Industrial enterprises are failing to connect the short-term and long-term or find the talent to do so. However, the standout leaders are finding both immediate and strategic value for their businesses, their people, and the environment. Too many expect their transitions to get easier over the coming years. Our data and enterprise stories show that it will get harder, but that there are immense opportunities now and for the future.

Sustainability, AI, and new skills are three generational transitions for industry that also offer immediate opportunities. Strategic transition plans and day-to-day management must both embed and enable short-term and long-term objectives to work together effectively to address the climate emergency and regulation, keep pace with competitors adopting digital and emerging technology, respond to cost pressures, and find new talent that views the industrial sector as low-tech and unsustainable. Changing that image is well within reach, however, as this report hopes to show.

To gauge the pulse of the industrial sector’s present and future, in partnership with GlobalLogic, we surveyed 102 C-level and senior executives from industrial firms with over $1 billion in annual revenue, across various sectors including automotive, aerospace, chemicals, energy and utilities, and construction. Our comparison of today’s priorities with those leaders anticipate for two years from now reveals a clear disconnect between the present and the future, which is reflected throughout the data and enterprise stories in this report. But the brightest prospects in industry are rising above.

Industrial executives will always have to balance efficiency and competitive pressure with long-term transitions. A lack of skilled talent, however, creates a cascading effect of barriers that include cybersecurity, data, and processes, as well as crafting strategies and business cases. These challenges need clear transition planning, clearer goals, and new operating models to link the present and future value of sustainability and AI.

Efficiency and optimization will always be critical, especially for the industrial sector, as will keeping pace with the competition. Yet, executives seem to think that in two years, they’ll be under less pressure to be frugal and agile and more able to focus on strategic priorities. That will not be the case.

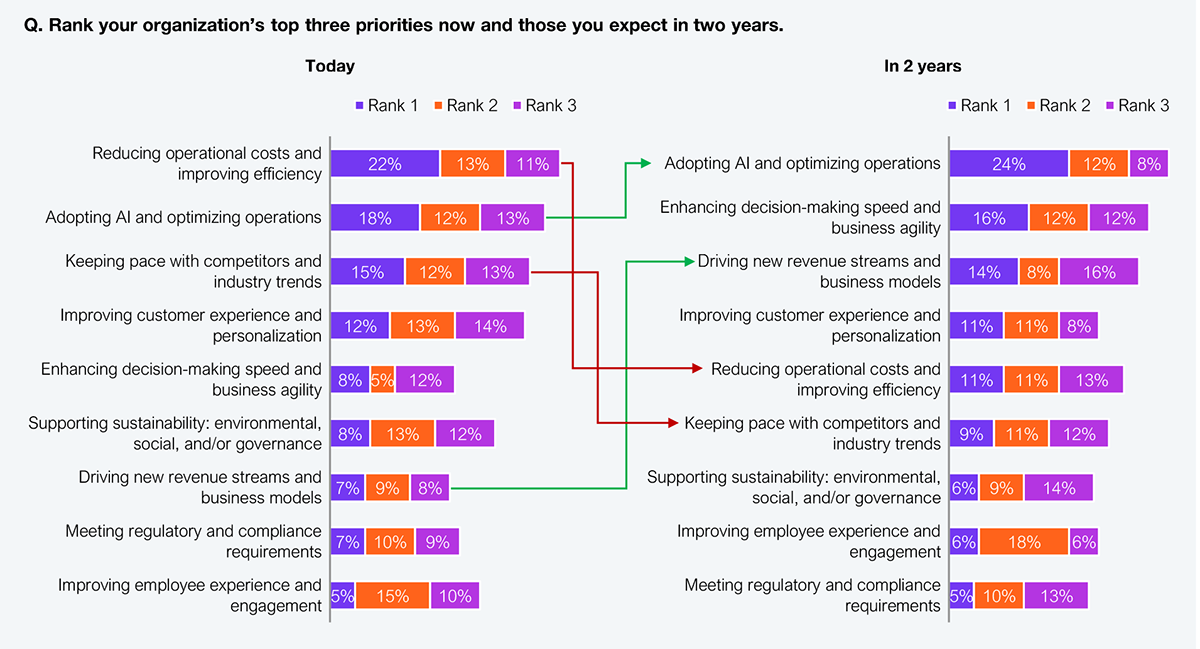

The present priorities, unsurprisingly, include efficiency and “keeping pace with the competition and trends” at the top of mind. However, these priorities drop in importance for the future (see Exhibit 1) when more strategic priorities like new business models and revenue streams emerge. AI for optimization remains a top priority, albeit with a jump in importance within two years; at least most realize AI is here to stay. AI is expected to cement itself as the top priority within two years.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

