You can’t realise your enterprises’ digital ambitions, without having a frank and honest evaluation about which hyperscale cloud provider will make it all possible. Now, more than ever, finding the right cloud engine and support services to manage your digital business is mission critical.

As the market develops, we’re starting to see clear points of differentiation between the main cloud contenders. For example, Google is focusing its heft on AI and analytics, while IBM is touting its implementation clout and unrivaled credibility in enterprise IT services. Meanwhile, AWS is currying favour in the tech developper market, while Microsoft focuses on leveraging its ubiquitous productivity suite to push the value of Azure. It’s no longer a case of “any cloud will do” – finding the right partner could be the difference between success and failure.

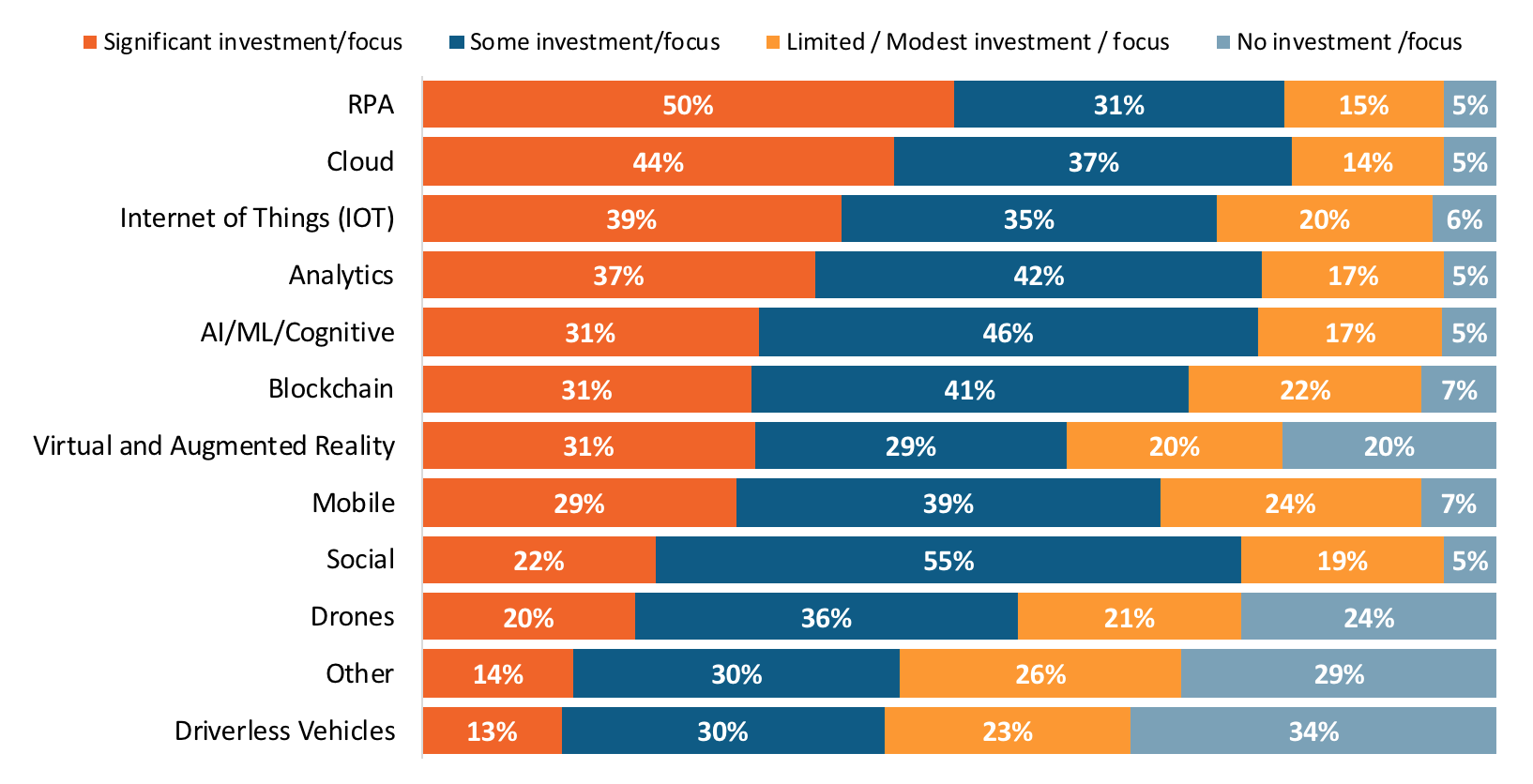

44% of Global 2000 enterprises plan significant investments in Cloud this year creating a land-grab among the cloud providers to bolster market share

In a recent report, we set out to explore how the four main hyperscale cloud providers are carving out their journey to success. But this only tells half the story. The reach and scale of cloud providers used to be what set them apart from traditional infrastructure engagements, but with more of us looking to the cloud for salvation, it’s becoming more about the nature of their approach and development roadmap – and with good reason, as enterprises reveal a seemingly insatiable appetite.

In Exhibit 1, below, we can see that 44% of enterprises plan to invest heavily in the cloud, while only 6% expect no investment at all. The growth of the market, combined with an increasing reliance on cloud, is pushing buyers to demand more, and providers to bring new and exciting innovations, models and approaches to market.

