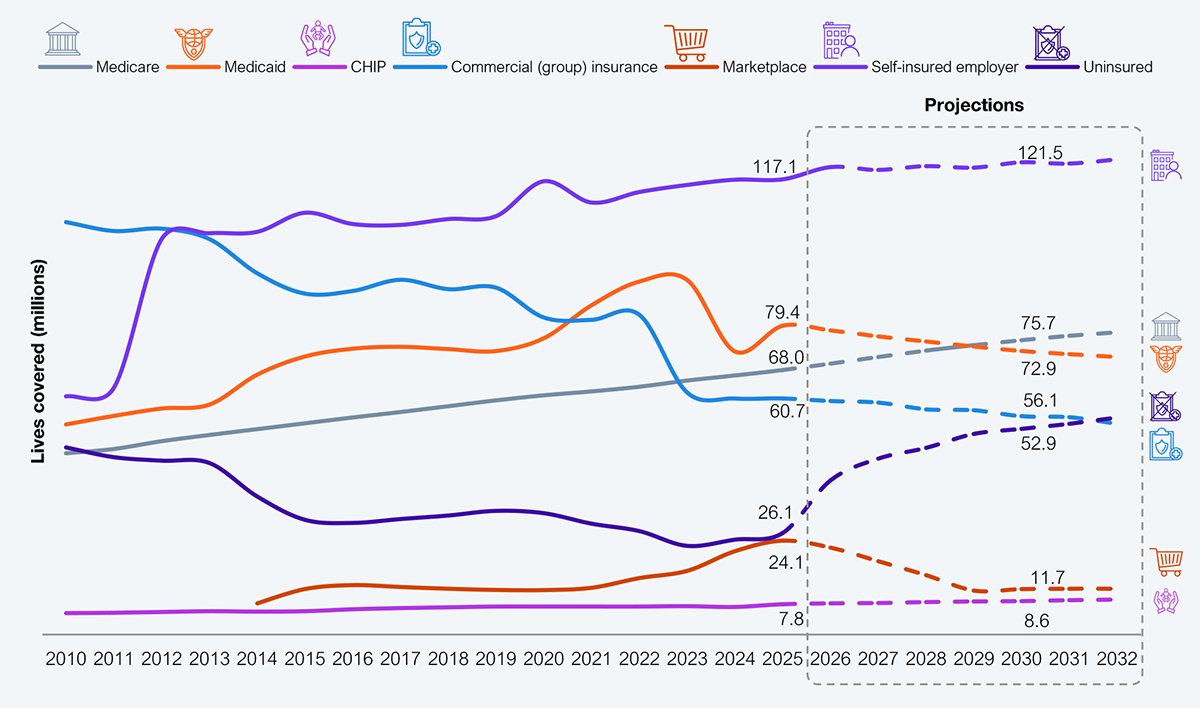

The core admin processing systems (CAPS) market is facing structural headwinds. UST saw that and divested UST HealthProof, its CAPS business, to Bain Capital (hereafter referred to as Bain). Bain will combine HealthProof with its recent acquisition of HealthEdge. These moves reflect two key strategies: (i) recognize the health plan market decline (see Exhibit 1) and sell before it’s a fire sale, and (ii) drive platform consolidation in the payer market to squeeze more juice. Platform players must wake up to a new reality and decide whether to ditch or engage in hand-to-hand combat.

Source: CMS, CBO, KFF, US Bureau of Labor Statistics, HFS Research, 2025

The CAPS market remains crowded with participants such as Cognizant, HealthEdge, Plexis, HSP, m360, HealthAxis, and NASCO along with every health plan’s homegrown mainframe system. Over time, this market has embraced new technologies: from cloud for delivering functions and integrating mobility to, most recently, AI.

However, the underlying functionality is still aligned with the traditional healthcare ecosystem, proving unbecoming due to its rapidly eroding value. CAPS players have turned to addressing adjacencies, including bridging providers to payers (such as the Epic Payer Platform) and creating modular functions to make the transition attractive to health plans.

These are survival tactics, not growth strategies, as the incremental value proposition is limited and health plans will not change their stripes. So in an environment where the number of insured will double in a year, commercial underwriting will continue declining, and the BBB will drive a 10–15% reduction in government programs (Medicaid and Medicare), health plans must reimagine their value proposition. Platform players that choose to play here will still experience consolidations and exits, deteriorating revenues and margins, and faster value erosion.

CAPS and other payer platform players have three choices: (i) double down and fight shrinking wallet share, (ii) exit and fund growth markets, and (iii) exit and leverage healthcare experience to address the only growth market (see Exhibit 1), i.e., the employer sponsored.

Their overall trajectory is set to double down, given the investments made over time, alignment of skills and talent, and relationships in the market. This strategy of kicking the can down the street is not surprising, as platform providers had a decade to recognize the market trends (see Exhibit 1). While the topline remained under pressure as payers shifted from underwriting to services with the increase in employer self-funding, platform providers focused on improving their margins through technologies. However, there is no evidence to suggest that it worked.

UST chose the second path, i.e., to ditch HealthProof to fund its AI and technology ambitions. This is business 101: forge ahead into growth ones. For UST, that is its core business of technology enablement. With free cash flow equivalent to almost 25% of its 2024 revenues, the company is well-positioned to accelerate new investments.

Curiously, none of the traditional platform providers are eyeing the employer-sponsored market. Their rationale paints the typical excuses: not wanting to compete with clients (what!), lack of clarity about the employer market, and pure laziness.

For the “last man standing,” the CAPS market will look like the remains of an old western town: empty storefronts, abandoned infrastructure, and haunting reminders of what could have been. Yet there is a penny to be made, as 50% of the US population still needs to be serviced, and that will be through CAPS.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started