Once driven primarily by cost efficiencies and large-scale outsourcing, the IT industry in India is now redefined by the need for agility, innovation, and a fundamentally different approach to value creation. These include shifting from cost efficiency to positive business outcomes, project-based to strategic co-innovation, monolithic to modular deals, and generic point solutions to domain-specific executions. As global enterprises recalibrate their digital strategies, service providers must navigate a landscape defined by shifting demand patterns, financial volatility, and the increasing role of AI in shaping operational efficiencies. The key for IT service providers is strategically balancing short-term stabilization with long-term innovation. HFS Research has been studying broad trends impacting the IT service provider ecosystem that will shape the industry’s future in the coming years. Shifting market dynamics and business models.

The Q3 FY2025 predictions for Indian IT majors show signs of stabilization, with marginally stronger growth than in previous quarters. Stronger traction in BFSI within North America and a surge in AI-led and digital deals highlight selective growth pockets. However, the demand recovery is uneven across verticals even as sequential revenue growth exhibits marginal improvements. Even though IT service providers have effectively managed margins through operational efficiencies and favorable currency movements, headcount additions remain subdued as companies focus on re-skilling and leveraging AI to reduce their dependency on human counterparts.

While the pandemic-fueled digital surge has passed, the sector’s outlook for FY2025 remains conservative. The industry still faces headwinds from cautious global demand and shorter deal cycles. Although FY2025 is likely to close on a modest note, a shift toward emerging technologies and client-centric innovations could drive stronger momentum in FY2026, depending on macroeconomic stabilization.

The reliance on smaller deals underscores a structural shift in the IT services market. Enterprises prefer modular, outcome-driven engagements over monolithic mega-deals, which may not provide the agility businesses now demand. While mega-deals won’t disappear entirely, their role is evolving toward platform transformation and cloud modernization. Indian IT service providers must align with this trend by developing a broader portfolio of digital and AI-led services to cater to a fragmented deal landscape.

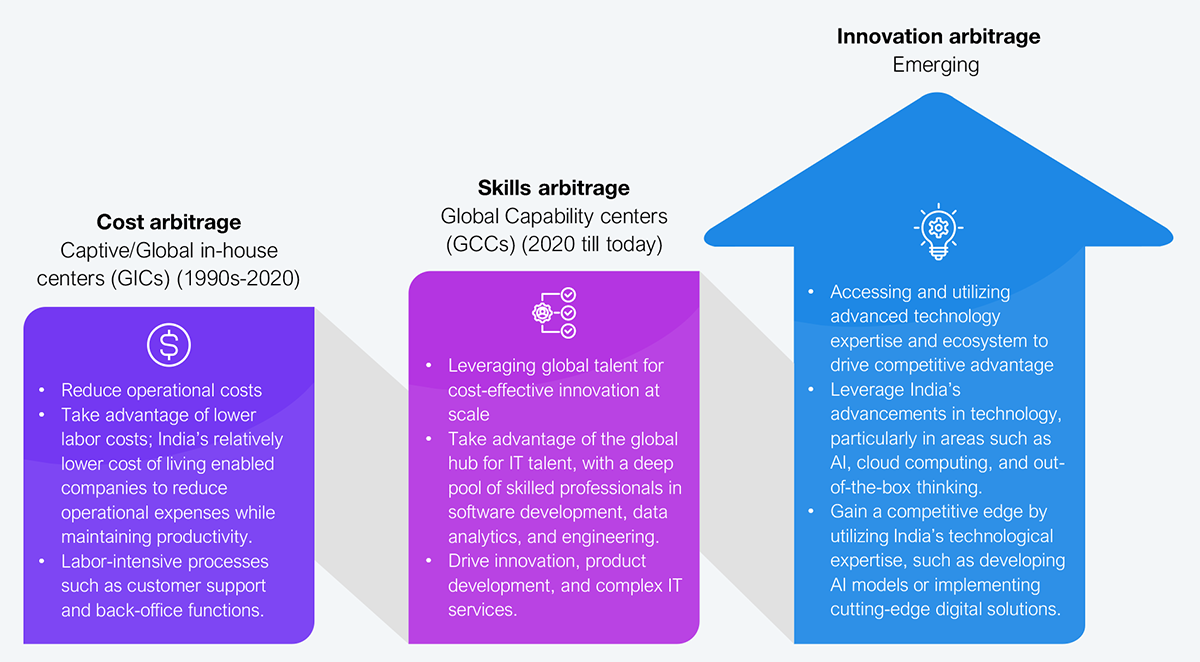

Global capability centers (GCCs) are no longer just cost-arbitrage hubs but innovation centers driving enterprise transformation, tracing the evolution of GCCs (see Exhibit 1). Traditional IT services firms must differentiate through deep domain expertise, co-innovation, and a consultative approach to try and capture a greater share of IT spending. This shift redefines the competitive landscape, with IT majors moving beyond traditional service delivery models to stay relevant.

