Insurers are drowning in complexity, and most can’t modernize operations fast enough to keep up. But a small group of carriers is proving that the only scalable path forward is co-creating the operating model with a partner that can design, build, and run at enterprise speed. This alliance goes beyond outsourcing to bring an agile, future-ready operating model that aligns with fast-moving business goals.

Mosaic, a dynamic startup in the specialty P&C insurance market, is one such partner. Its partnership with WNS helps enterprises navigate operational complexity, drive rapid growth, and redefine competitive advantage—setting a new benchmark for operational excellence in the insurance industry through deep collaboration and continuous innovation.

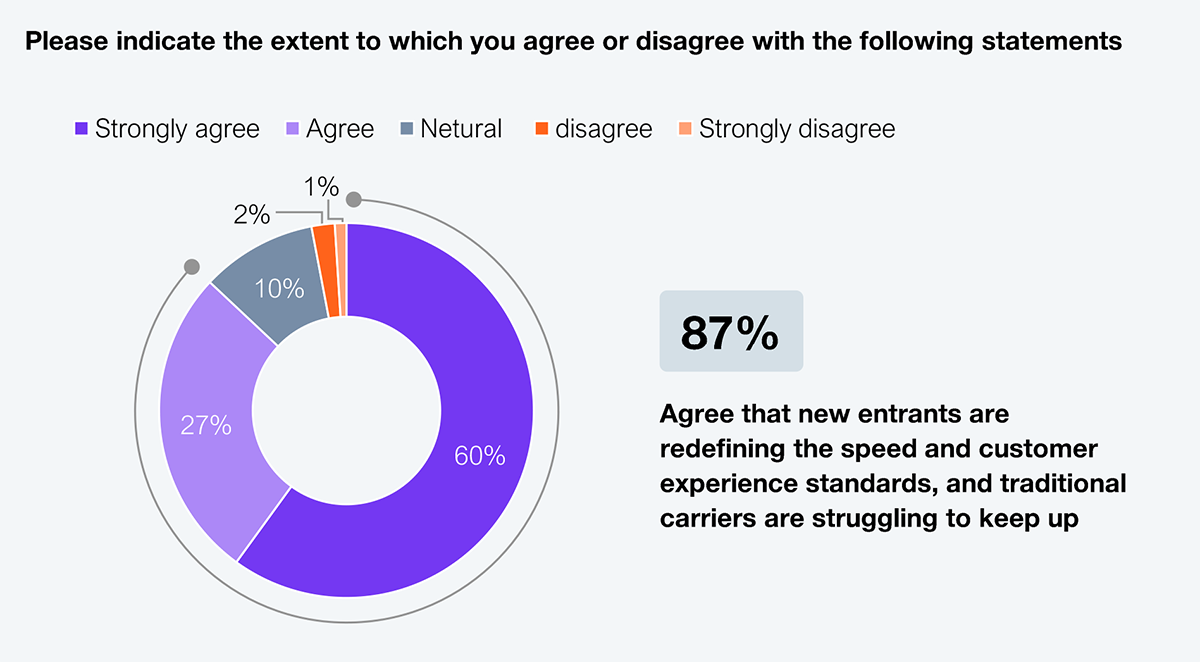

Insurance isn’t what it used to be, and thank goodness for that. Today’s industry is continually adapting to rapid technological advances, shifting customer expectations, and digital business models that are rewriting the rules of engagement. Future success demands an entirely new breed of carrier, underscored by our recent survey of over 350 commercial carrier executives (see Exhibit 1). Enter Mosaic Insurance, a nimble specialty insurer that calls itself an “underwriter’s underwriter,” highlighting its risk expertise. Operating uniquely as both a managing general agent (MGA) and a Lloyd’s syndicate entity, Mosaic’s agility and underwriting precision immediately set it apart.

Sample: 350 commercial insurance leaders

Source: HFS Research, 2025

Launched in 2021, Mosaic knew from the outset that lean operations and strategic partnerships were key to its bold ambitions. For startups in the specialist insurance space, operational complexity isn’t just a hurdle—it’s a core part of the journey. Mosaic’s hybrid business model required the delicate balancing of rigorous Lloyd’s regulatory standards with the flexible demands of an MGA, alongside managing intricate relationships with 27 distinct syndicated capital management (SCM) partners.

Simply put, standard solutions weren’t going to cut it. Mosaic needed a partner that could quickly understand the subtleties of the London insurance market, scale bespoke processes, and handle sophisticated capital flows without blinking. The partner would have to share its ambition—to scale rapidly, break industry molds, and lead with innovation. Moreover, it should proactively identify operational inefficiencies and introduce innovations, continuously refining processes as they scale. In essence, Mosaic needed a partner with experience in co-creating smarter businesses.

Our processes tend to be slightly bespoke and nuanced for every variation we bring in. Managing global syndicated risks across stakeholders called for a partner that could not only keep pace with us but also challenge us to think bigger. That’s where WNS came in. Our focus from day one was to have a fairly lean set of technology and operational footprint. WNS aligned immediately, stepping in as a critical partner to quickly scale our operations.

