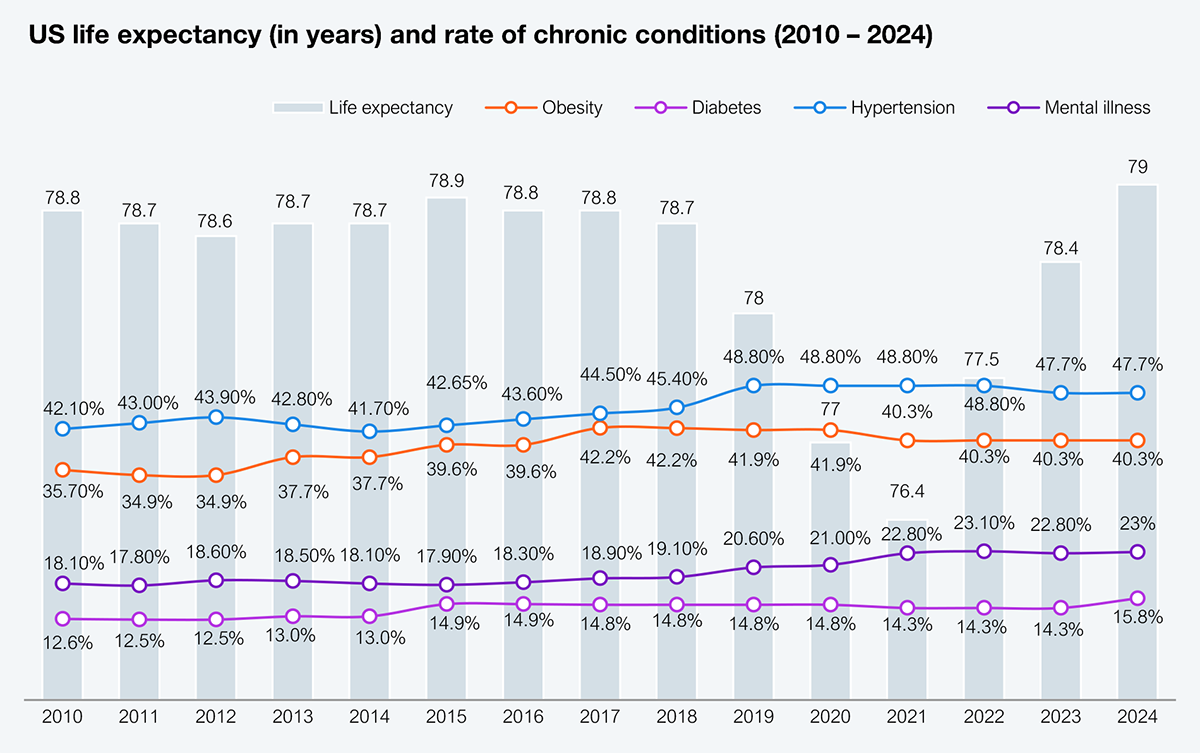

Continuity of care is key to engagement, driving better health outcomes and healthy financials for healthcare enterprises (health plans and health systems). Engagement offers more touchpoints to influence health outcomes and monetize interactions. Continuity requires consumers and patients to maintain a regular cadence with care agents (health systems, primary care physicians, specialists, nutritionists, etc.). However, healthcare is predominantly episodic, i.e., addressing a symptom or a disease condition, often a single touchpoint. This is apparent given the state of US consumer health (see Exhibit 1) despite the per capita spending of around $15,000. For providers (health systems) to effectuate better health and be financially viable, they must engage consumers and patients. This is possible if the focus is on empathy, not transactional interactions and point-in-time experiences that have no bearing on enterprise financials or consumer health.

