This case study is for banking and financial services (BFS) executives and CIOs who need to modernize collections under tight regulatory and technology constraints. It examines how a leading US-based non-prime lender applied Firstsource’s unBPO principles of an operator + design partnership, outcomes-focused execution, and platform-agnostic delivery, to anchor the model on outcomes rather than rate cards. Its approach separates operations from core systems and reconfigures the economics and control of collections and recoveries.

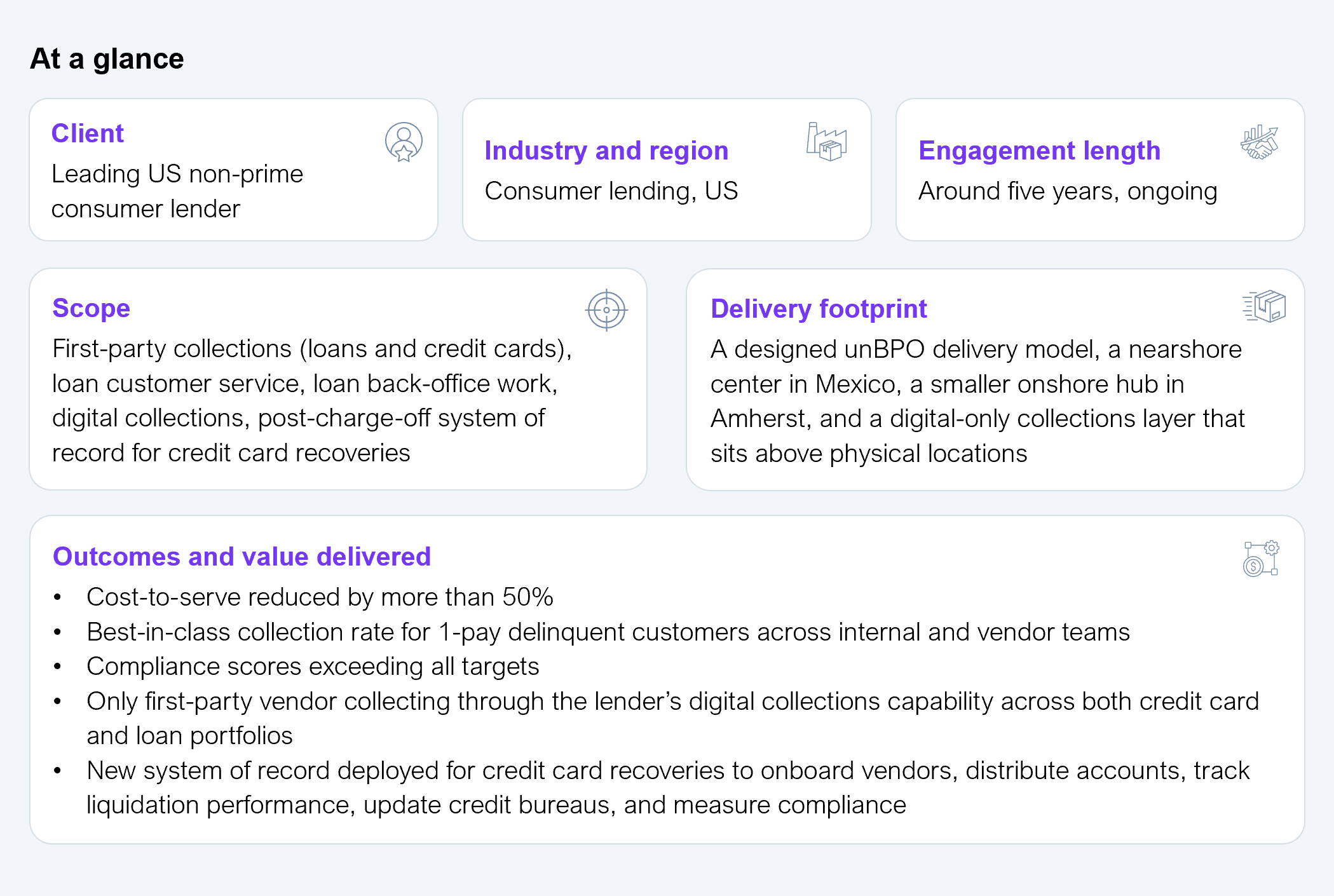

The partnership, described in Exhibit 1, cut the cost-to-serve by more than half, delivered best-in-class performance on early-stage delinquency, strengthened compliance, and created a platform- and AI-ready recoveries backbone, all while keeping core systems in-house.

Source: Firstsource, 2026

Many consumer lenders are navigating delinquency risks and pressure to cut servicing costs while remaining cautious about adopting new technologies.

The customer in this case study is no different. This US non-prime lender serves customers across the country through branches and central sites and offers personal loans, auto loans, and credit cards. Collections and servicing are highly regulated and materially shape the P&L. However, it has been operating with three hard constraints for years. It worked with several first-party vendors and maintained a firm line around its systems. Partners worked entirely on the lender’s platforms and were not expected to bring their own technology into the environment. By the time leadership looked again at the model, three problems were stacked on top of each other:

The CIO and business leaders needed a higher-capacity collections model that was cheaper, more effective, and could support future digital and AI initiatives, and they wanted to do this without outsourcing core systems to a partner or rushing into untested tools.

