Nothing in Generative AI is ‘business as usual.’ GenAI is underwriting loans, reshaping pharma compliance, and refactoring codebases at an industrial scale. Yet many enterprises still use outdated commercial models of hourly rates, fixed scopes, and endless change orders, even as the link between billed hours and value collapses.

In HFS’ Horizon study, Generative Enterprise Services Horizon 2025, we gathered information from 40 key service providers in the GenAI domain. On average, 30% of 2024 GenAI engagements already include outcome, consumption, or risk-sharing components. Providers expect this to exceed 50% by 2026.

An EVP of Data and AI at a leading service provider explained why commercial models are shifting: “We’re no longer contracting for people. We’re contracting for digital labor. We’re paying for the performance of the model, not the hours of a person. It’s the single biggest shift we’re seeing in how enterprises buy AI-driven services.”

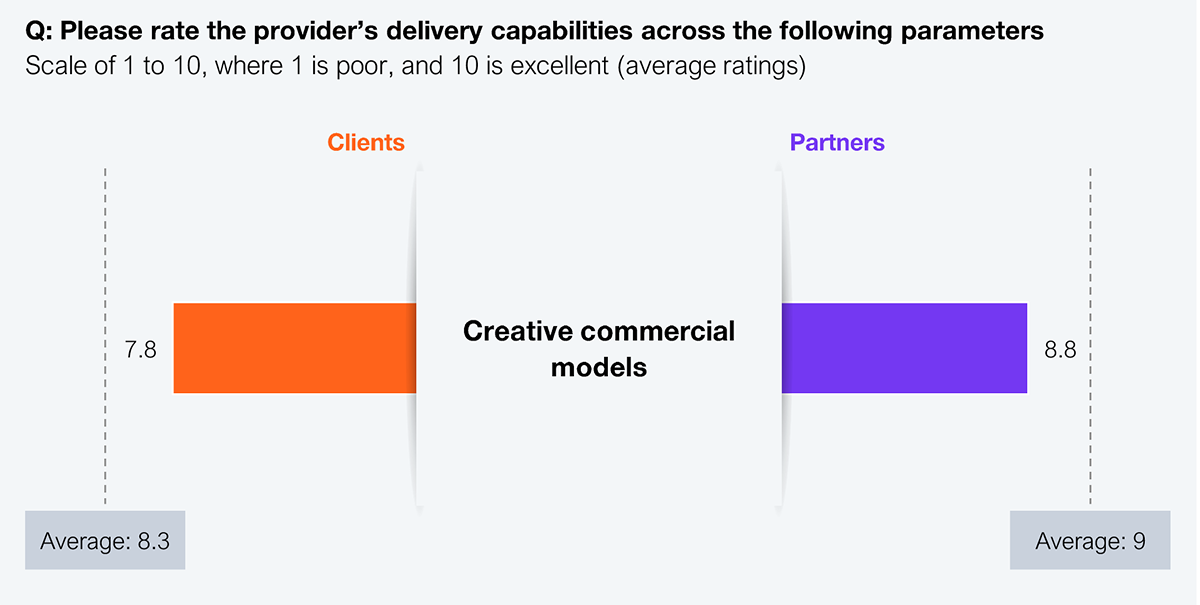

However, enterprise buyers are not satisfied with the commercial models included in service providers’ GenAI deals (see Exhibit 1).

Sample: N = 75 GenAI partners, 71 client references provided as a part of Generative Enterprise Horizon, 2025

Source: HFS Research, 2025

Service providers may push gainsharing or transaction-heavy pricing for AI/agentic solutions. However, buyers are unsatisfied and strongly resist for these reasons: decades of experience with software and services pricing that prioritize predictability, a deep psychological preference for certainty and fairness, and risk aversion tied to career consequences, not just financial waste. Providers must abandon purely rational pricing assumptions and strategically leverage behavioral insights, anchoring on outcomes rather than effort, transparently addressing fairness, decoupling payment from incremental usage, and carefully mitigating loss aversion.

Boards and CFOs must also understand that contracting GenAI like traditional IT leads to overspending on experimentation, rigid change requests, and losing top talent who expect shared value. GenAI’s dynamic and automated nature demands non-traditional commercial models that enable real-time adaptation, attract strategic partners, and deliver meaningful ROI in fast-evolving environments.

GenAI can create economic value faster than human staff hours can track—contracts need to change or be left behind. Also, commercial models are no longer procurement housekeeping. They are an operating model choice that can double or halve an organization’s GenAI ROI. The following six complex factors drive this disruptive shift.

GenAI solutions might still progress under legacy contracts, but the value could be limited. To realize its full potential, enterprises must adopt commercial models designed for experimentation, shared risk, and measurable outcomes.

Replacing legacy contracts can be complex, particularly when they are well-established and widely accepted by stakeholders. Enterprise buyers should demand total cost of ownership (TCO) transparency, push back on gainsharing unless clearly fair and measurable, anchor pricing on outcomes and trust, and favor hybrid pricing models with clear governance levers. This section explores some of the key challenges and considered approaches to adopting new contracting archetypes.

KPI ambiguity remains a major barrier. There are usually endless debates on what really improved. Consider organizing a joint value-charter workshop, third-party audit, and shared dashboard to align all stakeholders on measurable outcomes.

Accounting and procurement inertia also hold back progress. Effort-based systems are hard-wired into the enterprise fabric. One way forward is to create a new value-contracting lane with pre-approved clauses to fast-track non-traditional deals.

