Our latest HFS OneOffice Pulse Study has revealed that organizations are no longer looking at cost reduction as the primary driver for using managed services. Supporting digital transformation and improving stakeholder experiences have now become one of the top drivers for considering the usage of managed services.

While we can celebrate this new focus, most commercial relationships remain centered on transactional contracts and measurements, indicating that enterprises are just beginning to view managed service providers as true strategic partners.

Note that HFS considers managed services to include the practice of outsourcing or co-sourcing responsibility for the delivery of business and IT processes and functions through a multi-year, outcome-based model to improve business efficiencies, boost operational resiliency, and reduce costs.

The once-popular managed service areas are making way for more services focused on IT modernization, business transformation, and cybersecurity.

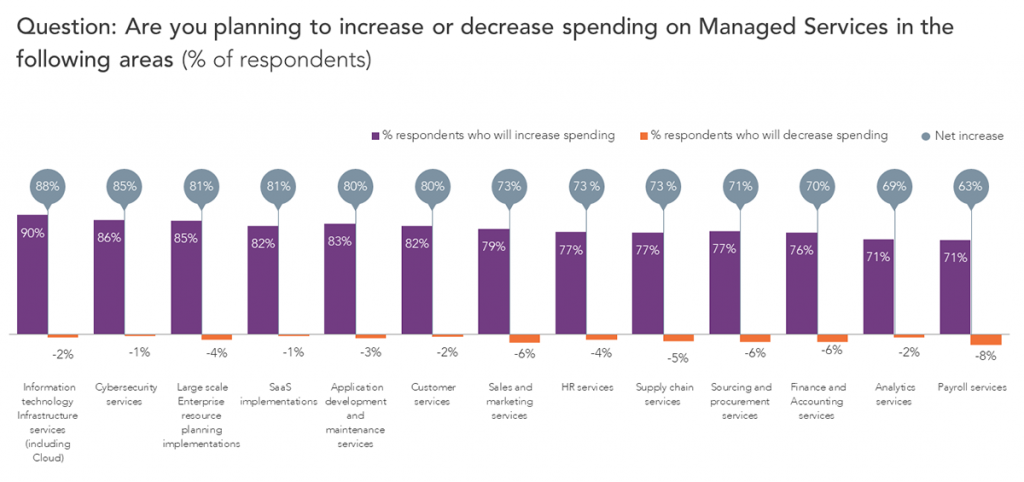

Our latest HFS OneOffice Pulse Study highlighted that eight percent (8%) of enterprise executives in Exhibit 1 are planning to decrease spending in payroll managed services, the highest decrease. Six percent (6%) are also looking to decrease spending in finance and accounting, sourcing and procurements, and sales and marketing managed services.

Enterprise’s cloudification and cybersecurity will dominate immediate spending. Enterprises will be looking for ongoing support from managed service providers in redesigning and moving their new operational workflows in the cloud. Ninety percent (90%) of executives are planning to increase spending in information technology infrastructure services. As enterprises adopt SaaS applications to manage business processes, service providers are also ramping up their corresponding service offerings to support their customers in this journey. Eighty two percent (82%) of executives see their managed services spending increase with respect to SaaS implementation. A clear sign that SaaS is not replacing services, and SaaS and services have a symbiotic relationship (check our latest report that examines how the convergence of SaaS and services has furthered the capabilities of software as a critical tool for achieving sustainable business outcomes.

The push in cloud spending is accompanied by a substantial demand for risk and cybersecurity managed services. As the cyber threat ecosystem keeps evolving, organizations are doubling down on cybersecurity measures, and they will be looking at managed service providers to provide the required capabilities and resources. The shortage of qualified cybersecurity experts has intensified in the past few years and is driving a bigger appetite for risk and cybersecurity managed services.

Eighty six percent (86%) of executives see their managed services spending increase with respect to cybersecurity.

