Data quality has never been more critical. The AI explosion has created a burning platform for enterprises to finally tackle their data foundations, because without clean, structured, decision-ready data, AI will always underdeliver. Unfortunately, commercial insurers remain overwhelmingly manually run and document heavy.

AntWorks believes its Insurants business has developed the technology and skill set to finally make enterprise-grade, production-ready, high-quality data a practical reality for commercial insurers. This could be a case of the right solution at the right time, as insurers know they must address their data quality problem.

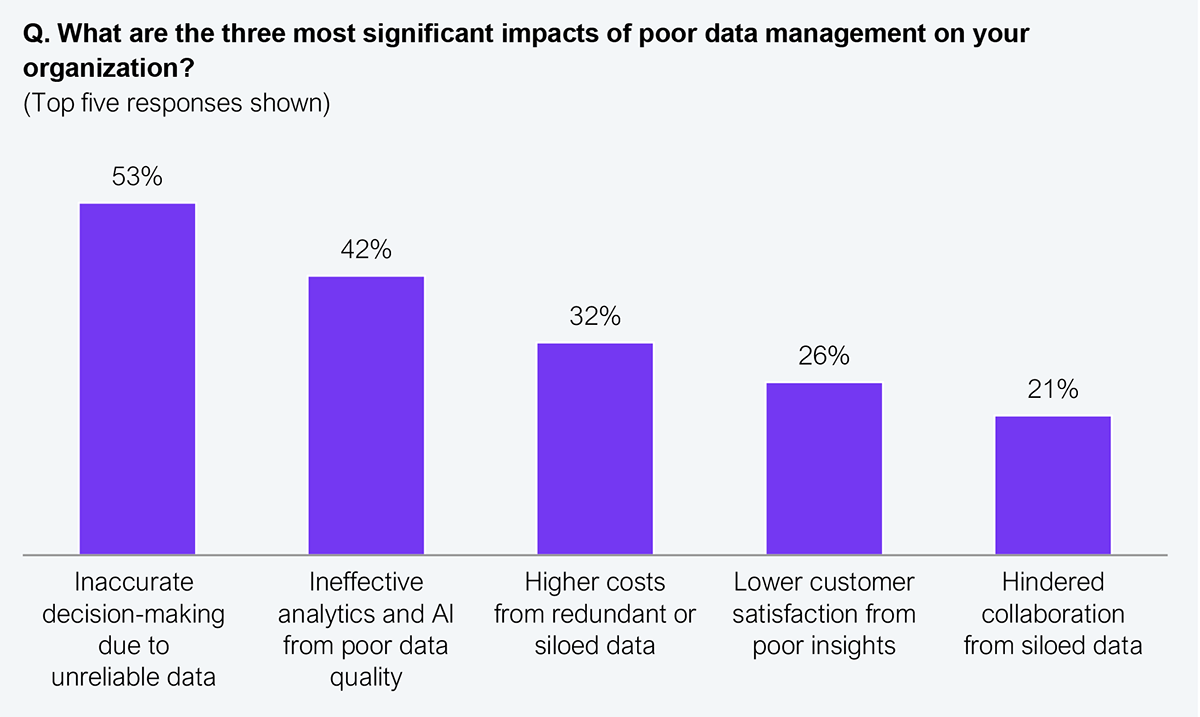

Decades of manual, document-heavy processes have left insurers’ data fragmented, inconsistent, and unreliable. Piecemeal transformation efforts have papered over the cracks until now—but our data in Exhibit 1 reveals that poor data quality is the biggest challenge preventing insurers from achieving their goals.

Sample: 19 leading executives from Global 2000 insurers

Source: HFS Research, 2025

Conversations between HFS analysts and leading insurance executives reveal an overwhelming excitement for the potential of AI within the industry. From intelligent underwriting to rapid quoting, its transformation potential is real; however, they must first overcome their data challenges. The old “garbage in, garbage out” adage still applies. AI cannot generate reliable insights if the underlying data is not handled correctly. That doesn’t mean just extraction. Data must also be normalized, validated, and enriched before it can flow into AI models.

Every insurer has ambitions to leverage AI within its organization, creating a burning platform to address its data problems today. That’s exactly why AntWorks believes it has the right solution to make it a reality.

AntWorks has a strong intelligent document processing (IDP) heritage, but it spun out Insurants when it recognized the need for a vendor with a deep commercial insurance specialty. Insurants has now processed thousands of policy documents, quotes, and submissions, allowing the company to move beyond simple document extraction to deliver high-quality data that insurers can actually use to power AI. In fact, Insurants executives advise that they no longer discuss IDP with insurers. They talk solely about outcomes.

At the core of this capability is Insurants’ Periodic Table, a library of nearly 1,500 smart, reusable data elements, built on the years of documents it has processed across the industry—a scale very few insurers could replicate. The pre-built logic enables Insurants to recognize how data elements are presented in different—often varied and unstructured—documents, assess the data’s accuracy, and format it for use in various enterprise systems.

It couples this with pre-configured workflows, such as quote extraction and policy comparison, to drive insurers to production faster, recognizing the importance of fast return on investment. Additionally, with each new implementation, the platform’s Periodic Table builds in self-learning by incorporating pre-trained data elements, reusing existing logic, and leveraging cross-client learning that benefits the entire client user base.

GenAI has created the need for change; now, the challenge is for insurers to finally tackle decades of manual processes and poor-quality data. Tools like Insurants, with its Periodic Table, might go a long way to making this vision a reality, but as always, it’s about more than just the technology. Commercial insurers must ensure they foster a culture of change, with alignment between business teams, IT, and operations, if they want to drive high-quality, AI-fueled data within their business.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started