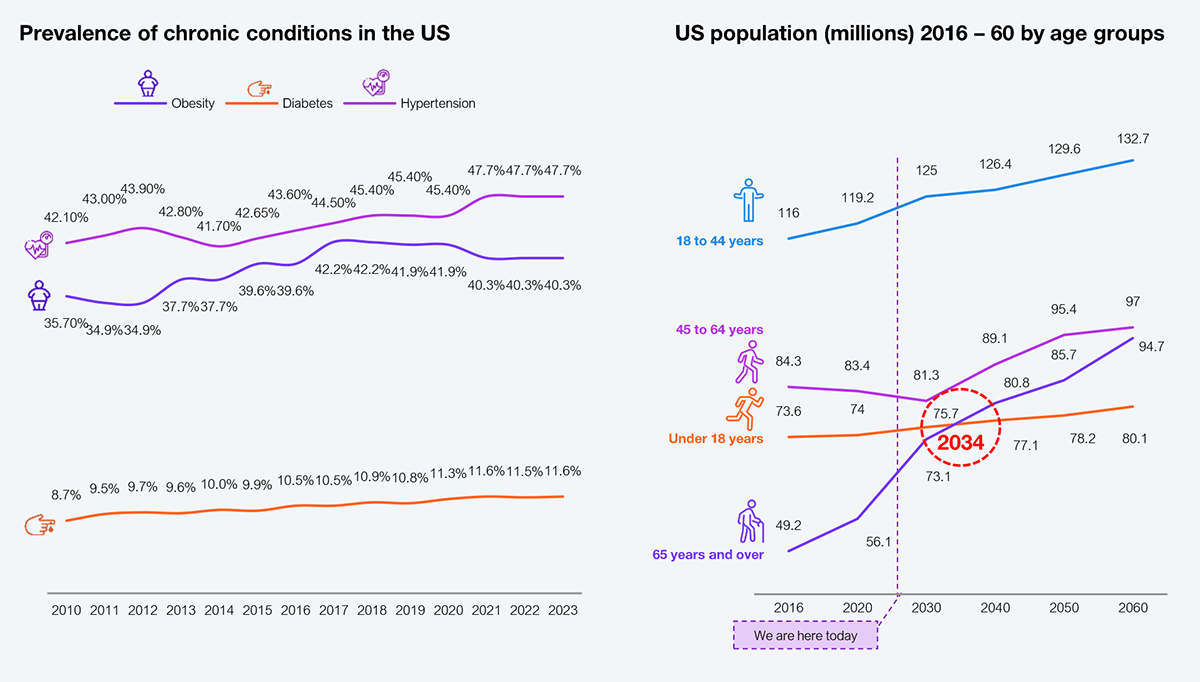

Healthcare in the US was already careening toward an unsustainable financial cliff (increasing percentage of GDP spend year-on-year), with deteriorating health outcomes (see Exhibit 1). The recently signed Big Beautiful Bill (BBB) will accelerate that with soaring uninsurance rates and healthcare costs (premiums, medical rates), closures of hospitals, and increased pressure on health plan and health system margins. Consequently, the market will force reconfiguration of the supply landscape for services (clinical, administrative, ancillary) and technologies (infrastructure, systems, telehealth). The reconfiguration will drive consolidations (traditional service providers, BPOs), exits, or the making of a new generation of providers addressing growing adjacent markets.

Chronic conditions such as diabetes, hypertension, and obesity are on the rise (see Exhibit 1), setting the stage for the need for growing acute care. To complicate matters, by 2034, the US will have more seniors (65+) than younger (18 years or younger) people, for the first time in its history (see Exhibit 1), as it ages faster than most OECD countries.

It does not help that the US is predominantly a service economy that has perpetuated a culture of a sedentary lifestyle and excess consumption of processed food, which contributes to disease prevalence. Lastly, epidemics and pandemics are becoming more common as governments cut funding for federal health agencies, including the National Institute of Health (NIH) and the Centers for Disease Control and Prevention (CDC), adding to the demand column for healthcare.

