Lenders are stuck in a hire–fire loop, reacting to rate shifts by scaling people instead of building resilience. The result? Burned capital, bloated ops, and no agility. Modernization isn’t just a tech project—it’s how you escape the margin death spiral. HFS released its Mortgage Reinvention 2025 Horizons report to capture this pivotal moment. The mortgage industry is staring down the rapid shifts in home prices, interest rates, and housing availability in the US. It is responding by scaling people, but it’s trapped in a reactive cycle of hiring and firing rather than strategically right-sizing.

The Horizons report also explores how service providers support two main entities: banks and their affiliates, and non-banks operating outside of, or without ties to, depository institutions. These groups originate and service mortgages, along with the broader ecosystem delivering adjacent services. Our Horizons evaluation encompassed 15 service providers (see Exhibit 1), drawing insights from 40 lenders and partners that contract with them.

Note: All service providers within a Horizon are listed alphabetically

Source: HFS Research, 2025

During the pandemic, the housing market boomed, and many lenders rode the wave without bracing for the crash. The pandemic-era origination boom, refinancing frenzy, and record-breaking demand for homeownership masked the industry’s deep structural cracks, such as endless approvals, mountains of paperwork, and manual underwriting. Those cracks split wide open after the pandemic waned: affordability collapsed, inflation surged, and origination volumes cratered.

Through 2025, rates have steadied, hovering in the 6%–7% range for a standard 30-year fixed mortgage as the Fed holds firm. However, every move by the central bank sends signals, swinging affordability and demand in both directions. To avoid repeating past mistakes, lenders must be prepared to manage the fallout by harnessing technology and innovation, now more advanced than ever, to finally unshackle the industry from its unwieldy past, no matter which way the market turns.

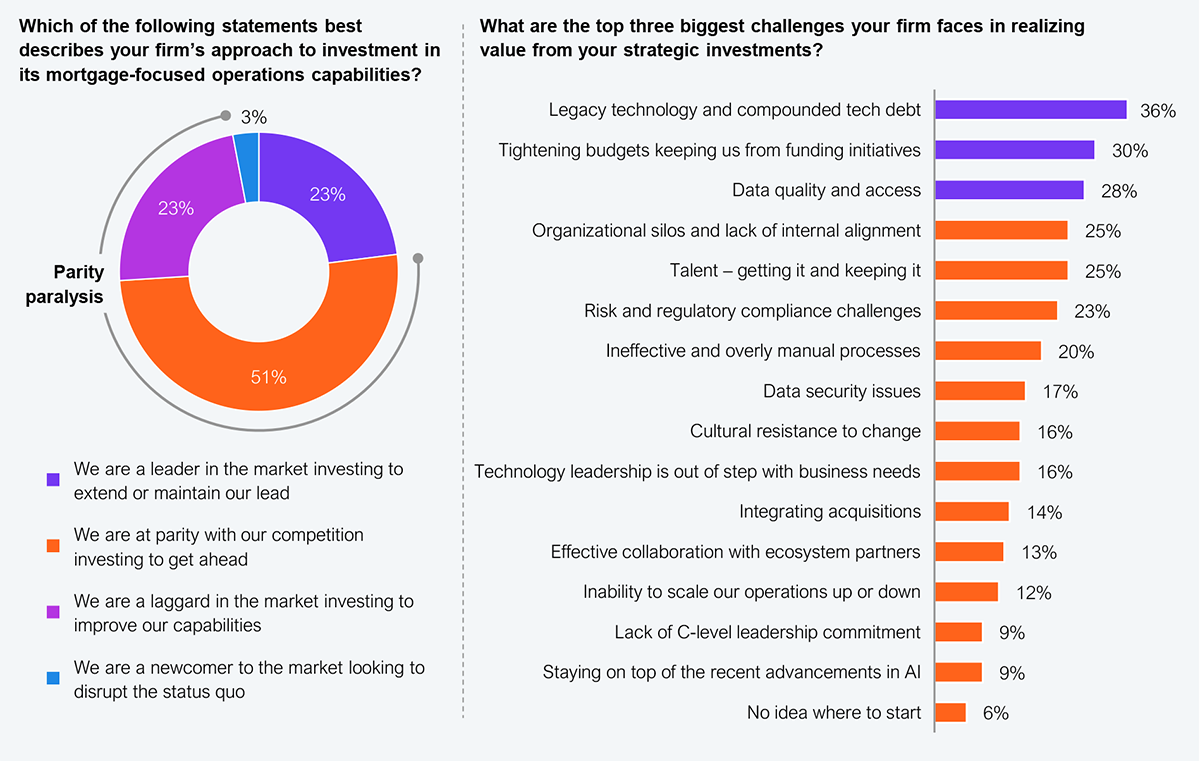

The mortgage industry has been feasting on a smorgasbord of external and internal pressures, and lenders must be ready to ride out the odds. By Q3 2023, origination costs had surged to $11,600 per loan, according to Freddie Mac, and servicing remains a low-margin grind, offering little relief. Add the internal drag of legacy technology, tightening budgets, and fragmented data, and most lenders remain stuck in a sea of sameness, unable to break out as leaders, as shown in Exhibit 2.

