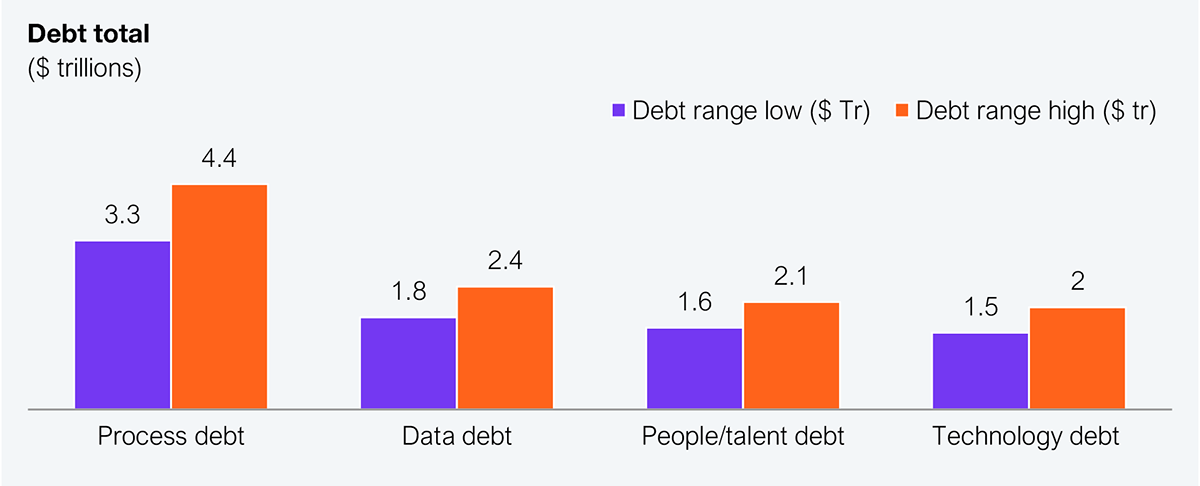

Enterprise debt across technology, process, data, skills, and culture—which once seemed hard to quantify—is now undeniable, with the bill at $8.2–$10.9 trillion (see Exhibit 1). AI, especially agentic forms, has added to this load and raised the bar as it can’t be scaled on top of unresolved debt. Bank CXOs must measure this debt rigorously, make it board-visible, tie new spend to the value realized, and deliberately pay down the backlog, ensuring that AI can be successfully adopted and scaled.

Source: 305 major enterprise decision makers, various external data sources

Source: HFS Research, 2025

Quiet debt has crept into banks for years, stemming from broken processes, undocumented workflows, inconsistent handoffs, and overreliance on tribal knowledge. Moreover, multiple “sources of truth,” tangled post-M&A data integrations, missing or siloed data, brittle systems, and a bureaucratic culture slow everything down. Humans could paper over it with swapping process know-hows at the water cooler, ad-hoc fixes, and IT patch-ups. AI isn’t that forgiving: it won’t clean messy data, normalize inconsistent processes, stabilize fragile infrastructure, or call out bad culture; instead, it magnifies these issues and makes them visible.

Copilots and agents depend on predictable process pathways and defined workflows. AI, on the other hand, needs grounded, trustworthy data—feed it bad input and it’ll confidently produce bad output. It’s threaded across multiple systems, so one brittle link can bring it down. And without real adoption and change management, even good AI will stall. You must thus surface the debt, assign ownership, connect debt to AI progress, and pay it down while scaling AI.

AI is thrilling, a genuine force multiplier with visible wins. Predictive power at speed, orchestration across systems: a seduction that is hard to resist. But jumping straight to agent-led workflows or plugging in LLM models or AI platforms won’t clean up enterprise debt; it would expose it, and sometimes, at the expense of the customer. Don’t rush in with hasty rollouts, sloppy integrations, or skip governance and guardrails. Half-measure adoption breeds complacency, and that’s why we see banks run a dozen pilots and deliver little. To turn AI into a sustainable advantage, fix the bedrock around data, process, infrastructure, and talent—only then does AI scale.