Source: US Centers for Disease Control and Prevention (CDC), US Census Bureau, HFS Research, 2025

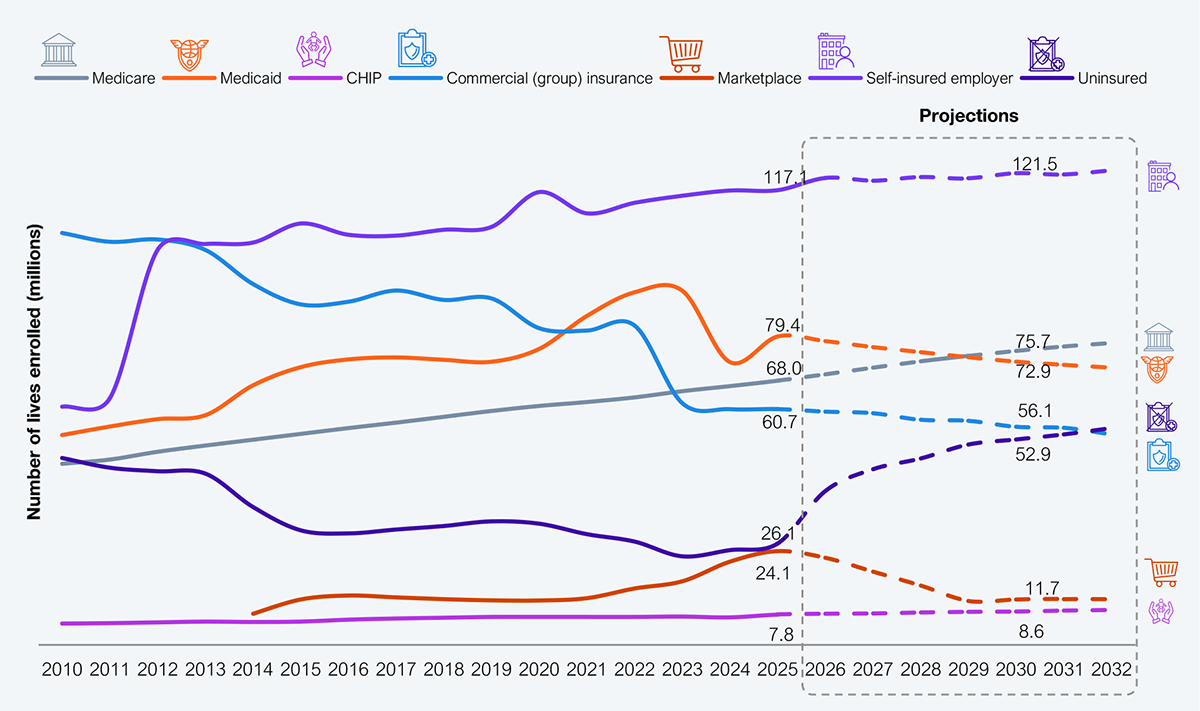

Critical elements of direct supply, including funding (health insurance), clinicians (doctors, nurses), and access to care, are already under pressure. The passing of the BBB will accelerate its exacerbation, negatively impacting the cost of care, health outcomes, and care experiences.

The uninsurance rate in 2025 is estimated to be about 7.6%. Still, due to BBB impacts, combined with the expiry of the ACA premium tax credits and voluntary dropout due to the cost of premiums, uninsurance is projected to rise to 11.5% in 2026 based on HFS Research estimates (see Exhibit 2). That trend will continue through the end of the decade, reaching approximately 15%, a rate last seen before the passing of the ACA in 2010. In the same vein, Medicaid and the ACA Marketplace will begin to decline, joining the trajectory of commercial group insurance. The only bright spot is the lives covered by self-insured employers, assuming an economy that remains robust and that the threats of AI replacing humans are mostly a myth.

