Insurers are no longer on the sidelines while AI reshapes other industries. The technology is redefining the very core of insurance: understanding risk, pricing it right, and serving policyholders effectively with empathy. To unpack the how, HFS Research, in partnership with IBM, brought 17 top insurers to a New York boardroom. The message was clear: the era of “death by 1,000 POCs” is over.” AI is live in production across underwriting, claims, customer service, and operations.

Exhibit 1: Insurance brain trust discussing AI; not plotting world domination, just better claims

Source: HFS Research; August 19, 2025; New York

Apply AI to transform functions and not fool around with meaningless pilots

AI’s potential is massive, but it’s easy to get caught up in the hype and scattered use cases. What makes AI, particularly GenAI, truly different is the reusability of its core components—the building blocks that power multiple functions of claims, pricing, and underwriting. For example, a natural language processing (NLP) engine designed for customer queries can easily be tuned for claims adjudication. A foundation model trained to analyze BOTH structured and unstructured data can flex across the claims cycle and underwriting.

A smarter approach is to apply AI to transform high-value functions such as pricing, underwriting, claims, and policy servicing while steering clear of subscale experiments. But this requires a complete rethink of workflows, moving away from sequential handoffs toward straight-through resolution or connecting workflows and data pipelines to stream IoT and behavioral data from telematics, wearables, and smart homes to recalibrate risk in real time for dynamic pricing. This function-wide view unlocks shared enablers such as data preparation, systems integration, and change management, turning a single investment into compounding ROI across the enterprise.

