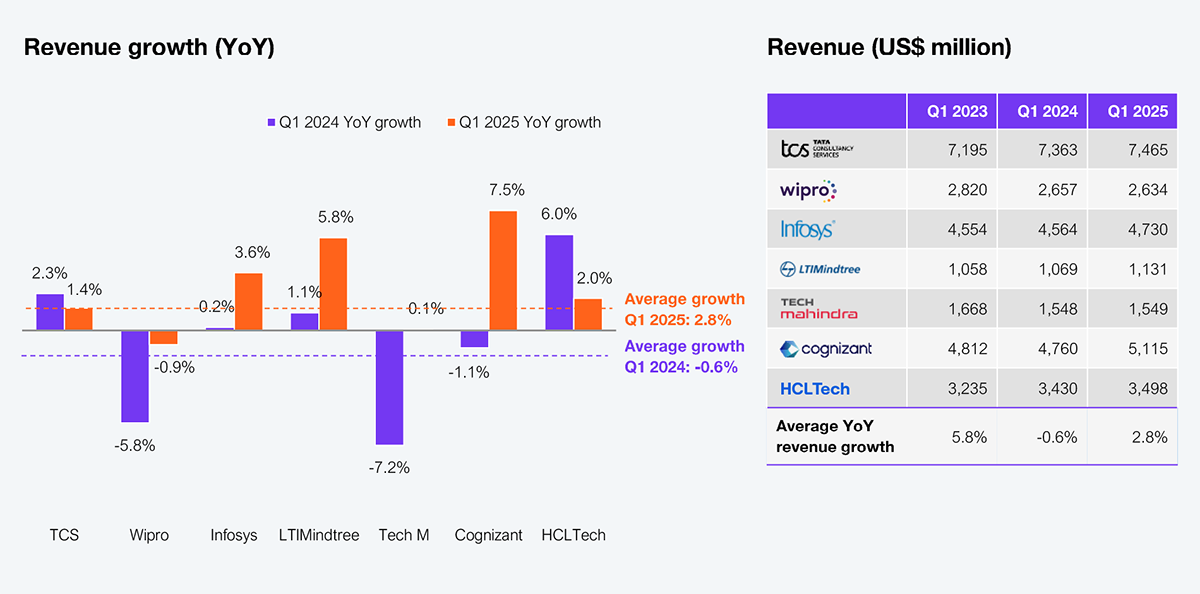

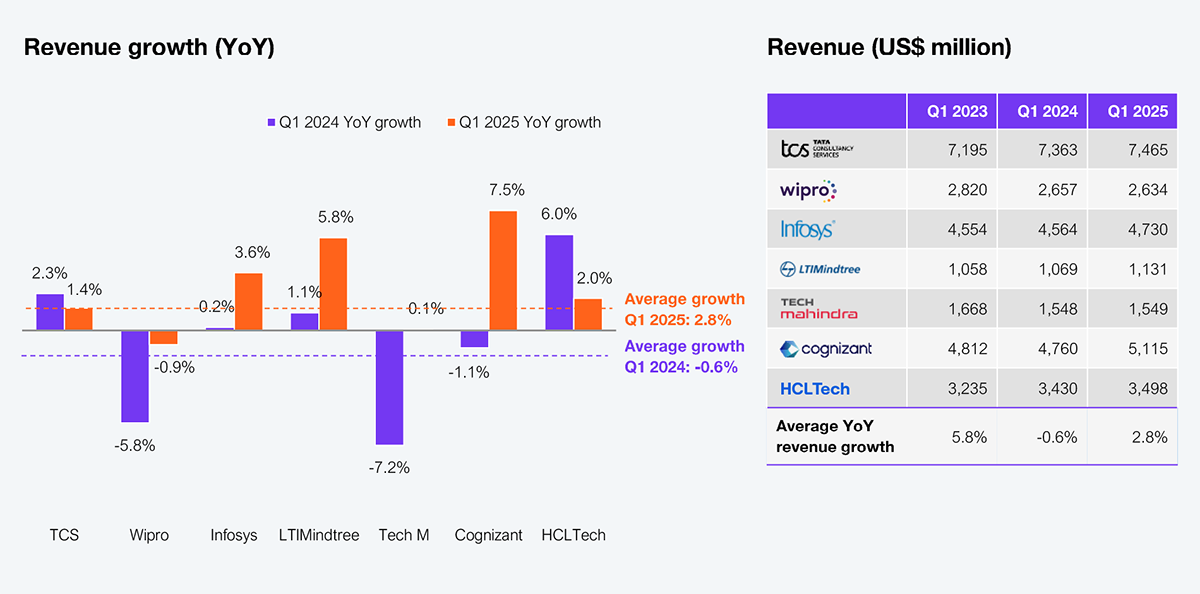

TWILTCH (TCS, Wipro, Infosys, LTIMindtree, Tech Mahindra, Cognizant, and HCLTech) represents India’s leading heritage IT and business service providers, which is why we often use their financial results as an indicator for market-wide performance. Exhibit 1 indicates slow but improving revenue growth for the services industry—average growth rates are climbing to low single digits, reaching 2.8% YoY in Q1 2025. It’s a definite improvement from Q1 2024 when revenue declined 0.6%, but the industry has not yet returned to pre-pandemic highs.

Exhibit 1: Q1 2025 revenue growth driven by Cognizant and LTIMindtree

Note: Revenue and growth data represent HFS estimates based on analysis of publicly available information. YoY growth compares a quarter with the same quarter of the previous year.