Source: CMS, CBO, KFF, US Bureau of Labor Statistics, HFS Research, 2025

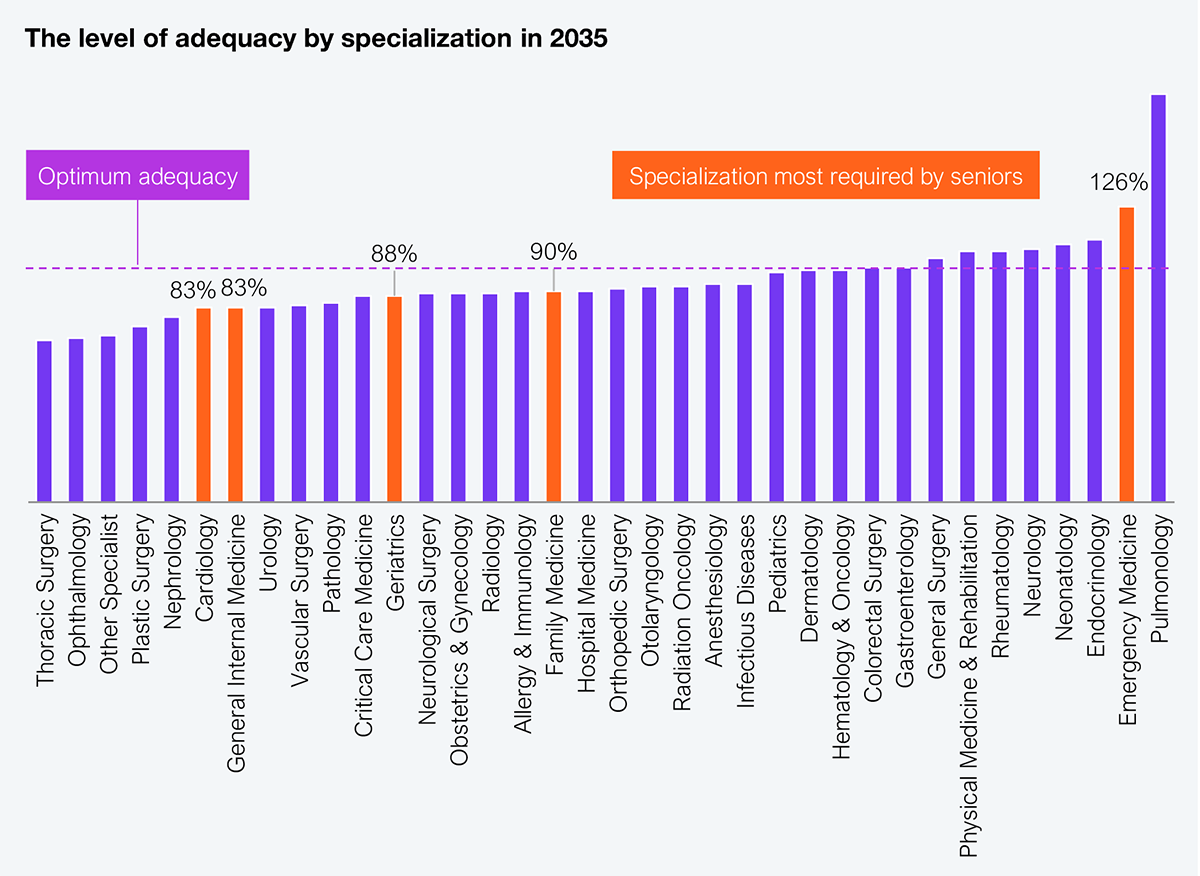

A key reason for funding to dry up relative to the increasing cost of care is the shrinking supply of doctors and nurses. Clinician counts are simply not going to keep up with population and disease prevalence, particularly for seniors, as the level of clinician adequacy for seniors gets worse (see Exhibit 3).

Source: US Dept. of Health and Human Services, Bureau of Health Workforce, HFS Research, 2025