Source: HFS Research, 2025

Shorter deal cycles signify a market transition toward faster, more agile engagements. While this enhances customer value, it pressures IT firms to deliver rapid results, often squeezing margin buffers. Firms must redesign engagement models with AI and automation to sustain profitability, ensuring efficiency without compromising quality.

While North America has picked up, Europe’s slower recovery highlights the uneven global demand landscape. IT service providers must strengthen their core geographies while diversifying into emerging markets such as APAC and the Middle East. Long-term growth depends on regional adaptability and tapping into localized opportunities. This means expanding the client base to include more smaller clients in addition to large and medium-sized ones.

A. Financial and economic factors

Rupee volatility: A double-edged sword

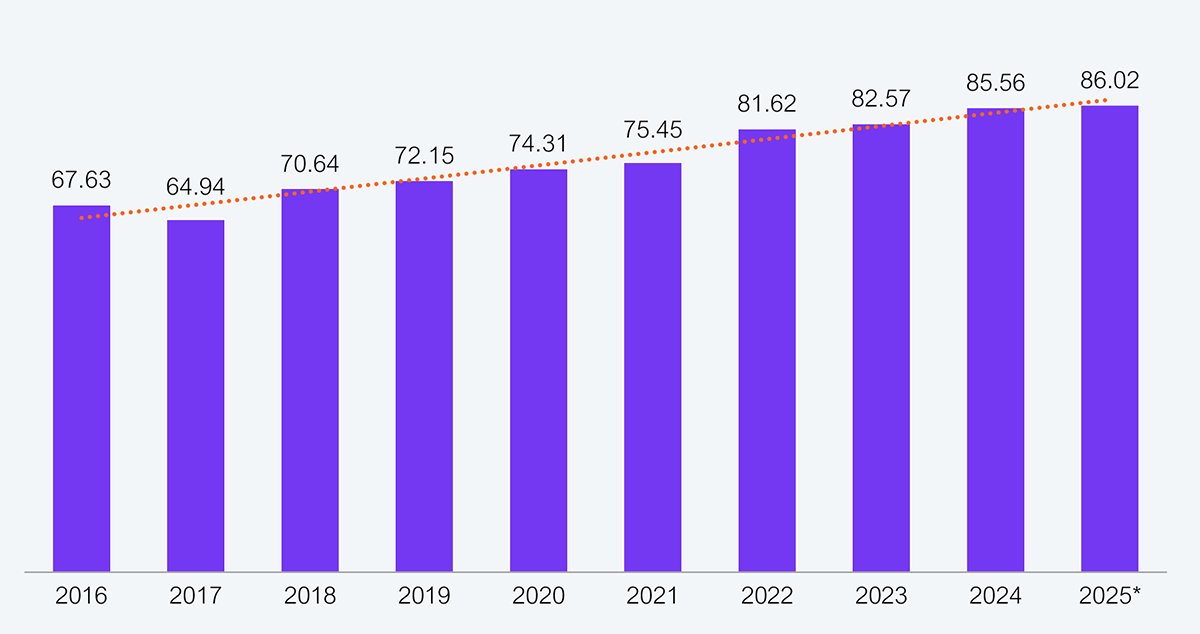

The volatility of the Indian rupee will continue to be a double-edged sword for the IT companies in 2025, having depreciated by over 27% in the last decade (see Exhibit 2). A weaker rupee can provide a short-term revenue advantage for export-driven IT firms, but constant fluctuations complicate hedging strategies and operating cost predictability. Amid global economic uncertainties, firms must prioritize financial resilience through dynamic pricing models and flexible cost structures to mitigate adverse impacts.

Source: Forbes study, 2025

Demand outlook for FY2025/2026: Stability hinges on global factors

While latent demand for IT services remains strong, macroeconomic uncertainty and stress in key sectors will continue to affect the industry. Even though deal cycles have shortened, unpredictable client budgets and shifting priorities have led to cautious spending. FY2026’s outlook hinges on the stability of the US economy, the resolution of geopolitical challenges, and renewed corporate tech investments. To fuel sustained growth, IT service providers must focus on driving digital transformation outcomes and proving the ROI of AI adoption.

