Procurement executives expect their service providers to maintain the level of engagement, collaboration, and responsiveness while also providing them with inputs, ideas, and acumen around the future of procurement, with new technologies and customer experiences top of mind.

At the same time, clients are aware their organization (in terms of culture, maturity and resources) is holding them back to move faster on procurement transformation and realize service providers can be a larger and critical part of the puzzle. This is essentially an open invitation to service providers to keep pushing the envelope on innovation, although progress might be slower than expected or desired.

This report outlines Procurement As-a-Service clients’ experiences and preferences and is based on the interviews with service buyers conducted during the HfS Research Procurement As-a-Service 2017 research process. The Procurement As-a-Service Blueprint looks at services offered to the market across the procurement value chain, spanning upstream and downstream procurement.

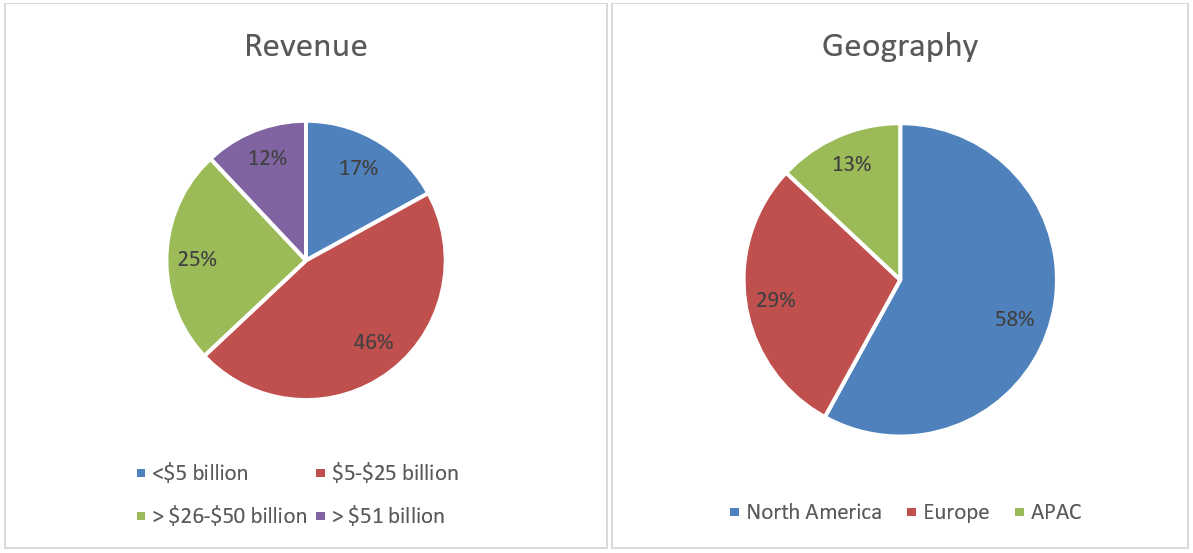

This Point of View (PoV) analyses and reviews how the clients of procurement services experience a market that’s evolving toward more business-outcome focused, flexible, and collaborative services, infused by new technologies such as cognitive computing and automation. It also reviews how service providers are meeting the needs of procurement clients against the background of changing expectations from stakeholders. The results in this PoV are based on interviews with 24 procurement executives (See Exhibit 1).

Exhibit 1: Study Demographics

Source: HfS Research, 2017, sample size 24 procurement executives

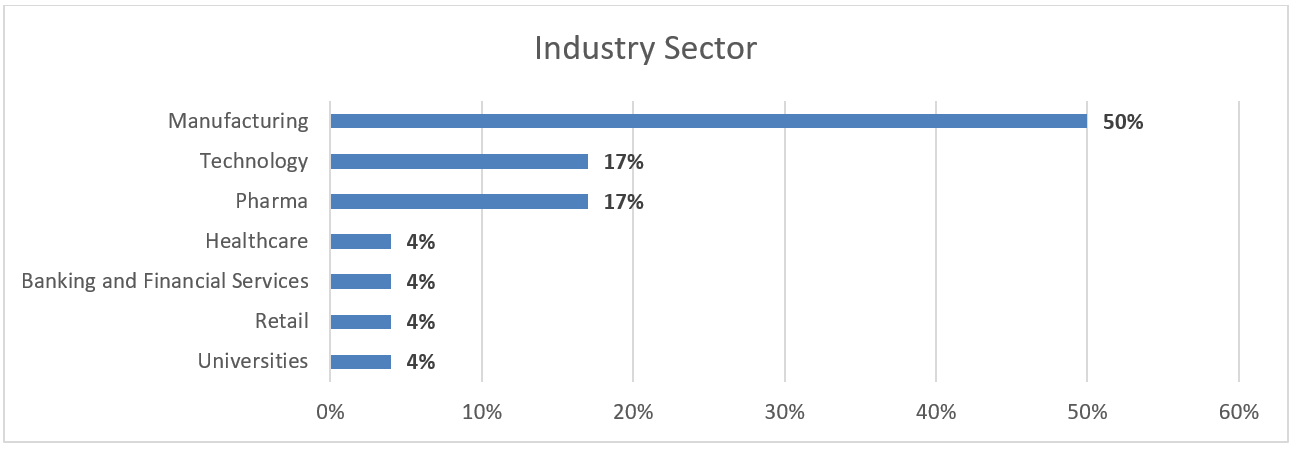

HfS has outlined services in the Procurement As-a-Service Value Chain, covering category management, strategic sourcing, supplier management, contract management, technology management, and transactional procurement (see Exhibit 2).