Bank tech spend climbed by six points in 2025, but striking the right balance between keeping the lights on and betting on innovation remains a challenge. When cost-cutting dominates, dollars flood into “run-the-bank” operations. When growth re-enters the conversation, spend shifts to “change-the-bank” priorities.

Cloud, AI, machine learning, and analytics are easy sells, promising agility, back-office relief, and smooth integration with modern platforms. But the unglamorous essentials of infra, IT ops, software upkeep, and compliance are still mission-critical. The real danger comes when banks chase transformation by retrofitting point solutions without a clear handle on the drivers, costs, and ROI or fail to align with legacy systems and regulatory frameworks. That’s not innovation. It’s a technical debt black hole, burning millions and setting modernization back again.

Harness AI, especially generative AI, to quantify and pay down tech debt. Deploy code analyzers to expose hidden debt and leverage automated testing, code generation, and UI prototyping to accelerate modernization, and prevent the next wave of building debt.

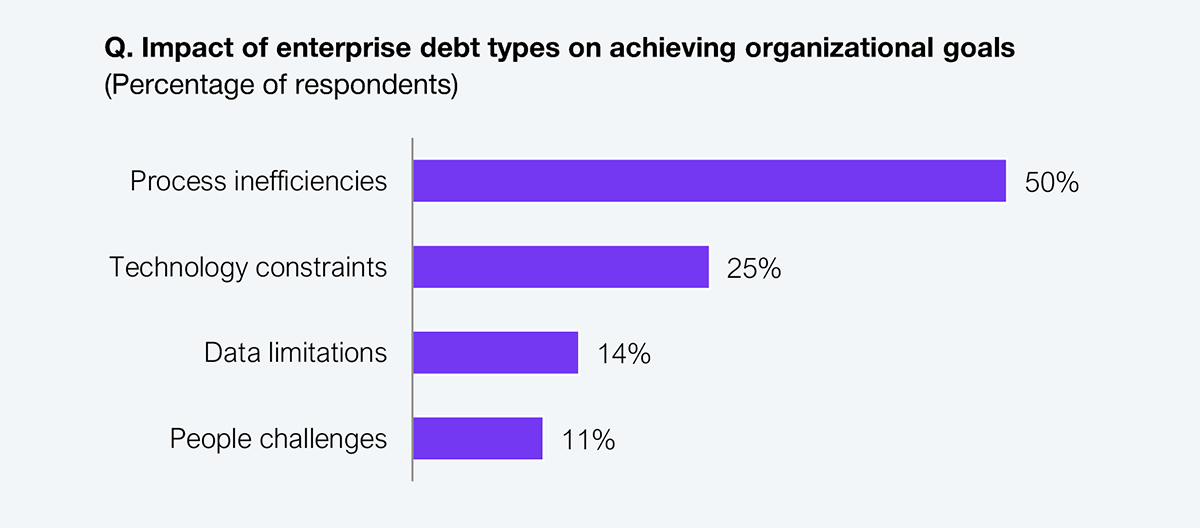

Process debt tops the stack in banking (see Exhibit 2), which is no surprise. Layers of bureaucracy and compliance feed it; and for customers, the drag shows up as slow, clunky journeys. It’s where bold ideas go to die, diluted by approval committees until they’re sanitized into irrelevance. The issue isn’t just operational; it’s cultural. Decades of risk-averse muscle memory have prioritized control over creativity, stifling innovation before it ever reaches the customer.

Fixing this takes more than new tools; it demands the courage to break with legacy thinking. Redesign journeys from the outside in—anchored on customer outcomes, not internal efficiency. Shed old process paradigms, integrate the right tech enablers, deliberately engineer data along the flow, and bring in fresh perspectives unbound by old rules.

Source: 36 G2000 banking and financial services firms

Source: HFS Research, 2025

Zero enterprise debt in banks is a pipedream. Legacy, regulation, bureaucracy, and entrenched complexity create a permanent baseline—the collateral of doing banking. With every bank now on an AI journey, the spotlight on debt is sharper than ever.

Link the debt explicitly to AI progress and choke off new debt before it compounds. Own past decisions and gate every new investment, especially toward AI with a debt-impact test. That’s leadership.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started