The energy and utilities (E&U) industry is reshaped by a brutal efficiency drive, sustainability regulatory pressure, cybersecurity, talent finding, and shifting consumer expectations. Enterprise leaders demand more than incremental change. They need bold innovation and tangible business value. The global context and innovation must connect their efficiency and security to their requirements. Service providers from consulting and technology to IT, engineering, project management, and beyond are critical enablers. However, HFS research reveals that while delivery is solid, their ability to scale innovation and partner effectively still lags.

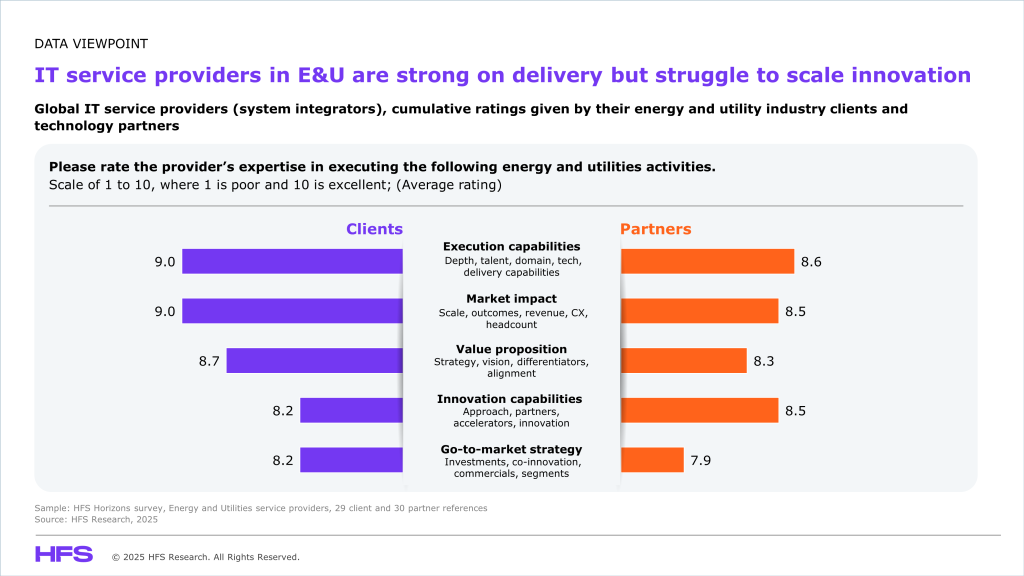

HFS Research recently assessed IT providers delivering Energy and Utility Services for its Horizon Report 2025. Clients gave providers strong ratings (over eight out of 10) across execution, innovation, market impact, and value delivery. However, clients and ecosystem partners flagged concerns around go-to-market effectiveness, innovation, and inconsistent collaboration strategies.

High scores do not guarantee high impact. Enterprise leaders must look beyond the average scores to evaluate if a provider’s delivery strengths align with scalable innovation and execution that meet market demands. The only industry with too many priorities and little time to meet the energy transition objectives and net-zero sustainability goals.

Execution Capabilities and Market Impact top the client ratings, both scoring the highest. This reflects intense satisfaction with providers’ domain expertise, talent, delivery capabilities, and ability to deliver scale and measurable outcomes. Partners echo a similar sentiment but slightly lower scores of 8.6 and 8.5, respectively.

Regarding Value Proposition, which includes strategic alignment and differentiation, clients rated providers at 8.7, while partners offered a slightly lower score of 8.3. This indicates partners and providers have differing expectations or perceptions of long-term strategic fit.

For Innovation Capabilities, both groups acknowledge the importance of collaborative innovation. Clients gave an 8.2 rating, which indicates that they look for more innovation in the process, while partners rated this aspect slightly higher at 8.5, possibly reflecting their more direct involvement in joint innovation efforts.

The Go-to-Market Strategy received the lowest scores from both groups, with 8.2 from clients and 7.9 from partners, highlighting its need for greater alignment, investment, or clarity in commercialization and segmentation approaches to approach the market.

Out of all these parameters, customer and partner interactions through surveys and telephone discussions, the providers who secured the highest rating across all the parameters include (alphabetically) EY, HCLTech, Hitachi Digital Services, Infosys, LTIMindtree, and Wipro.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started