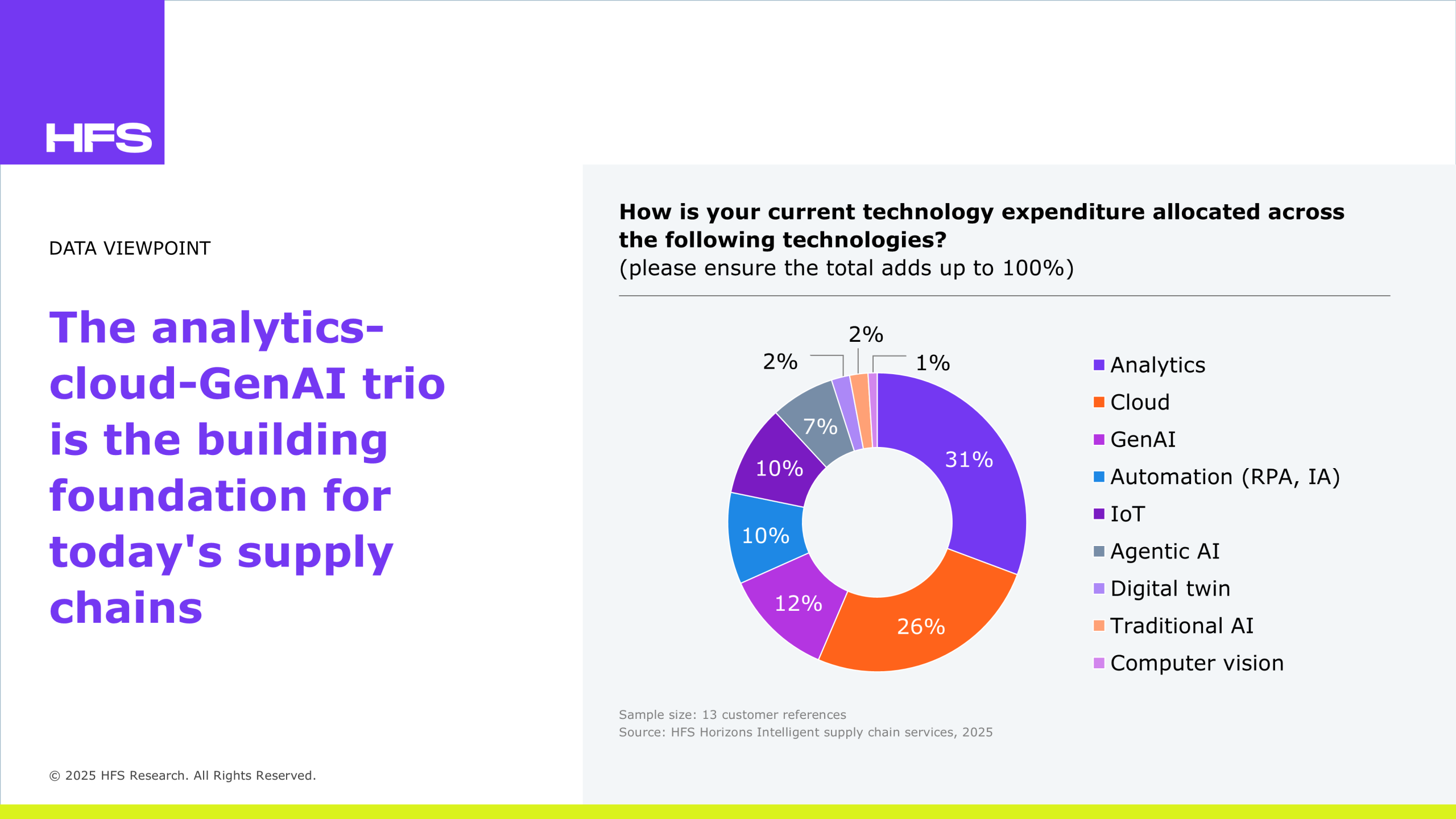

A data chart from “HFS Horizons: Intelligent supply chain services, 2025” shows where the money is flowing. For supply chain leaders, analytics (31%) and cloud (26%) remain the dominant destinations for tech spending, capturing nearly 60% of total investment. However, what’s surprising is the sharp pivot toward GenAI (12%) and agentic AI (7%), which now outpace traditional AI (2%), signalling how enterprises are envisioning the importance of intelligence. Meanwhile, automation (10%) continues to hold steady, showing that robotic process automation (RPA) and intelligent automation (IA) are being reinvented, not retired, for the GenAI era. Digital twin and computer vision remain on the margins (2% each), but that’s where the next wave is quietly forming.

Analytics and cloud remain the first frontier and building foundation for supply chains: Cloud and analytics remain the backbone of supply chain modernization. From real-time inventory visibility to predictive demand planning, these technologies have elevated supply chains from disconnected functions to dynamic ecosystems. Enterprises rely on cloud platforms to break silos across suppliers, logistics providers, and internal teams. Analytics has turned yesterday’s reactive firefighting into today’s data-driven decision-making.

But here’s the rub: this reliance on proven tools reveals a risk-averse mindset. Few enterprises are still catching up on past transformation programs, doubling down on what’s safe rather than exploring what’s next. In a world where disruptions are constant, whether geopolitical, climate-driven, or economic, that conservatism could soon become a liability.

AI is solidifying an otherwise fragmented enterprise function: While AI is undeniably on the radar, client investment remains fragmented and often experimental. GenAI has secured 12% of tech spend, a promising figure that reflects growing enterprise curiosity and early-stage adoption. Automation (including RPA and IA) and IoT have each captured 10%, underscoring the continued relevance of process efficiency and smart device ecosystems. It enables applications such as intelligent document processing, faster RFQ responses, and smarter procurement recommendations.

However, agentic AI, the kind that can reason, act, and learn over time, is lagging with just 7% of spend. This is the AI that will drive autonomous logistics, dynamic rerouting, and AI-led procurement negotiations. Other emerging technologies, such as digital twin and computer vision, are also underfunded despite their potential to optimize warehouse operations, improve safety, and model supply chain scenarios in real-time.

The enterprise mindset must evolve from cautious to risk-calculated: Enterprise technology leaders should reassess how they prioritize and allocate budgets. Continuing to over-index on cloud and analytics may deliver incremental returns, but not transformational ones. AI, particularly in its more advanced forms, offers a broader value horizon.

This shift won’t happen in a vacuum. It requires:

Procurement leaders must also evolve their evaluation criteria. Instead of just comparing AI capabilities on paper, buyers should assess providers based on their ability to deliver measurable AI outcomes, whether they’re cost avoidance or revenue growth. This shift will accelerate maturity across both the buy and sell sides of the market.

This outcome-first approach will drive AI maturity across both buyers and suppliers, accelerating meaningful innovation.

Cloud and analytics remain essential for supply chain continuity, but they are no longer differentiators. The real edge will come from GenAI, agentic, and embedded technologies infused across planning, procurement, logistics, and fulfillment.

Supply chain leaders must act now to rebalance their portfolios, continuing to invest in what works while making room for what’s next. The AI-powered supply chain is not a future vision; it’s already in motion.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started