Nearly half (46%) of organizations currently prioritize “reducing operational costs” in their top three priorities, but this drops to just 35% within two years. In its place, “AI adoption and operational optimization” takes the top spot in priority-one votes. The path to competitive advantage will always, to some extent, run through efficiency gains; it’s unmistakable that AI will play a major role in both efficiency and strategic planning.

“Keeping pace with competitors” falls from third to sixth place, while “driving new revenue streams” moves to third place and, in the minds of executives, marks a shift from following to leading. But competition will always be there, and it will certainly create pressure for new revenue streams and business models.

We know AI in its best form can help address persistent challenges for industrial enterprises, including operational efficiency and cost pressures, competitive threats, sustainability opportunities and mandates, workforce capacity, and skills gaps.

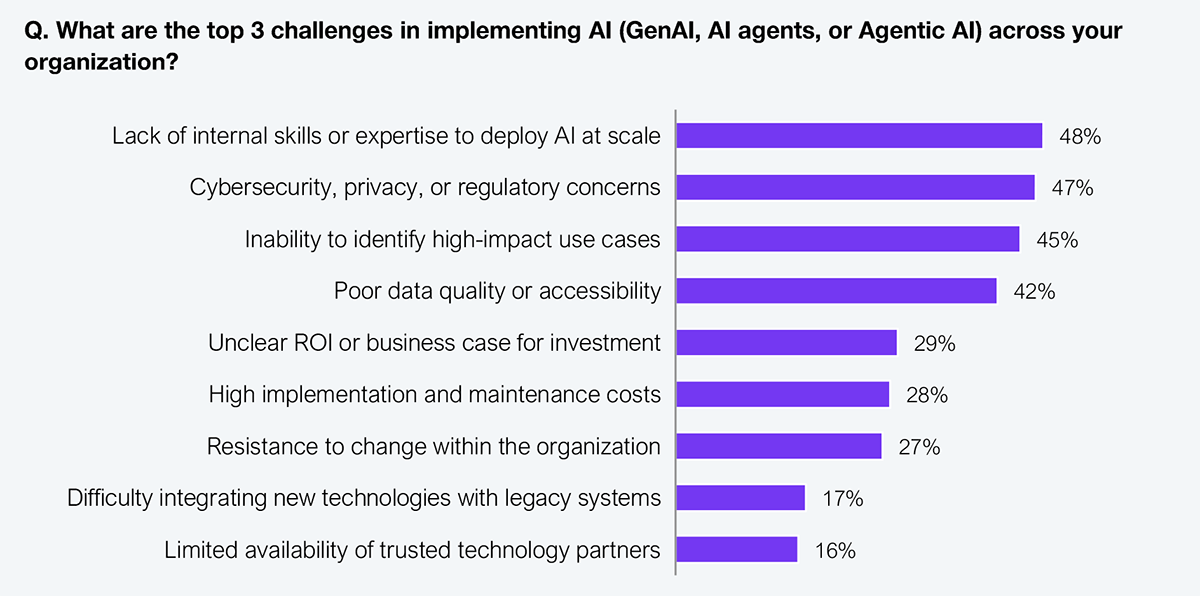

But nearly half of executives identify the lack of internal skills and expertise as a major barrier to deploying AI at scale (see Exhibit 2). Organizations also struggle to identify high-impact use cases (45% cite this as a top challenge) and cannot properly assess data readiness (42% face issues with poor data quality or accessibility). As much as talent prevents the widespread adoption of AI, it also affects the ability of firms to achieve the immediate efficiencies and optimization that AI and emerging technologies promise. Later, we’ll cover enterprise stories of success and failure.

Barriers also cluster around governance and risk in the absence of talent, with 47% flagging cybersecurity, privacy, and regulatory concerns as paramount. This regulatory anxiety, combined with the skills deficit, means organizations have the budget and technology for AI, likely executive and workforce buy-in too, but lack the expertise, confidence, and processes to move forward.