Source: CDC, CBO, SAMHSA, NIH, HFS Research, 2025

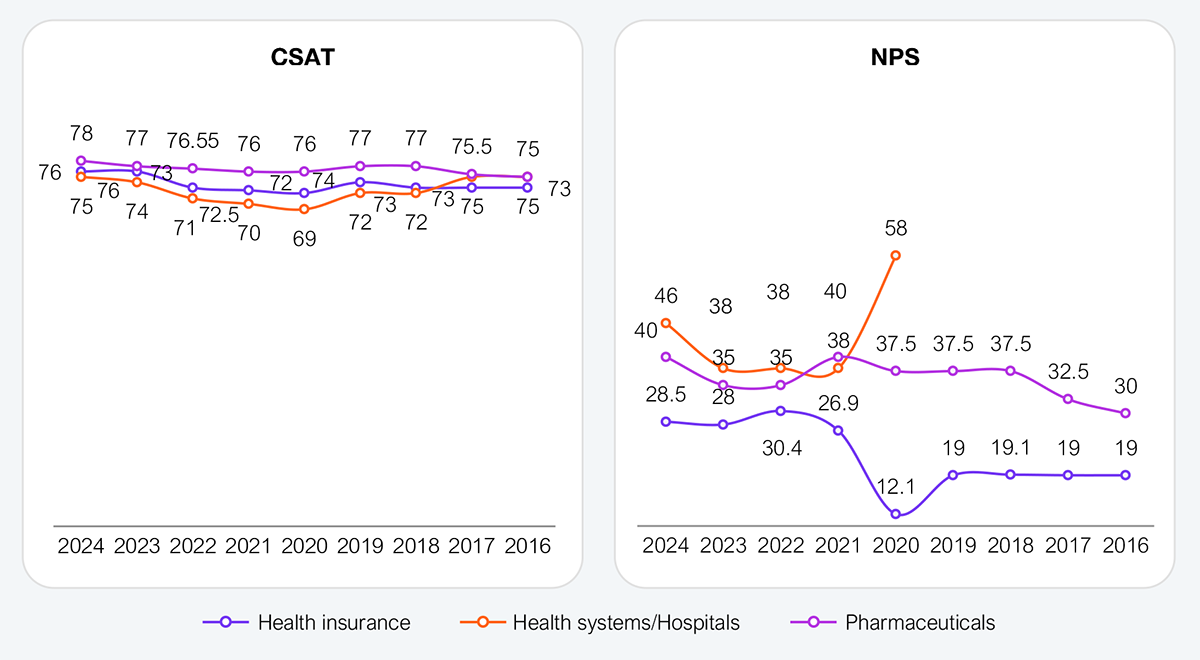

No matter how much you like your dentist or proctologist or enjoy the warmth of an infusion center, none of that will compare to a good experience. Experience (see Exhibit 2) measured by traditional methodologies, be it customer satisfaction (CSAT) or net promoter score (NPS), remains a key benchmark to measure quality. Despite our frustrations with health insurers—such as the need for prior authorization (limiting access to care or cheaper and less effective treatments), long wait times to meet doctors, and lack of follow-up from providers—experiences have been trending higher across the healthcare ecosystem. This is likely because healthcare executives are clinging to CSAT (misaligned incentives) and optimizing for the wrong scoreboard, fixing hold times while ignoring life spans and margin erosion.

Source: ACSI, Qualtrics, Relias, Survey Monkey, HFS Research, 2025

The upward trend is because of marketing and misaligned metrics. Some measures that inform CSAT metrics include the speed of answering calls, first contact resolution, and ease of navigating a website. These metrics will improve with technology advancements but won’t necessarily lead to a better experience. They certainly have no bearing on financial or health outcomes, as the data suggests over time.

