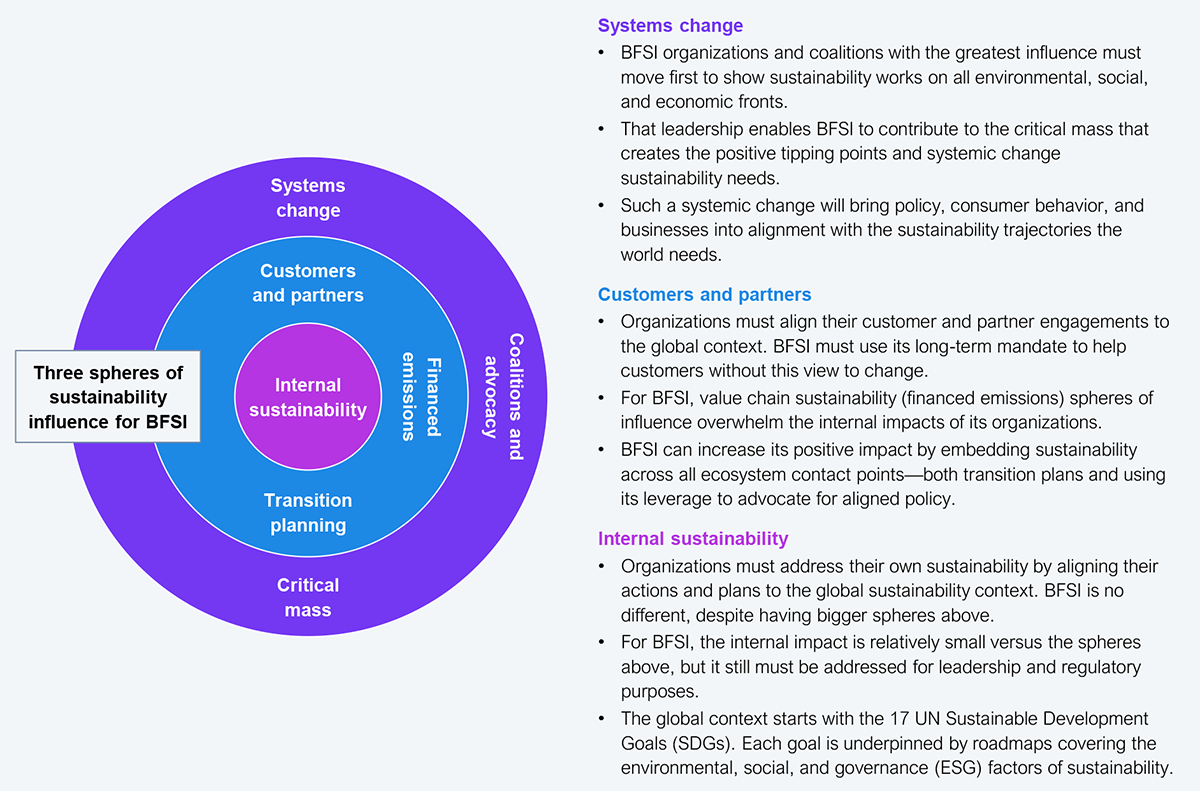

The CEOs, boards, and heads of risk responsible for financial sector transition planning—to decarbonize while protecting nature, human rights, and beyond—must align their long-term strategies with their present-day operations. Finance’s biggest sphere of influence (see Exhibit 1) is its clients—the impact of its financed portfolios. Regulation is currently too weak to meet the long-term trajectory and systems change sustainability needs. This trajectory impacts banks, financial services, and insurers (BFSI) more than other sectors. If you are not ahead in mapping out the “red lines” that set rules, timelines, and consequences for your clients who don’t plan and take action on sustainability… then political, societal, and business tipping points will force an almighty turbulent process of frantically catching up.

BFSI must dramatically accelerate the process of moving away from transition plans that contain only token ambition and long-term goals without a clear roadmap. The approach to client impact is currently nothing but guidance, or “soft collaboration,” without the incentive to act as climate science and broader sustainability unequivocally demand.

Recent analysis from the London School of Economics (LSE) has slammed the financial sector, finding that none of the 36 largest banks have adequate plans.

