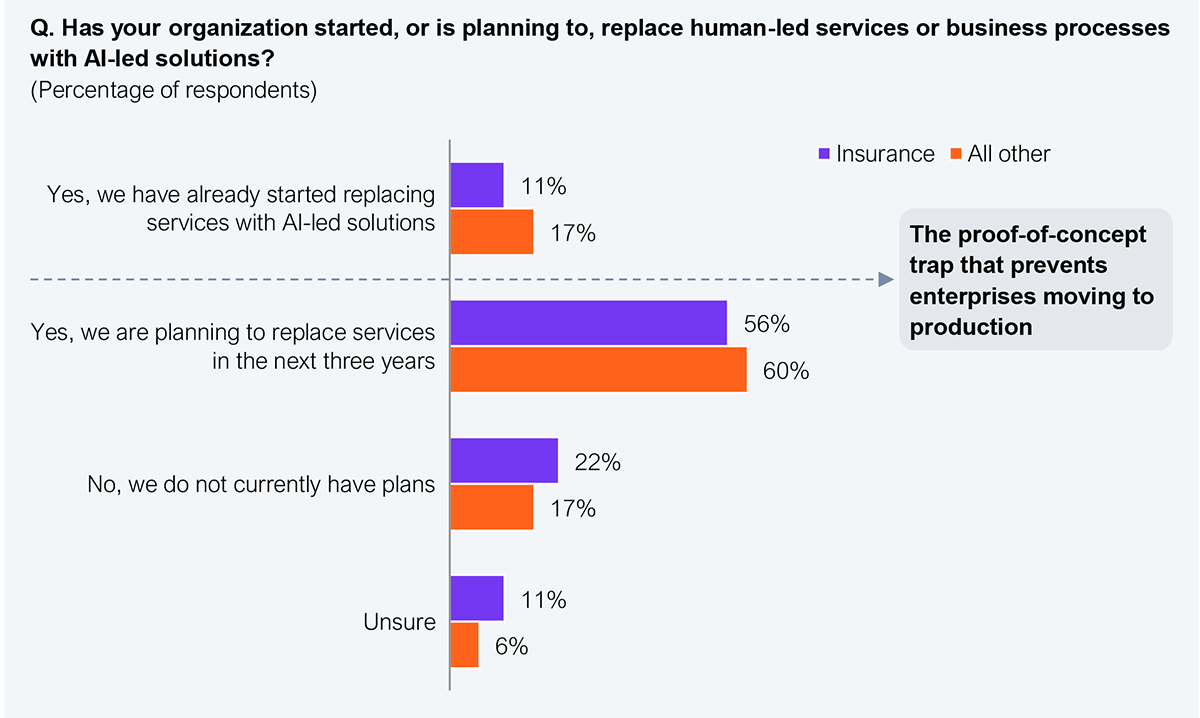

As part of a company-wide transformation program, Allianz Partners partnered with agentic automation vendor Otera (formerly DeepOpinion) to skip proofs of concept (POCs) and move straight to AI-led services, contributing to a planned €300 million profit uplift by 2027. Enterprises often talk about shifting to AI-led services, but few actually move beyond pilots (see Exhibit 1). HFS calls this shift Services-as-Software™—where entire services, not just tasks, are delivered by AI systems.

For Allianz Partners, a global leader in protection and care insurance with €10 billion in annual revenues, speed wasn’t optional—it was critical to prevent intermediaries from defining the market and to maintain competitiveness. Going straight to production with two key use cases laid the foundation for the firm’s broader transformation and profit ambitions. Chief Executive Officer Tomas Kunzmann explained:

Time was against us. If we didn’t act quickly, we risked losing half of our value chain—we needed to move immediately to protect our margins.

HFS analysts connected with Tomas Kunzmann and Pieter Viljoen, Chief Data Officer, to understand their journey and how you can replicate their success.

HFS research reveals a gap between ambition and execution—more than half of insurers plan to replace traditional services with AI-led solutions, but only 11% have initiated this process (see Exhibit 1). The number who have done it at scale is even lower. Clearly, most insurers are either unsure where to start or remain stuck experimenting with POCs that never translate to real enterprise value.