There is a need for deeper operating model transformation that enables effective human–AI collaboration and addresses the lack of frameworks for how people and machines work together.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

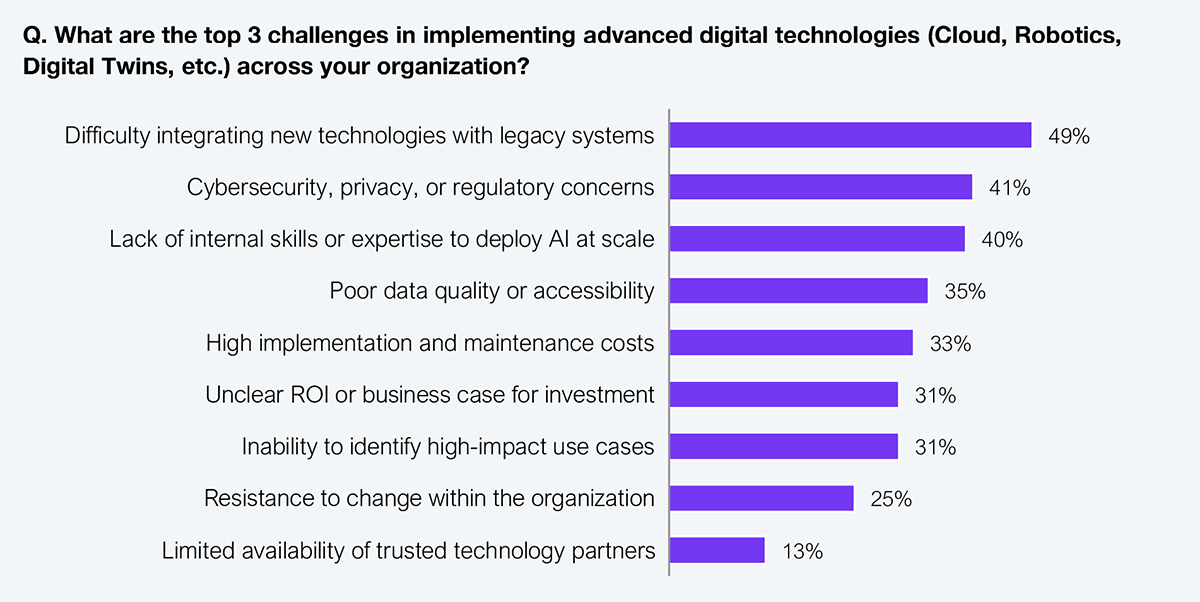

Beyond AI, we also looked at other advanced and emerging technologies (see Exhibit 3). Nearly half (49%) of organizations identify integrating new technologies with legacy systems as their greatest barrier to deploying advanced digital technologies. Talent troubles won’t help here either.

Technical debt—and the broader enterprise debt spectrum we often cover at HFS across data, strategy, culture, skills, and process—traps companies between the promise of technology and their existing infrastructure.

But legacy systems aren’t just technical debt; they’re also a sign of limited readiness to support the new, “intelligent,” connected operating models required for technologies like agentic AI. Instead of adding complexity into existing systems, organizations should focus on their overall strategic transitions that, again, connect short-term value and longer-term vision—modernizing architecture, governance, and workflows—to enable adaptive and collaborative systems that create new forms of value now and well into the future.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