B. AI-driven transformation and workforce evolution

Agentic AI’s role in shaping IT revenue models

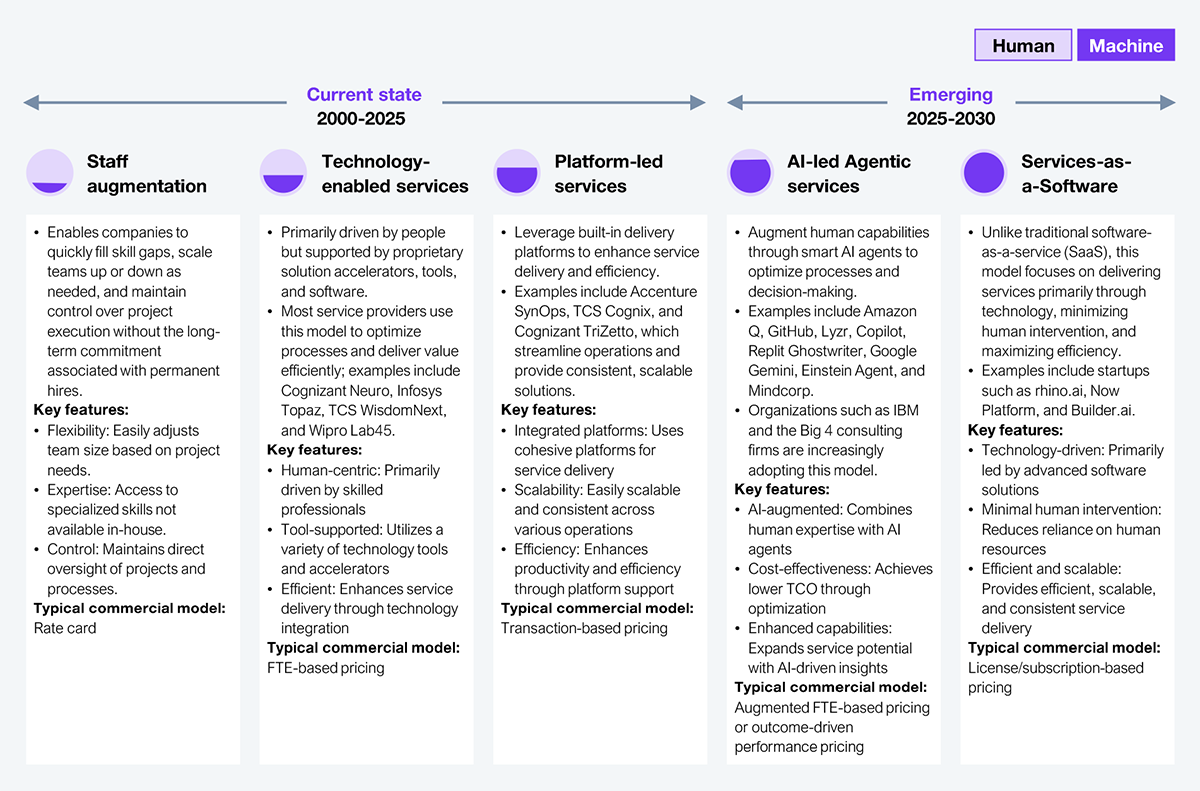

Agentic AI is a transformative force that redefines how enterprises interact with technology, embedding intelligence into workflows and decision-making processes. HFS Research’s 2030 vision sees Agentic AI’s role in reshaping the IT services industry by transitioning from a traditional services-led model to a ‘Services-as-Software’ approach. Over the next few quarters, Agentic AI will accelerate demand for outcome-based services, particularly in customer engagement, coding, and testing. This transition will commoditize low-value tasks while opening new revenue streams for IT service providers in AI training, co-innovation, and platform maintenance.

The ‘Services-as-Software’ model, as shown in Exhibit 3, will help IT firms scale solutions faster and monetize recurring revenue streams, breaking the reliance on linear headcount growth. Early movers who can package AI capabilities into repeatable, software-like solutions will gain a competitive edge. To capitalize on this trend, IT companies must build domain-specific AI expertise, form partnerships to accelerate innovation, and educate clients on the tangible ROI of AI-led transformations.

Source: HFS Research, 2025

GenAI’s impact on hiring: A shift from volume to value

Generative AI is beginning to decouple revenue growth from headcount addition, signaling a shift from labor-intensive delivery models. The focus is flowing toward talent reskilling and creating value through AI-enablement rather than sheer volume. In the near term, hiring trends may stabilize, but firms must proactively address attrition by offering compelling career pathways in AI-centric roles. Long-term success hinges on building an AI-first workforce that drives innovation rather than just executing tasks.

As local and global paradigms shift, the Indian IT industry can no longer rely on past playbooks to ensure future success.

Despite ongoing macroeconomic uncertainty, companies that prioritize digital transformation, redefine workforce strategies, and demonstrate tangible AI-driven value creation will emerge as long-term leaders. The challenge is evident as we move into FY2026—adapt and innovate or risk stagnation in an increasingly dynamic global market. The goal is not only to survive but also to excel and become the best among your peers.

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started

If you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started