Global manufacturers with their engineering, research, and development (ER&D) global capability centres (GCCs) are sitting on an overlooked innovation engine. When these GCCs stop behaving like offshore centers and start productizing their know-how into Services-as-Software (SaS), they don’t just support their firm but become a growth engine. This is happening at scale in India.

Those who are innovating are filing patents, launching new services, and scaling and transforming software-defined business models from India. To accelerate software engineering and embed services, manufacturers are changing their operating models and the scope of their services. HFS Research, in collaboration with the ER&D forum of the Hyderabad Software Enterprises Association (HYSEA), discussed these trends at Eastman Chemicals India’s office in December 2025.

Photo: HYSEA’s ER&D forum members convened a roundtable with GCCs contributing to manufacturing industries. Micron, Eastman Chemical, Qualcomm, Carrier, Hyundai Mobis, and Thermo Fisher Scientific participated in the roundtable.

The rise of GenAI and agentic AI is leading to greater autonomy and flexibility by embedding new services into software. ER&D teams have been increasingly tapping this to engineer industrial data and develop new features with more specialized software. For instance, Siemens AG acquired Altair Engineering (a $10 billion deal) to consolidate industrial software and services as a product. The parentship was aimed to develop an Industrial Foundation GenAI Model trained on 150 petabytes of industrial, engineering, and manufacturing data for engineers to leverage computer numerical control (CNC) programming, manufacturing planning, and connecting bills of materials (BOM) to robotic simulators.

GCCs are also changing their operating models by integrating software-defined services into new product launches. Hyundai Mobis, for instance, has been expanding its software services in India by adding infotainment, software-defined vehicles (SDVs), and advanced battery systems.

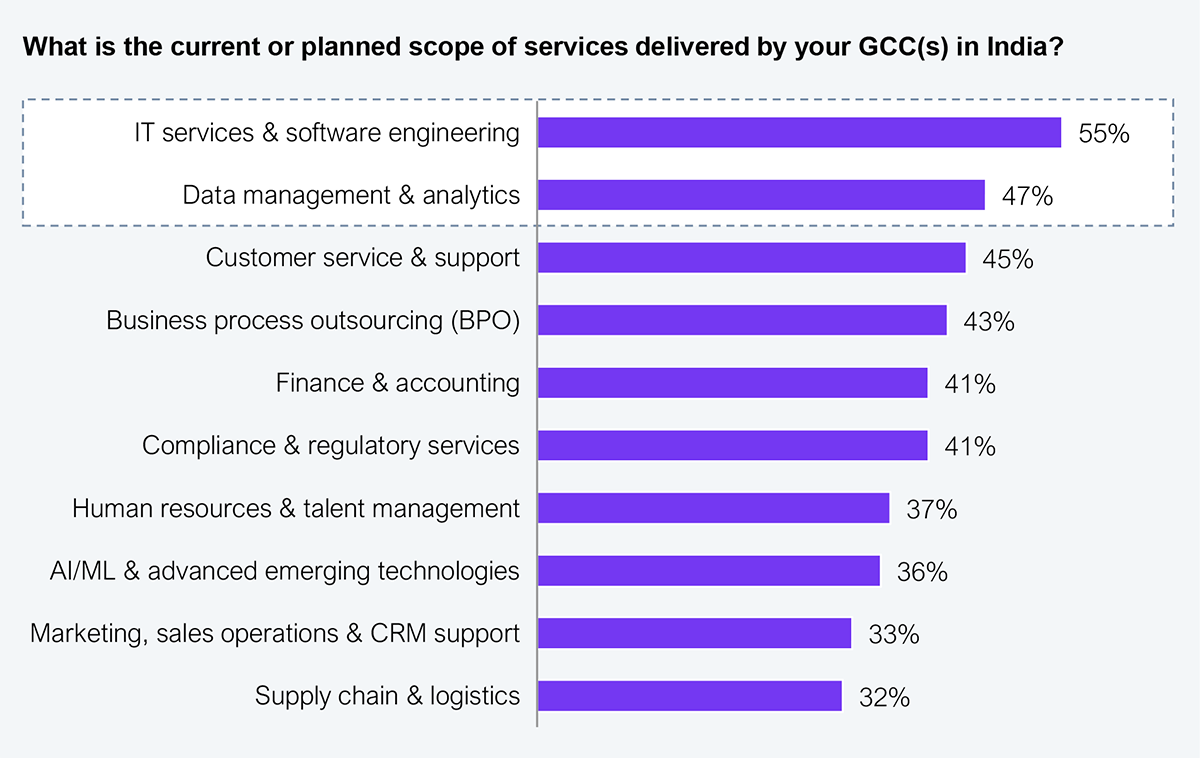

Our recent Pulse survey supports this: more than 204 GCC leaders revealed that about 55% planned to deliver IT and software engineering services, followed by data management and analytics (see Exhibit 1). This shows the mission-criticality of both software services and clean core data for executing software-defined engineering solutions.

