Accenture has announced a bold move to double down on its ‘One Accenture’ growth model, aiming to simplify and unify its vast capabilities under a single banner of Accenture Reinvention Services with Manish Sharma at the helm. It’s an ambitious move to simplify and unify its sprawling empire for the age of AI, but delivering on that promise will be anything but easy.

What’s in the win column

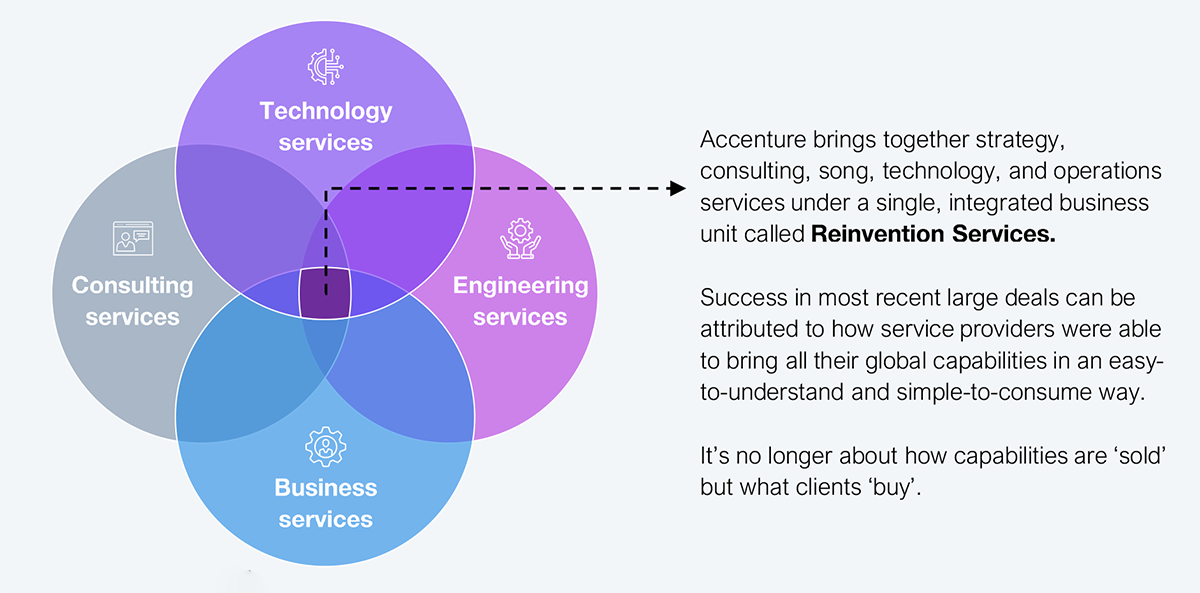

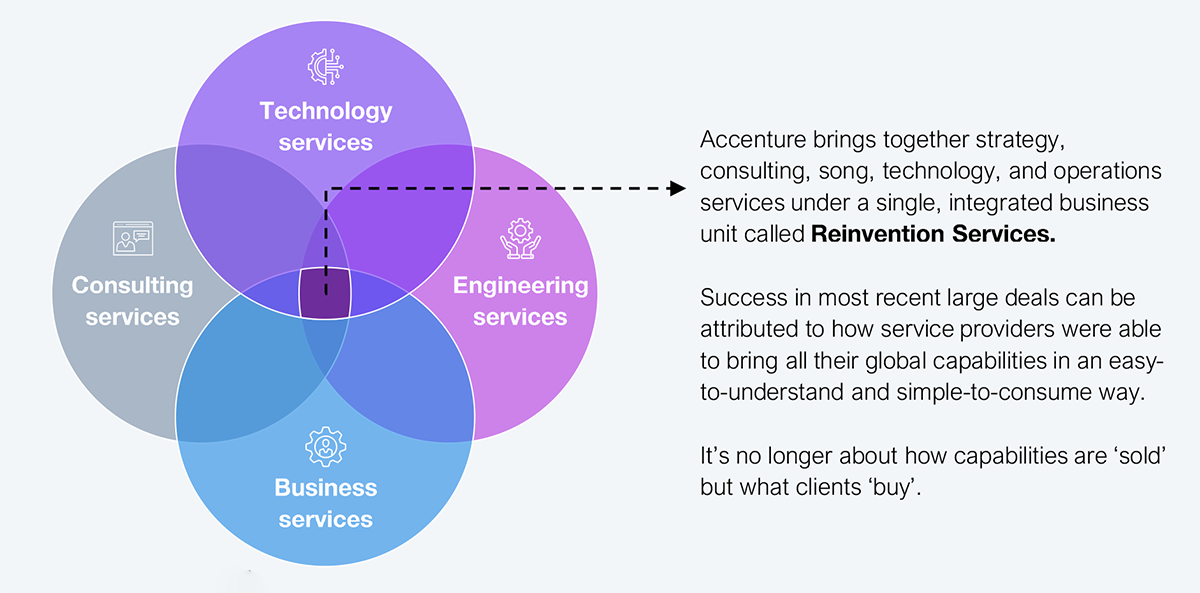

- Moving from selling capabilities to solving client needs: Accenture’s decision to merge Strategy, Consulting, Song, Technology, and Operations into Reinvention Services cleans up a complex story. Instead of marketing disconnected offerings, the firm is shifting the conversation from what it sells to what clients buy: real, end-to-end outcomes. That mirrors the HFS OneOffice vision, which champions breaking silos to deliver seamless, connected client experiences.