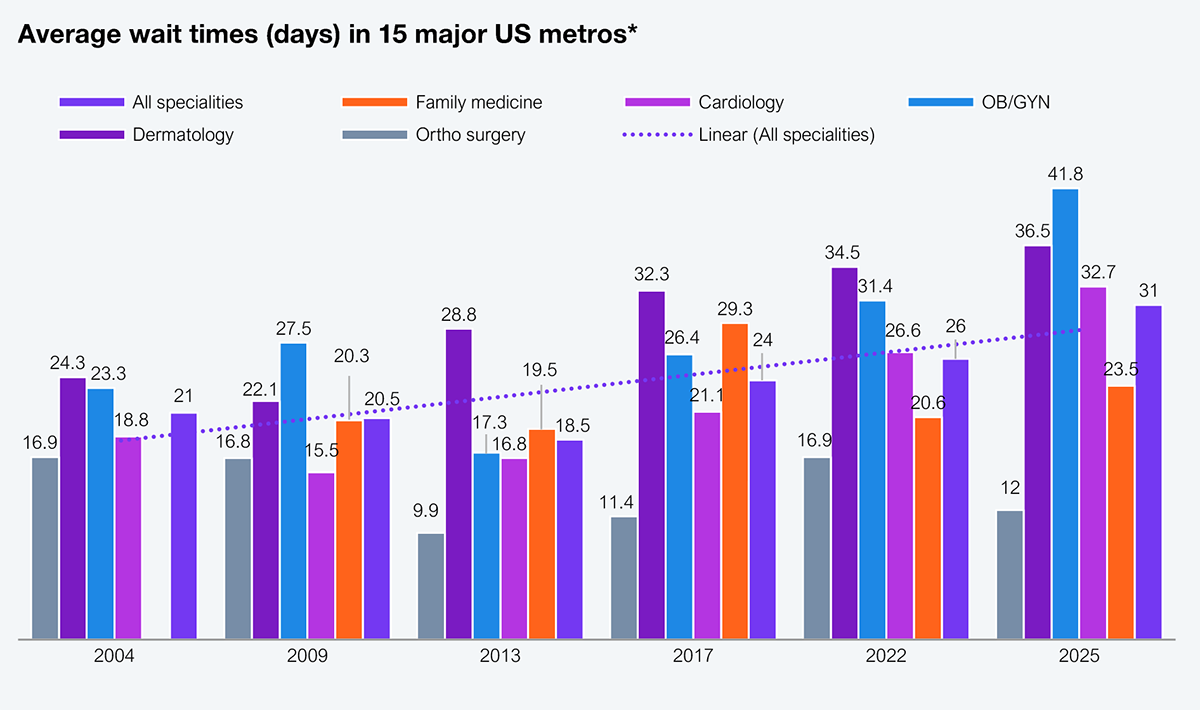

Shrinking supply manifests in the time it will take to get an appointment with doctors across various specializations around the country. Exhibit 4 indicates that in the largest 15 metros, wait times have doubled over the last two decades and threaten to worsen as specialists get choosy about who they see, i.e., deprioritizing Medicaid beneficiaries while prioritizing commercial insurance members with no prior-auth requirements. These supply optimization techniques will further harm consumers’ health, increasing demand for healthcare that cannot be met.

Source: AMN Healthcare, HFS Research, 2025

The implications of the BBB will be cross-industry, touching health plans, health systems, consumers, and suppliers of all stripes (e.g., services, technologies). It will lead to increased insurance premiums, hospital closures, and job losses (10% of all jobs are in healthcare), to name just a few.