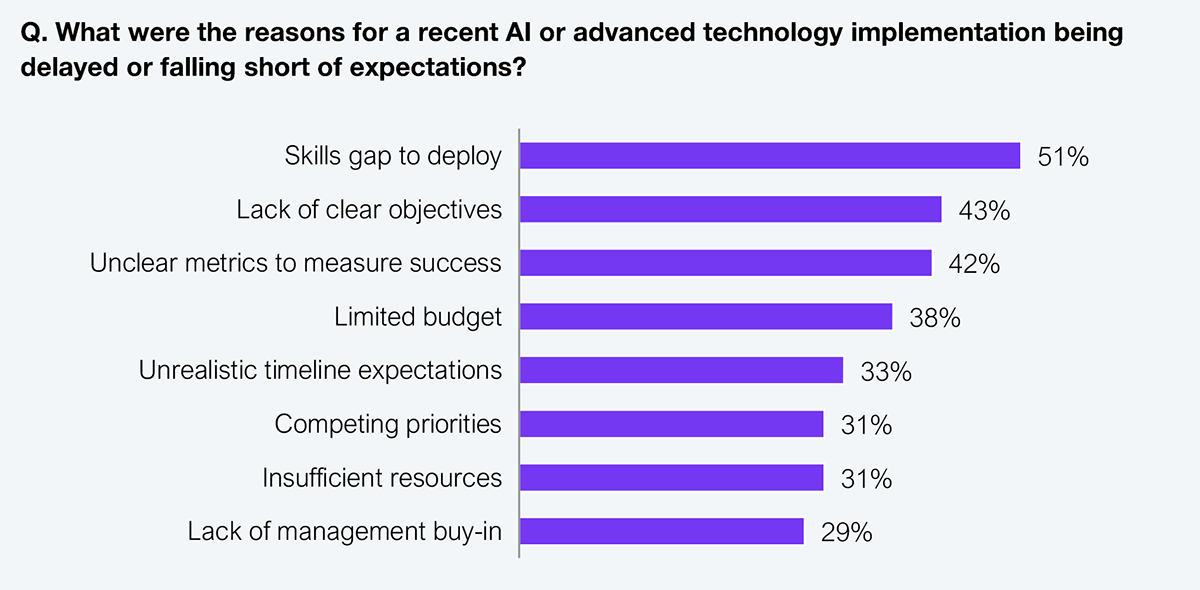

Cementing the talent challenge is that 51% of companies cite skills gaps as the primary reason their AI and advanced technology initiatives fail or underperform (see Exhibit 4). Forty-three percent (43%) lack clear objectives for their implementations, while 42% have no meaningful metrics to measure success. Organizations are launching into whatever their transformation is supposed to look like essentially blind and without the people to execute, the vision to guide, or the instruments to navigate.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

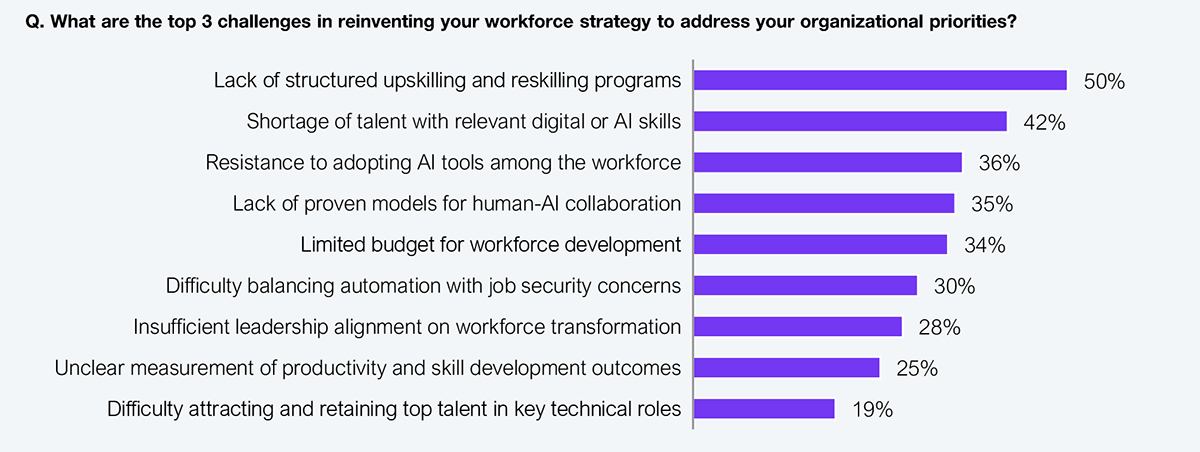

When considering workforces specifically, half of our surveyed leaders said companies lack structured upskilling and reskilling programs when they need them most, and 42% cannot find talent with essential digital and AI skills (see Exhibit 5). Without training programs, employees cannot develop the necessary capabilities, and without access to talent in the market, the workforce grows increasingly anxious about its future relevance (36%).

Returning to the lack of clear plans and goals, 35% admit they have no proven frameworks for how humans and machines should work together. Industrial employees remain uncertain about their future roles, further fueling the resistance and anxiety.

The energy sector is an example from our prior research, which often sees innovation teams across time horizons disconnected from one another—and from the wider corporate strategy.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

We asked for example stories from our 102 executives for AI successes. All show templates for immediate efficiency and a vision of an AI-led future for industry:

These use cases mark the early stages of agentic AI through human-in-the-loop orchestration, where agents act contextually under human oversight.

