Life sciences firms are expected to lose $1 trillion to $1.5 trillion in revenue through 2035 due to the Inflation Reduction Act (IRA – CMS negotiating for Medicare and Medicaid), the end of the blockbuster era, and the patent cliff. These market forces demand a shift: global business services (GBS) must be a critical component of the growth engine or risk sliding into irrelevance.

To stay ahead, life sciences CXOs should proactively reorient GBS toward revenue generation, launch execution, and business development. This calls for immediately giving GBS a topline-focused mandate, elevating their leadership to the C-suite, and embracing AI to supercharge their next-gen revenue growth engine.

Source: HFS Research, 2025

Life sciences GBS leaders who joined the roundtable concurred that AI offers significant potential in life sciences and that focusing solely on productivity and cost reduction limits its real impact. Business cases for AI must account for broader outcomes, including personalization, predictive analytics, and performance improvements, to realize actual business value.

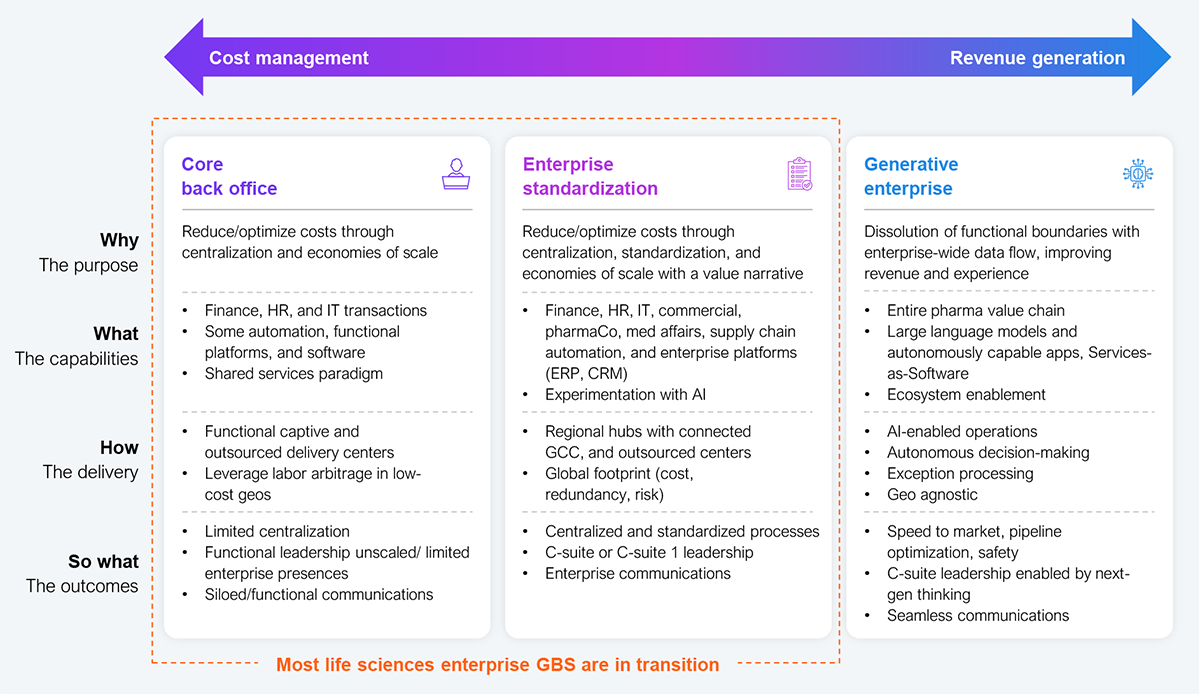

AI is a catalyst for reimagination, and GBS is a prime target for functional reimagination. However, applying AI to drive efficiencies in legacy GBS processes is a tempting low-hanging fruit given the easy metrics to compare. It should drive the remodeling of value chains to break down functional silos (see Exhibit 2), address the root cause rather than the symptom, and position the organization to advance enterprise growth.

Source: HFS Research, 2025

GBS opportunities must extend beyond pure cost play. This includes becoming a clearinghouse for outcome-based contracts in EU markets where GBS could serve as a neutral, AI-driven adjudication service that ingests payer claims, pharmacy data, and patient-reported outcomes to automate outcome measurement for risk-sharing deals. As GBS has access to a treasure trove of data, it could become a micro-registry factory for real-world evidence (RWE). It must, on demand, AI-assemble disease or product registries using federated learning across healthcare partners in weeks, with no raw data leaving the site, ensuring privacy and regulatory compliance.

If GBS doesn’t pivot now, launch speed and market access will collapse under IRA pricing. Given the unprecedented revenue headwinds, enterprise CXOs must reposition GBS as a strategic enabler to address those revenue challenges. This involves adopting better internal marketing practices, utilizing outcome-based contracts, and driving innovation and business outcomes, rather than only focusing on labor arbitrage or operational efficiency.

Additionally, GBS must play an enhanced and more central role in the elements of revenue generation by:

These opportunities are mostly within the wheelhouse of a typical GBS supporting mid-sized to large life sciences enterprises. This will require some retooling, embracing AI, and leadership buy-in.

GBS maturity in life sciences lags due to organizational silos, regulatory burdens, legacy hurdles, and slow change processes, particularly in the adoption of technology. To overcome these intrinsic challenges, enterprise GBS needs strong change management, C-suite support, and a shift in mindset to drive transformation, with an emphasis on cross-functional collaboration and embedding change expertise in all initiatives.

The culture of the GBS organization must lend purpose to the mission. While culture can be a fuzzy concept, leaders must anchor it to the enterprise’s top-line priorities. They must be patient- and provider-centric (revenue-oriented) by aligning their service measures with patient health outcomes and access, rather than productivity SLAs.

GBS leaders must foster experimentation (launch execution) while supporting test-and-learn sandboxes and developing risk models to maximize the potential of AI. They should also drive an intent to participate in product launches by building standard playbooks, datasets, and templates that every brand and market can use.

A third vector is to engage in partnerships and alliances by creating and supporting a services desk. GBS leaders should make it easy to onboard biotech, diagnostics, and tech firms with standard rules that support enterprise business development efforts. While these initiatives are atypical and may make GBS leaders uncomfortable, they help reorient perspective and make a case for a different role in the coming years.

Life sciences will have a revenue problem, not a demand challenge. Leadership must be bold and creative in creating a new playbook that anchors GBS in its growth plans. Consider options that have not been considered before, explore paths that have yet to be explored, and rely on organizations that were often overlooked. The time nimble in the margins is over, so address the revenue challenges head-on.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started