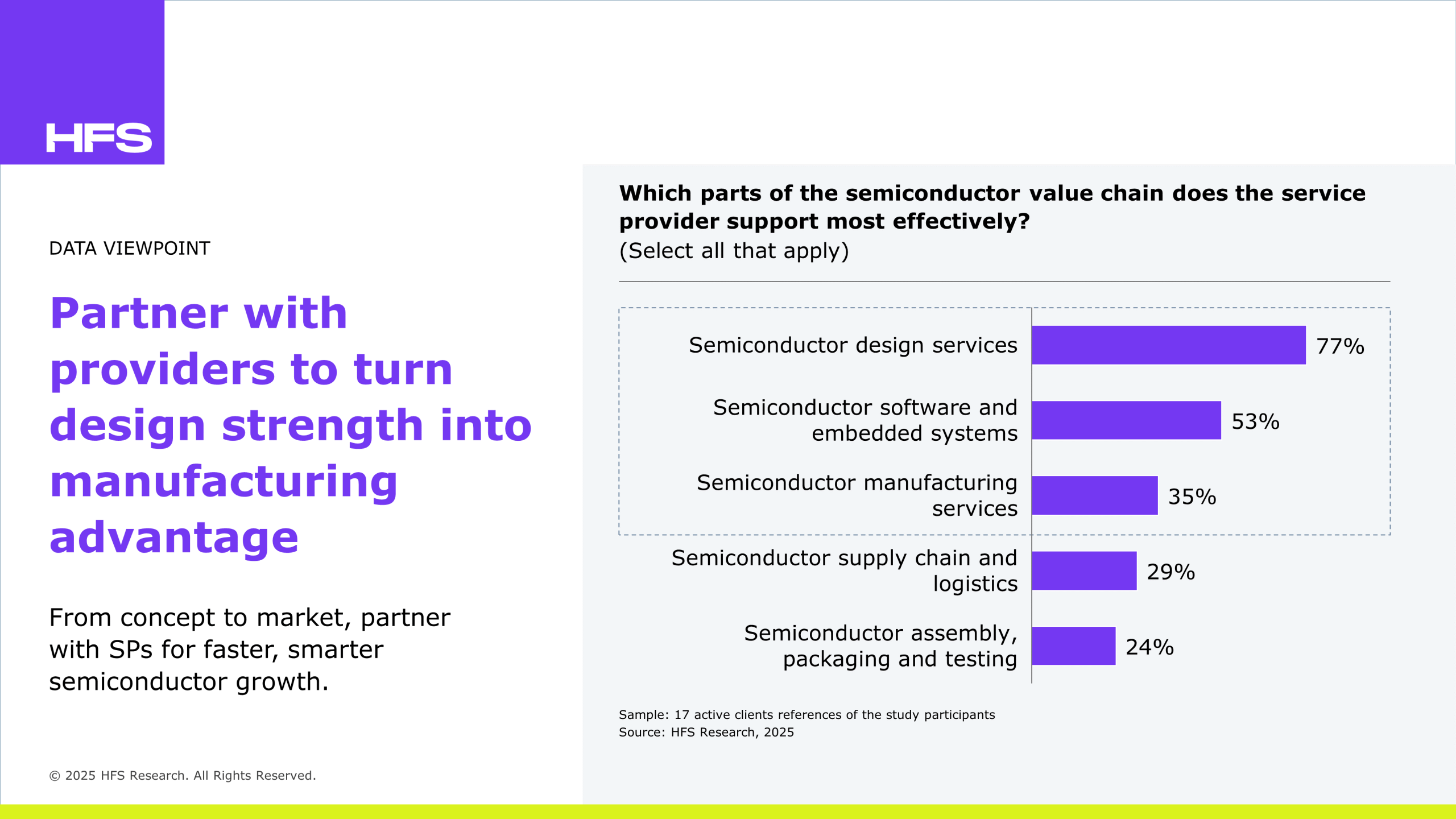

During the reference check process, we learned that enabling the upstream, knowledge-driven segments of the semiconductor value chain, particularly design and embedded systems, are the most common services. Service providers (SPs) offer extensive manufacturing enablement and supply chain support, but their involvement is less pronounced in capital-intensive downstream segments such as assembly, packaging, and testing. Semiconductor manufacturing services are the highest in terms of capital spend, mainly because the cost of fabs and leading-edge equipment is very high. It is followed by assembly, packaging, and testing, which are also high as they need specialized facilities. Supply chain and logistics are mid-range in terms of cost, with complexity and risk in shipping high-value components worldwide. Semiconductor software and embedded systems, especially semiconductor design services, are comparatively low-cost since they depend more on people and tools than heavy assets, thereby having much lower capital intensity.

The following are the top value chain elements that service providers serve the most:

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started