The notion of providing healthcare without considering health is a primary reason the US spends approximately $4 trillion annually on a population that is getting sicker. The Centers for Disease Control and Prevention (CDC) estimates over 30% of Americans have diabetes, hypertension, or obesity with declining life expectancy. CDC also estimates American’s lost one calendar year pre-covid between 2010 and 2019. We may be primed to rethink health and healthcare for the first time in over 50 years and change the trajectory of the health of the nation as healthcare funding sources change.

Ninety percent (90%) of Americans fund most of their healthcare expenses through health insurance provided by either the government (Medicare or Medicaid) or through their employer’s sponsorship of health insurance underwritten by insurance companies or by employers themselves.

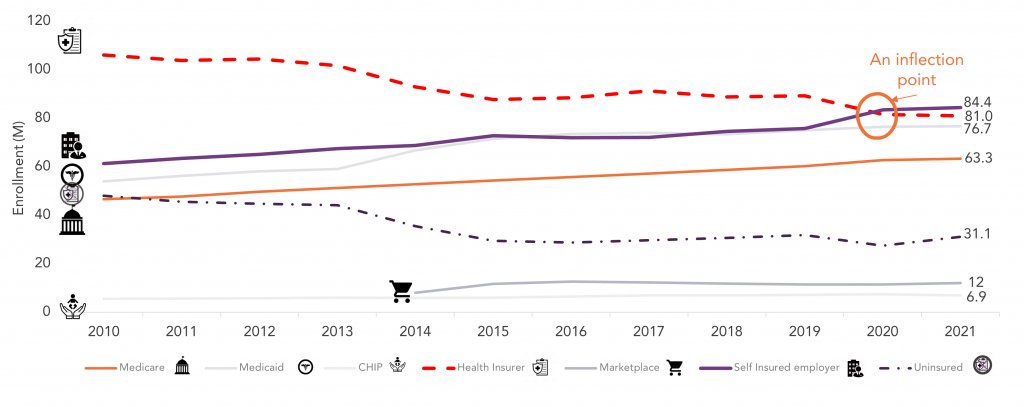

However, that has been changing over the last 10 years for employees of large corporations. Data in Exhibit 1 shows employers are directly underwriting and subsidizing healthcare for employees and their families—self-insured employers are effectively the health insurance company for 84.4 million (25% of all insured American’s) employees and their families.

The 2020 inflection point, with self-insured employers now boasting the highest enrollment in plans they underwrite, gives employers enormous power to influence and direct health and healthcare dollars. With this unprecedented power, employers can break the shackles of the oligopolistic health insurance industry and begin to address the health needs of their employees rather than worry about “coverage” allowed by health insurance.

Data: CMS, US Dept. of Labor, Kaiser Family Foundation

Source: HFS Research, 2022

Power to change does not guarantee change. The Kaiser Family Foundation estimates 92% of large corporations (with more than 1,000 employees) in the US are self-insured, as are 67% of all US companies. That accounts for 25% of the US population, the largest segment and growing, providing employers enormous influence thinking, and doing for our health and care needs.

This concentration of power for self-insured employers has been growing for the last 10 years, which should have translated into improvements in how these corporations think about health and care delivery. Unfortunately, benefits leaders at self-insured employers have taken the lazy approach of perpetuating the tried-and-failed insurance paradigm but made it worse by taking on the risk while allowing the insurance companies to deliver services for a price.

Some self-insured employers have attempted to break the mold, such as Haven Healthcare, the failed combination of Amazon, Berkshire Hathaway, and JPMorgan Chase. Others have formed consortia, such as the Pacific Business Group, to buy directly from health systems and hospital systems. These models attempt to remove the health insurance company as the broker but retain the same model around buying healthcare based on volumes. There has not been an effective attempt to change the paradigm and will not, given the 50 to 60 years’ worth of experience we have.

America appears to insist on not wanting to learn from the reality that spending more money does not translate into better health or longer life expectancy. We have proven that the opposite is true. According to the CDC, approximately 30% of the US population suffers from a comorbidity, and that number will increase to about 50% of the population by 2030. Meanwhile, our life expectancy has declined and now ranks 28th of the 37 OECD countries, but we spend about $4 trillion annually—more than the GDP of the fourth-largest economy in the world.

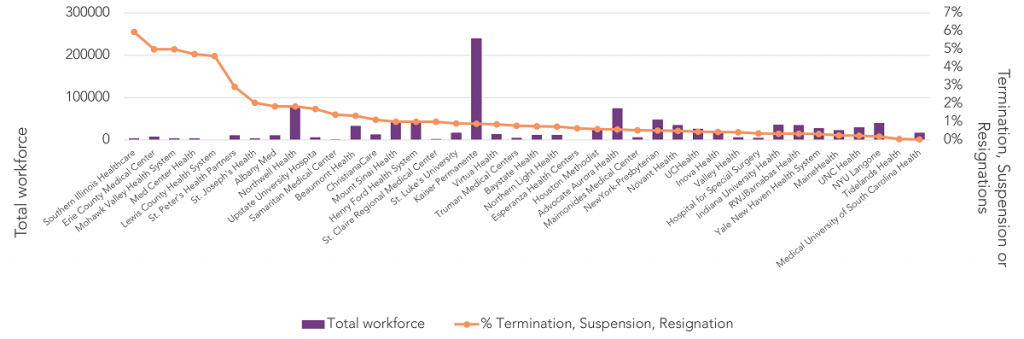

Despite that gloomy picture, we now have an opportunity to address the health needs of our population through self-insured employers. These employers have a captive audience in their employees incented to follow the path laid out for them. This paradigm has worked well and continues to. An example that bears testimony is the COVID-19 vaccine mandate. Despite some legal battles, nearly all healthcare workers at health organizations in Exhibit 2 followed the enterprise path to fight the pandemic.

Data: Fierce Health, Oct 22, 2021

Source: HFS Research, 2022

Imagine if self-insured employers incorporate social determinants of health (SDoH) and consider a macro view of health, wellbeing, and employees’ productivity in designing a holistic life program. A program like this could expose employees and their families to information supporting their life goals, including nutrition, education, and finance. Employers and health providers already provide many of these benefits, but they tend to be wasteful–standalone and disconnected from employees’ needs. Employers must lean into making benefits beneficial (no pun intended) to optimize their resources and stop just checking the box.

The benefits departments of self-insured employers are begging for an epiphany that is starring them in the face. Their laissez-faire approach thus far has meant that the enterprise healthcare costs continue to escalate without value. Employees are not getting more productive or healthier as self-insured employers plow more dollars into healthcare. Employers’ approach of sourcing line-item benefits from the usual suspects of Tower-Watson or Mercer has failed. To change this direction, enterprises must tie benefits managers’ compensation to the health and productivity of the enterprise, else they will be singularly responsible for losing an opportunity to course-correct America’s health!

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started