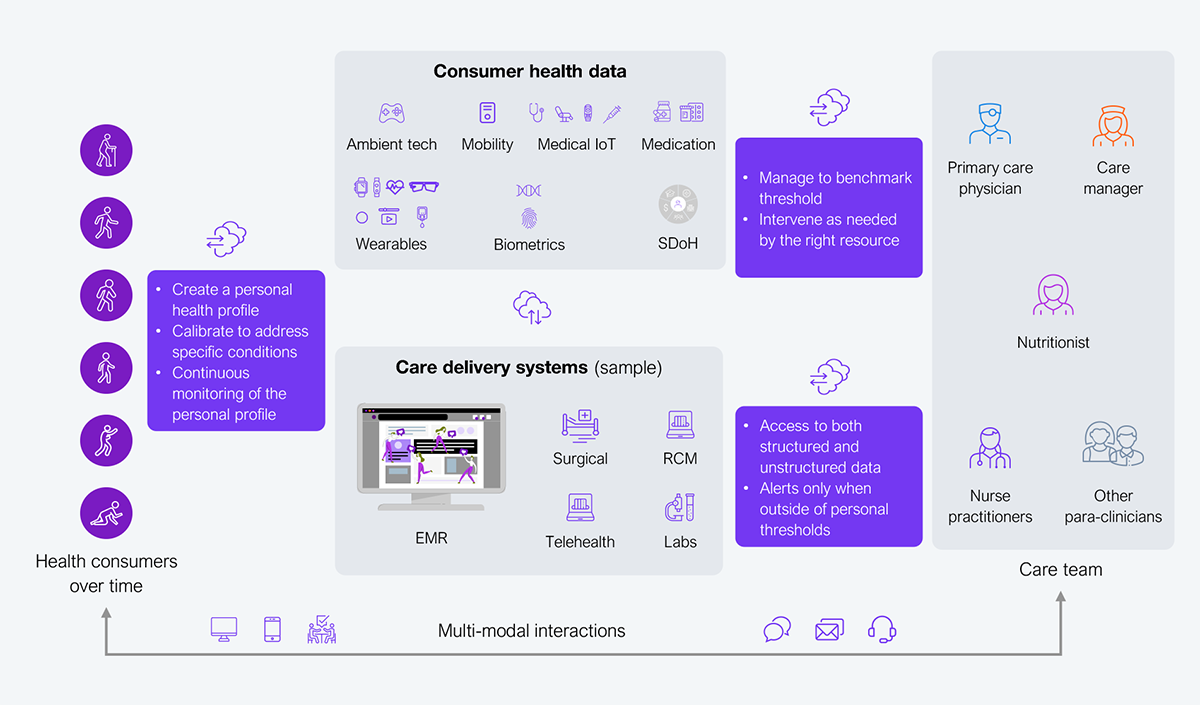

The traditional care delivery paradigm, driven by consumer needs, allows consumers to decide on care based on inconsistent emotions, symptoms, and other drivers (instead of medical or clinical data points). This has led to overutilization and inefficient clinical workforce management, translating to poor experiences, higher costs, and sub-optimal health outcomes. However, a shift in the care delivery paradigm to one of need-based care, enabled by a suite of existing technologies (see Exhibit 3) such as wearables, ingestibles, and home digital health devices, can aid interventions as needed based on data.

Source: HFS Research, 2025

The thesis of need-based intervention is to analyze and make decisions based on data captured from consumers in real time. This collaborative approach will still involve consumers (often unqualified) but negate the need to triage their condition and clinicians to indulge in trial and error to treat patients, reducing time and cost. In the need-based care delivery paradigm, data will trigger the intervention of clinicians (doctors, nurses) or other care team members (social workers, caregivers, nutritionists), ensuring the best outcomes. Empathy is intrinsic in this engagement model as it eliminates friction (consumers are not fighting payers or forever on hold to make appointments), ensures the right care team member addresses the need seamlessly, and drives a greater level of trust through uber-personalization.