This is the trap Allianz Partners wanted to avoid, given speed was critical to success, which is why they went straight to production with agentic AI instead

Sample: 36 leading executives from Global 2000 insurers, and 369 leading executives from other industries

Source: HFS Pulse, 2025

Tomas told us that responsiveness is the metric for success in Allianz Partners’ industry. It is the foundation of both growth and profitability. It drives top-line expansion by improving customer satisfaction while enabling bottom-line improvements through streamlined operations, lowering the cost of claims. That’s why improving responsiveness was a personal priority for the CEO. Tomas explained:

Responsiveness will be the decisive change that drives both productivity and customer success. It will take our margins to a different level. It will help us double our operating profit by 2027 (in comparison to 2023).

But rapid organic and inorganic growth meant Allianz Partners had scope for improvement. Managing 90 million cases annually across dozens of disconnected systems with no standardized process led to long delays and high costs. This is the challenge Tomas wanted to overcome. He knew Allianz Partners had a responsibility to equip its workforce with the technology needed to deliver responsiveness at scale.

Previous attempts, including with robotic process automation (RPA), failed to handle the industry’s variability, compliance demands, and decision-making complexity. However, Allianz Partners recognized that agentic automation could be applied differently—using agentic AI to connect autonomous agents that collaborate to execute entire business processes, not just repetitive tasks. This means it can handle the industry’s variability across end-to-end processes. Now, they needed a partner to make that a reality. Pieter Viljoen, Chief Data Officer at Allianz Partners, told us:

It doesn’t make sense to spend months proving the concept works. These capabilities should be treated as platform capabilities that you scale from the start—not patchwork fixes.

Tomas explained that Allianz Partners opted to find a third party to “remove uncertainty by outsourcing speed and bringing a strong third party to the table.” The company ultimately selected Otera for its agentic automation platform and expertise, as well as insurance-specific capabilities, which enabled it to handle the complexity of claims and invoice processing end-to-end. This expertise formed the foundation of Allianz Partners’ trust in Otera, and it gave them the confidence to skip POCs. Pieter told us:

It was very clear from day one that Otera understood exactly what the insurance problems were. They didn’t just come with the technology; they came with the domain knowledge to help us solve them.

Together, Allianz Partners and Otera focused on two high-impact use cases to demonstrate value and build momentum: claims automation and invoice automation. Both went live in production within 2.5 months in Allianz Partners’ highly regulated UK and DACH (Germany, Austria, and Switzerland) markets before being scaled globally.

Allianz Partners built for scalability by leveraging Otera’s reusable technology components, which included standardized building blocks that enabled the replication of production-ready solutions across markets. This enabled it to scale quickly globally. An early investment in compliance reinforced this foundation. Tomas explained that by bringing in third-party legal experts specializing in AI regulation, Allianz Partners “outsourced assurance,” accelerating progress by removing uncertainty and giving confidence to stakeholders. This was also key to the rapid 2.5-month deployment.