Sample: 800 Global 2000 Enterprises

Source: HFS OneOffice Pulse Study, H2 2021

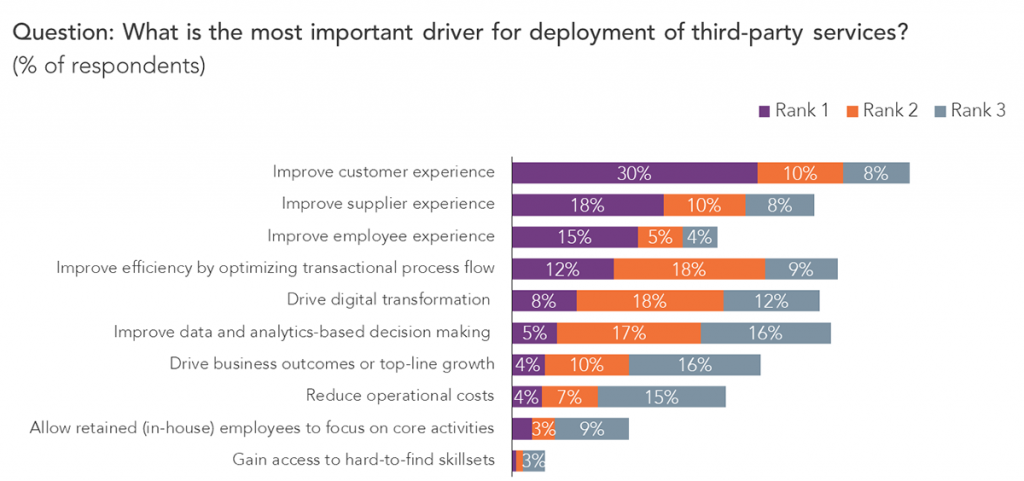

Enterprises are no longer looking at cost reduction as the primary reason for using managed services. Only 4% of respondents have mentioned cost reduction as the primary driver for using managed services in our HFS OneOffice Pulse Study. Improving employee, partner and customers experiences is becoming the top driver in Exhibit 2 for using managed services. Despite the changes the pandemic forced businesses to make, the organizational silos that have inhibited digital transformation initiatives for years didn’t go away. To eliminate the silos between the front, middle, and back offices, enterprises are now looking at managed service providers to help them improve and align employee experience with partner experience and customer experience.

It is becoming abundantly clear that managed services are not about processing data more efficiently but using it to help enterprises re-think processes across functional areas. Enterprises expect managed service providers to position their services based on “solving challenges” rather than executing existing operational runbooks. They want managed service providers to act as problem solvers and not only problem handlers. In short, organizations want to buy continuous access to data outcomes and experience great service partnerships to achieve them.

As one CIO respondent shared with HFS “Managed services should add value on top of existing platforms/models operated by the organization. If you have a data lake, storage repositories of one version of the truth, a managed service provider can have a value proposition where they provide APIs and advanced visualization to do large-scale data ingestion to extract information from their core applications (ERP, Workday, Salesforce, recipe solution) and supplement that with social media information. The managed service can be to give ongoing insights into what you should be innovating.”

Note: Less than 3% data are not shown in the chart

Sample: 800 Global 2000 Enterprise

Source: HFS OneOffice Pulse Study, H2 2021

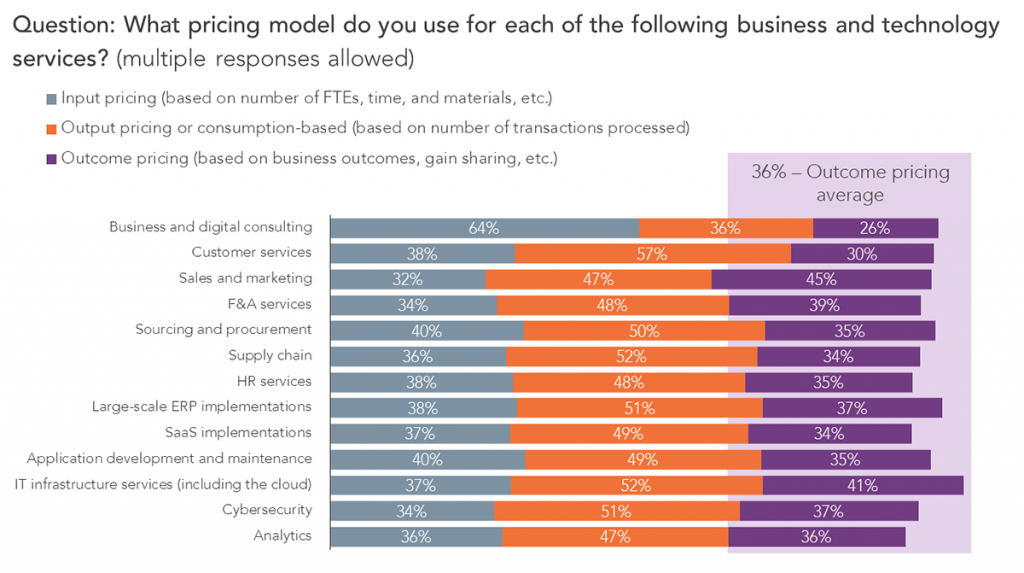

There is a greater appetite for organizations to include a component of outcome pricing (pay for performance or gain sharing) to incentivize suppliers to deliver beyond contractual commitments. However, most commercial models underpinning managed services contracts are still based on transactional measurements, indicating that enterprises still don’t see managed service providers as strategic partners with a joint mission of growth and mutual success. Cost reduction is no longer a key driver, but most managed services contracts are still measured against input (number of full-time equivalents, time, materials, etc.) or output (number of transactions processed).

According to our HFS OneOffice Pulse Study, only one out of three respondents (36%) in Exhibit 3 uses outcome-based pricing models (business outcomes, gain sharing, etc.) that prioritize generating value from services over just measuring the cost of running services.

Many respondents have flagged that outcome-based relationships proposed by service providers are still too difficult to define and measure at the enterprise level, which has resulted in limited adoption of such commercial models.

As one Global Business Services Strategy Director shared with HFS “Traditional outsourcers don’t go the extra mile because the pricing model doesn’t push them to go the extra mile.” Similarly, a Head of Business Services highlighted that “Initially, managed services were seen as a pure staff augmentation (FTE-based model), but because the knowledge and expertise of many service providers have matured over the years, now the commercial relationship must also mature.”

Note: Less than 3% is not shown in the chart

Sample: 800 Global 2000 Enterprises

Source: HFS OneOffice Pulse Study, H2 2021

While transaction-based commercial relationships are not incompatible with managed services focused on IT modernization, business transformation, and trust, they don’t lay the foundation needed for long-term success. It is high time for service providers to double-down on their outcome-based models and help their clients decipher the outcomes and business benefits that their investments in strategic managed services will yield.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started