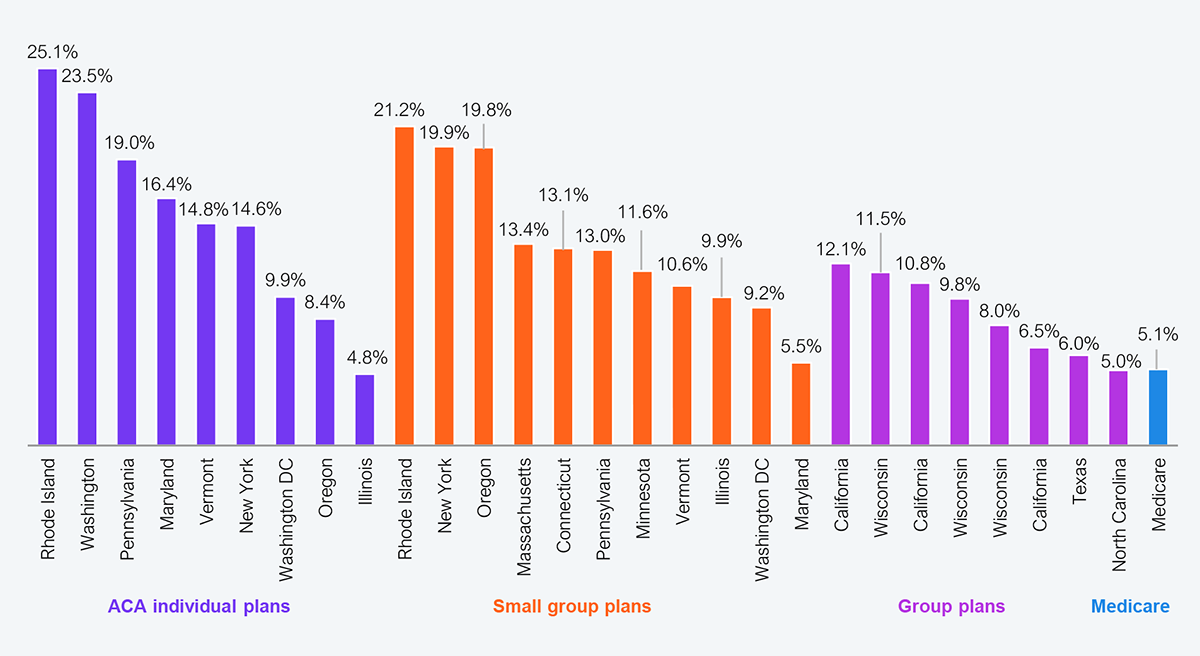

Health plans have already submitted their rates for 2026 to state insurance commissioners in many states for various coverages (individual, small, and large groups), while CMS has published its reimbursement rate for Medicare Advantage (see Exhibit 5). Tariffs currently drive the rate increases; however, there will likely be mid-year adjustments as the impacts of BBB become clearer. While rates can’t be changed mid-year, health plans will likely manipulate their prior-auth rules and increase utilization management cases to throttle utilization. The exchange market is particularly vulnerable in states where the population panel is smaller, and consumers lack the power of a larger supporting entity, such as an employer or CMS.

Source: SERFF, CMS, HFS Research, 2025

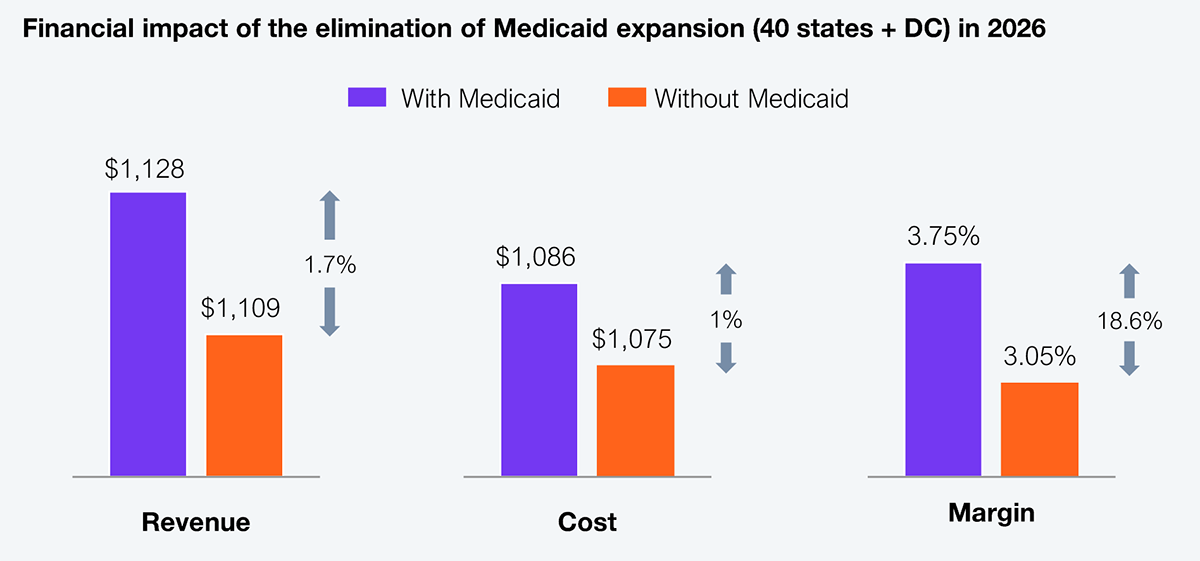

The rate of hospital closures will likely be unprecedented, driven primarily by increased uncompensated care. Health systems write off about 15% in uncompensated care. That rate will double and settle between 30% and 40% over the next few years as BBB drives higher uninsured rates. Health systems operating at about 3.75% margins on average cannot sustain operations (see Exhibit 6), leading to closures. While the year 1 impact may be 70 basis points on margins, they will worsen over the next ten years. Those closures will likely start in rural locations already under severe pressure, but urban systems will not be immune to shutdowns by the decade’s end.