The lender chose Firstsource as a strategic partner and framed the challenge simply: Turn collections and recoveries from a set of queues into a flexible, data-led engine that it could tune over time. Four big moves defined the solution.

Flip the footprint and reset unit economics

The engagement started in Colorado Springs with a single Firstsource team focused on first-party loan collections. As volumes grew, that team took on loan customer service. To address cost pressure, Firstsource proposed a nearshore model in Mexico. It moved a majority of the work to Mexico City, supported by a small team in Amherst. Headcount stabilized to around 125 to 130 full-time equivalents (FTEs) in Mexico and about 15 in Amherst, supporting first-party collections for loans and cards, loan customer service, and related back-office processing. A digital-only collections operation was added, which sits above locations rather than inside them.

This is where the hard numbers show up. Firstsource reports more than a 50% reduction in cost-to-serve across the work it runs for this lender. The client still maintains onshore capabilities where needed, but the structural economics of collections and servicing appear very different from the original onshore-heavy model.

Put digital collections at the center, not the edge

Once the footprint was stable enough, the partnership moved digital from the edges into the core. Firstsource plugged its digital collections capability into the lender’s portfolios. This includes email and SMS outreach, self-service journeys that enable customers to understand their situation and pay online, and coordinated contact strategies across voice and digital channels. Crucially, Firstsource is now the only first-party vendor that actually collects through the lender’s own digital collections capability across both credit card and loan books.

Build a recoveries backbone that vendors have to respect

The next step tackled a specific pain point in recoveries. The legacy system of record for charged-off credit card accounts was unable to keep pace with the lender’s desired operational approach. Accounts were difficult to manage across multiple vendors. Liquidation was hard to compare. Compliance reporting and bureau updates were stitched together across systems. Firstsource and the client designed and deployed a new system of record for credit card recoveries to do the following:

Every vendor in the lender’s ecosystem now runs through this backbone, a core unBPO principle where the client retains system ownership while the partner orchestrates performance, compliance, and outcomes. The client still owns core systems. Firstsource provides the operational layer that makes recoveries measurable, tunable, and ready for smarter analytics.

Treat AI as a set of options, not as a big-bang decision

As AI entered the discussion, the lender did not want a platform decision. It wanted structured choices. Working with the client, Firstsource brought forward two groups of AI and automation ideas: AI-supported collections calling and automation of document-heavy processes. The teams co-designed these as option sets, not single-point solutions. For one key document automation case, they framed two routes: a more extensive automation path that would deliver higher impact and required deeper system access, and a limited automation path that fitted current access rules and risk comfort and could be deployed sooner.

Internally, the lender is still moving through approvals, risk reviews, and budgeting debates. Comparing the economics of AI pricing with FTE pricing is a genuine hurdle, but because the designs exist and are costed, sponsors can move from abstract talk to concrete trade-offs whenever they are ready.

This case is not a story about a shiny new platform in a greenfield bank. It is a story about a cautious, regulated lender that:

For CIOs and business leaders who work with outsourced partners, this case offers several practical lessons.

Choose the delivery location with eyes wide open

Mexico City did not land as perfectly as anticipated, and management continuity and attrition are real issues. These conversations compelled Firstsource to keep senior attention on the site, adjust leadership, and strengthen governance rather than assuming a simple lift-and-shift. For the client, this created confidence that nearshore is a designed operating model, not just a cheap location.

Best practice: If you are moving work to a lower-cost location, tie that move to changes in governance, leadership, and scope. Treat it as a chance to reshape how collections and servicing work, not just where.

Digital and data must be owned by outcomes

Digital collections and the new recoveries system of record were framed around outcomes such as cost per contact, liquidation performance, compliance scores, and customer experience, not around tools for their own sake. Core metrics, such as more than 50% lower cost-to-serve, a best-in-class collection rate on 1-pay delinquent customers across all teams, and compliance scores above target and easier to evidence, showcase how each component of the model contributes to these outcomes, which makes it easier to back further changes.

Best practice: Pick at least one partner to own digital journeys at scale, with clear accountability for volumes and outcomes. This gives you a live template for what “good” looks like and a benchmark for internal teams.

Leverage the partner as both an operator and a design studio

From the client’s point of view, Firstsource’s value is not just in numbers and headcount. It is also the way that ideas move. The lender’s leaders highlighted the following:

That is why AI and automation are being designed as option sets. It is the same mindset that shaped the nearshore move and the recoveries backbone.

Best practice: Delivery capability is table stakes. The differentiator is a partner who can run the work day-to-day and also act as a design studio for the next version of your operating model.

The first thing I think of when I think of Firstsource and how good our partnership has been is their industry feedback. They have a good pulse on what’s going on in the industry…and how it applies to the servicing they provide for us. Another thing we’ve valued is they’re quick to act…when they see a need; they act on it.

— Head of vendor management at the lender

This lender squeezed far more out of its outsourcing contract than just a better rate card. It used Firstsource to rebuild the collection stack around nearshore, digital, and a shared system of record. It now sits on a structurally cheaper, better-controlled, AI-ready engine that still runs on its own systems, with connections designed to drive better collection outcomes. BFS leaders who treat the next sourcing event as an operating-model redesign rather than a price refresh will be the ones who gain similar leverage.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started