Sample: 467 US mortgage lenders and their ecosystem partners

Source: HFS Research, 2025

What’s needed now is a dual strategy that combines technology and operations, because betting on just one is a losing game. The operating model must be powered by cloud platforms, automation, and AI, while staying anchored in compliance and a well-governed data foundation to deliver a seamless digital borrower experience.

Lenders will always need some staffing flex, and technology can finally break the rigid link between loan volumes and headcount. The pursuit of labor arbitrage must evolve into right-shoring with intent, tapping global talent while equipping underwriters, loan officers, servicers, processors, and compliance teams with technology that augments their capabilities and productivity.

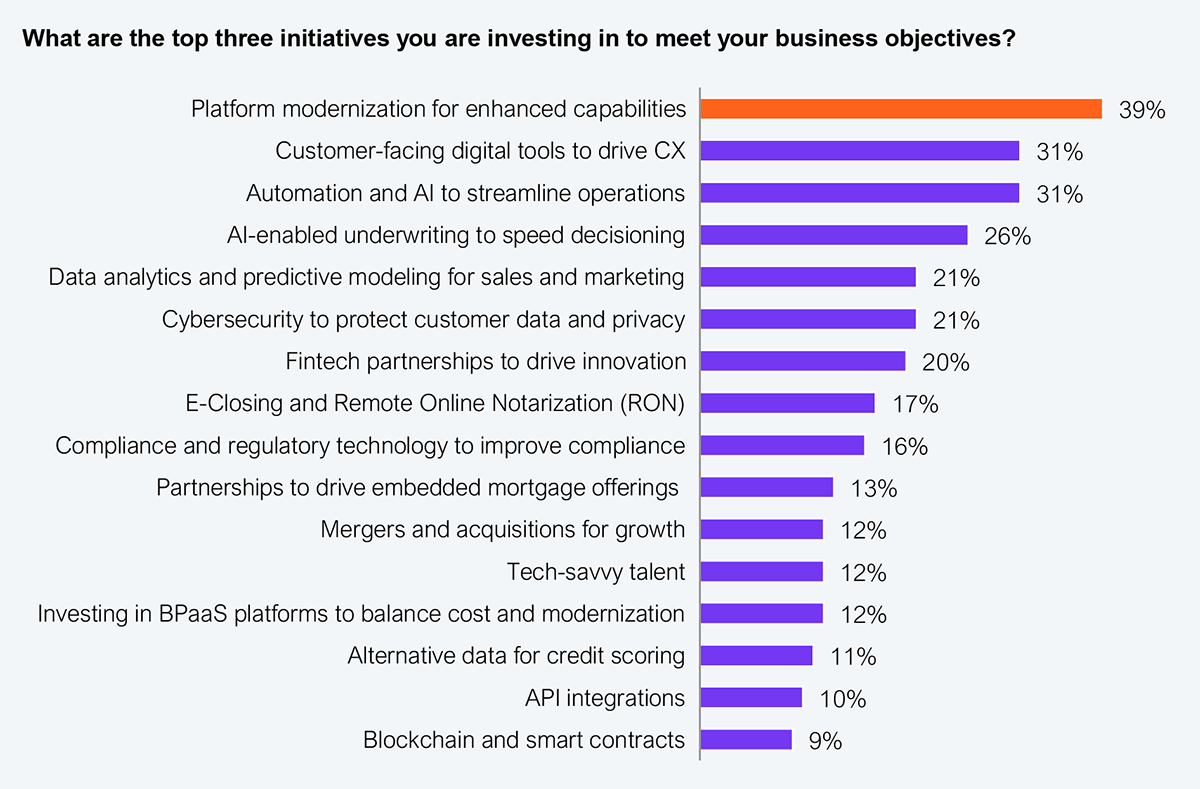

Platform modernization has become the top strategic investment priority for lenders (see Exhibit 3), alongside digital transformation, automation, and AI. Shedding legacy systems injects agility into mortgage operations, shifting them from fragmented, labor-intensive workflows to digitally and data-driven business models. Modernization also strengthens integration with internal systems and deepens connections across the external ecosystem, leveraging technologies such as automation and AI. In a fiercely competitive and price-sensitive market where borrowers routinely switch for better rates and, more importantly, a superior experience, modernization is no longer optional.