Sample: 204 GCC leaders’ responses

Source: HFS Research GCC Pulse Survey, 2025

Data from this exhibit proves that GCCs are focusing on using structured data, software engineering, and IT services to create new sources of value. Qualcomm and BMW, for example, have embedded data, services, and engineering in software, all leveraging SaS. Both companies planned to launch the BMW iX3 this year with services such as contextual lane change, hands-free highway driving, AI-powered parking assistance, in-cabin monitoring, all delivered through over-the-air updates.

At the Roundtable discussion, 38% of the participants agreed that the key factor distinguishing successful GCCs from those struggling is the “speed of innovation.” Around 25% highlighted that having the right talent in place is another crucial factor for driving innovation. Besides racing to deliver innovative and cost-efficient services, the focus is also on patenting services for monetization and protecting them against copying.

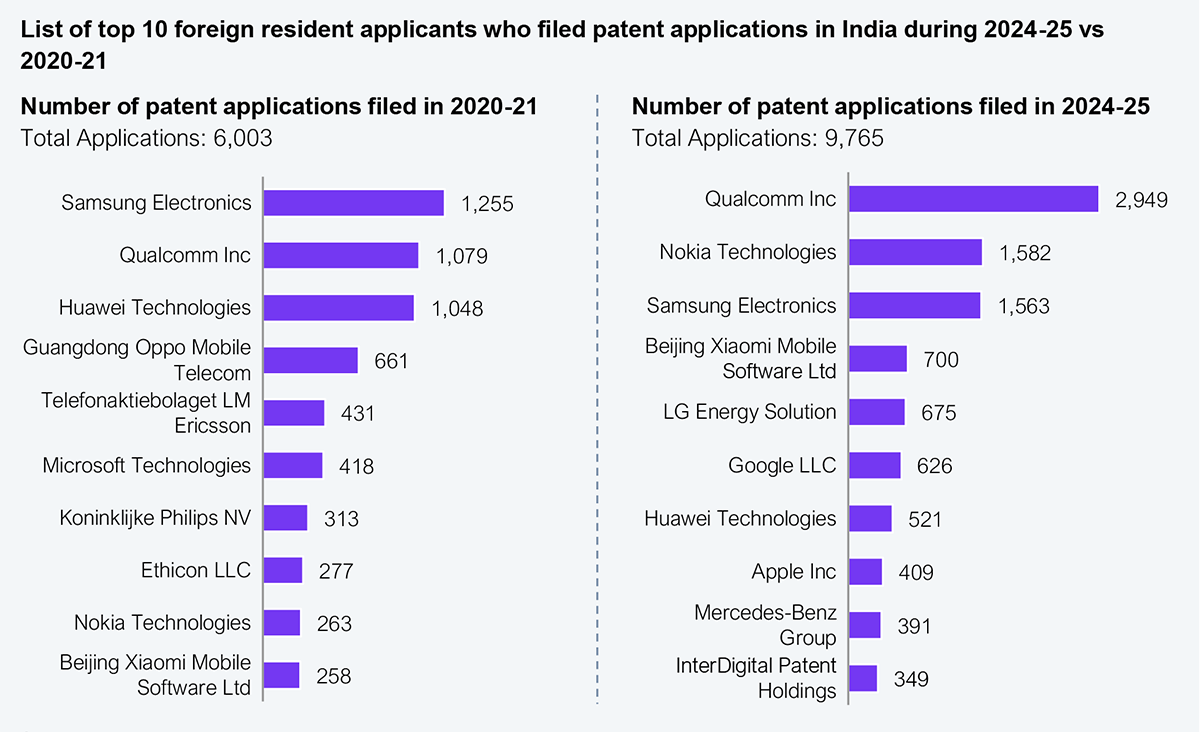

Our research showed that the top 10 foreign resident applicants in India, including Qualcomm, Nokia, Samsung, and Google, filed over 9,765 patent applications in 2025. This represents a 60% increase (from 6,003) from 2021, highlighting their ability to innovate and differentiate themselves globally. Qualcomm leads in patent applications and grants, with most filings coming from mobile and ancillary manufacturers. Google, Apple, and Mercedes-Benz recently started filing patent applications in the country, pointing to their inclination to further expand their core products and offerings.

Source: Intellectual Property India Annual Report, 2025

Reflecting on these trends, an ER&D executive from Hyundai Mobis stated, “In the rapidly changing future vehicle industry, patents are becoming a key asset that influences market dominance beyond merely being tools for technology protection. We are pursuing a R&D strategy that goes beyond simple technology development to include the commercialization and ‘rightsization’ of patent ideas.”

Manufacturing leaders must move beyond viewing their GCCs as cost centers to treating them as product studios. The winners here don’t just innovate; they create, protect, and monetize on their IP. They’re the ones that can innovate at scale and speed and sustain momentum to address future challenges and customer needs.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started