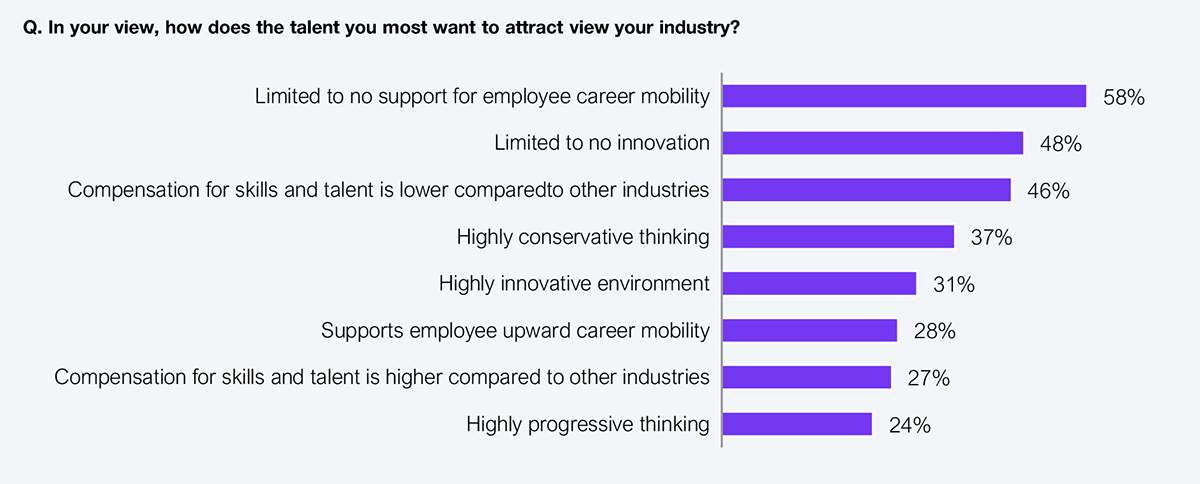

We asked exactly why talent might not be available for industrial enterprises to augment their existing, experienced workforces or to bridge the operating and digital technology divide (the proverbial IT-OT divide).

Over half of executives (58%) think that their targeted talent views their industry as offering limited to no support for employee career mobility (see Exhibit 6). The industry also has a perception of a lack of innovation (48%) and underpay for skills compared to other sectors (46%).

Clear plans and goals for technologies like AI and challenges like sustainability and the transition to clean energy are still lacking. We explore the importance and lack of climate transition planning here.

This perception matters enormously in an era where top talent gravitates toward companies and sectors that promise cutting-edge work and continuous learning opportunities. Take our experience of the oil and gas industry and its decade-long talent challenge, here.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

As seasoned experts leave the industry, these traditional industrial roles don’t draw new talent, creating a structural challenge that makes technology like agentic AI and shifts like sustainability particularly relevant. They can help bridge the divide through intelligent automation and new image creation for industrial sector companies.

Instead of focusing solely on upskilling or reskilling, there is a need for deeper operating model transformation that enables effective human–AI collaboration and addresses the lack of frameworks for how people and machines work together.