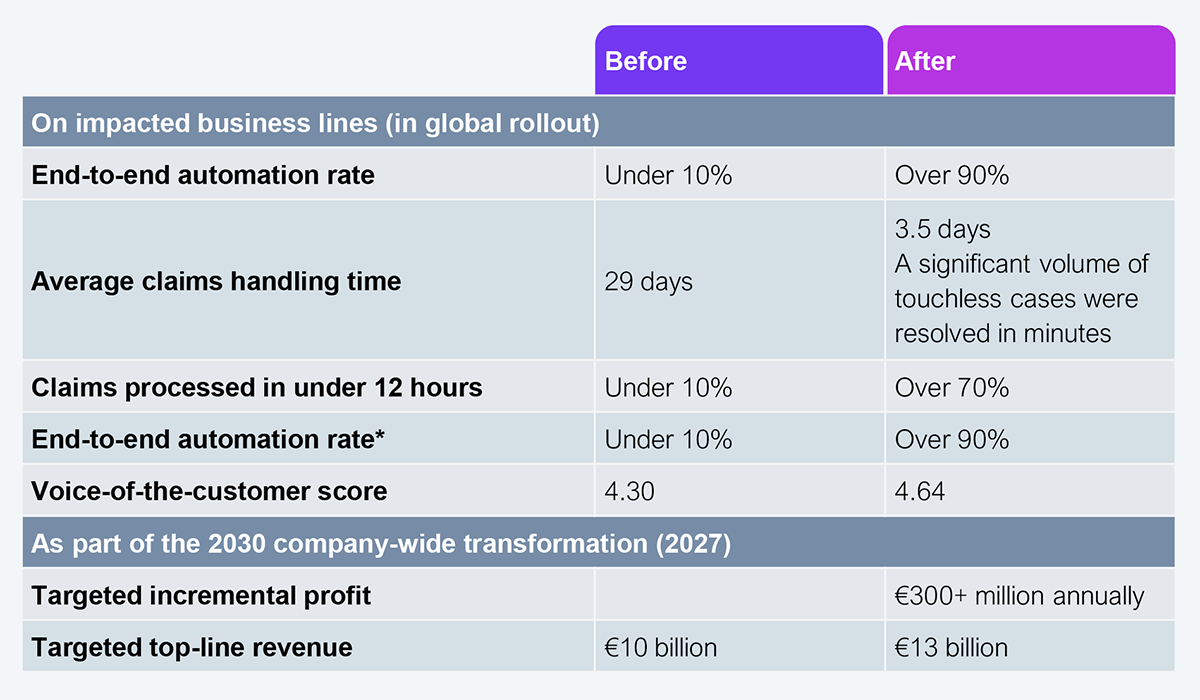

Allianz Partners’ transformation demonstrated that going straight to production drives measurable results in months, not years, and it achieved its strategic goal of enabling responsiveness at scale. By redesigning its operations with agentic automation at the core, Allianz Partners reduced the average claim handling time from 29 days to 3.5 days. They processed a significant volume of touchless cases in minutes. This improvement had a significant impact on its financial performance; Tomas and Pieter confirmed they expect this transformation program to add €300 million in incremental profit annually by 2027. Exhibit 2 outlines the shift in Allianz Partners’ key metrics.

* Touchless cases are processed in minutes

Source: HFS Research, Allianz Partners, and Otera, 2025

Tomas emphasized that this transformation was never about headcount reduction. Instead, the transformation completely changed the daily workflow of employees. Without the shackles of manual case handling, employees were freed to focus on delivering peace of mind to clients when needed, fostering genuine human connections with empathy.

Our conversations with Tomas and Pieter made one thing very clear: if Allianz Partners hadn’t gone straight to production, they would still be reporting incremental value from POCs rather than genuine transformation.

Going straight to production takes more than just speed. It demands discipline and strategy, or enterprises risk breaking both employee and customer trust. But that risk doesn’t make it not worth pursuing, as Stefan Engl, the Chief Executive Officer and Co-founder of Otera, explained:

Agentic AI has shifted the transformation paradigm; old blueprints are obsolete. Market leaders like Allianz Partners act decisively, going straight to production to drive outcomes from day one, iterating and scaling relentlessly.

Throughout the engagement, Allianz Partners embraced what Otera calls its ACV Framework™—Autonomy, Control, and Velocity—which Otera applies in every engagement. For enterprise leaders, the lesson is clear: Treat these three principles as operational levers, not vendor features.

1. Autonomy unlocks agility and capacity

Decoupling growth from headcount means designing processes that enable the replacement of human-led services with AI solutions. Do it from day one to drive responsiveness, customer satisfaction, and profitability through efficiency. Define clear ownership between humans and technology, with humans exclusively in the loop for exceptions and oversight, rather than continued operation. Real enterprise autonomy is dependent on having control and velocity firmly established.

2. Control turns speed into trust

Untrusted autonomy isn’t autonomy at all, which is why it is essential to create visibility into AI decision-making, ensuring every action can be explained, traced, and reversed if required. Involve risk and compliance experts early and ensure they facilitate progress, rather than hinder it. With established control, autonomy becomes trustworthy, sustainable, and regulator ready.

3. Velocity generates scale from early success

Scale stems from the repeatability of the technology stack, where standardized components enable rapid repeatability across various functions and markets. Foster structures and a culture of continued movement at speed, rather than a rapid one-time transformation effort. Velocity is essential to enterprise autonomy because it allows AI systems to scale quickly.

Otera has designed an extensive agentic automation transformation blueprint, proven by Allianz Partners’ success, which you can find here. Finally, Pieter summarised the practical foundations every enterprise should put into place before expecting results:

If you want this to work, get your APIs ready, set up real product ownership and agile squads—and then pick best-in-class tech like Otera.

Stop waiting for the perfect POC. Allianz Partners proved you can go straight to production in 2.5 months and deliver €300M in expected profit—even in heavily regulated insurance. Every quarter you spend piloting is a quarter your competitors spend scaling. Act now or watch them leave you behind…

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started