The telecom sector is undergoing a massive overhaul as the capital expenditure-heavy industry seeks new revenue streams to drive growth and stakeholder value. As mentioned in a previous HFS Point of View, chief among the industry’s challenges are the ongoing need to modernize aging infrastructure, accelerate new service offerings, reduce churn, and achieve growth in adjacent sectors.

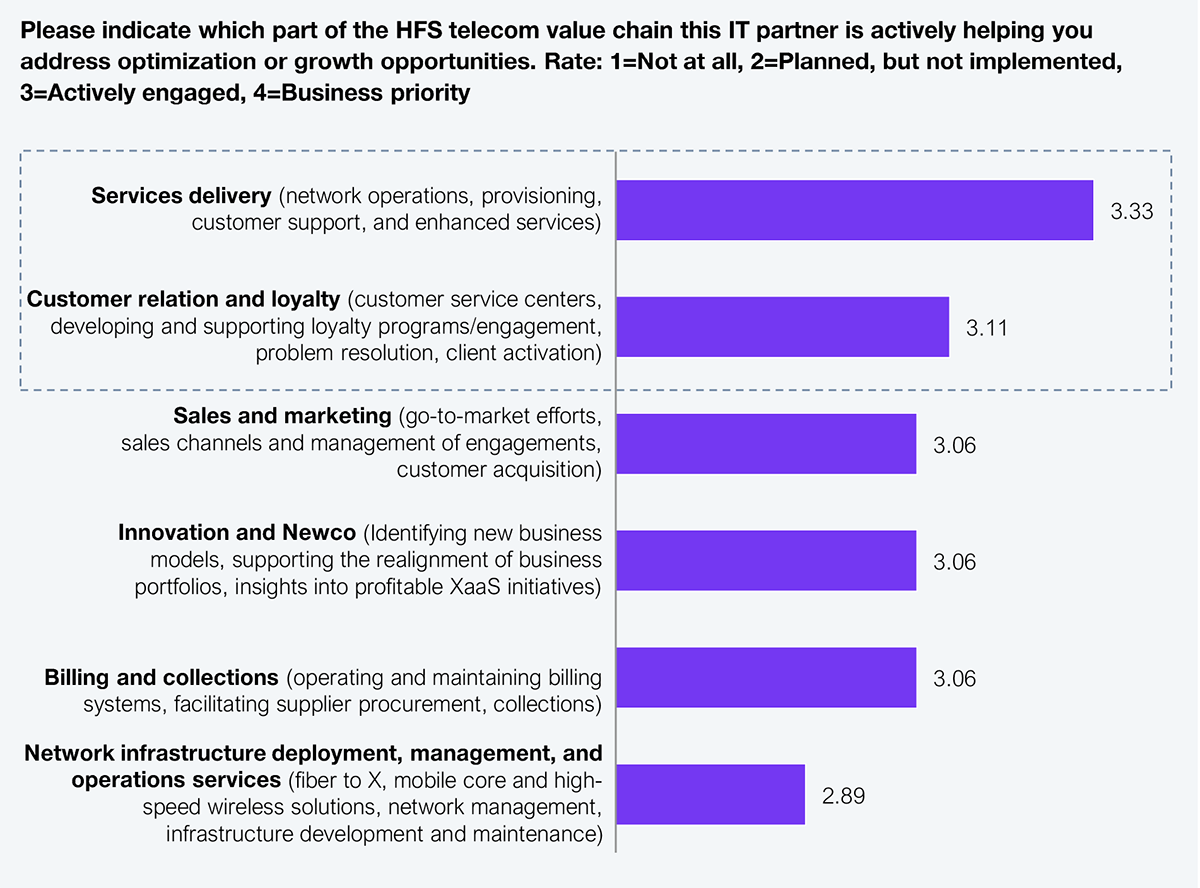

In its Communications, Media and Information Services (CMI) presentations to analysts, TCS laid out its roadmap to help telcos shift into this new paradigm. This aligns well with the HFS telecom framework, which identifies three strategic imperatives: end-to-end ecosystem orchestration, compliance-first operations, and innovation through open architectures. Unsurprisingly, service delivery and customer service are the two most important factors for telecom clients. Using data from the HFS Telecom Horizon, Exhibit 1 illustrates how telecom clients prioritize these two factors and want service providers to help them in these areas.

Sample: N=18 client references

Source: HFS Research, 2025

The event highlighted some crucial pointers about the current state of the telecom sector, which include:

TCS leverages its Operations of the Future (OOTF) framework with ‘Zero-X’ and ‘Self-X’ capabilities to enable zero wait, zero-touch, and zero-friction services through AI-driven predictive monitoring and orchestration. It also provides self-managed network operations to clients for service fulfilment, assurance, and optimization. Its CX Transformer and Agentic AI assistants support first-time-right resolutions and provide proactive customer care for telecom clients.

