E&U companies are accelerating their own versions of transformation in the face of global turbulence and disruption. They’re doing so beyond other sectors while zeroing in on operational efficiency such as better asset management, building a critical mass of investment into renewable energy, and ingraining AI into the customer experience. E&U leaders who aren’t moving at speed into the new year will find that their competition will dictate the future. This data point comes in line with our broader research and roundtables on E&U’s efficiency drive, giving digital and emerging tech like AI a new lease of life in a traditionally slow-to-change sector as well as a silver lining for sustainability and the energy transition.

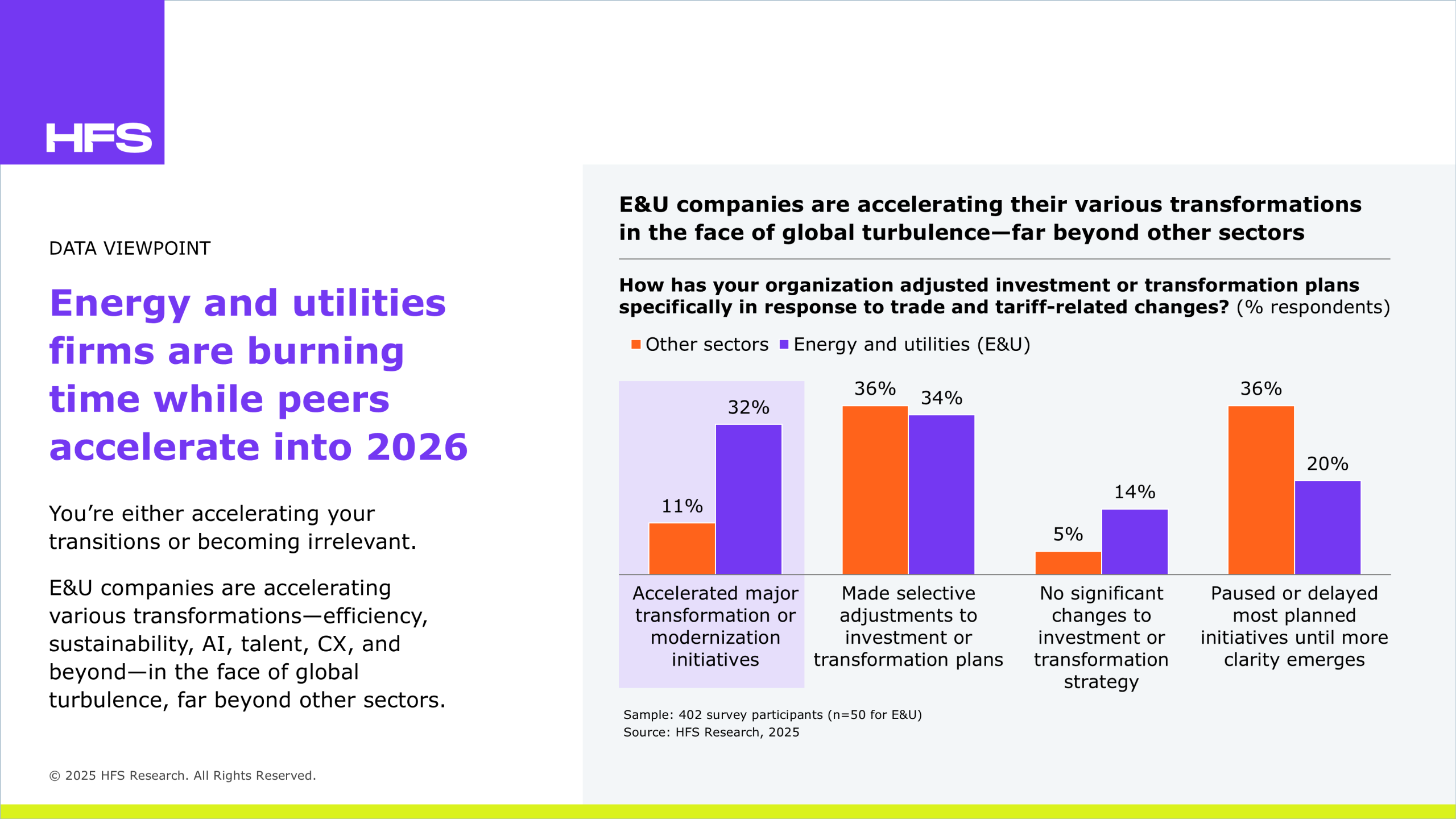

In our recent study in partnership with KPMG, we found that a small but significant subset of organizations is using chaos as the reason for reinvention—disproportionately in the E&U industry (see Exhibit 1). That transformation can take many forms in a sector with globally critical impacts—both extremely negative (climate crisis and conflict) and positive (investments in the transition to cheap and clean energy that can reach the least advantaged). Major oil and gas firms are restructuring, citing AI as the reason for thousands of job losses across the biggest firms, but it’s really a tough market with slower global demand and a lower oil price. Utilities, especially power generators, are pressing ahead, though too slowly, with the build-out of renewable energy. Consumer-facing E&U firms are increasingly looking to AI and digital to boost their customer experience (CX) but are still falling short of a “positive and proactive” one. E&U enterprises face three generational transitions that must be met head-on:

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started