Sample: 467 US mortgage lenders and their ecosystem partners

Source: HFS Research, 2025

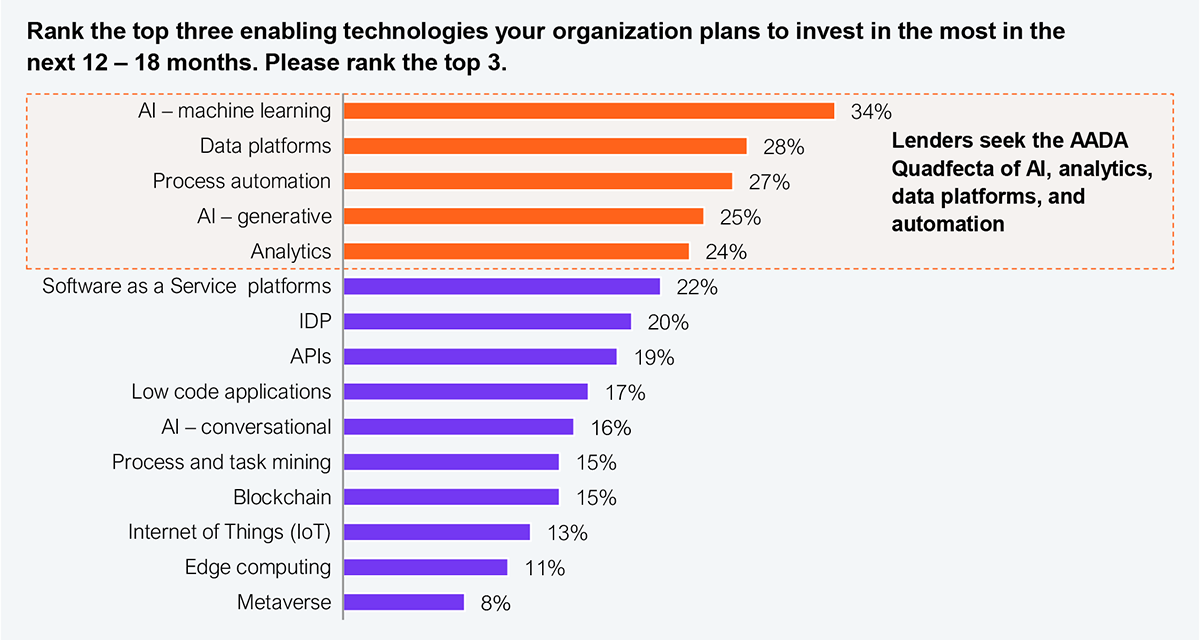

Frontier technologies are reshaping mortgage operations, from streamlining origination to extending deeper into the lending lifecycle, particularly servicing, which remains a whitespace ripe for disruption. These technologies align with the HFS AADA Quadfecta—analytics, artificial intelligence (AI) (machine learning and generative AI), data platforms, and automation—as illustrated in Exhibit 4. When implemented effectively to optimize the most promising parts of the value chain, this cohort of technologies can improve efficiency, reduce costs, raise loan quality, and expand product offerings through data-driven decision-making, delivering a significantly enhanced borrower experience. While automation remains the golden lever, technologies such as intelligent document processing (IDP) and optical character recognition (OCR) are commonly used across mortgage operations, bridging the analog–digital divide.

Sample: 467 US mortgage lenders and their ecosystem partners

Source: HFS Research, 2025

Mortgage operations have always been ripe for automation, with robotic process automation (RPA) leading the charge. Bots took on repetitive grunt work, freeing resources for higher-value tasks. RPA delivered on its promise of efficiency, and most of the low-hanging fruit has already been picked. Now GenAI has flipped the script. At the intersection of GenAI’s cognitive intelligence and automation’s execution muscle, agentic AI is emerging and fusing reasoning with precision.

Training and deploying models have become far easier with GenAI, unlocking mortgage use cases that were once too complex or costly to pursue. GenAI delivers the cognitive lift, RPA provides the execution, and together they create intelligent agents that operate at the intersection of decision and action. Lenders are wisely approaching this shift pragmatically, applying agentic AI in targeted, high-impact areas rather than chasing sci-fi visions.

The mortgage industry is in reset mode. Both lenders and their service provider partners are shifting from labor arbitrage to tech-led transformation, anchored in AI. Service providers are building the capabilities the market demands to meet the moment. Lenders must take bold and sometimes uncomfortable steps to reset operating models, platforms, and strategies. The conversation moves beyond “why change” to “how to build differently this time.”

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started