Exhibit 2: Procurement As-a-Service Value Chain Source: HfS Research, 2017

The Procurement Dilemma

Many procurement organizations are still fixing the basics. While the conversations among procurement professionals often focus on “the future of procurement” and all the innovative technologies that have started to shape the direction of procurement and many transformation journeys, the reality is that many procurement organizations are still struggling with transactional procurement processes, getting invoices processed with intelligent character recognition (ICR) and optical character recognition (OCR), and matching invoices and purchase orders correctly in one go. They simply don’t have the time or bandwidth to focus on “the future.” Thirty-five percent of executives interviewed indicate their organization has to move forward but currently lacks the processes, infrastructure, or resources to seize the opportunities presented by technologies like automation, cognitive procurement, and platforms.

This, in effect, is a significant gap between the level of innovation clients feel is right and suitable for their organization and the leading-edge innovations providers are offering, particularly in areas like cognitive procurement. Many buyers see cognitive procurement as the next frontier but don’t have a clear understanding of, or plan for, how to make it work for their organizations; the majority of procurement organizations perceive themselves as far removed from advanced innovative procurement capabilities. They are fixing the basics, getting procurement technology to work, digitizing invoices, and pondering the opportunities RPA could bring the procurement function.

Clients indicate time and again they don’t blame their provider for a lack of innovation in the engagement, and rather point at their own organization as holding back progress. Culture plays a significant role, as do organizational complexity, legacy technology and processes, a too narrow focus on short-term cost savings, and a lack of resources and skills in the procurement function to plan and execute a future-oriented strategy.

High Satisfaction with Account Management, Responsiveness to Feedback, Innovation and Collaboration

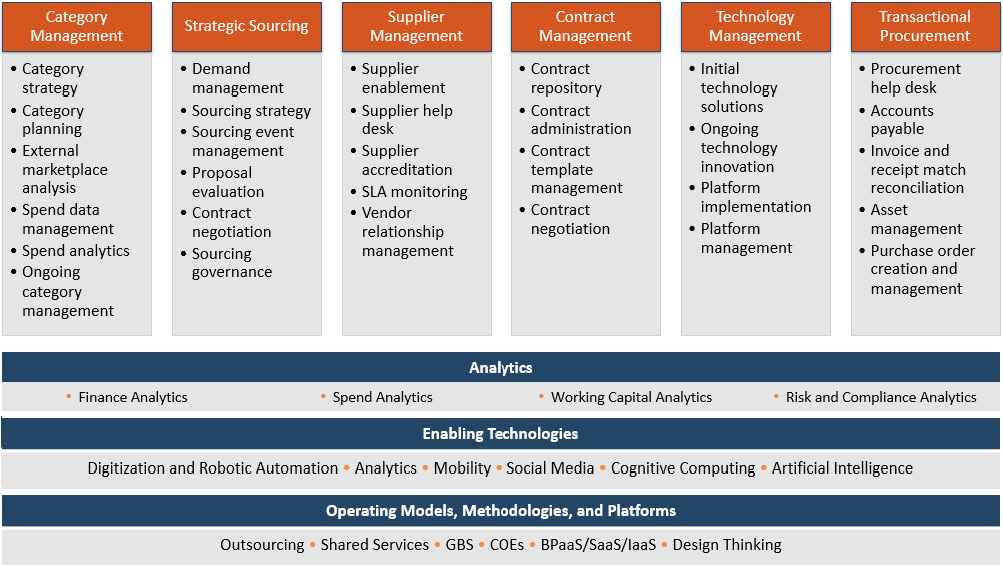

We asked clients about their satisfaction on seven criteria pertaining to account management, responsiveness and integration of customer feedback, the application of technology in the engagement, the level of automation the provider has brought in, proactivity, innovation and collaboration, and commercial model innovation.

Exhibit 3: Ranking of Satisfaction Level with Seven Key Client Criteria in Procurement As-a-Service

Exhibit 3 shows satisfaction is highest with the responsiveness to and integration of customer feedback, the quality of account management, and the level of collaboration and innovation in the engagement.Source: HfS Research, 2017

Where Providers Need to Step Up

Clients see a path for providers to evolve from primarily being an execution engine to an innovation partner or even innovation driver. Currently, however, all clients classify their providers as execution engines. Executives would like to see even more innovation from their service providers. Other areas of focus should be increasing proactivity in engagements, the use of automation, and offering new commercial models.

Bottom Line: Clients tell providers to keep pushing them toward the future with innovations and ideas

Procurement executives expect their service providers to maintain the level of engagement, collaboration, and responsiveness while also providing them with inputs, ideas, and acumen around the future of procurement, with new technologies and customer experiences top of mind. Clients are aware their organization is holding them back to move faster on procurement transformation and realize service providers can be a larger and critical part of the puzzle. This is essentially an open invitation to service providers to keep pushing the envelope on innovation, although progress might be slower than expected or desired.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started