Source: HFS Research and earnings reports of leading service providers, 2025

TWILTCH firms must balance macroeconomic headwinds with AI-fueled growth

Trade tensions, tariff flare-ups, and geopolitical uncertainties are dampening global tech services demand, leading to a knock-on effect on service providers’ revenues. In response, enterprises are pausing their discretionary spends, stretching decision cycles, and reassessing transformation timelines. The hardest-hit industries are manufacturing, retail, and hi-tech, where tariff-linked pressure and global supply chain recalibration are holding back spending.

The continued pivots are cost takeout, vendor consolidation, and operational efficiency. This shift is pushing clients toward platform modernization, managed services, and AI-powered automation. Growth has been muted or negative in North America, and Europe remains cautious. On the other hand, the bright spots are India, MEA, and APAC, where firms such as TCS, HCLTech, and LTIMindtree are riding a wave of public sector digitization and sovereign cloud adoption.

GenAI is becoming the growth engine across TWILTCH

GenAI has emerged as a core growth lever for all TWILTCH firms, tightly woven into their long-term strategies. Every provider is investing in proprietary AI platforms or embedding GenAI within existing offerings. Workforce reskilling is in full swing, and strategic alliances with ecosystem giants (such as NVIDIA, Google Cloud, Microsoft Azure, AWS, and ServiceNow) are fueling innovation and model access. Rather than being used as a standalone tool, GenAI is deeply embedded in broader digital, cloud, automation, and consulting deals. Internally, firms are using GenAI to boost delivery efficiency from code generation to AIOps and BPaaS, driving both client value and margin uplift.

Delving into the earnings announcements from the TWILTCH providers

- TCS reported 1.4% YoY revenue growth in Q1 2025, led by robust performance from its energy (3.2% YoY), Regional Markets (21% YoY), and BFSI (1.4% YoY) businesses. This was driven by a handful of large deals, including multi-year deals of TCV more than $100 million, such as public sector digital platform upgrade deals in India, core infra modernization for Muscat Clearing and Depository in Oman, and an AI-first transformation deal with Air New Zealand. However, legacy-heavy and cost-sensitive industries remained under pressure on account of budget rationalization, notably Communications (-10.9% YoY), Manufacturing (-3.2%YoY ), and Life Sciences (-6.1%).

- Wipro reported a -0.9% YoY decline in Q1 2025, thanks to volume declines and delays in project initiation, driven by tariff policy shifts-led uncertainty. This was particularly seen in its Energy, Manufacturing and Resources (-7.3% YoY), Consumer (0.2% YoY), Technology and Communications (-0.9% YoY) businesses.

- Infosys reported 3.6% YoY revenue growth, led by subdued spending and decision delays in Retail (-3.6% YoY), Communications (-1.4% YoY), Energy (0.5% YoY), Hi-Tech (-1.1% YoY), and Life Sciences (-3.5% YoY), as well as the North America (-0.7%) region. Despite the slowdown, the firm is proactively responding via diversification, strategic expansion, and operational discipline, driven by acquisitions in US-based energy consulting, cybersecurity in Australia, and a JV in Japan. Its internal Project Maximus emphasises structural cost optimization for margin preservation amid economic pressure.

- LTIMindtree reported 8% YoY revenue growth in Q1 2025, led by its BFSI, Tech/Media, and Manufacturing verticals, as well as its North America region. This was fueled by large, efficiency-focused and AI-infused deals, including six large deals (TCV more than $50 million) in insurance, energy and utilities, and life sciences. In contrast, the retail and healthcare sectors along with the Europe and RoW regions faced headwinds due to macroeconomic caution, project delays, and client-specific issues.

- Tech Mahindra reported 0.1% YoY growth, which leadership attributed to ongoing macroeconomic pressures and client caution. The performance was weighed down by sectoral declines in Manufacturing (-5.5% YoY), Communications (-2.3% YoY), Hi-Tech & Media (-4.3% YoY), and a significant drop in the Americas region (-5% YoY). This quarter saw the firm announce the launch of TechM Consulting and a robust AI transformation agenda anchored in alliances with Google Cloud, NVIDIA, and Qualcomm.

- Cognizant reported 7.5% YoY growth, the highest of its TWILTCH peers this quarter. Growth was driven by strong performance in Financial Services (5.6% YoY), Healthcare(10.9% YoY), and Products & Resources (12.8% YoY), supported by large deal wins and inorganic growth from the Belcan and Thirdera acquisitions. Notably, Belcan’s limited exposure to government defence offsets tariff risks.

- HCLTech reported 2% YoY growth this quarter, led by strong traction in its Telecom, Media, and Publishing (TMP) business at 23% YoY growth—largely due to the $2.1 billion Verizon deal (as discussed in the previous quarters) and expanded engagement with a Fortune 50 telecom client. However, weakness in Manufacturing (-7% YoY), Life Sciences (-8% YoY), and Financial Services (-0.4% YoY) weighed on overall performance, impacted by client-specific ramp-downs and a divestiture in Financial Services. Furthermore, HCLTech launched Public Sector Solutions, signed mega AI-led engineering deals, and aligned software and services more tightly.

The Bottom Line: Investments in AI and automation for efficiency gains offer a temporary fix. Enterprises must aggressively rethink business strategies, reskill themselves, and break free from legacy lock-ins to become more resilient for heightened volatility.

In the current period of macroeconomic and policy unpredictability, enterprises should move beyond tactical cost savings. Engage TWILTCH providers as strategic partners, not just outsourcers, to co-create resilient infrastructure and AI-driven delivery models that can adapt, scale, and deliver sustained business value.