyers, regardless of situations, prefer fixed pricing.

Compare that with the mind-bogglingly complex pricing models many providers have proposed for services-as-software and AI-enabled deals. AI pricing devolves into a shell game where cost components are littered across so many line items that buyers lose track of the total. From token charges to human-in-the-loop add-ons, some providers are masking delivery risk behind opaque, bloated pricing. These models include minimum fees, termination fees, transaction fees, overage fees, token and storage fees, costs to train and retrain models, implementation fees, human-in-the-loop costs, and infrastructure and software expenses.

Buyers should treat these overly complex pricing models as red flags—suggesting that providers don’t understand their own cost structures or can’t commit to outcomes. Software companies have long used simple, easy-to-understand pricing metrics: user counts, revenue or spending, and customer counts. Service providers aiming for outcome-based pricing (see part 3 of this three-part series) should simplify pricing and engineer more precise pricing terms. Providers that offer AI solutions at straightforward, flat fees gain client loyalty by reducing complexity and speeding up deal cycles.

Flat-rate pricing doesn’t just reduce anxiety—it asserts control. It allows buyers to dictate terms, cap downside, and avoid becoming hostages to usage patterns they can’t predict or govern. The best enterprise negotiators don’t see a flat fee as simplistic but as a strategic power play.

Providers proposing flat-fee pricing demonstrate their confidence in AI’s capabilities, which reduces buyer skepticism in the technology. Moreover, fixed-fee AI models convey a straightforward psychological message: providers will absorb the risk because they’re confident of the results. This approach attracts clients and reinforces long-term trust and loyalty.

The underlying costs buyers can’t ignore in AI-powered services

These hidden costs explain why providers resist flat rates—yet buyers still demand them. Providers must bridge this disconnect transparently to win trust.

Flat-rate deals are appealing but carry certain risks. We recommend the following for both buyers and providers:

Source: HFS Research, 2025

Don’t back down from demanding flat-fee rates. Create contracts that balance budget predictability with flexibility. Choosing flat-fee rates at higher prices isn’t a financial miscalculation; you’re buying insurance against potentially career-ending gotchas. In a world where AI’s performance, costs, and outcomes seem unpredictable, budget is a mandate.

Flat-rate pricing is not an indulgence—it’s a test of provider integrity. In this AI era, demand transparency, hold providers accountable for outcomes, and reject pricing models that shift delivery risk back onto the enterprise.

Up next in this three-part series – ‘Closing the gap: Introducing the operations pricing model for the AI era’

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started