Enterprise leaders, these five breakout providers—Cognizant, Persistent, Coforge, Mphasis, and EXL—demonstrate that growth can finally be decoupled from headcount. It’s time to demand the same outcomes in your own engagements.

At HFS, we coined the term “Services-as-Software” (SaS) last year to describe the reinvention of the services industry, moving away from linear, labor-driven models toward software-like economics, where growth and profitability scale through platforms, artificial intelligence (AI) agents, and automation, rather than headcount.

Enterprise leaders have been stuck with their services spending anchored to labor-based models. Early signs from a few providers show that achieving non-linearity (de-linking from headcount) in such expenditures is finally possible. Services-as-Software isn’t a theory anymore; it’s happening. The only question is whether service provider partners are keeping up.

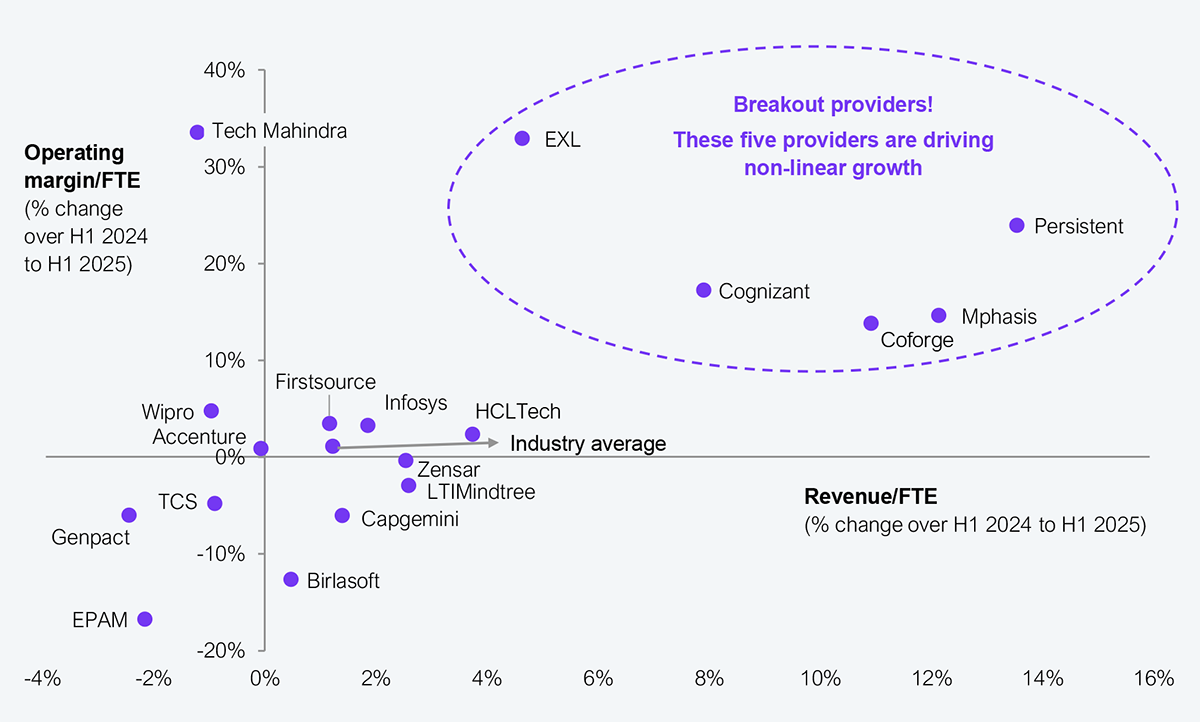

The latest performance data from leading service providers shows some early proof points. A small group of firms is decoupling revenue and margin from workforce size. Both top-line (revenue per FTE) and bottom-line (margin per FTE) are growing without armies of new people. But these are early signals, and the industry average remains largely flat.

Source: HFS Research, service provider earnings reports, 2025

Five firms, Cognizant, Persistent, Coforge, Mphasis, and EXL, are showing what happens when you start to shift away from pure labor-arbitrage models.

Let’s not over-romanticize it: even these breakout firms haven’t fully embedded Services-as-Software into their DNA. Some margin uplifts reflect structural levers, such as utilization, bench optimization, and sharper pricing. However, the early markers are clear. We see more AI-led deals, productivity gains, and platform evolution.

The industry is sitting on a burning platform. The world is demanding new economic models, but most providers are still clinging to outdated ones. Outside the breakout firms, the industry average is flat on both revenue per FTE and margin per FTE.

From the five breakout service partners, we see five themes that must become industry-wide priorities in enterprise–provider engagements.

Enterprise leaders must stop accepting labor-based proposals and start rewarding partners that bring platforms, AI, and outcomes to the table. Services-as-Software isn’t a nice-to-have. It’s your only shot at sustainable growth.

Provider leadership matters, but only when it drives your outcomes. If your provider’s senior executives aren’t actively shaping the engagement, challenging delivery assumptions, and pushing their teams toward platform-led value—as leaders like Ravi Kumar at Cognizant and Sudhir Singh at Coforge are doing—they’re not serious about this shift. Treat executive commitment as a litmus test: purposeful leadership accelerates transformation. Absent leadership stalls it.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started