Decode insurance functions to realize the value of AI

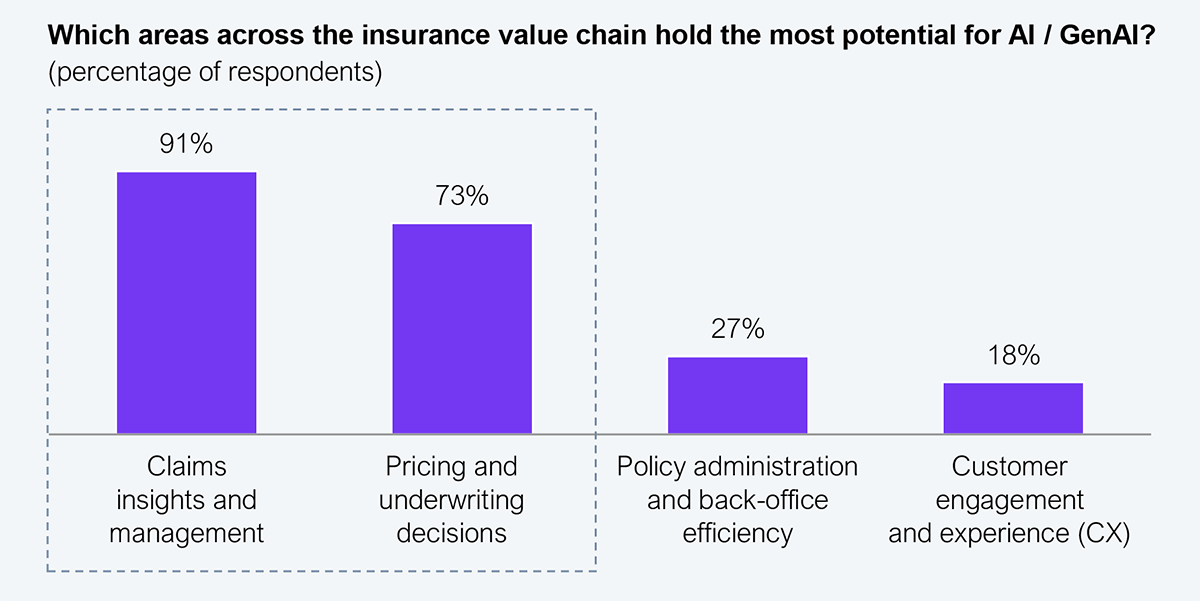

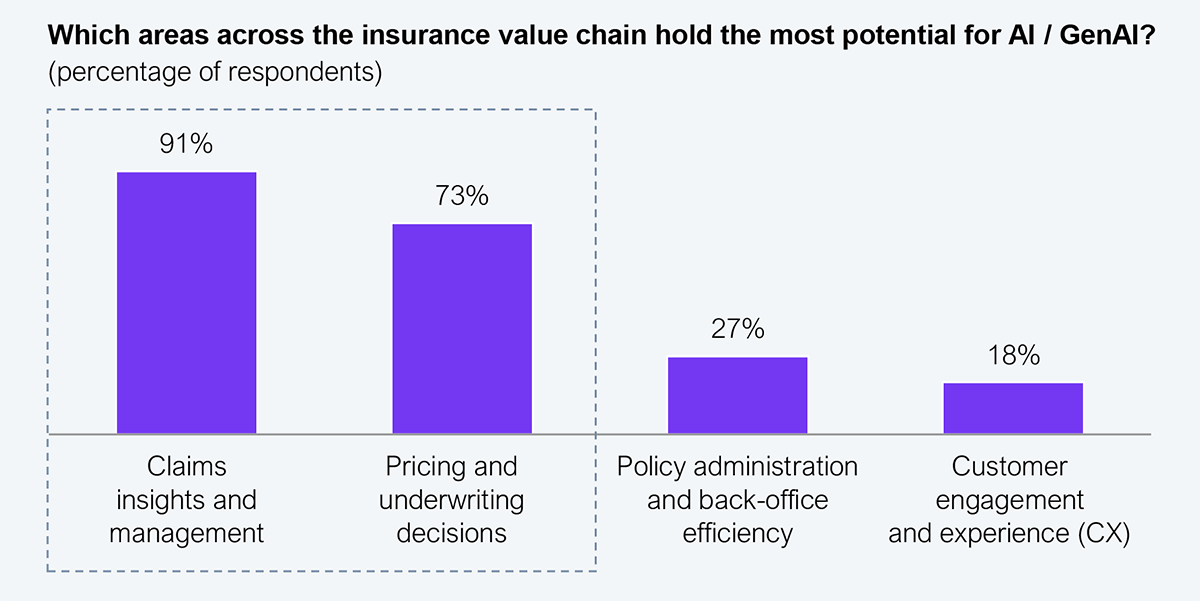

Our discussion with the delegates bears out the case for transforming AI by function. Within the fiefdom of these functions, we take a closer look at opportunities that resonated strongly (see Exhibit 2).

- Claims insights and management: Claims can be streamlined end to end, from submission, demand recognition, and detail extraction to policyholder interactions and adjudication. AI handles the heavy lifting in complex cases (FNOL, document processing, triage) and powers straight-through processing for simpler claims, from data capture to automated settlement.

- Pricing and underwriting risk selection: AI shifts underwriting from static rules to dynamic, context-aware models that fuse structured data with qualitative insights. In pricing, it enables underwriters to optimize across dimensions, leveraging unstructured data to make sharper, faster, ex-ante decisions, delivering bindable quotes based on more accurate risk profiles and coverage needs.

- Policy administration and back office: The back office is a rich realm for AI and home to the most complex parts of insurance operations, where systems juggle process, logic, and data under pressure. It’s also where high-volume, repetitive tasks and prediction overwhelm traditional automation. Real impact comes from fusing automation with intelligent, context-aware decision-making to navigate this complexity precisely.

- Customer engagement and experience: AI tools such as chatbots, virtual assistants, machine learning, and automation streamline policy management by addressing customer queries, providing anecdotal quotes, updating policies, and supporting claims more efficiently and meaningfully.

Exhibit 2: Claims and underwriting lead the charge for AI adoption

Source: HFS Research, 2025; insights from 17 insurance leaders in the boardroom

Unlock IoT data to shapeshift the traditional insurance value chain

The rise of telematics and IoT in insurance ameliorates data collection by transforming static snapshots into real-time intelligence. In automotive, the old playbook of age, address, and credit history gives way to data on how, when, and where people drive. Claims are evolving too; video, audio, and images create a living record that reduces litigation risk, accelerates resolution, and deepens customer insight. The proliferation of this rich data fuels dynamic policies, usage-based premium models, and sharper personalization. Ultimately, those with the best data will increasingly lead in creating new sources of value. Here are a few steps to get started:

- Create the application environment and position for ecosystem participation: As data becomes ubiquitous, winning in IoT is a platform play. Yet many platforms still push all sensor data to the cloud, raising challenges around latency, cost, scale, and resilience. Don’t stitch together a quick solution; platforms must be cloud-native, interoperable, integrate seamlessly with your infrastructure, and support AI and ML applications. Anchor your IoT strategy with long-term partnerships, as insurers are already working with telematics providers, automotive OEMs, repair shops, and more.

- Manage the explosion of data: Data remains the biggest hurdle for insurers, and IoT is only amplifying it. Massive streams of sensor data are now layered on top of core proprietary data, intensifying the pressure to process everything in real time. Insurers need an enterprise data strategy to store, process, and tame this deluge, turning it into timely, high-value business decisions.

- Refine your people, process, and infrastructure to make data count through IoT: Blend existing skills with new capabilities by building cross-functional teams and investing in fresh talent. Strengthen infrastructure pipelines to harness field-device data and integrate it into downstream applications, AI, business processes, dashboards, and reports.

- Secure the connected data flow: The flood of data between connected vehicles and insurers is vulnerable to cyberattacks, interception, and claims fraud. Double down on data security and fraud protection to safeguard trust and stay ahead of emerging threats.

The Bottom Line: Traditional insurance isn’t dying but being reshaped by disruptions that are redefining the value chain. Get smart on AI and its powerful combination with IoT.

Insurance leaders who embrace such disruptive technologies are building the skills, talent, and culture to succeed, riding the wave instead of resisting it. The individuals in the room exemplified this mindset, proving that the future belongs to those who harness disruption, not fear it.