Provider balance sheet fear adds complexity. Considerable at-risk exposure stresses quarterly margins. Enterprises should consider establishing hybrid models with a fixed base fee plus upside and downside risk, along with caps and corridors and governance controls to manage volatility.

Legal and compliance departments often act as brakes on innovation, especially in regulated industries, where firms worry about sharing proprietary data on outcomes. Solutions include clean-room data environments, privacy guardrails baked into the statement of work (SOW), and stage-based access.

Finally, cultural change is critical. Delivery teams are rewarded for utilization, not business impact. Consider revising the KPI hierarchy, embedding a product-owner from the client in the vendor pod, and including reskilling funds in contract fees.

A delivery lead at a product-engineering firm pointed to enterprise hesitation as a key factor slowing the shift toward more agile, value-driven contracting. He explained, “Eighty percent of our projects are still time-and-materials today, but the only brake on faster outcome pricing is client readiness.”

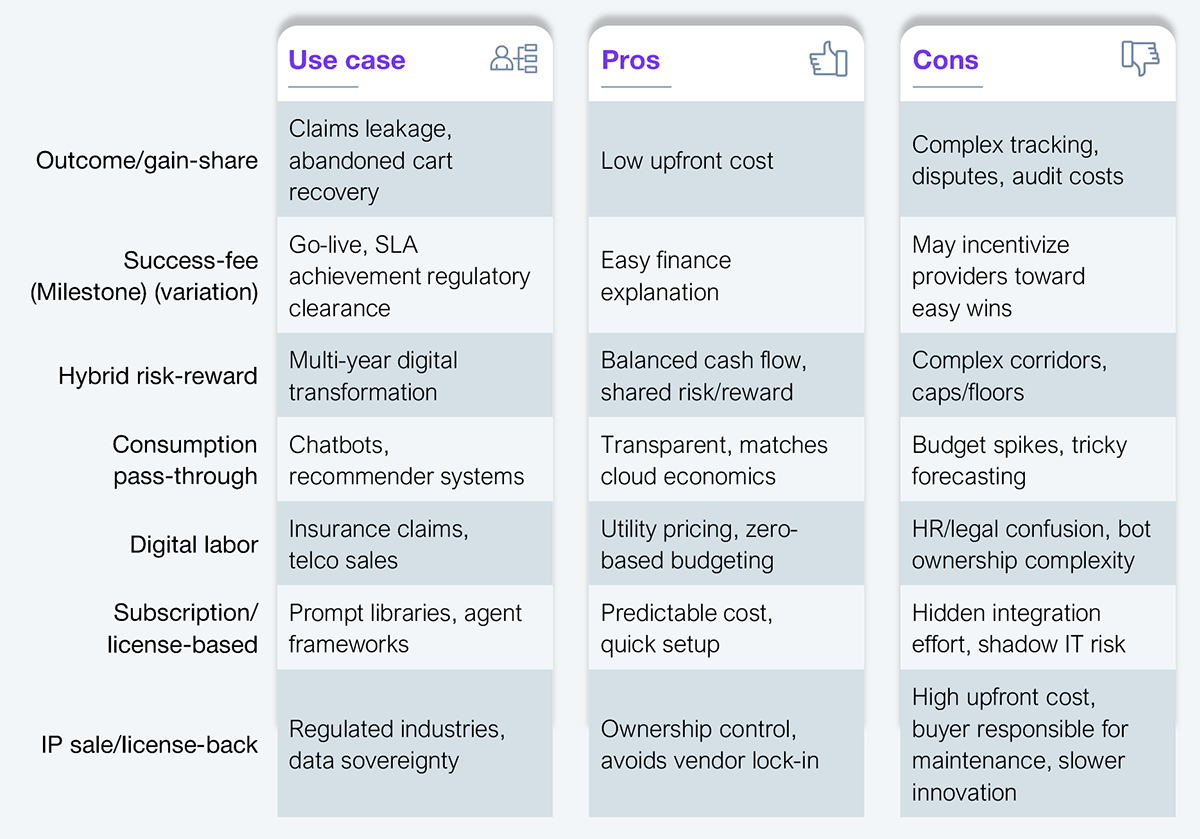

Most forward-looking enterprises are pioneering new contract archetypes that tie fees directly to business impact instead of hours spent. Exhibit 2 reveals the rising hybrid and consumption-linked contracts across top GenAI service providers, highlighting the waning relevance of traditional T&M models.

The traditional time and materials (T&M) and fixed-price models are used for budget certainty, simple invoicing, and low contract overhead. Still, these might lead to misaligned incentives, scope creep, change-order warfare, and risk premiums in hidden costs. Non-traditional commercial models can mitigate these drawbacks, but adoption is not without friction. Exhibit 2 illustrates the potential challenges of various types of contracts, such as audit costs, hidden integration effort, bot ownership complexity, and tricky forecasting. Thus, before finalizing any new model, organizations and its partners must ensure that sound KPI and baseline definitions, advanced monitoring capabilities, and organizational maturity are in place.

Sample: N = 40 service providers, Generative Enterprise Services Horizon, 2025

Source: HFS Research, 2025

Below are some scaled projects of enterprise clients that successfully use innovative contracts

In GenAI, how companies charge shapes how they build and operate. Enterprises’ GenAI success will not be decided by who writes the best prompt; instead, it will be decided by how you buy. To lead in GenAI, stop asking, ‘How much per hour?’ and start asking, ‘ What value will this create?’ That’s how you unlock ROI, retain talent, and stay ahead of disruption.

Further reading:

Flat-rate pricing isn’t rational but psychological—that’s why it wins

Services-as-Software and psychology biases break services pricing

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started