Exhibit 1: Reinvention Services promises to create the ‘One Accenture’ experience for clients

Source: HFS Research, 2025

- Tailored for mega-transformations: Most large, enterprise-wide deals today demand multi-disciplinary capabilities spanning from strategy to execution. Accenture’s biggest and most sustainable differentiator is its ability to deliver that breadth at a massive scale.

- Proven leadership: Accenture’s appointment of Manish Sharma to lead Reinvention Services signals strategic clarity. Known for his pragmatic yet ambitious leadership style, Manish brings deep operational experience, a proven ability to scale growth, and strong credibility among clients and colleagues.

- Scale as a weapon: With nearly 800,000 professionals worldwide, Accenture can throw unmatched resources and expertise at any challenge. Its scale is a superpower, blending deep industry know-how, functional depth, and a world-class tech partner ecosystem. Crucially, the firm speaks the language of business outcomes, not just IT, setting it apart.

Where the wheels could come off

- Leadership volatility: Accenture faces at least four CEO changes between September 2024 and September 2025 (explained below), adding big leadership churn right in the middle of its reinvention. That degree of turnover could unsettle client confidence and disrupt momentum, especially for a $68 billion giant attempting to transform itself on multiple fronts. Such shifts can unsettle the trust and continuity built with clients over decades, making the path forward more challenging.

- Technology: Rajendra Prasad will succeed Karthik Narain, who is leaving in September 2025.

- Song: Ndidi Oteh will take over from David Droga in September 2025.

- Consulting: Jason Dess will succeed Jack Azagury later this year.

- Operations: Arundhati Chakraborty replaced Yusuf Tayob in September 2024.

- Too big to pivot: We’ve often likened Accenture (in jest) to a country, not a company. That kind of scale is impressive but comes with a heavy price: slower decision-making, complex policy rollouts, and a workforce that can easily lose sight of the bigger picture. In the meantime, smaller, nimbler rivals growing at double-digit rates are stealing both mindshare and top talent, exploiting Accenture’s structural inertia to its advantage.

- Incentives—the Achilles’ Heel: For ‘One Accenture’ to succeed, it can’t just be driven from the top—it demands a deep, bottom-up transformation, especially around employee incentives. Most service providers reward their people for scoring the goal, not passing the ball. Embedding a culture of true collaboration across Strategy, Technology, Operations, and Song will take more than a new org chart. Unless that pass-the-ball mentality is hard-coded into incentives and day-to-day behaviors, the operating model will keep hitting the same old silo walls.

- Acquisition overload: Accenture made a staggering39 acquisitions in 2024 alone, using inorganic growth to bolster capabilities and stay relevant. While many of those deals make strategic sense on paper, both clients and the acquired teams are still trying to navigate ‘the Accenture way’ of working. Now, layering on top a completely new ‘One Accenture’ operating model makes integration even more complex—and potentially messy.

- The TLC factor: In the latest HFS Pulse survey of 300+ enterprise leaders, only 4 in 10 felt their service providers truly get it—and Accenture scores no better than the average. Smaller competitors gain ground with better senior access and more personal, high-touch relationships. No shiny org chart can substitute for genuine client empathy and humility. Ensuring every client gets thetender, love, and care they expect will take far more than a structural shake-up.

- AI is levelling the playing field: GenAI and agentic AI are flattening the playing field fast. Smaller players can now stitch together sophisticated solutions at lower cost and higher speed, once the exclusive domain of giants like Accenture. Unless a client has a truly massive problem to solve, Accenture’s scale advantage is looking a lot less bulletproof. Reinvention Services is a great narrative for big, hairy audacious client goals, but it falls short of articulating the competitive advantage for ‘small t’ initiatives.

The Bottom Line: Reinvention Services can win, but only if Accenture also reinvents itself from the inside out.

Accenture’s ‘One Accenture’ reinvention is a smart strategy on paper—the only logical play to maintain relevance as the AI era rewires business. But strategy is only half the battle. The other half—fixing culture, aligning incentives, stabilizing leadership, and staying nimble—is where things could come apart.

As Accenture pivots to Reinvention Services, clients should:

- Challenge how ‘One Accenture’ delivers measurable outcomes, not just a new narrative

- Insist on true cross-unit collaboration and integrated delivery

- Verify leadership stability and talent integration across acquisitions

- Leverage competitive options in the AI era to demand more speed, flexibility, and value

Make Accenture earn your reinvention, not assume it.