TCS’s solutions demonstrate real-world gains in Net Promoter Score (NPS) and Average Revenue Per User (ARPU) aligned efficiencies for telecom enterprises under pressure to reduce churn and costs. For example, for a DTH and digital platform client in India, TCS improved NPS and enabled peak recharges under 30 seconds while reducing IT costs in line with the ARPU reduction. Additionally, TCS’s access to the broader TATA ecosystem could offer additional leverage in complex deals. Still, its true differentiator will depend on how it can meaningfully integrate value across service lines across its various subsidiaries.

Every service provider servicing the telecom sector has incorporated generative AI into their offerings. TCS, too, is embedding generative AI across its telecom offerings to help meet business goals such as customer experience, scaling operational efficiency, and launching new services faster—in practical, outcome-oriented ways. Here’s how TCS is operationalizing generative AI for providing telecom transformation to its clients:

For network operations:

For customer experience:

Revenue assurance:

Sovereign AI:

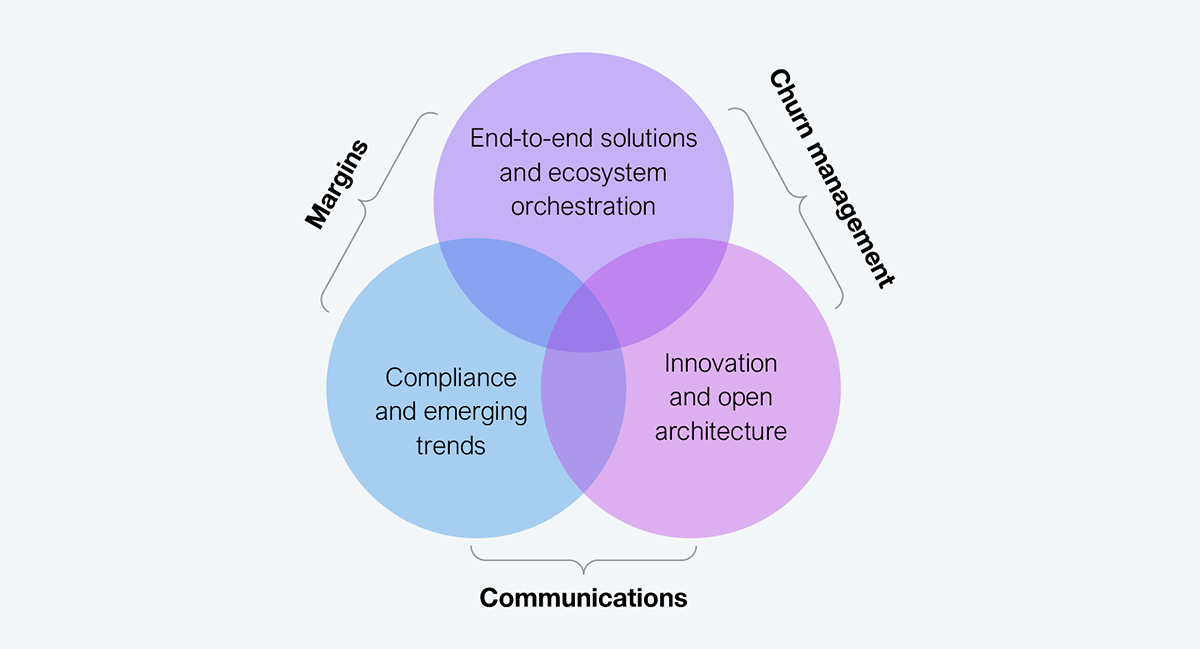

HFS Research believes telecom companies must focus on three key areas to overcome the challenges. This is illustrated in Exhibit 2:

TCS has been focusing on all three critical aspects of its telecom and media offerings and services.

Source: HFS Research, 2025

The shift from ‘telco’ to ‘newco’ is not merely a buzzword; it’s a reality that organizations must face. Telecom clients must understand that choosing the right transformation partner is about outcomes, not optics. TCS’s approach, rooted in zero-touch AI, customer-centric platforms, and ecosystem leverage, reflects its network capabilities. However, enterprise buyers must measure all partners based on who can deliver measurable impact across essential metrics, such as monetization, loyalty, and agility. Enterprise buyers must push partners to prove ROI across core telecom KPIs such as NPS, ARPU, SLA adherence, and CX improvement, especially as generative AI initiatives scale from pilots to production.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started