Transition plans map how an organization will address sustainability from decarbonization to the broader environmental, social, and governance (ESG) context. The BFSI sector is further ahead than some industries, thanks to the long(er)-term mandate of investments, funds like pensions, and insurance. But it is still woefully behind meeting the trajectory that the global sustainability context demands.

Finance must go much further, overcoming disconnected time horizons within their organizations, which our own financial contacts despair over—for example, the day-to-day account managers, three-to-five-year portfolio holders, and decade-long risk analysts that are not aligned in their efforts and incentives.

Deutsche Bank is a positive example that recently updated its public transition plan, alongside ING, HSBC, NBIM, and a growing series of enterprises covered in this report, giving hope that some in the sector might rise above turbulent politics and focus on the clear, unchanged direction of sustainability.

We see several financial firms attempting to refine transition plans behind the scenes, incorporating technology and energy investment into the process. However, the urgency of the change required has not yet translated into clear, public roadmaps that enable politics and industry to align around what must be a global transition.

Senior financial sector leadership must work with these disconnected teams around strategy: Align transition planning with the urgency of getting ahead rather than frantically reacting to catch up when systems change—as the costs of new sustainable technologies, societal attitudes, or big disastrous events, for example, trigger policy, consumer, and business tipping points.

Source: HFS Research, 2025

Through collaboration, organizations must align their plans and actions—and those of their ecosystems—to avoid creating cliff-edge moments and injecting unwarranted turbulence into the economy, and, crucially, into people’s lives.

The financial sector can only maintain a friendly collaborative approach for so long before the realities of the climate emergency, nature loss, and inequality force political and economic change.

There will come a point when client plans will no longer be compatible with the direction of sustainability and financial stability.

Many financial firms are going quiet in the face of political noise, preferring low-key progress alongside their clients. Most signed up for the overarching goal of net-zero emissions (including financed emissions) by 2050. Only a few are disclosing their public plans and timed milestones.

Many BFSI giants left the Net-Zero Banking Alliance purely for political reasons in the US, leading to the coalition shutting down. We still need loud sustainability champions despite the quiet progress continuing across sectors. Even the banks’ existing alliances, like NZBA, say they maintain their strategies and programs; time will tell.

Notably, Deutsche Bank maintains a publicly disclosed transition plan (updated for 2025) for its €118 billion ($137 billion) corporate portfolio. It would be interesting to see if future updates also integrate social and economic sustainability, as well as environmental aspects such as nature, waste, and water, aligning fully with the UN Sustainable Development Goals (SDGs).

Deutsche Bank has broken down its portfolio, outlining how its financed emissions far exceed its own emissions through direct emissions and supply chains (including offices, travel, electricity, and equipment, limited at financial organizations). The firm has outlined its targets for 2030 and 2050 and, crucially, its approach to engaging with its portfolio companies—including those that aren’t mapping and making their own transitions. Deutsche Bank will be making “case-by-case decisions [like] phasing out or reducing exposure, limiting maturities, and agreeing to corrective action plans.” For those on track, it will “monitor and regularly review progress.”

Another example is ING becoming the first global “systemically important” bank to have its plans validated by the Science Based Targets Initiative (SBTi). HSBC and Norges Bank Investment Management (NBIM; manages Norway’s sovereign wealth fund) have also disclosed new transition plans, each picking up on the themes of Deutsche Bank, in the latter stages of 2025.

Beyond finance, BFSI firms will be looking to the likes of Ikea, which recently disclosed a full transition plan covering its material spheres of influence. Energy firm NextEra did so with plenty of attention in 2022. In telecoms, TalkTalk has embedded supply chain engagement in its own transition plan. ITV is an example from British media. Unilever, BHP, and Ball Corporation also have public plans.

Beyond regulation, voluntary but influential standards are changing. SBTi recently produced a new draft standard mandating power companies to “publicly disclose [transition plans] from unabated fossil fuel power generation,” including “interim actions to decarbonize, phase-out or retrofit unabated fossil fuel assets, with maximum five-year milestones up to the net-zero year.”

The financial sector must overcome the inertia in systems to change the overstory of sustainability. They must lead in building a critical mass that triggers positive tipping points, pulling policymaking, consumer behavior, and industry into alignment with trajectories that meet the emergency.

Politicians will do it for you and your clients if you don’t. And you can bet that transition won’t be as well-managed as it would be if you take the positive option now.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started