Exhibit 1: Investment to help achieve cost-saving goals

Q: How much investment/focus is your organization making in the following in the next year to help you achieve operational cost saving goals?

Source: HfS Research in conjunction with KPMG “State of Operations and Outsourcing 2018,

Source: HfS Research in conjunction with KPMG “State of Operations and Outsourcing 2018,

N-381 Global 2000 Enterprise Buyers

They all do cloud, right? So why should I care?

As the cloud market continues to grow, four providers appear to be best able to satisfy demand – AWS, Google, IBM, and Microsoft. Each has carved out a sizeable segment of the market, developing differentiated capabilities that will make them ideal for particular businesses but not for others. So, here’s our quick run through of what makes each of these players different, without getting bogged down in the techie details (thankfully).

AWS

AWS needs little introduction, as the firm has become synonymous with hyperscale cloud, growing at an unprecedented rate over the past few years. What makes this firm stand out is its strong commitment to the tech community – and the subsequent push to remove friction and bottlenecks for developers and IT professionals – a fact which led to the firm being rated well for innovation in a recent survey. The firm has one of the most expansive partner networks in the space, which brings with it the added bonus that AWS cloud offerings are frequently a weapon in the arsenal of other providers supporting digital transformation engagements. However, clients and providers are telling us that they’re starting to see some kick-back against the firm, as its leviathan parent Amazon continues to encroach in other enterprise spaces. Retail clients, for example, are reluctant to sign a cheque to AWS knowing that it’s simultaneously a competitor in their market.

Microsoft

In the enterprise productivity space, Microsoft has become so firmly embedded that utilizing its Azure platform is almost a given, according to some enterprise buyers. So it’s no surprise to see an equally well-stocked partner list for Microsoft’s cloud offerings – it’s almost mandatory for any serious IT services player to have a partnership with the firm, given the ubiquity of its software. However, one thing stands in Microsoft’s way, and that is how enterprises perceive its services. Our research shows a considerable dip in the perception of its commitment to innovation. No doubt it has been hampered by its historic challenges communicating its vision for the future of enterprise technology needs – focusing instead on the proscriptive suite of tools and technologies its pushed over the past decades. In other words: if you want an enterprise license for MS Office, you have to have all the rest of the baggage that comes with it. Microsoft has also struggled to match AWS’ clear commitment to wrapping value-add capabilities and platforms around its cloud offerings. Nevertheless, you would be hard pushed to find an enterprise that can’t see the value in at least partially utilizing Microsoft’s cloud capabilities in partnership with its productivity suite.

Google is a bit of a harder prospect to gauge and marry up with the others, which also makes it one of the most interesting. Google hasn’t shied away from pushing its prowess in analytics and, more recently, AI and Machine Learning (when powered by its cloud offerings), albeit with less of a vigorous vision around cloud than AWS and Microsoft. However, there are signs that a lethargic push into cloud may not harm the firm. For example, a recent conversation with an executive from a major IT Services firm indicated that enterprise clients were showing more interest in Google’s cloud capabilities. This would particularly seem to be the case for those investing in AI and machine learning, or who are keen to avoid getting into bed with a potential rival, like Amazon. The perception of Google’s innovation in the space is viewed highly by clients in our survey. However, opinions on its delivery capabilities are somewhat neutral – something which a firm of Google’s size could remedy with relative ease, once it’s fleshed out a vision for the future of cloud and starts to execute on it.

IBM

Although it is often left out of the conversation, when examining the largest of the cloud providers, IBM is nonetheless worthy of consideration. The firm is caught in a dichotomy that makes its position somewhat conflicted. Unlike the other players, it’s role as a significant IT services player has limited its partnership ecosystem – understandably, as fellow IT services providers are less keen to partner up with a major rival. However, this is also seen as the firm’s biggest strength, by those clients who look to its history of delivery and credibility in enterprise IT to guide their cloud journey. IBM is also much less dependent on partners to fulfill large areas of its engagements, with ample professional services and broader IT capabilities to help with its delivery of end-to-end cloud and transformation engagements –from which its cloud peers would likely shy away.

The bottom line: Do you want the IT services credibility of IBM, the techie-focused innovation of AWS, the enterprise productivity bent of Microsoft, or the enthusiasm for AI and Analytics that Google offers? The decision you make now will hugely impact your digital journey

With more and more enterprises looking to the cloud to drive their transformation agenda and handle all of those shiny technologies that businesses and customers crave, choosing the right cloud provider has never been more difficult. Do you want the IT services credibility of IBM, the techie-focused innovation of AWS, the enterprise productivity bent of Microsoft, or the enthusiasm for AI and Analytics that Google offers? There is, of course, more than one option on the table – you don’t have to select just one, single, cloud provider to manage the entire workload, and partners are looking to make the most of the increasing differentiation by providing brokerage services and multi-cloud support. However, this same differentiation is likely to drive bigger wedges between some providers and enterprises, while pushing others closer together.

With cloud now such a vital building block of an enterprise’s digital journey, the decision of who to work with is not a matter to be taken lightly. Enterprise buyers must take a long, hard look at the vision a provider has for the cloud, and ensure that it matches their roadmap.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started