— Krishnan Ethirajan, Chief Digital and AI Officer at Mosaic Insurance

WNS’s deep operational expertise and agile mindset perfectly matched Mosaic’s ambitious vision. Its ability to navigate complexity quickly proved invaluable, enabling Mosaic to capitalize on emerging opportunities without the usual burdens of legacy operational structures.

Mosaic selected WNS not only for its general insurance operations credentials, but also for its specialized domain expertise, particularly in the Lloyd’s market, and strategic transformation mindset. Unlike traditional service providers that often operate reactively, WNS demonstrated the critical capability to design complex insurance processes from scratch, positioning Mosaic to quickly leverage market opportunities.

Critically, WNS’s deep experience in the London market meant it was already familiar with the unique complexities of the market, from stringent compliance requirements to nuanced broker relationships.

WNS had a pretty good understanding of the nuances and quirks of the London market, particularly Lloyd’s. Their operational expertise and proactive approach to our unique model made them stand out distinctly.

— Krishnan Ethirajan, Chief Digital and AI Officer at Mosaic Insurance

Moreover, its commitment to innovation was evident from the outset. WNS didn’t just step in to run operations—it stepped up to co-architect a scalable operating model aligned to Mosaic’s future growth curve. By aligning with Mosaic’s long-term goals, it went beyond meeting service levels to delivering transformational value.

Few insurers have figured out how to scale operations without dragging legacy baggage. Mosaic’s lean, co-located, and automation-first model proves that a startup mindset (not just startup size) is key to transformation.

WNS’s teams have helped Mosaic build SOPs from scratch, execute process migrations without rebadging talent, and develop middle-office support roles co-located with underwriters in the UK and the US to bridge offshore delivery teams with the business. WNS quickly became an extension of Mosaic’s core team, embedding itself across geographies and functions to turn Mosaic’s ambitions into tangible actions.

On the technology side, WNS partnered with Mosaic to co-create broker-facing portals for cyber and PV lines of business, accelerating quote generation and underwriter productivity. This also extends to system modernization, helping Mosaic migrate away from dual-entry legacy systems and piloting automation to streamline complex credit control tasks. These aren’t just system upgrades; they’re bold steps toward Mosaic’s vision of a modern, tech-enabled underwriting operation.

For carriers that fail to modernize, the cost of inaction will result in slower quote cycles, increased operational friction, delayed cash reconciliation, and constrained underwriting capacity.

Our business is continually evolving—new products, new geographies, new syndicated partners. WNS has risen to this challenge, adapting processes, finding automation opportunities, and consistently enabling our growth.

— Krishnan Ethirajan, Chief Digital and AI Officer at Mosaic Insurance

Each operational win, whether in cost efficiency or underwriting speed, has brought Mosaic closer to its vision of becoming a next-gen insurance leader:

WNS delivered a very compelling product on our cyber platform, significantly improving underwriter efficiency, operational involvement, and financial visibility.

— Krishnan Ethirajan, Chief Digital and AI Officer at Mosaic Insurance

These results are not happy coincidences; they’re proof of what happens when ambition meets the right partner.

As Mosaic eyes bold new frontiers, from expanding into the US to embedding agentic AI, WNS remains a committed partner in shaping what’s next. While automation and data unification initiatives are currently underway, Mosaic is already thinking about the future, and specifically, the transformative potential of agentic AI. According to Krishnan, this exciting set of technologies could fundamentally reshape traditional operational roles, augmenting human productivity and decision-making.

This forward-looking stance involves ambitious reengineering of underwriting processes, integrating generative AI technologies, and redefining the very nature of operations to maintain competitive advantage. Mosaic views agentic AI not as a shiny toy, but a means to overhaul outdated processes. Through Mosaic, WNS is exploring the use of small LLMs tailored to underwriting workflows to automate complex decisions without compromising control. Most carriers are still debating pilots, while Mosaic is already on the path to redefining the underwriter’s job. The task ahead for both is ambitious. In a world of rapid change, WNS brings not just operational strength but the foresight and adaptability to co-design what’s next.

For insurers still experimenting at the edges of AI, without a redesigned operating model, agentic capabilities will sit idle, widening the competitive gap.

Agentic AI holds real promise for automating complex, bespoke tasks. We’re looking at this technology to augment human capabilities and fundamentally redefine operational roles. WNS will be integral as we navigate this next phase.

— Krishnan Ethirajan, Chief Digital and AI Officer at Mosaic Insurance

By treating operations as a strategic advantage instead of back-office support, Mosaic and WNS aim to rewrite the service provider-client equation. Their partnership demonstrates how operational capacity can be a key competitive advantage for nimble insurers. In a market that rewards speed, agility, and ingenuity, this collaboration sets a blueprint for transformation. It’s a clear wake-up call: operational excellence isn’t just a best practice; it may be the strongest lever for staying competitive in the insurance market.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started