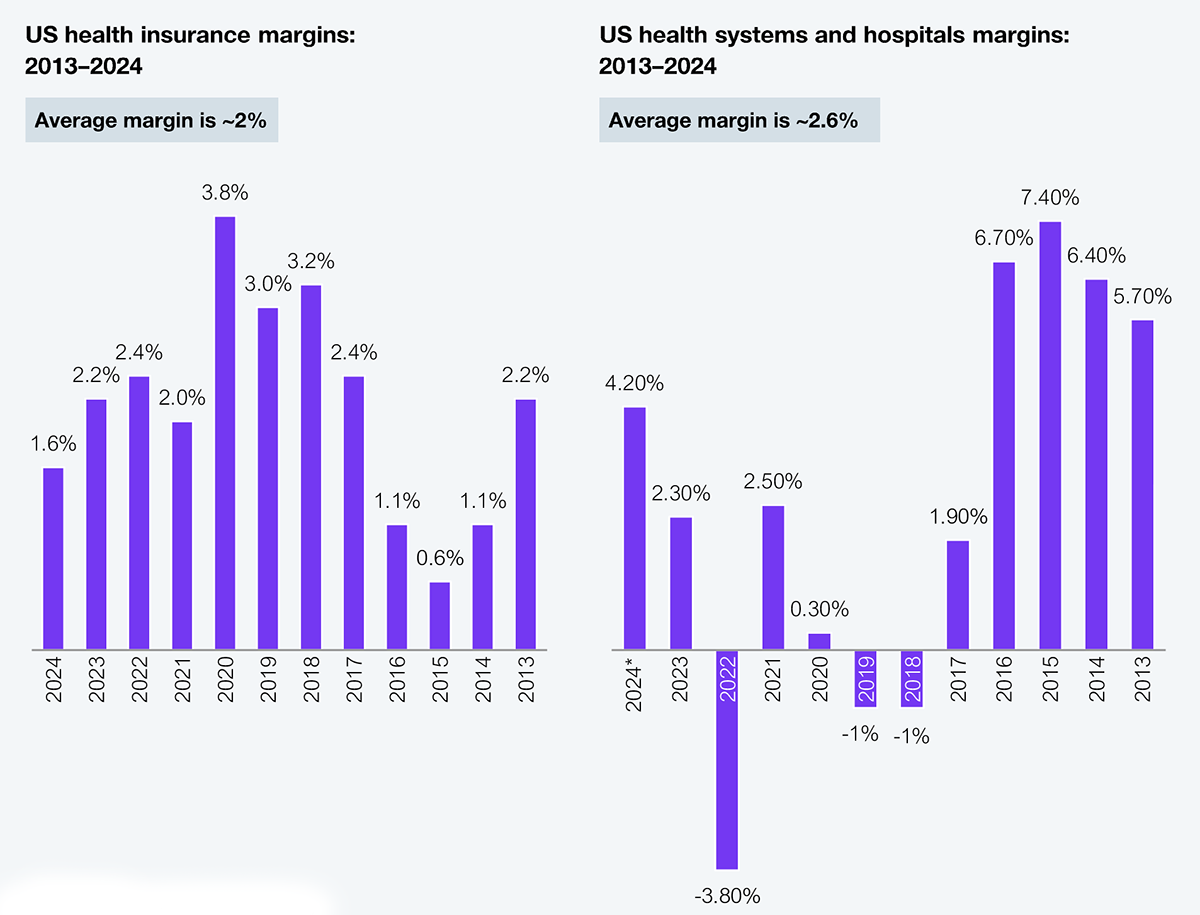

Despite billions spent on improving CX scores, margins continue to decline (see Exhibit 4). This is a wake-up call for CFOs and population health leaders. Improved experience does not translate to better health or financial outcomes. Unlike other industries, where experience can drive loyalty and retention, healthcare does not subscribe to that model. Instead, it focuses on reactive care as fewer consumers have access to primary care physicians for guidance. Consequently, consumers are more inclined to seek care based on what’s available or covered by their insurance network, irrespective of how they feel about specific clinicians. However, clinicians who sign up for value-based care are more likely to drive engagement given its direct impact on their financials.

Note: * 2024 margins are preliminary

Source: NAIC, AHA, Kaufman Hall, Definitive Healthcare, HFS Research, 2025

Engagement means more touch points with consumers, suggesting increased opportunities to monetize in a fee-for-service construct or higher incentives (savings, no penalties, higher reimbursement) in a value-based arrangement. Regardless of the financial arrangement, it will drive better financials and, more likely, better health outcomes.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started