If you want to know what your peers are really prioritizing, you should look beyond press releases and where they’re spending. TWILTCH (TCS, Wipro, Infosys, LTIMindtree, Tech Mahindra, Cognizant, and HCLTech)—India’s leading heritage IT and business services providers—and their financial results are often used as an indicator for market-wide performance, which is why enterprise leaders should pay careful attention.

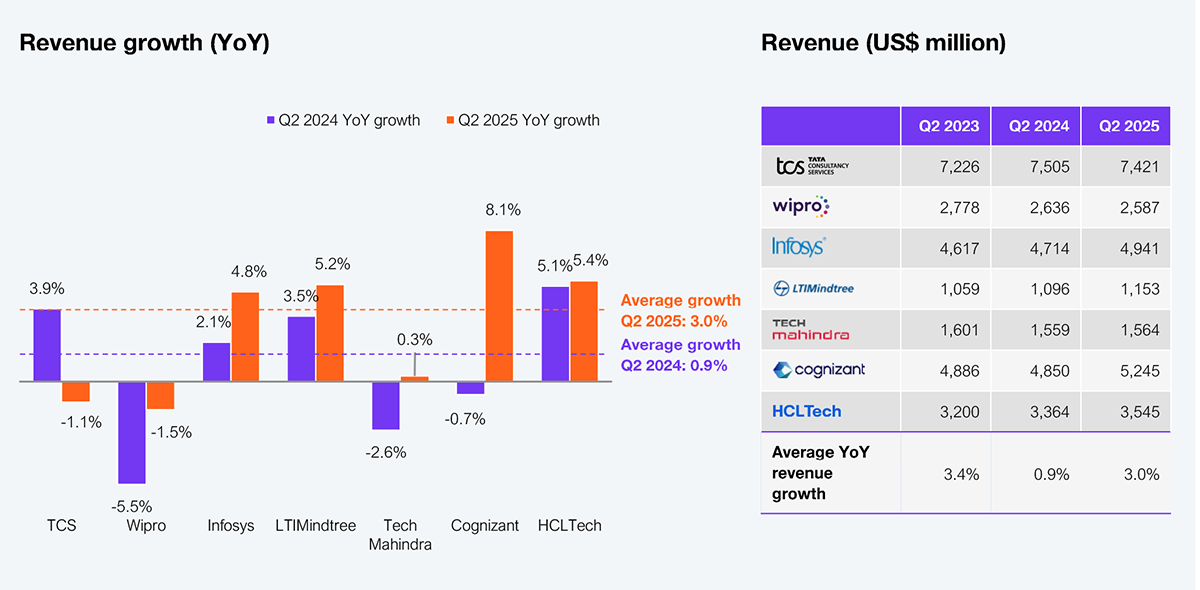

Exhibit 1 indicates slow but improving revenue growth for the services industry, proof that enterprises are continuing to spend. Average growth rates are climbing to low single digits, reaching 3% YoY in Q2 2025, a definite improvement from Q2 2024 when revenue grew by 0.9% YoY.

Note: Revenue and growth data represent HFS estimates based on analysis of publicly available information. YoY growth compares a quarter with the same quarter of the previous year.

Source: HFS Research and earnings reports of leading service providers, 2025

Enterprises are sending clear signals: investments are shifting to consolidation and efficiency-led transformation. Every TWILTCH provider highlighted this in their latest earnings reports. Rising contract values suggest that enterprises are seeking fewer overall partners in favor of larger strategic relationships. Despite this, booking numbers remain higher than recognized revenue, indicating that larger deals are taking time to ramp up.

Enterprises are also prioritizing AI to drive new efficiencies, with many claiming that AI investments have crossed the threshold from experimentation to execution. However, our conversations with leaders revealed this might not be the case just yet. TWILTCH are continuing to embed AI agents within their services, but the broader impact on these companies, their clients, and the shared cost efficiencies is yet to play out.

Concurrently, growth is fragmented across different geographies and industries, largely driven by macroeconomic uncertainty, including tariff and policy-driven concerns. BFSI stands out for its stability despite these headwinds, while the manufacturing and high-tech sectors are under pressure from discretionary spending cuts and delayed decision cycles.

TWILTCH earnings show more than just revenue figures; they indicate where enterprises are investing. Efficiency-led transformation and vendor consolidation are dominating many enterprises’ minds today, but they can’t afford to have such a short-term mindset. The real challenge is balancing short-term survival efforts with a long-term vision and investment into AI-driven value.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started