Source: Urban Institute, Commonwealth Fund, HFS Research, 2025

However, there is one good piece of news for service providers. They will experience a burst of new outsourcing opportunities as health plans and health systems attempt to eliminate anything that is not core to their business. This is a pure cost play for healthcare enterprises without the pretense of any innovation or strategic positioning. Consequently, service providers must be highly cautious as these outsourcing deals will be low-margin and will get lower over time. Service providers who claim to be able to mitigate margin pressures with the deployment of AI are just buying into the myth. The math does not add up as they invest in new capabilities in a declining market, as the per-unit price of LLMs continues to evolve, and infrastructure and energy costs will not stabilize for a while.

In the post-pandemic world, with the V-shaped recovery in healthcare, service providers have become extremely complacent with the volume of big outsourcing contracts they have won with health plans and some health systems. As indicated, these tactical cost plays initiated by healthcare enterprises will translate into low-margin work for service providers. It is the only way it works for health plans and health systems.

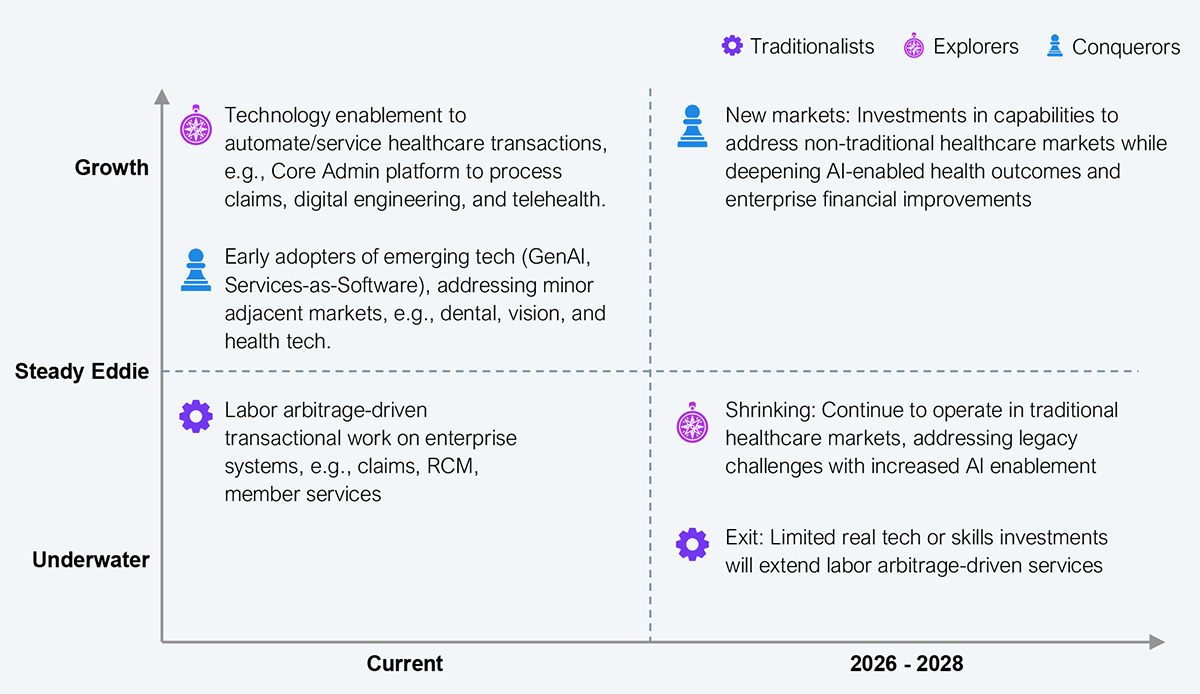

Service providers naturally fit into three archetypes (see Exhibit 7), which will define their role in the future.

Source: HFS Research, 2025

As the healthcare market shrinks and shifts, those service providers who continue to invest in the legacy market will have a shelf life that will expire before the end of the decade. Those service providers who will begin to explore, commit, and invest in new market opportunities on the backs of their domain expertise will be the ones who create a growth path forward.

The BBB will have an oversized impact on the US healthcare market, which was already on the edge thanks to disease prevalence, aging, clinical shortages, and tariffs. The BBB will essentially tip over the market, shrinking it but creating new opportunities for a different type of funding (self-insured, retail out-of-pocket), new contract arrangements, and consequently, a new set of technology needs. Service providers that approach this inflection strategically, select smartly, and execute boldly will see growth; the others should start packing up.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started