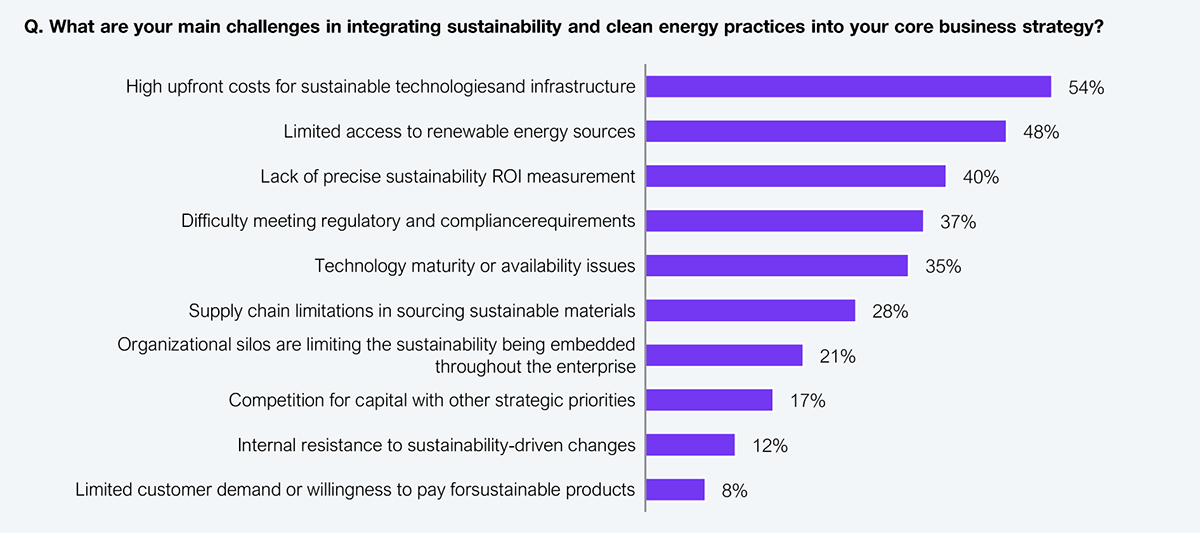

Demand for sustainability and clean energy practices exists, and people are largely on board; what’s missing, say our 102 industrial executives, is affordable capacity, access to clean power, and tangible evidence of returns.

High upfront cost (54%) is a top barrier, as is limited access to renewable energy (48%), and unclear return on investment (ROI) measurement (40%), followed by regulatory complexity (37%) and technology maturity (35%).

Areas that are less problematic suggest that industry executives feel the processes and technologies are there, but they just can’t win the argument and embed sustainability into strategies and operations. Supply-chain gaps (28%) and organizational silos (21%) matter, and classic blockers like capital competition (17%), internal resistance (12%), and weak customer demand (8%) are comparatively minor.

Sample: 102 senior industry leaders

Source: HFS Research, 2025

Success across the enterprise leaders we surveyed often came not from standalone gestures but from practical, scalable changes that created value for multiple stakeholders—again, connecting immediate value and outcomes with meeting strands of the broader sustainability systems change (see our separate outline).

Digital tools like predictive maintenance that cut energy use by 30%, AI-driven flight planning reducing fuel by 8%, and smart water sensors slashing losses by 30% show how data and automation deliver measurable impact.

Circular economy approaches also stood out: reusing steel from demolished buildings, refurbishing EV batteries for grid storage, and closed-loop recycling with suppliers created both cost savings and environmental benefits.

Extending these efforts beyond internal operations proved critical, from providing customers with software to manage energy use to persuading suppliers to repurpose end-of-life materials.

Finally, embedding sustainability into brand identity and workforce culture attracted talent, reduced attrition, and inspired innovation, underscoring that lasting progress comes when green practices strengthen both business performance and purpose.

Many of these practical, scalable changes, like predictive maintenance, water sensors, and flight planning, are also signs of early agent-led workflows. These are not just efficiency wins but glimpses into “agentic orchestration” delivering measurable sustainability outcomes.

Executives reported that sustainability projects frequently stall due to fragile supply chains, shifting regulations, and technology-performance gaps, as well as cultural and financial barriers inside organizations.

External factors, through supply chains and regulations, included the inability to secure reliable, sustainable materials—such as recycled plastics, cobalt for electric vehicle batteries, or sustainable aviation fuel—as a key obstacle. At the same time, regulatory delays (e.g., “byzantine” aircraft certification or waste-to-energy approvals) made planning risky and slow.

When considering technology, even when they showed promise, tech often underperformed in practice, like cobalt-free batteries degrading too quickly or bio-surfactants failing on shelf life.

Internally, projects faltered when middle management lacked incentives, employees resisted behavioral changes, or customers rejected eco-friendly alternatives that looked different or cost more.

Financial pressures also loomed large, with long payback periods, retooling costs, and premium pricing proving hard to justify.

Taken together, these experiences underscore that achieving sustainability requires not only technology and investment but also stable policy frameworks, resilient supply chains, cultural buy-in, and financial models that balance long-term impact with short-term realities.

Executives will never not have to link the short-term and long-term. They need the talent, goals, and plans to link the two.

The data and stories of industrial executives point toward a present failure to plan transitions for sustainability, AI, and the talent they’ll need to address both.

That alignment starts by aligning the senior leadership team on the long-term trajectories and goals. With those trajectories aligned throughout the company and down to daily operations and innovation teams. With clear outcomes and messaging that show the current and future workforce that your enterprise is part of the sustainable and technology-based future system… before it’s frantically forced to react to others who lead instead.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started